Find the best small-cap fund for 2020 along with the selection process and review the performance of the best small-cap fund of 2019.

Let us find the best small-cap mutual fund to invest in 2020 and review the performance of our choice of best small-cap fund of 2019.

So let’s begin.

The year 2019 was challenging for small-cap stocks and predominantly small-cap funds.

The Sensex and the Nifty did well in 2019, but one can’t say the same either for the mid-cap index or for the small-cap index.

Investing in the right stocks and funds in 2019 made sure there is less red in the investor’s small-cap portfolio. Still, I believe the amount invested in 2019 in a small-cap fund, SIP or otherwise, will reap the benefits over time for many of the passive investors.

The Top Small-Cap Funds for 2020

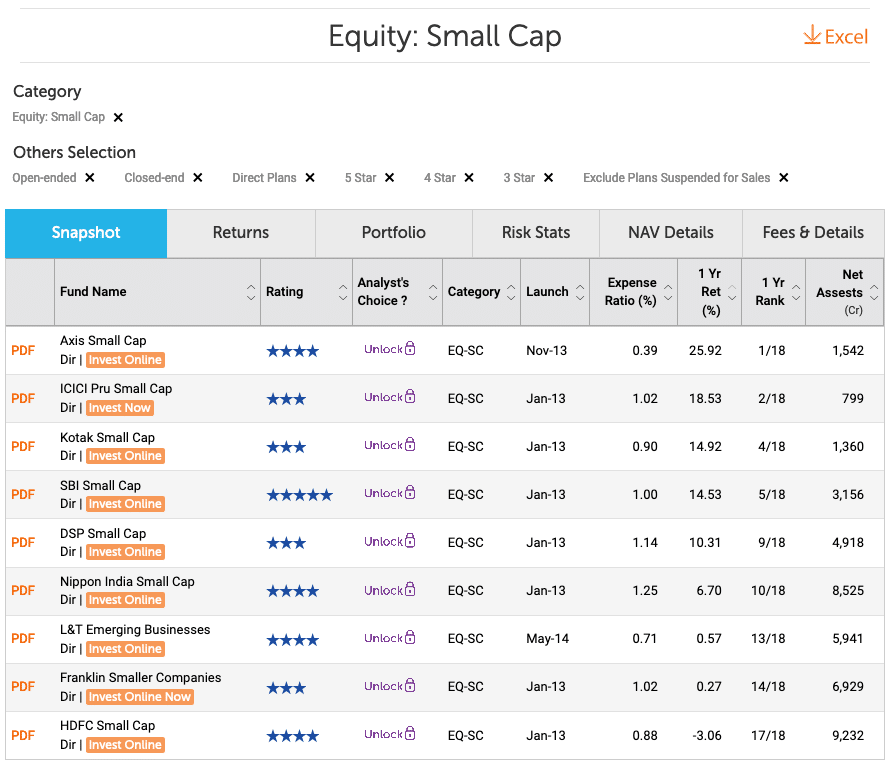

The process we will use to come to the best small-cap fund for 2020 is – from the 3, 4, and 5-star rated small-cap fund by ValueResearchOnline, we will compare the performance for the past year along with expense ratio to get the best mid-cap fund.

The reason we use 3,4 and 5 star rated funds instead of only 4 and 5-star rated funds is that there aren’t many funds rated as 4 and 5 stars — only 5 funds in total. The reason is that the small-cap segment of the market has performed poorly; the funds have done poorly as well. So there isn’t much better-rated fund.

Best Small-Cap Fund To Invest in 2020

We see a diverse return from funds ranging from +26% to -3%. So a variation of almost ~29%.

There is a reason for such divergence as well. The funds that have done well have less exposure to small-cap stocks as compared to those that have done poorly.

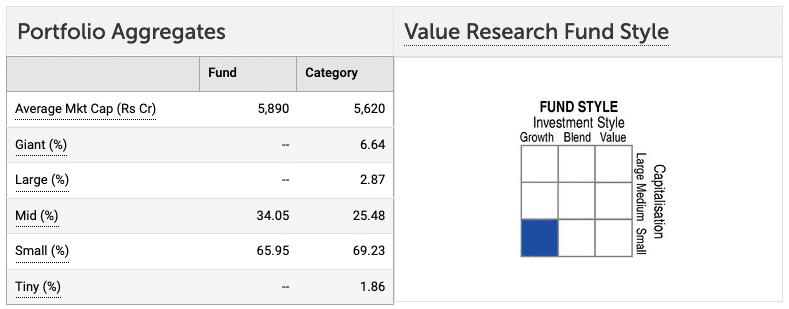

As per ValueResearchOnline, the Axis Small-Cap fund has 65% allocated to small-cap stocks.

