I will not prefer my money or my investments lying with a company that is trying to cut corners.

I have recommended Zerodha since 2013 and one of the main reasons for recommending them was they offered very innovative solutions like Z5 HTML5 platform, Charts, Good Backoffice Software. It seemed like was a broking house that was designed by the traders for the traders.

But recent incidence I encountered that was really hard to digest and created doubt about Zerodha as a company.

So let me share with you recent trust issues that I experienced with them as well as some of my blog readers who have confirmed which has made me to stop recommending them.

1. Affiliates as Employee – Is it?

I recommended Zerodha to my readers and they paid me part of whatever brokerage they made from my referred customers at no extra cost to them. I hardly made ₹500 per month because my recommendation wasn’t for the commission but was more of a genuine recommendation.

They had been paying me since 2014 but a few months ago they switched the payment type to sub broker payment which was quite ok to me because they used to pay me part of whatever they would earn as brokerage from customers referred to them by me.

The TDS for payment were deducted correctly as well as was getting credited with nature of payment as 194H which meant brokerage and commissions payment.

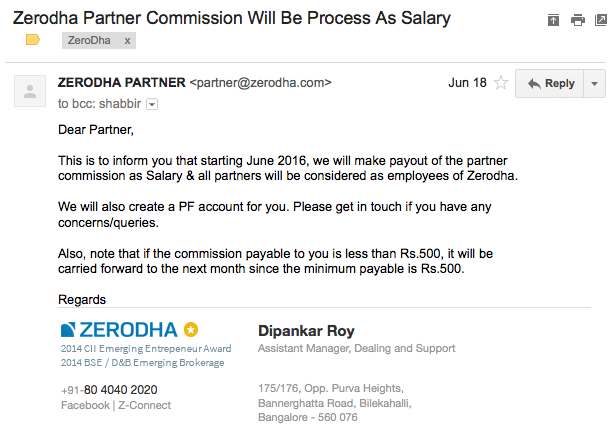

All good till June 18 when I got an email where they switched the payout of the partners commission as salary & all partners will be considered as employees of Zerodha.

I am not sure exactly why this is done and there is no reason given either.

What I sense is it could be related to SEBI’s rules for unregistered sub broker’s (remember they treat affiliates as sub brokers) but there can be various other reasons like they want to show higher number of employee count or want to show low attrition rates of employees or it could be related service tax which is not applicable on salary or any other reason.

Whatever be the reason, it creates a doubt in my mind as to why.

Updated July 6th 2016

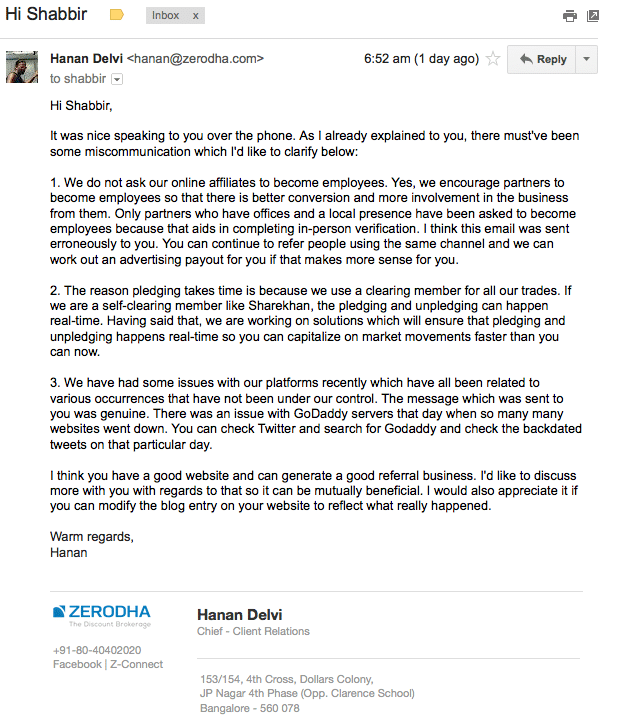

Clarifications By Zerodha: My Verdict – Not convinced & Looks Scammy?

There were long discussions about this article especially the point about making me an employee of Zerodha. They shared an explanations in an email as well. The email is as follows:

As per Ministry of Corporate Affairs site, Hanan Delvi is one of the directors of Zerodha Securities Private Limited.

