Find the best mid-cap fund for 2020 along with the selection process and review the performance of the best mid-cap fund of 2019.

Let us find the best mid-cap mutual fund to invest in 2020 and review the performance of our choice of best mid-cap fund of 2019.

So let’s begin.

The year 2019 was challenging for midcap funds.

The Sensex and the Nifty did well in 2019, but one can’t say the same for the mid-cap index.

Investing in the right stocks and funds in 2019 made sure there is less red in the investor’s mid-cap portfolio.

The Top Mid-Cap Funds for 2020

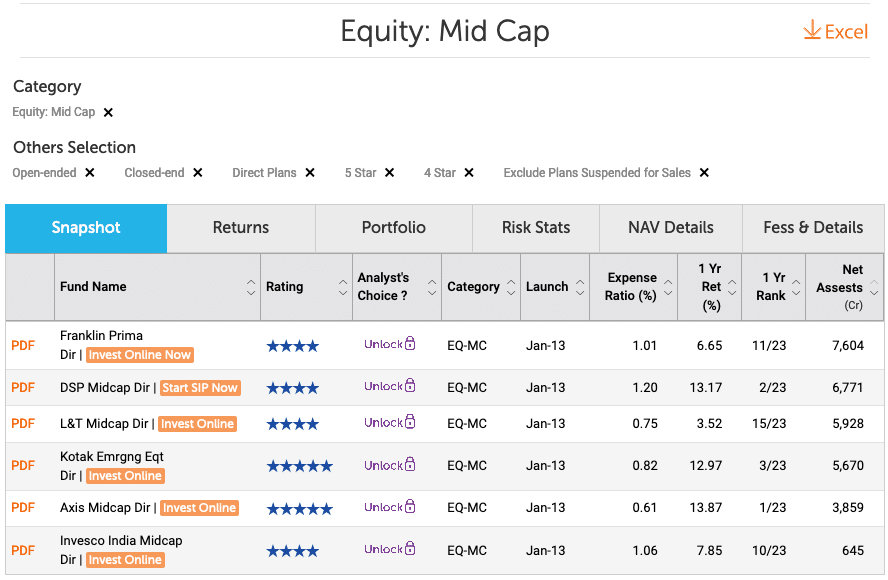

The process we will use to come to the best mid-cap funds for 2020 is – from the 4 and 5-star rated mid-cap fund by ValueResearchOnline, we will compare the performance for the past year along with expense ratio to get the best mid-cap fund.

The reason I prefer to use only one year’s performance is, it was a challenging year for mid-caps. So funds which can do well in the bad times will have an edge in the coming years when the mid-cap section of the market does well.

Best Mid-Cap Funds for 2020

The best performing funds in 2019 are

- Axis Midcap

- DSP Midcap

- Kotak Emerging Equity

Based on the expense ratio, if we have to select only a couple of funds, then it will be:

1. Axis Midcap

Axis Midcap Fund has been a consistent performer. It has done well not only in the past year but has been doing well in the bad times for mid-caps for a long-time. Without a doubt, it has to be the best mid-cap fund for 2020 as well.

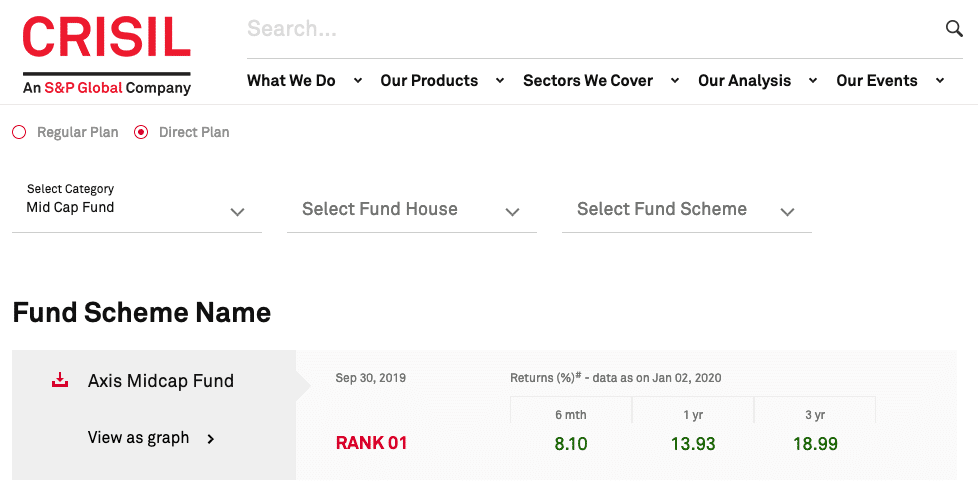

As expected, CRISIL also lists the Axis Midcap fund as the top mid-cap fund.

2. Kotak Emerging Equity

The next best mid-cap fund for 2020 has to be Kotak Emerging Equity. Better performance in 2019 and a low expense ratio will be my way to choose the best mid-cap fund for 2020.

How Well The Best Mid-Cap Funds of 2019 Performed?

The main reason I share the series of best funds is, we evaluate how we have done in the past. It means either we do well investing or we learn from the selection process.

The best Midcap funds of 2019 made us better returns this time.

To my surprise, both the best mid-cap funds, I selected for 2019 were the best performing funds in the year gone by.

- Axis Midcap Fund

- Kotak Emerging Equity

And so we now can be a little more confident that the process we are using is working.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the past funds. Create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. The emphasis is on the process. The funds may be doing well now, but when you want to be investing, use the same process, and find the best fund at that time to invest. Use ValueResearchOnline and CRISIL as and when you want to invest in 2020.

is there any other parameter to look at apart from expense ratio while selecting funds?

also i would love to know your view on Value oriented funds.

Thanks in advance.

Depends on view of the market. Expense ratio is one of them for a midcap fund. In a multi-cap fund, I checked the allocation to mid-cap segment and you can check it out here https://shabbir.in/best-multi-cap-fund-2020/

Hi Shabbir,

I know that this post is about Midcap MF. I am struggling to move my new money into either Axis midcap or Axis multicap fund. Would you have a suggestion on which one may do better over a period of time? Thank you so much

Don’t rely on anyone including me to tell you what will do well or what won’t. I like to help you take that call based on the information and use the information to the best of our view and knowledge.

Still, if you ask me which one will do well, I will say both because one is a small cap fund and other is a multicap fund. You are comparing apple with oranges. We can compare fund within the same category and not across category for performance. They are meant for diversification.

Sir ,I am invested in Tata mid cap growth fund and Invesco India mid cap fund. Should I continue with them or select new funds. Kindly advise.

You can keep those funds and move over the SIP to better funds.

It seems, Axis MidCap fund is best fund. I am invested in HDFC Midcap with an SIP of 5K per month but I am not happy with HDFC midcap. Another one Mirae asset emerging bluechip may be considered (in MID and Large) also..Thanks sir.

Instead of switching. Stop the SIP in the non-performing fund and opt for the performing fund and allocate more money to it.

Thanks Sir. I will do the same as per your suggestion.

The pleasure is all mine.