I don’t invest in mutual funds to the extent a retail investor should be investing. This is against my own view where I recommend every retail investor should invest in mutual funds.

I don’t invest in mutual funds to the extent a retail investor should be investing. This is against my own view where I recommend every retail investor should invest in mutual funds.

Let’s keep that thought on hold for now and let me explain why I don’t invest in mutual funds.

Why Don’t I Invest in Mutual Funds?

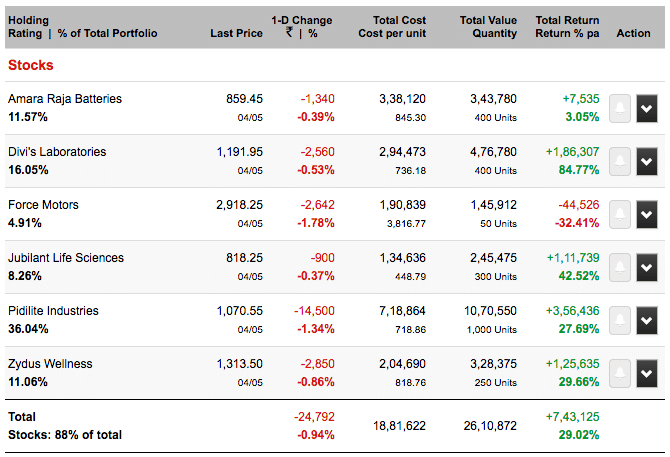

I did share a monthly portfolio update along with contract notes from 1st Jan 2016 to 1st March 2017. Since March 2017 I have stopped updating it for regulatory reasons. I have churned some of my stock since the March 2018.

Still, I hold some of the stocks from my March 2017 update.

I have booked profit in Ashok Leyland, Britannia Industries and Jubilant Foodworks. Has added Amara Raja Batteries, Force Motors and Divis Lab in the second quarter of 2017 itself.

Without considering the booked profits, the return from the portfolio is close to 30% CAGR.

Note: These are the past investment I still hold and has shared publicly as portfolio update or in community members area. This isn’t my complete equity portfolio and there are lot more additions recently.

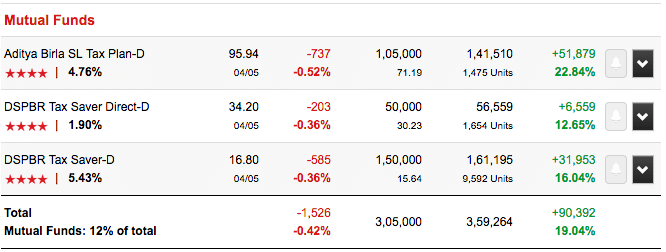

Now consider the mutual fund investment that I did openly at the same time.

The returns from my stocks are better by almost 10% overall than mutual funds.

One can argue these are ELSS funds and my stocks are midcap stocks.

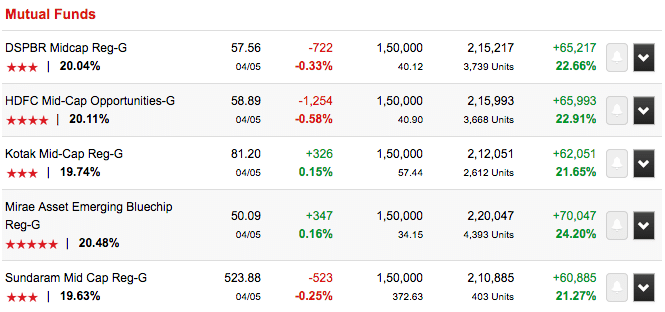

So let us see how a SIP in the best midcap fund of 2017 (not the best midcap fund 2018 but 2017) for the 15 month time period.

The returns are in the range of 21% to 24%.

So for me, investment in stocks is a wiser choice than mutual funds.

There is no rocket science as to why my portfolio works better than mutual funds. My portfolio has focused approach to investing where I limit the number of companies I invest in compared to mutual funds that opt for a diversified approach to investing.

When Should You Consider Investing in Stocks?

The point isn’t what I can do but what you can and should.

I recommend investing in mutual funds for others but I don’t do it myself. Can be contradictory but the answer lies in the question which is when one should consider stocks.

If you can beat returns from the best performing mutual funds, you should definitely consider investing in stocks but not otherwise.

If you read my article where I recommend mutual funds over stocks, the first criteria are the return on investment.

I only invest to the extent I need to for saving tax with mutual funds.

If you can beat the returns from the best performing mutual funds consistently and by a significant margin, you should invest in stocks.

Similarly, if I am trading and is able to consistently make higher returns than investment, I should be trading more than investing. I am an active trader but couldn’t scale my trades beyond a point. So I moved to being an investor.