So why I am not convinced on being an employee?

First they say that email was sent in error by the associated partner or AP team.

Do you believe that. The erroneous email was sent on June 18th and you have not emailed back again saying please discard the message sent and you don’t need to be an employee.

It could be that you didn’t realize but now you know it was error, so why there isn’t any mail in last 48 hours and why only a personal email sent only to me. Looks like it was an error only to me.

The more important question is – Why they wanted partners to be an employee?

In the long discussions we had over phone about why they wanted to make partners as employees and as expected it was inline with the regulators but was also inline with showing employees PAN India.

If you are opening a trading and Demat account, Zerodha’s employee should verify the documents. Zerodha’s don’t have employee’s in many parts of India so they want associated partners as employees.

Looks scam because

If I become an employee, and if some other AP refers a customer in Surat (Where I live currently), you will ask me to verify the documents of that customer? If they wanted it this way, they never told about the extra responsibilities. I sense they will opt for either one of the two possibilities

- Show referred customer as verified by the referred AP who is now an employee.

- Show referred customer as verified by an AP who is now an employee in that region.

In either case you are allowing unverified accounts to be shown as verified to the regulators and doing it in the name of the employed AP.

One more possibility could be to ask employed AP to verify the documents as well as assign the referred customer to him instead of the one who has actually referred which may not be right on the AP’s.

In all possible alternatives, asking partners to be an employee is looks phishy to me and so my initial verdict of company cutting corners looks more true now.

2. Margin to DP (Pledging of Shares) not Real Time

Moving shares from DP (Depository Participant) to margin known as pledging of shares may be needed if you want to place a buy order before you have money in your trading account. It could be for various reasons including a technical glitch where money is debited from your bank account but not credited instantly in the trading account. So instead of waiting for money to get credited, you can execute a purchase order using stocks in the DP account to be moved over to margin as credit to place buy orders.

One of my blog readers reported that Zerodha has margin where if you put pledge stocks to margins, it takes 2 days for the shares from margin to come back to DP and then only you can sell.

In ShareKhan, I can pledge and un-pledge shares instantly and can even place immediate sell orders on shares that were pledged for few days and unpledged.

This made me to think if they actually keep the stock in the DP when we move them to margin or they sell it off in the market and purchase back when we move them back from margin to DP. Don’t see any other reason for delaying in availability of shares.

If they sell off shares in margin, it can mean you lose dividends or can have short term capital gain tax on the transaction due to the sale and purchase of shares but as per their website, it states we will continue to get benefits of all corporate actions like dividends, splits, bonuses, etc. on the stocks pledged.

Updated July 6th 2016

Clarifications By Zerodha: My Verdict – Convinced

Zerodha is low brokerage broker and so they use IL&FS for some services which makes them bottleneck to pledging of shares. The process is if you pledge, the shares goes to IL&FS and they release the margin for trading. Again once the request is placed for unpledging, it takes time for IL&FS to release the shares from margin.

