As an investor, I have 5 triggers to sell stock from my investment portfolio. Understand each with an example to understand better

For traders, it is simple to sell a stock, and you have a stop loss and target. You hit the stop loss or the target or a trailing stop loss and trailing target and then sell the stock. However, it is much more challenging for investors.

Five key points help me know when I should be selling the stock.

You can watch the video or read the article. So without much ado, let’s begin.

Initial Decision was Wrong

The number one reason I sell a stock is if my initial motivation to invest has been proved wrong, so I come out of that investment.

The time I may need can span a few years before I realise my initial investment decision was wrong.

Let me help you understand this with an example.

I prefer investing in solvable problems. So a business is going through some issues, and I like to invest if I am convinced these problems are temporary and the management can solve them moving forward. However, the issues can also take two to three years to solve.

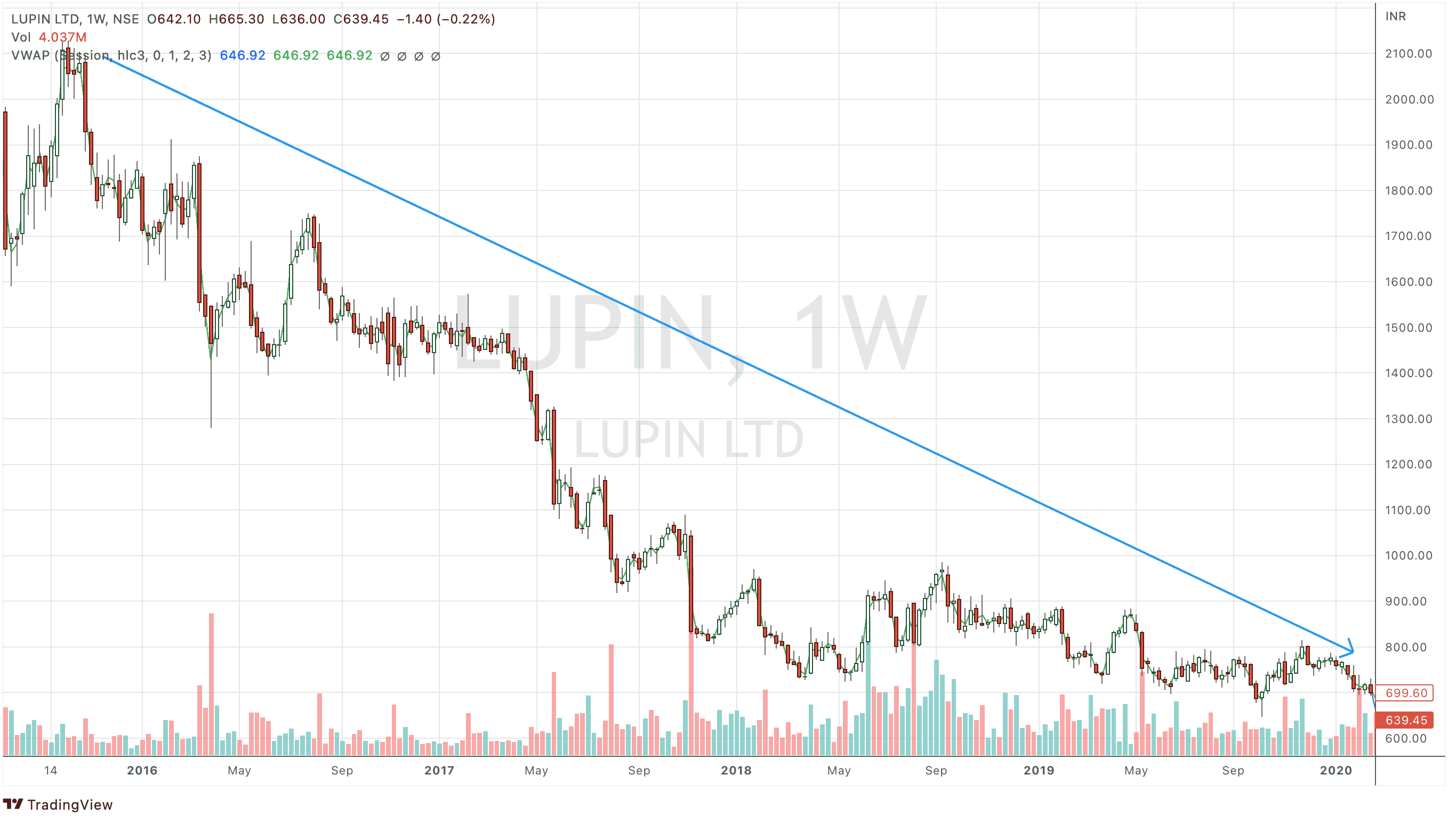

I invested in Lupin in December 2017 at around 800ish because the stock fell from the high of 2100.

The fall was also justified because most of Lupin’s business was in the US. The USFDA stricter guidelines made the life of every Pharma company difficult, and Lupin was also part of the same issue.

My understanding was in a couple of years, Lupin should be able to fix the USFDA issues. And once the company can do that, the business can again be where it was.

However, Lupin couldn’t do it, and the USFDA problems persisted, and other issues (litigations and pricing control in the US) started coming up.

So after three years, I came out of stock at just under ₹1000.

My initial understanding was wrong: the problem is not too big for Lupin and will be solved. So I made little profit but nothing significant when you see my holding period, but still, I was out of my investment.

Story has Changed

The second most important reason for me to sell a stock is when the story has changed.

You invest in a company based on a specific theory or being a leader in a sector, and suddenly you see the company going in a different direction.

Generally, I tend to invest in a business with good growth and has some monopoly. So companies seldom change direction.

Still, let me explain this with an example of Exide Industries. We know the company manufacturers batteries for cars.

