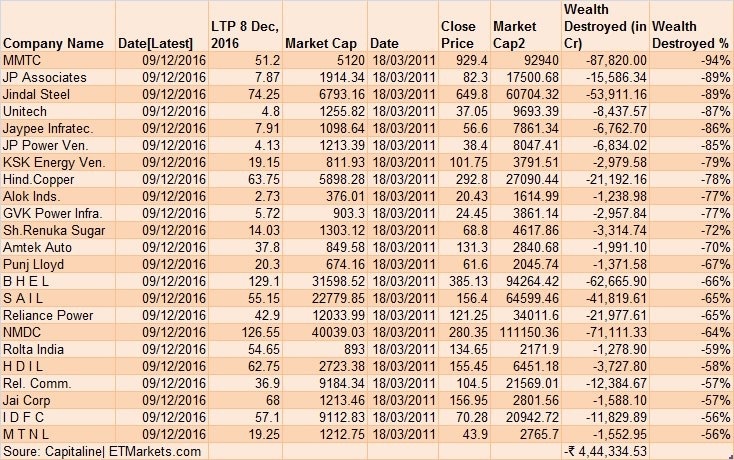

Report by ETMarkets on 23 most wealth destroying stocks from march 2011 to December 2016 and how to identify such wealth destructors in advance to invest safely

A report by ETMarkets.com for the list of stocks that destroyed the most wealth from march 2011 to December 2016.

So let us use this report to analyze each stock on the process I follow to invest in my open portfolio using fundamental analysis.

If I would have invested in these companies in 2011 or not if no then what could be the possible reason from my investment checklist.

| Company | If avoided, Why |

|---|---|

| MMTC | PSU, Operational efficiency |

| JP Associate | Group of company |

| Jindal Steel | Commodity, No unique product |

| Unitech | Real Estate |

| JayPee Infratech | High Debt |

| JP Power Ven | Power Sector, No pricing power |

| KSK Energy Ven | Power sector, No pricing power |

| Hind Copper | Commodity, No unique product |

| Alok Inds. | High Debt |

| GVK Power | Power sector, No pricing power |

| Shree Renuka Sugar | Commodity, No unique product |

| Amtek Auto | High Debt |

| Punj Lloyd | high Debt |

| BHEL | PSU, Operational efficiency |

| SAIL | Commodity, No unique product |

| Rel Power | Power sector, No pricing power |

| NMDC | PSU, Operational efficiency |

| Rolta India | High Debt |

| HDIL | Real Estate |

| Rel Comm | Telecom Sector |

| Jai Corp | Group of company |

| IDFC | High Debt |

| MTNL | Telecom sector |

Luckily all 23 companies would have been avoided and this gives me a sigh of relief. Let me explain the above short answers in detail.

- PSU – PSU companies have tough time attaining high operational efficiency and also lags research and development.

- Group of Companies – I avoid group companies as which business brings how much profit becomes difficult to assess.

- High Debt – High debt and no focus on reducing it has always been a no for me.

- Real Estate – Management even if they are honest, sector deals with so much under the table deals (land deals, municipal approvals …) that you cannot rely only on balance sheet and profit and loss statements.

- Commodity – Commodity producing companies don’t have pricing power and rely only on operational excellency to make profit as commodity price is always fixed. Lowest producer of the product will always have an upper hand.

- Power Sector – Yet another sector similar to commodity with no pricing power and need operational excellency to remain profitable.

- Telecom Sector – A price competitive sector with no pricing power.