3. Technical Issues

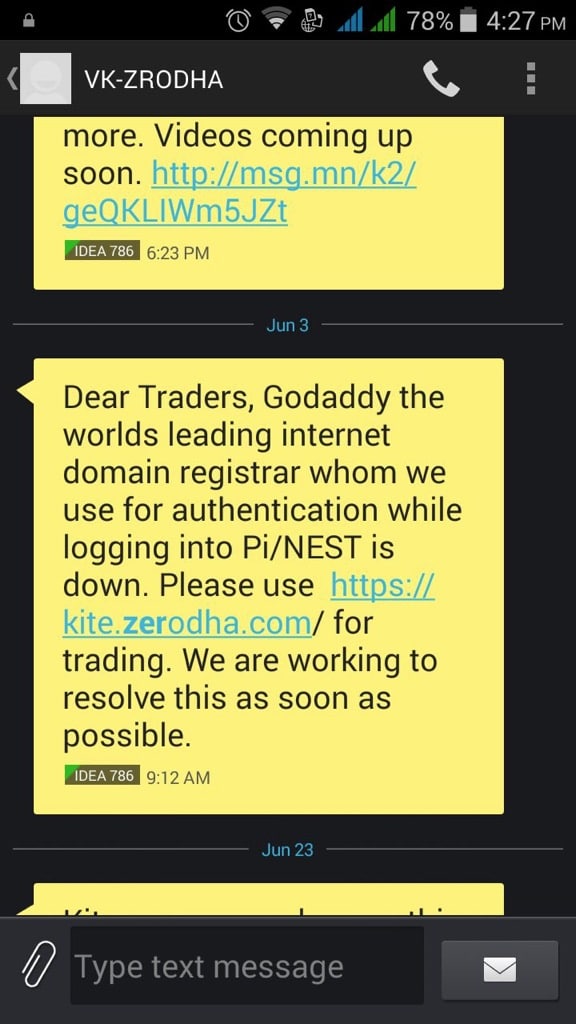

Have experienced when the complete Zerodha system was not reachable for a few hours and the SMS wording made it look like the issue was with GoDaddy domain registrar whereas actually it may have been an issue of the hosting server that Zerodha uses from GoDaddy.

Apart from that I see a lot of issues to system being down or not available too often.

Updated July 6th 2016

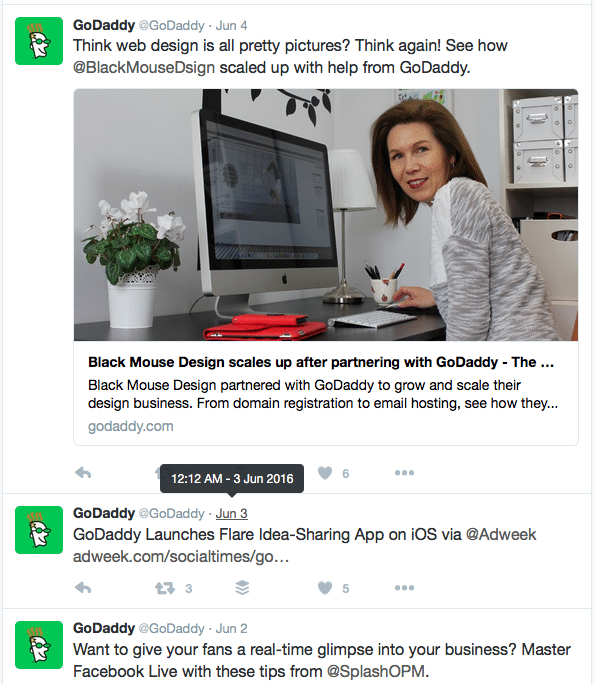

Clarifications By Zerodha: My Verdict – Not Convinced

I did expect a link to the tweet in an email but GoDaddy had only 1 tweet on 3rd June. Here is what I see tweets in the official GoDaddy Account.

Conclusion

I will not prefer my money or my investments lying with a company that is trying to cut corners.

So I have stopped recommending them as well as I thought it would be fair to my readers to let them know that I don’t recommend Zerodha anymore.

As of now, I will recommend ShareKhan despite high brokerage. I may experiment with other low brokerage brokers and see if I can come with an alternative to Zerodha.

I am not sure till now will my problem solve or not but I am having serious problem with Zerodha. Waiting for the climax.

Hi, today also the same problem with Zerodha.. The second leg gets rejected due to ‘server not ready’ error…. I luckily am trading with very little qty as I am having very little confidence in the system.

Second issue I face is in scalping… many times my trade does not get executed at all… it just sits pending even though it crossed the given price point. Today my sbin is waiting at 254.95 even though it came below to 254.9 and went above as well.

Customer Service has standard replies- logout login/ reboot system/ your internet is not strong etc… They always revert during the end of day or after the issue is auto resolved.

In March 2016, I lost a few thousands due to second leg getting cancelled suddenly.

Nitin called me personally and apologized, he was very courteous.

You can verify personally with Zerodha about today’s server issues… I am unable to exit my trades.

