How can an individual investor keep a watch on his or her companies important dates and updates without wasting too much time watching financial news channels?

How can an individual investor keep a watch on his or her companies important dates and updates without wasting too much time watching financial news channels?

Ideal Number of Stocks in a Portfolio

As an individual, if you have too many companies in your portfolio, it can become tough to remain updated about each news and event about the company and it can also become boring to follow all the news and events.

There is no general rule as to how many stocks are too many and can vary from individual to individual but ideally, the number of stocks in an individual’s portfolio should be in between 5 and 20. If you have too few stocks i.e. less than 5, you have too little diversification but if you have more than 20, you are overly diversified. It may be a better choice to opt for the best mutual fund that invests in majorly in your stocks and you may not even need to invest in stocks directly.

My personal choice is to keep the number of stocks in my portfolio to around 10 or 12 and go the focus investment route instead of being overly diversified. Note this is my personal preference and is not a rule, you are free to make your own rules and even break them if you know what you are doing.

TV channels & Newspapers

TV channels can take up a lot of your time for a small set of news that may interest you. So I don’t prefer to use them as a source of news for individual companies but can be used for a broader sectorial view.

I do watch CNBC TV18 on days when there is an expected management interview of companies in which I have investments but if I miss the interview, can watch it on MoneyControl.com

Personally, I don’t read newspapers but if I had to, it has tot be economic times for sure.

The NSE Website

The tool I like for updates of the companies is from the exchange websites NSE and BSE. You can get all the information you need but at times it isn’t presented in a very easy to understand format still the information needed is there for us to use.

NSE, the links is https://www.nseindia.com/corporates/corporateHome.html.

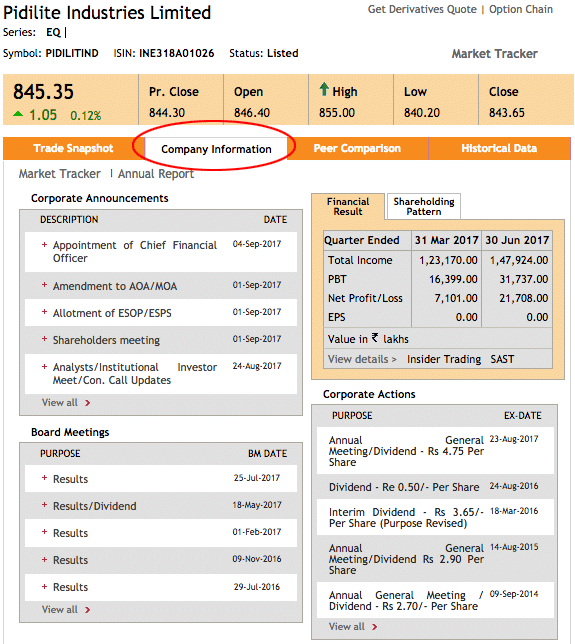

If you don’t want to use the above link, you can visit the NSE website and search for a company in the top right-hand corner. Visit the company page and click on the company information tab where you can find all the information as a summary.

The red+ will give you a small overview of the news and View all link in each section will take you to the details about each of those announcements. You can bookmark those View all links in your browser and keep track of announcements for each of your company in the portfolio.

Note: The snapshot summary of shareholding patterns on NSE website is quite good to get the picture of the promoter holding in a company.

The BSE Website

The corporate updates are better organized on the BSE website than on NSE. Use the same process to find the company in the search box of the BSE website and then use the left navigation to click on the Corp Announcement to visit all the announcement a company has made in the reverse chronological order.

The link for corporate actions for Pidilite is http://www.bseindia.com/corporates/ann.aspx?scrip=500331&dur=A&expandable=0. So you can bookmark each of such links for each of the company you want to follow.