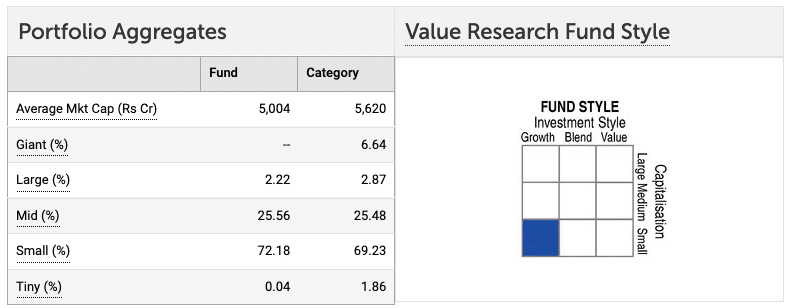

Whereas, HDFC Small-cap fund has 72%.

So if a fund keeps only 65% in small-cap stocks (as per the SEBI guidelines) to outperform can have an underperformance if the small-cap segment of the market starts to perform well.

Axis Small Cap Fund

Going by the process of better performance and the lower expense ratio, Axis small-cap fund has everything one needs to outperform.

Moreover, as the small-cap segment of the market starts performing, I am sure the fund manager will start allocating more capital towards small-cap stocks.

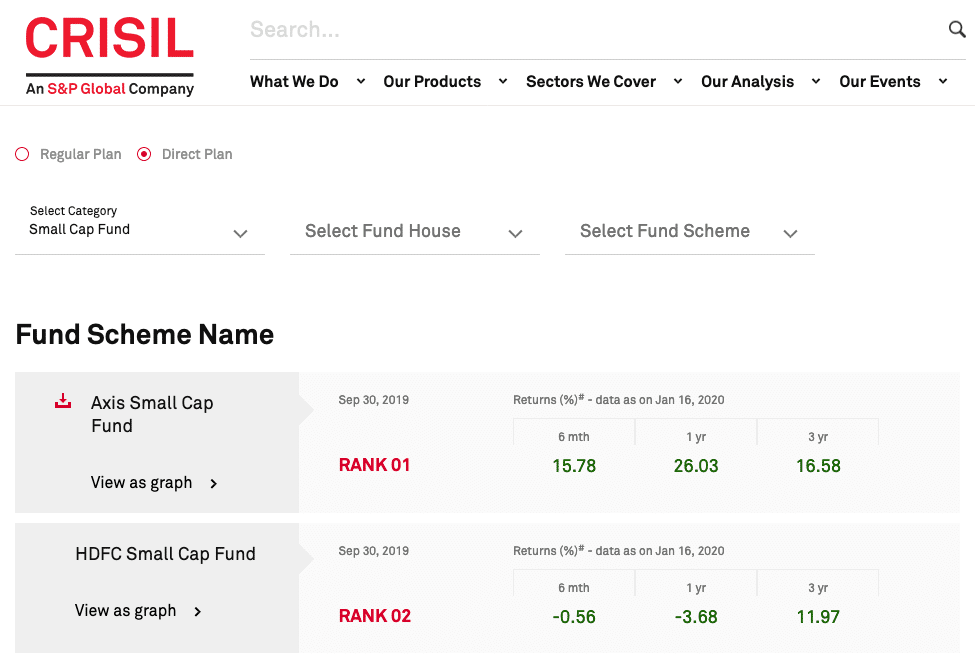

On top of that, CRISIL also ranks Axis Small Cap Fund as the best small-cap fund for 2020.

One more point which needs a mention is the outperformance of the Axis fund house.

- Axis Bluechip Fund is the best Large Cap fund of 2020.

- Axis Midcap Fund is the best Mid-cap Fund of 2020.

HDFC Small Cap Fund

Small-cap performance depends mostly on the selection of good and quality stock that can become mid-cap and large-cap over time. So as a contrary, if I have to select another fund from the small-cap segment, it will be the HDFC Small Cap fund for sure.

Averagely good expense ratio and right allocation to the small-cap segment can mean the fund can outperform for sure in the coming years.

How Well The Best Small-Cap Fund of 2019 Performed?

The main reason I share the series of best funds is, we evaluate how we have done in the past. It means either we do well investing or we learn from the selection process.

The best small-cap fund of 2019 was the HDFC Small Cap fund. It has made us learn a fundamental lesson, which is – small-cap investment shouldn’t be looked on a year-on-year basis. It is all about investing in future leaders.

Moreover, market cap allocation to small-cap should be done to mitigate the risk of under-performance.

Small-Cap fund should be a small part of the portfolio unless you can handle the high volatility without being too concerned about it. Don’t always consider the returns as the point to invest. Assess the risk associated when investing in the small-cap fund or stocks.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the past funds. Create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. The emphasis is on the process. The funds may be doing well now, but when you want to be investing, use the same process, and find the best fund at that time to invest. Use ValueResearchOnline and CRISIL as and when you want to invest in 2020.

Sir.. U have completely missed the importance of portfolio turnover ratio, risk statistics and large AUM causing poor flexibility in managing funds.. HDFC small cap scores poorly in many aspects..

Can be. One can’t take into account everything. Moreover, as always, this isn’t an endorsement of any fund. The emphasis is on the process. Your process can vary from mine and this is what market is all about. No process is perfect and one should invest that helps him remain calm in turbulent times.