Can an Indian retail investor invest like Warren Buffett? The answer is YES. Here is the process to cherry-pick stocks during the tough time for the Indian economy.

Can a retail investor invest like Warren Buffett in the Indian market?

The answer is YES.

Let me share you how you can do the same.

Don’t Try to Get Rich Quick

The first rule of thumb for investing in the market is to build wealth over a long period.

You should not be in it to get rich quick.

If you are in the market to get rich and that too in a short period, you are doing it all wrong.

As a day trader, to make profits, you have to be right twice in a day. The odds are stacking against you. Even when you are right twice in a day, the feeling of getting more than what you have managed will always be around. It will make sure you try to get the most next time, and the market will make a smarter move.

Be a Reader

You should not only be reading the books on investing or annual reports. What I am referring to is the impact of what is happening around the world. How it can impact the business, you have invested in.

As an example, if you had an investment in the print media in the 90s when the Internet was taking everyone by surprise, you could book out of such businesses only if you knew what is coming. One can see if you were a good reader.

Similarly, if you are investing in a business where something disruptive like Blockchain, Artificial Intelligence or any other technology for that matter will disrupt, you will know if you are a good reader on the subject matter.

Similarly, any new opportunity will come over when you know how the future will pan out.

Be a Customer

Warren Buffett’s most prominent investment is in Coca Cola, Wrigley, and Gillette.

And if you ask him, he says people will drink coke, chew gums or use Gillette products.

So true. I like to use the same to invest, as well.

So why not invest in companies where you are a satisfied customer.

