Tips to managing cheque carefully and this is over and above ensuring sufficient funds in the bank account.

India is moving to less cash economy and so the use of cheque and online transactions will increase. There’s a lot of awareness being created by banks about not securing the online transaction and keeping password and pins secret but I think cheque should also be used with care.

Banks do whatever they feel like with your cheques and even to the extent that they may not show cheque as cleared even if it was cleared from source bank or reject cheque with a reason of overwriting whereas actually, you wrote the date on the cheque at a later time with a different pen (not different colour) without any overwriting.

But you as an individual who has their hard earned money with the bank should be careful when handling cheques. So let me share with you few tips to managing cheque carefully and this is over and above ensuring sufficient funds in the bank account.

- Write all the details (name, date, amount and amount in words) on the cheque using the same pen, at once and do it all yourself. It not only helps you to avoid mistakes but also prevents any misuse.

- When writing the amount mention an “only” after amount in words and put “/-” after the amount in numbers and strike through unused space in the name and amount fields to avoid any further additions.

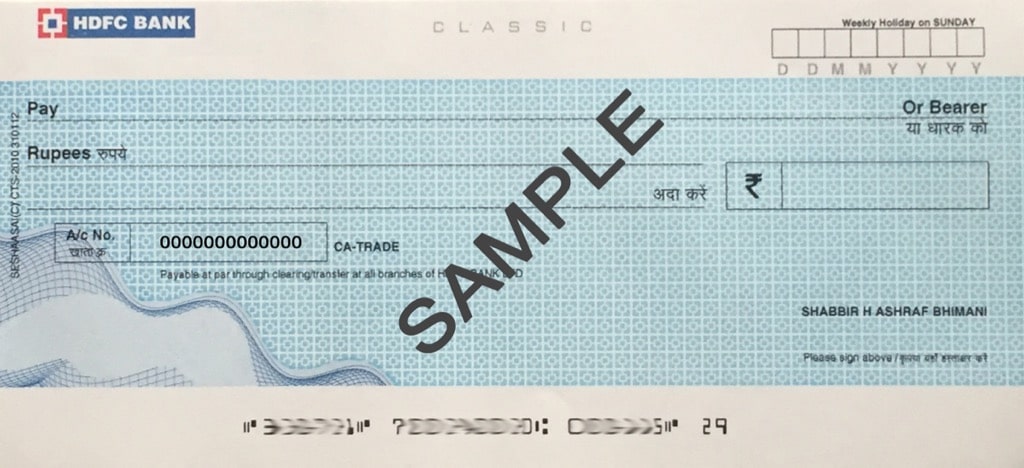

- Cancel the words “or bearer” after the name field & write “A/C payee” somewhere on the cheque. If you do not cancel the “or bearer” or write “A/C payee” anyone with the identity of the name mentioned on the cheque can do a cash withdrawal from the account.

- Sign clearly and only in space provided. For individuals it is above the “account holder’s name” and for companies, it is above “authorized signatory”. You should not sign anywhere else on the cheque if there is any need because of any overwriting, scribble, cancel or rewrite, issue a new cheque.

- For canceled cheques, write “canceled” clearly across the cheque to make it unusable. There is no harm in signing a canceled cheque. Normally canceled cheque are kept for reference of bank account details and / or for sign verifications.

- Avoid handing over even an account payee cheque to third parties. If you are issuing a cheque for a loan payment, insurance premium payment or a credit card payment, do not hand over the cheque to others whom you don’t know. Take the effort to drop those cheques in the drop box yourself. If you need to hand over the cheque to others, please verify the identity of the person.

- Immediately report a loss of cheque to the bank and even request stop payment for the lost cheques and checkbook.

- Many individuals have a habit of keeping checkbook signed and it is worst habit ever. Never even keep a single cheque signed.

- Cheque has an MICR band at the bottom of the cheque and also CTS mark on the left portion. Make sure you never write in those areas.

Share your views about cheque in comments below and if I have missed anything that you want to add about cheques, do so in comments below.

Thank you, what’s risk in giving account payee cheque to third party ?

If you don’t write a complete name of the company and something appended to it can be encashed. As an for example you wrote the check in the name of LIC where as name should have been written as LIC of India and so any other company LICXXXX can encash such cheques when handed over to third party.