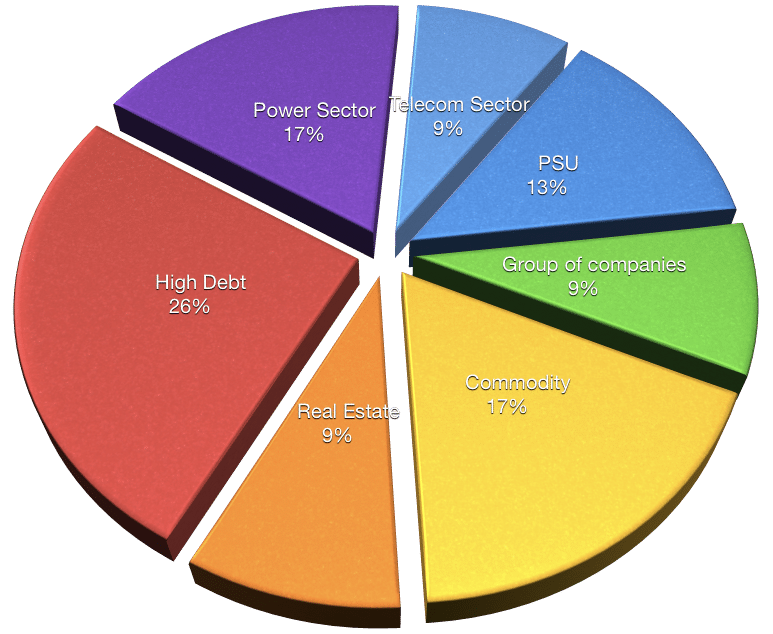

Classifications

Let us classify the above 23 companies.

- PSU – 3

- Group of companies – 2

- Commodity – 4

- Real Estate – 2

- High Debt – 6

- Power Sector – 4

- Telecom Sector – 2

Debt is the biggest reason for companies that perform badly.

If we combine commodity, power sector and telecom companies under one roof of no pricing power, it becomes the single biggest reason of wealth destruction.

Conclusion

When the market corrects, portfolios are in losses and it is the time when you should validate the process of identifying stocks to see if you can find any false positive in your approach.

Investment can flourish if and only if we can identify good future businesses and two most important aspects of safe investing are low debt and how well the company can price their products or if it is a commodity company, are they the lowest producer of the commodity.

Shabbir Ji,

I have a basic question, but it’s not related to this particular blog.

My question is, How many SIP should a person have?

I invest in 2 ELSS, 1 Large cap, 1 mid cap, 1 micro cap through SIP route.

Now, each time I read a article like “Best mid/large/ELSS MF to invest”, i feel like I am missing on something, if that particular fund is not in my portfolio.

Request you to kindly write a blog on how many SIP one should ideal have, and how to dived the total invest-able money per month, among these SIPs.

Utpal, sure I will add that article and has added that in my towrite article list. It may take sometime for me to write that as an article but I will answer them to you right here and according to me one should have 1 ELSS fund, 1 large cap fund, 1 Midcap Fund, 1 small cap fund and 1 multicap fund.

I don’t prefer investing in debt or anything apart from equity and so my view is biased towards equity but still I think those are the maximum number of SIP a person should have.

We see an ad where it is advised to have 1 SIP for each of your future plans but again that is not what I completely agree with.

Sirji, IDFC is good company, and started IDFC bank, so it is growing company….

May be but companies cannot grow when they have such huge debt and company with 5 times its equity size as debt has seldom grown.

Thanks Shabbir; I am totally in sync with your logic.

in your filters, you should add Promotor quota and Promotor quota shares under pledge.

Not only PSU as criteria, i would prefer Ownership Pattern and in that PSU is a big villian there. Also Promotor share of Equity is important.

Another filter: Promotor quota shares is under pledge, if it high, it shows that the many indicators are red.

Yes Nataraj, I have that as the criteria to add from many of my readers but has not taken any call on stocks that are low in quota but can you suggest what percentage of promoter holding you prefer or you have seen that has issue.

I have input from many members that want from above 50% to as high as 70%.

How to check Debt of any company?

There are multiple options to find that out. You can use screener.in and for any company look at debt to equity ratio and it should be under 1 or preferably under 0.5

Using moneycontrol you can browse through companies financial reports > ratios and there you will find debt equity ratio of companies in each financial years.

I personally prefer moneycontrol as it gives me better view of how debt is increasing decreasing each year.

I found out two destroyer in my portfolio,

1. P c jewellers 70% promoter pledge

2. Kolte Patil, though honest management, sector is reality.

Too much stock pledged can be a warning signal to not enter into stock as well.

Lowest producer means ?

The cost of production is lowest among the peers. As an example if all companies produces steel, the one that has lowest cost will benefit the most because price of steel is fixed or power the company that has lowest cost of unit will benefit the most because the cost of each unit is fixed.

Hope it clarifies.