However, they forayed into the insurance business. For me, it’s a classic case where the story has changed, so I like to sell the stock.

I Find Better Opportunity

The third most important reason to sell a stock is if I find a much better opportunity to invest in the market.

There is a limited number of stocks that I keep in my portfolio. The number ranges from 15 to 20. I’m not particularly eager to go below 15 or above 20. So the maximum that I had in my portfolio was 21.

It also helps me compare the new opportunity with all my current options for fundamental analysis, investment and business checklist.

So if I finally have a better investment opportunity that I want to add to my portfolio, I have to sell one.

Further, as I am always fully invested, I may not have the funds to invest in the new business I want to add.

The two examples I want to share are Marico and TTK Prestige, which I sold at different times to invest in what I saw may have better growth and provide me better returns on my investment.

There is nothing wrong with either TTK Prestige or Marico. However, if I have to bet my complete net worth on someone, no one will be better than TT Jagannathan or Harsh Mariwala.

I am a big fan of both of them and follow them. Both the companies are doing great business, but I think I found a better opportunity and need the money to invest in them.

Change In Business Environment

The next important reason for me to sell a stock is when there is a change in the business environment.

So if I see a big competitor entering the market or a technological change happening in the sector, I am out.

The example that I want to share is Amara Raja Batteries.

I moved out of the stock when Tesla entered the Indian market. Once Tesla was in the Indian market, I knew there would be substantial technological changes in the automobile and EV ecosystem.

I need Money

Last and the final reason for me to sell a stock is when I need money. I must sell a stock if I need a large sum of money.

I may sell a stock depending on which of the above four parameters match.

It can be that I sell the slow grower, or I may book profit and only invest some part of it in the new opportunity because I need funds.

One more point I will like to emphasise is that if I see a stock that has run up too fast too soon and may now consolidate for some time, then I book out of it and then use the money and start accumulating the stock again.

Final Thoughts

When do you sell a stock from your investment portfolio? Please share them in the comments below.

Leave a Reply