After the Jul-Sep 2022 results season, I am neither optimistic nor pessimistic view of the market. Find out why

In June 2022, I shared why we should be buying the dip based on the EPS of the Nifty at that time and the growth that we were seeing in the results season then.

After the Jun-Sep 2022 results season and Nifty hitting the all-time high, my view has changed slightly.

So I thought I would share it in a video and the blog article here.

How Has Been Jun-Sep’22 Results Season?

The EPS of Nifty hasn’t moved much after the current results season.

Source TrendLyne.

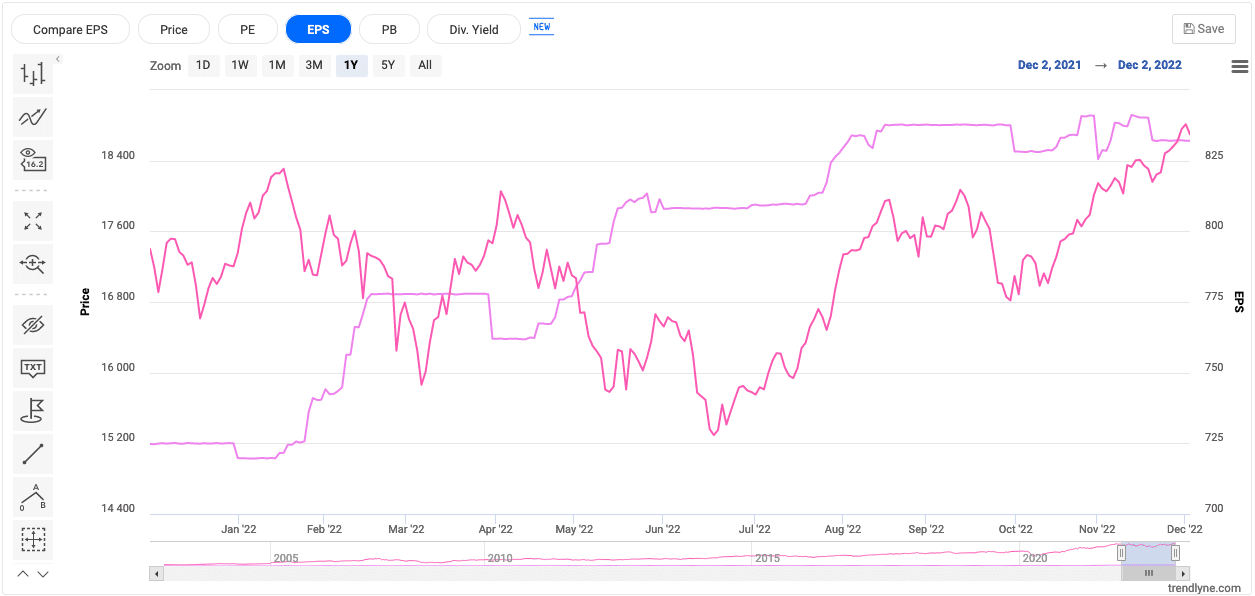

Let me explain the above EPS chart. The more pinkish line that you are seeing is the Nifty EPS.

In December 2021, the Nifty EPS was around 725 ish, and Nifty was trading at about 17,500.

In March 2022, the Nifty EPS Rose to 777. Then in June 2022 the EPS the Nifty EPS Rose to 808, and it was constantly on the rise.

When I made that video, the EPS of nifty was around 837.

So my understanding was the Nifty EPS would reach 900 by the end of the current financial year, and in the next financial year, it would be around 1000.

So in June, when Nifty was at 15k, one year forward earnings of 1000 means a 15 PE ratio of nifty, which was a good time to invest.

What Changed in The Current Results Season?

Nifty EPS has not moved much in the current results season. From 837, it has only gone up to 840 levels and then back to 832.

It is one of the main reasons for me to change my view.

I am neither bearish nor bullish on the market to invest at the current levels.

The Indian market has outperformed the world. It is in the green for the year-to-date or one-year time frame, whereas many markets are down even 30 per cent year-to-date.

In the current result season, we see that there is not much movement in the Nifty EPS.

Most nifty 50 companies couldn’t increase their profit despite good sales growth. As we don’t have good earnings growth year on year, the Nifty EPS didn’t move much.

Nifty All time High and My view of the Market

Now Nifty EPS should reach ₹900 in the current season for the higher Indian valuation to sustain.

The following quarterly result has to do some wonders, and I think it is also highly possible.

The world is going into a recession so commodity prices will cool off.

The sales growth in the current quarter has been good, and companies will focus on improving profit margins giving them higher profitability which can make the EPS jump higher.

However, till February, I don’t have any view on the market. AKA, neither bearish nor bullish, but we will wait for the EPS to rise.

If the EPS doesn’t rise in February, the one-year forward earnings forecast will be between ₹900 to 1000.

Depending on the earnings growth forecast, the view on the market will vary. For example, closer to ₹900 and 18k is 20 times earnings. At the same time, closer to ₹1000 and 18k is 18 times earnings.

Conclusion

If you want to invest in the market, choose companies from your portfolio that have done good profit growth.

Because in this challenging environment, if they have good profit growth, you should consider them for investing because once the scenario improves, they will do even better.

Do you invest based on the macro analysis?

Macro analysis is when you are not analysing the business itself but the environment. If you aren’t, this is the time you should start considering it because it will help you give the bird’s view of the companies that will do better and the companies that will not do as well as the others.

Leave a Reply