Are you the unlucky one in the market? You invest and the market starts falling. Let me share why it happens and what to do about it?

Do you feel like when you start investing, the market somehow knows your money is in the market, and it starts falling?

You are not alone to feel the same, and let me explain to you why it happens. More importantly, we will look into it so that you will see less red on your investments.

So before we begin, let me share the Why?

Why Market Falls After You Invest?

I get this question a lot from most of the new investors. So if you have such a feeling, you are not alone.

I wanted to share this with everybody to let them know that people want to curse their luck in the market.

Somehow, people consider the share market as a place to gamble. So people assume they need to be lucky enough to make money from the market.

The reality is a lot different.

So if you somehow have heard about the share market as a place to gamble, in the back of your mind, you doubt it and so want to prove it.

Now, as soon as you invest and the market falls, your mind starts triggering the gambling thought and confirms, “See, I Told You“.

The reality is, market moves are always on both the side.

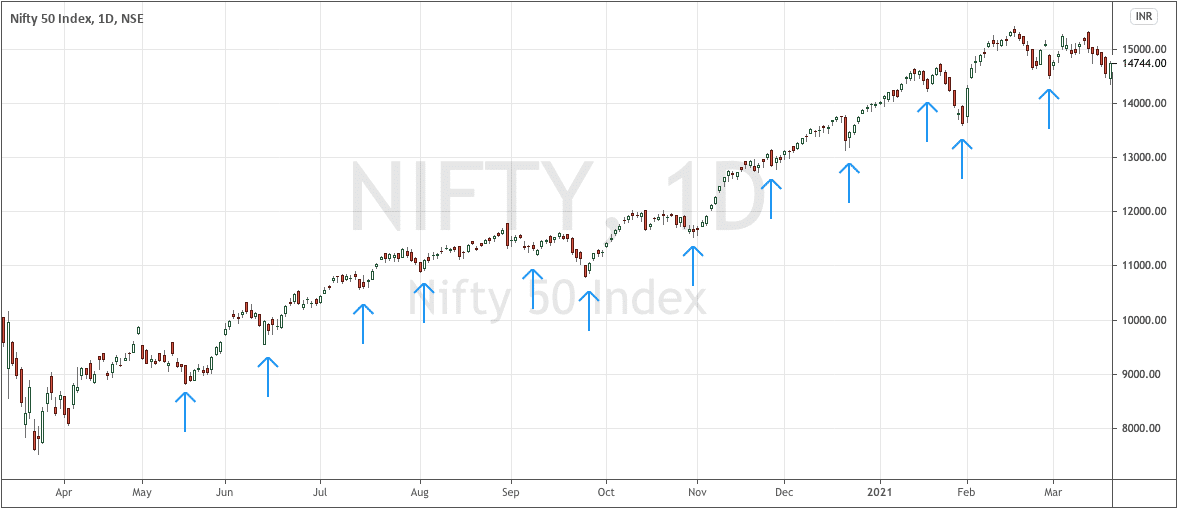

Let’s look at the chart of Nifty for the past one year, where it has doubled from the lows it hit in March 2020.

I have marked some of the corrections with arrows. You will see the corrections are everywhere. Even after October, when we see an actual speed in the market run, we see corrections.

So corrections will always exist in the market. It is just that you feel them when you are invested in them. Furthermore, sometimes, the corrections are short-lived, and so you tend to ignore them.

What you Can do and What you Should do?

The best you should do about the corrections is to invest more as the market starts to fall.

You will see that I have done some of the significant portfolios churns in the current market upcycle if you follow me.

Furthermore, I am also more than 10% into cash. I have never remained cash-heavy for the past five years. The reason is that I knew the market is pricing in a lot more, and anything unexpected will lead to a correction.

US Bond Yields is unexpected, and it should lead to a goodish bit of correction in the market. Once the unexpected starts, there will be many, which can lead to some great investment opportunities.

Don’t you think it is better if the market falls?

You want to invest in the market, but does it mean you are fully invested in the market?

If your answer is yes, it should be considered evil, but if you are only invested for a bit of an amount, the fall means you have more chance to invest more.

Don’t you think so?

So I think you shouldn’t care too much about the corrections. In the bull market, many corrections are ranging between 10% to 30% from the peak.

So a 10% correction in Nifty from the highs of 15,400+ means 14k levels, and a 20% correction means 12,400 levels.

Even if the Nifty hits a lot of 11,000, it will still be a 30% correction, and we will always consider it to be a correction in the long-term bull market.

So if you want to start investing, this may be the ideal time to start a SIP in Nifty ETF.

Final Thoughts

My assumption is the current correction will be around 20%, and depending on how the results and earnings pan out, the correction may form the bottom.

This is what I think will be healthy for the market though I can be completely wrong. The market has run up too fast too soon and needs a long pause for things to settle down.

Leave a Reply