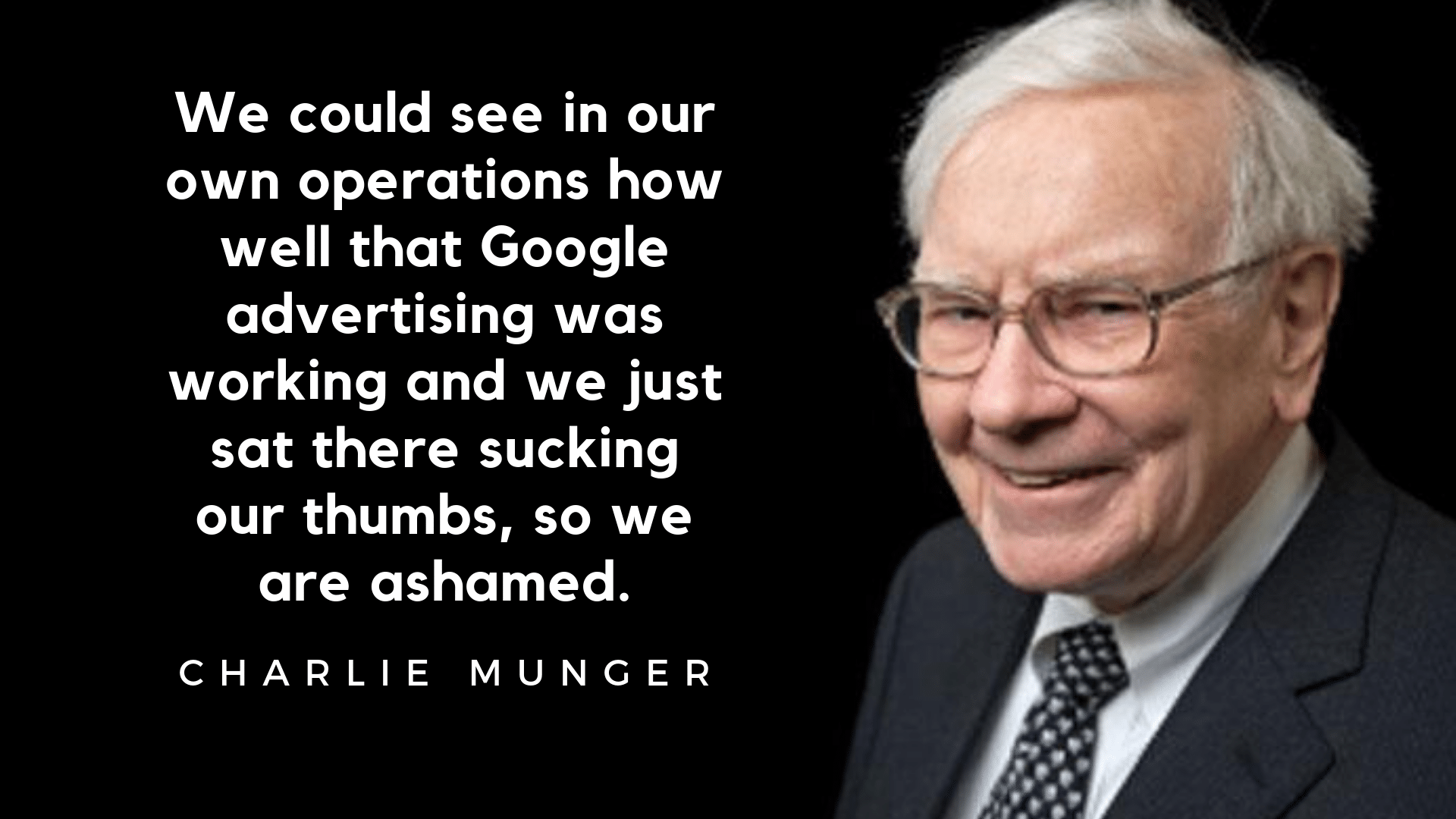

Warren Buffet has admitted he missed the opportunity to invest in Google despite the fact his insurance business was an advertiser in Google. Though being a very satisfied customer, he never considered it for investment.

Invest in a business where you are a customer, and more so, a satisfied customer is a great way to start.

- Which brand of inner wears do you prefer?

- Which brand of toothpaste do you use?

- What brand of products kids use in school or otherwise?

- Which brand of car/bike do you prefer?

- Which brand of watch do you like to own?

- Does your wife/mother prefer jewelry from a particular shop?

- What brand of footwear do you prefer?

- What mutual funds do you invest in? Can you invest in a company that manages those funds?

So on and so forth.

See if the current market provides an opportunity to invest in them.

Understand the Business

When you are a customer of such a business, it becomes a tad bit easy to understand the business.

But, if a business is too complicated for you to understand, it is an avoid.

When you choose the business where you are a customer, it is more often a case where they manufacture a good quality product and then use the right marketing channel to push the products.

Business With a Competitive Advantage

As a customer will you switch over to a different product for a slightly low price?

As an example, will I change my watch just because I am offered better pricing?

More likely, the answer is no.

But, will I change my flight or hotel if I am offered better pricing?

The answer will be yes in most cases.

So as a customer, if you find price as a reason to switch, it is time to relook at the investment.

Is Management Trustworthy?

The most important aspect of investing is – you aren’t investing in the business, but the team doing the business.

So can you trust the team in the bad times?

There has been a lot of bad news around Amara Raja Batteries.

The foreign promoter is selling the power business to Brookfield. The new promoter will be a shareholder in the company and not a promoter. On top of that, the automotive sector is having its issues of a slowdown. Moreover, the electric vehicles have the upcoming disruptions in the automotive batteries.

And I still have the conviction in the company because I trust the team to come out with flying colors.

Final Thoughts

The current market is providing a lot of value to the investor.

The slowdown in the Indian economy is for real.

I am sure the prices will go down another 10 or 20 percent.

And the fact also is, you may not be able to catch the absolute bottom.

So make a wishlist of your stocks and start adding them to your portfolio.

What stocks are you adding to your portfolio? Share them in comments below.

Following are my pick from current market

Auto : Maruti & Ashok Layland

FMCG : ITC & HUL

IT : TCS & Tech M

Finance : Kotak Bank & Muthoot Finance

Apart from this I have a question.

Why AMCs are listed in India although this business doesnot required much capital?

They do require capital. Not as huge as other business but it is still needed. LIC doesn’t need capital because of the amount of premium it gets but others do need

Idfc first bank

Should be good.

Very true. Currently adding Balakrishna industries and ITC.

Awesome.