Check out my test trades…

Time Type Instrument Qty. Avg. price Product Status

12:42:51 BUY TV18BRDCST NSE 0 / 1 68.40 MIS REJECTED

13:24:51 SELL TV18BRDCST NSE 0 / 4 68.55 MIS REJECTED

13:17:51 SELL BALRAMCHIN NSE 0 / 1 74.50 MIS REJECTED

13:17:51 BUY FORTIS NSE 0 / 1 153.00 MIS REJECTED

13:05:02 BUY FORTIS NSE 0 / 1 152.10 MIS REJECTED

13:33:01 BUY TV18BRDCST NSE 0 / 1 68.25 MIS REJECTED

12:42:51 SELL FORTIS NSE 0 / 7 151.75 MIS REJECTED

12:27:58 BUY FORTIS NSE 0 / 5 151.45 MIS REJECTED

12:27:58 BUY TV18BRDCST NSE 0 / 1 68.55 MIS REJECTED

12:27:58 BUY TV18BRDCST NSE 0 / 2 68.50 MIS REJECTED

12:27:58 BUY FORTIS NSE 0 / 3 151.50 MIS REJECTED

13:33:01 BUY SBIN NSE 0 / 1 254.95 MIS REJECTED

BUY TV18BRDCST NSE REJECTED

Quantity

0 / 1

Price

68.4

Avg. price

0

Trigger price

0

Order type

LIMIT

Product

MIS

Validity

DAY

Order ID

180412001117921

Exchange order ID

–

Time

2018-04-12 12:42:51

Exchange time

–

Placed by

…….

Server Not Ready

Even I faced Server Not Ready Error in Zerodha today when trying to purchase Lupin for CNC. The surprise was, I could purchase other shares in NSE like Jubilant Life in the midst of error that kept coming for LUPIN in NSE.

ONE HARISH IN ZERODHA IS playing with words he is not reliable, yesterday they never made any payout, TODAY they claim to have made for a lesser amount BUT TILL THE TIME OF WRITING NO AMOUNT HAS BEEN RECEIVED IN MY BANK. Be careful with these guys, they cannot be trusted.

They possibly have outgrown their own capacity.

Hello sir,

Hello all

I have opend account with zerodha as all did, attracted to low brokerage, for few days all went good but some times kite interface started showing errors while trading lot of times I have missed but on 13th March 2018 I became victim. I was playing CO shorted a stock at 706 with stoplosa of 709, while order was executing after 632 shares out of 1000 were sold all of suuden second leg of order showed rejected and first leg was cancelled but 632 shares were showing in my position I was unable to exit the position and contacted support they said it was technical issue at vendor side it will get resolve. I thought as it is a CO they will squareoff but it did not happend and lead it to auction. What to do in this scenario. I lost money for their software glitch?? Any suggestions sir

First tell them “it is ur fault and u will be liable to refund my money”If they say that they can’t do anything…Just tell them ” i will go for justice and i will do whatever necessary steps to get my money back..” If they don’t listen to you then go and file a complaint against them in NSE compliant portal as well as in SEBI. One of my friend got his money back from zerodha thats 13TH march day due to technical glitch …

Ok. Thanks for ur suggestion

Sir what about upstox.. yesterday i lost my money due to the technical problem in zerodha… Help me to choose a good broker…

Same with me bro

The quality of brokers has gone down considerably and we have to deal with those technical problems a lot. I prefer Sharekhan and Zerodha because I am yet to see a broker with no technical issues.

OMG! Without going through reviews I opened one just 2 days before and I am here at this forum now, cause Zerodha made first fraudulent transaction without my consent. I moved 25K and they invested in Reliance liquid fund for a single day without my consent. I have sent a stern warning mail now.

zerodha partner program is totaly fool I lost 2lak expenses

Zerodha Partner i payed them 25000 rs Zerodha brokership .. after paying thy teling office want, but i hav takn office for rent the office rent cost is 15000 rs but i tkn, , later thy told emplyee want to pkup form, only 100 rs thy give for pkup 1 form, , 1st thy told me all city demat form pkup thy give me, , but later there zerodha customer care telling to customer to send courier to zerodha direct, , thy not giving me leds all city only wekly 1 or 2 pkup thy giving and only 20 % brokerage sharing, , before paying thy told thy give all totoal leds city, , now a days thy r opepning online demat ac, , , totoal fek hai Partner, , if i goon to pkup form if customer not three 1 to 3 time i have to pkup 1 form i lost petrol 300 rs i zerodha give only 100 rs ..i lost 2 lak in office all expenses, , and so dont take Zerodha Partner office

Hi Shabbir. Thanks for being so transparent and sharing the post.

Thanks for being so genuine in the post. Appreciate the knowledge and experience you shared. People should understand the post in context of their own situation and not take it literally.

I’m planning to switch from Anand Rathi to Zerodha only because Anand Rathi has high brokerage charges due to which I’m not making any visible profits. I’ll be trading on my own and I’ll be trading only in Futures contract. Is Zerodha a good broker for me or else should I stick with Anand Rathi?

