Are you confused how to invest in the market at all-time high levels? Let me help you why I did a biggest churn to my portfolio in feb 2021

I am getting the question quite often about how to invest in the market at an all-time high. So let me answer this question for you as well as help you invest in the market correctly.

The first and the most crucial aspect to understand in the market is why we have Nifty running so hard and so fast.

I am no guru, but let me share my views based on my limited understanding.

Why Is Nifty Gaining New Highs Daily?

Markets are always forward-looking. Furthermore, markets always try to discount the forward earnings.

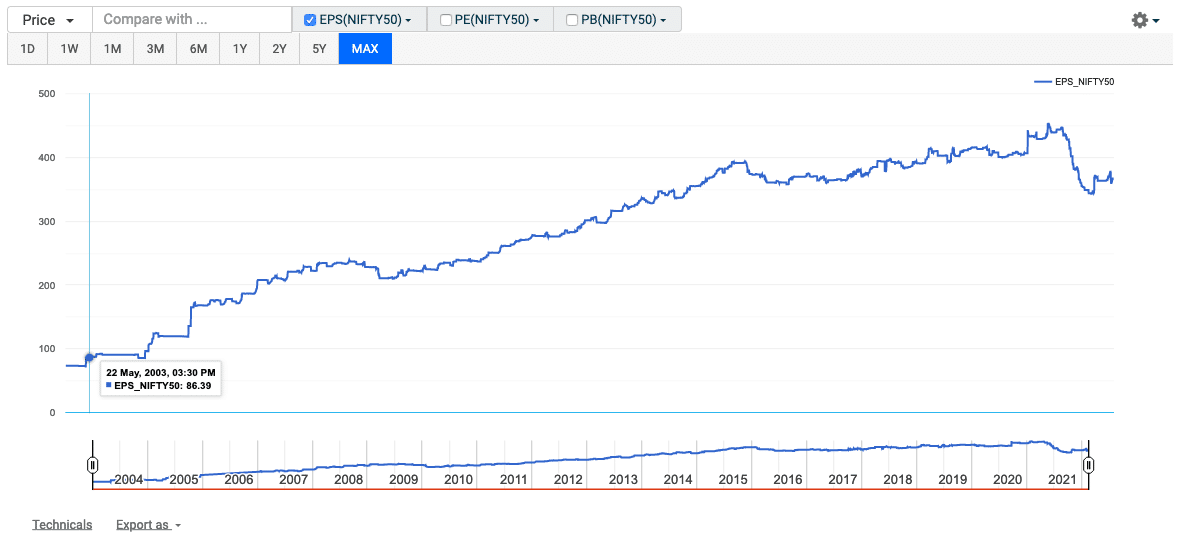

If we consider the last five years pre-Covid, the overall Nifty EPS has remained around ₹400 (in the range of 360 to 440).

Here is the graph of Nifty EPS on Trendlyne.

Post-Covid, there was a surge in businesses globally because of liquidity (and I will explain how later). Initially, markets assumed this is pent-up demand, but now it seems there is a surge in demand.

So the Nifty EPS forecast has increased from the 400ish zone to as high as ₹750 or even ₹800.

So when the EPS of companies is assumed to double, the market will see a surge in line with earnings expectations.

The correction will come if the estimation of EPS has to come down. If it doesn’t, we will have a perfect bull run in the market and some corrections within the bull run.

However, if the market assumed EPS doesn’t seem to achievable, the market will correct accordingly.

So now we know why the market is surging. Now let us try to understand what liquidity is and how it is driving growth.

What is Liquidity?

On the news channel, we hear the current bull run is liquidity-driven. The question is what is liquidity and how it is driving the market higher.

First, let me explain what liquidity is?

In some form or the other, every central bank has tried to print money and help people amidst Covid-19.

Of course, it is not a solution to the virus, but if the economy can do well for the businesses, it can solve people’s problems of becoming jobless.

Now when the money is available at a cheaper rate of interest, many people can take up loans to invest in the market. (Particularly FIIs)

Similarly, Indian businesses can take up loans at a cheaper rate and increase their business.

So we have higher growth projections for the Indian economy.

For example, first, you had to pay 10% as the home loan rate. Now it has gone below 7%, and so you can save 3% on your home loan. Assume you have not lost the job; you can buy a bigger home now, creating a better demand scenario.

We don’t spend based on what we need, but we tend to spend based on what we can afford. No one buys a sedan car because they need a car but because they can afford a sedan. If they could afford an SUV, they will go for an SUV and not for a hatchback.

Similarly, now if I can afford a bigger house, I won’t go for a smaller one just because I need one.

So liquidity is not only driving investment in the market, but it is creating a good demand boost within the economy.

It is OK to Be Wrong

My most significant churn in the portfolio happened after the budget in Feb 2021 in the past 20 days. I shuffled around 20% of my invested amount.

From 2017 till around mid of 2020, I was invested heavily in the Pharma sector.

When I see a lot is happening within the Indian economy, I have moved some of my investment out of the Pharma sector into stocks where I assume incredible growth is around the corner.

Again, when I say moved out doesn’t mean entirely out. At the peak, my investment in the Pharma sector was 50% of the overall portfolio. I reduced it to 35%.

Let me share with you an example to help you understand. Again, this is to explain the context, and it is not a recommendation of stocks or sectors as such.

I thought we would eat a lot more Maggi, biscuits, or edible oil in the lockdown. So companies in essential goods sectors and healthcare companies will continue to grow even in the lockdown.

Now when we have visibility of growth along with budget making sure the Government is focusing on growth. So I am moving out of companies that I think will grow slowly and move over to more aggressive companies in growth.

I could be wrong, and it is ok to be inaccurate, but my view is to move my investment to high-growth companies.

Again, it doesn’t mean I compromise any of my investment checklists or shy away from my way of considering the fundamental analysis. Further, every business has to qualify for my business checklist and the investing rules.

I agree, I may bend some of the rules for growth, but then if I know what risk I am taking, I should be ok with it.

Investing In The Market At All-Time High Levels

If you want to invest in the market at all-time high levels, you should be convinced that there will be growth.

So when you know there will be growth, you should invest in companies that are more likely to show higher than expected growth.

If you go by the averages, if the Nifty EPS has to jump from ₹400 odd levels to ₹800 odd levels, some companies will do much better than the average, and others will do worse to maintain the average.

In the last five years, we have seen Nifty EPS has remained flat, but that doesn’t mean every company has shown a flat EPS. The EPS of Asian Paints, which is a Nifty company, has grown as follows:

Asian Paints EPS from 2015 to 2020

| Year | EPS |

|---|---|

| 2015 | 14.54 |

| 2016 | 18.19 |

| 2017 | 20.22 |

| 2018 | 21.26 |

| 2019 | 22.48 |

| 2020 | 28.20 |

Whereas Dr. Reddy’s EPS from 2015 to 2020 has remained flat.

| Year | EPS |

|---|---|

| 2015 | 137.13 |

| 2016 | 124.88 |

| 2017 | 77.96 |

| 2018 | 57.07 |

| 2019 | 117.42 |

| 2020 | 121.92 |

And both are fantastic companies within the Nifty.

So it would be best if you focused on the right stocks to invest in because, indeed, this is an excellent time to be investing in companies that will flourish in the coming times.

Remember One Mantra

As a long-term investor, you will eventually make as much CAGR returns as your company’s profit growth.

So look for companies that can take advantage of easy money and accelerate growth in the coming few years. You should be then fine investing in the market at all-time high valuations.

Leave a Reply