Screener.in

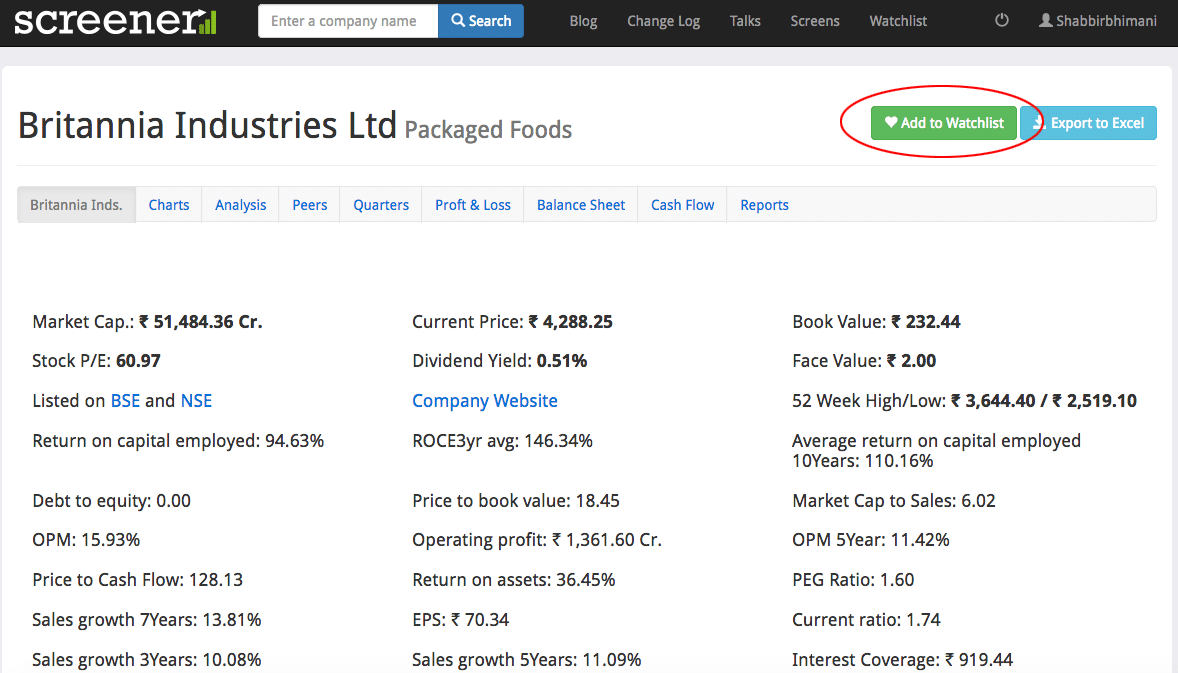

Possibly the best way to follow companies in your portfolio is through Screener.in‘s email alerts. Create an account at Screener.in and then add the companies to your watchlist.

When logged in, you can add any stock to your watchlist with a click of a button and can customize the information you want to see on the front screen for a stock.

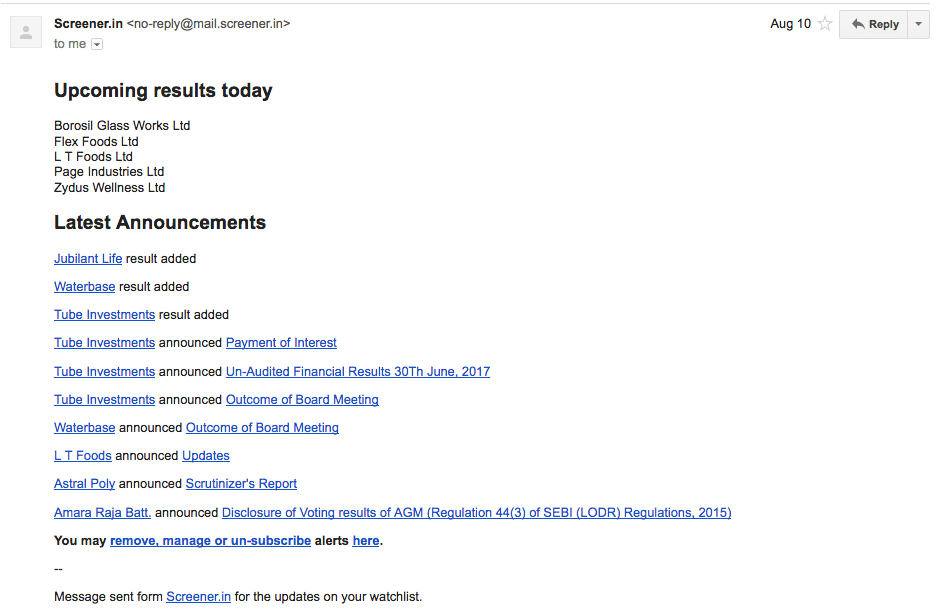

Once you have a company in your watchlist, they email you daily about all the action happening on NSE and BSE websites for those companies along with the upcoming results.

The email helps me keep updated on all the action happening for the companies in my watchlist.

Screener email links directly the BSE website and so if you are using screener, you can stop following the official websites. The emails are short, sweet and to the point and so takes hardly a minute to go through them.

Final Thoughts

If you aren’t using Screener.in, you may waste lot more time following the news and updates of your companies.

Additionally we can create alerts using alerts.google.com for the each of the stock that we wanna monitor closely. I have configured daily news alert mail about those companies.

One could use Google Alerts, set to deliver the company news at a predefined frequency. I use it to track is my bank is not going kaput 🙂

Google alerts often include stuff that aren’t related to the finance of the company and even when someone mentions or recommends the company anywhere on the web. At times it can mean too many alerts if you have a fairly popular company in your portfolio.

I feel moneycontrol is also gud as it shows cor announcmnts & other stuff all in one place alongs with charts.

Well Thanks Shabbir Bhai for the Last point i.e Screener feature . It will help me for future updates. Each time your Article comes in Short Piece but with good wisdom.

Thank U

Yes MoneyControl is quite good as well but then it has few distractions as well and the messageboard is too overly spammed.

Glad article is of help to you.

Yes u r right God knows what Moneycontrol gets by allowing so many Spam, I feel its done so that no one gets chance to right anything against any Company .

I can say I am simiply hooked to screener. So much better than moneycontrol in terms of speed and no ads. Awesome site.

Agree. Ads on MC are at times way too many and site is much better if you have the ad blocker ON.