Zerodha is probably the best low brokerage platform as far as what I have seen demo of many other low brokerage platforms or even some full fledge brokers are even concerned.

But I’ve been hearing some negative things about them on internet like “They place order in your account without even notifying it to you and also things like they’ll simply deduct your money by making unnecessary trades and also things like trades don’t get confirmed and trades don’t get placed”. Are they all true or is it the thing of past now?

I have been using them for all my trading and investing and I have huge amount invested with them and have had no issues for such trades. Whatever issues I had has been shared in this article which is not related to trades and demat account. You can see my open contract notes here for investment in Zerodha – http://shabbir.in/portfolio/

It seems like you are marketing zerodha services in this thread.

Will I face any problem ? If zerodha show me as employee, can I work for other their competitors then ?

Sir, my demdet with Nirmal bang, and there service is really very good, also brokrage is also very low….

HI, They are saying about IIFL DP but hope you are aware that zerodha is now providing its own demat accounts also for new accounts. Can they give real time margins with their own Demat??

It’s not IIFL but it is IL&FS. As far as I know they have started demat services but not sure if they have started partially or fully and if they provide real time margins in those scenario or not but they don’t say any such things on their website.

Regarding pledging of shares, I do not think Zerodha can sell the shares without the client knowing about it as the clients receive SMS from the exchanges and the depository participants as soon as shares are credited or debited from the account.

KSG, yes Zerodha has given clarifications about all the 3 issues I mentioned and it looks like the only issue where I am convinced is Pledging. They have bottleneck for IL&FS.

Dear Shabbir Bhai,

Shall we try to get the answers of mentioned concerns from Nithin Kamat of Zerodha?

Regards,

Kedar

Kedar, I had been discussing with Zerodha and it looks like I am not yet convinced about asking even high end partners to becoming an employee. You can refer teh article once again with clarifications from them as well as my verdict on each of them

So the problem is interms of server issues and pledging right..not in any other aspect?I am currently in process of shifting my invetsments to zerodha..

No Udayendra, the problem is with the trust as company is looking to cut corners.

OMG!! Shocking …I have been them with 2 yrs now mostly for derivatives ..so i should continue to build my portfolio in sharekhan and stop transiiton??I have not face problem with zerodha so far

If it is working for you, good but then for me it is trust issues for a company trying to find shortcuts.

Should we open new account and close one with Zerodha ?

It depends on where you open a new account.

For investor banks are good ?

Thanks for sharing your information. I am having trading account with RKSV but they have another problem. The report they give are totally wrong. If you select period of say 4 months , it shows you had 150 shares and sold 250 shares. How that is possible. When you ask them on phone they stragne explanations. I saw this for a year and then got fed up as there was no improvement in reports. They have horrible software. I aslso have trading account with ICICIDIRECT. Good platform but costly. I am going to close my RKSV account. I was thinking of joining Zerodha. Now a days famous cricketer is advsertising a broker. How is that broker?

Yes that could be horrifying. Kapil Dev is advertising about ITL but then again the broker is SAMCO. I have thought about it but not sure how good they are as of now but worth a try.

Why take a cheap shot and make private emails public? I have pledged shares with Zerodha for the past 3 years and have been receiving dividends without any issues. Shows your level of immaturity. Take it up with them instead of taking such cheap shot at publicity.

Agreed on your thoughts about margins but then it all started because they wanted to be on the right side of the regulators by wanting partners to be employees.

I have been reading your blogs over long time, but this time i disagree with you. I seems that you are taking it personally for just one reason i.e “Zerodha wants partners to be employee”. I guess you must have faced other issues earlier too but did not mind until you had a very decent income from referral.

Glad to hear that Pratik and when you have trust issues, you can have other issues coming along as well and I even told the same thing to Hanan when I discussed it over the phone.

Regarding payments, it was never significant and here is the screenshot of what their payment was for the quarter Jan to Mar 2016 – http://shabbir.in/wp-content/uploads/Screen-Shot-2016-07-11-at-6.30.07-PM.png

I do had problem with them. They promised some thing but do something else. Thanks I did not allow them to be trapped & had not deposited any amount to trade. it is better to pay more breakage than to be cheated later.

Completely agree with you on this.