Don’t Follow Anybody Blindly …

Following other investors isn’t the right approach in the market. Retail investor often follows other investors blindly of what they are doing.

How many times you a news flash about Rakesh Jhunjhunwala entry in a stock and it skyrockets.

Every investor each investment has an objective. If you aren’t sure about his objective, just investing based on what he has is recommended or invested may not always give you the same kind of returns.

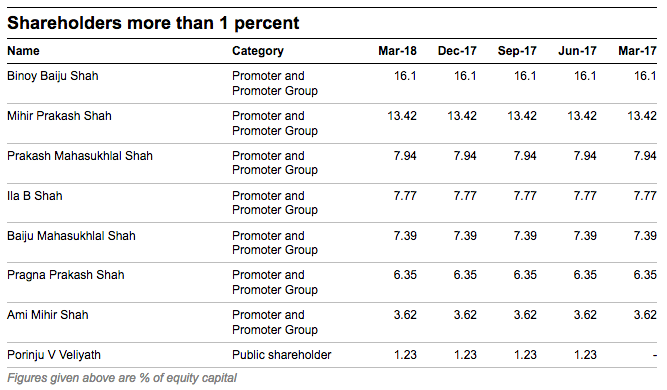

I am a big fan of Porinju Veliyath and his style of investing and I never miss his interviews, views and even stocks he mentions in those interviews.

Jubilant Lifescience stock in my portfolio is because I listened to one of his interviews but it doesn’t mean I invest everywhere where he has invested. He also has a large chunk of his investment in a stock called PARNAX lab.

Source: ValueResearchOnline

It isn’t something I am convinced with because my stock selection criteria a company shouldn’t be making losses.

I am fine investing when the company actually turns things around and not when it is turning things around. I may buy much higher price and even when he may have made money or even exited. But then this is how I prefer to invest.

So if you create your own investment criteria and follow others for ideas, there is no harm in it.

Over to You

I know this article has slight contrasting views. So I have to ask do you agree? What are your views about investing in stocks as compared to investing in mutual fund? Do you follow someone for investments? Share your views in comments.

your clarification are so good about stocks and Mutual fund Thanks Shabbir ji.

The pleasure is all mine.

Didnt get this point plzz elaborate “I only invest to the extent I need to for saving tax with mutual funds.”

I invest 1.5L per year in my account to save Tax under 80C. Nothing more in my mutual funds basket.

Ok. Seems like I have to clear few doubts.

You already have exposure to Equity than Why not invest in PPF for Tax saving .

Waise in last 5years how much return did you get in Tax saving fund.

Note: I am knew to Tax saving MF.

Lot more than PPF. Close to 15%.

axis long term equity fund is a tax saving and return is really good around 22%. It’s portfolio is having all good stocks including pidilite…

Yes I do agree that those who can beat mutual funds should be investing in stocks but how do we know we can beat mutual funds without investing and that is the bigger question. This is when people indulge into stocks and then often they use tips which makes them stuck in the bad stocks.

What you have said is easier said than actually do it.

Yes, I agree with abhi. I am investing in mutual fund for more than 1.5 yrs. I got all knowledge about mutual fund by reading shabbir sir blog. By now I have more than 6 lakhs in mutual fund. For last 2 months I am investing in stock.. here too I followed shabbir sir. By now I invested 3.8 lakh. I invested in amaraja, marico following shabbir sir and I am getting reward too. But except these I am in loss… Because not able to read market. Thus for new one selective mutual fund seems better and for expert, stock seems better..now I understand one thing., We can invest when stock started uptrend..I tried to understand graphs, candle stick…but I still not able to select right stock…I will request shabbir sir if he share some more stocks for us small invester. Page industries, wabco seems out of our reach…thanks so much shabbir sir..

You have a portfolio of 3.8L in stocks and still why you think Page or WABCO are out of your reach? Just invest in small quantity. I wanted WABCO around 7k but it just turn north from 7.2k and so missed it. Still waiting for some correction but this is one awesome stock to own for sure. Same is for Page. I am accumulating Page right before the results in Mid of May.

Thanks sir.. now I am trying to sell my all other stocks. Today I sold 50 units of Maan and 100 units of Nalco.. I will do the same for others within15 days and invest in pidilite, asian paint, Ashok Leyland, Amara Raja Batteries(I have already 58 units , will add more 42), Divis Lab, jubilant life science, zyduss wellness, wabco. I have 120 units of tata motors and 75 units of Marico to continue. Such article always helps and motivate us..thanks..

Good selection of stocks but then you should also focus on investing them at the right price and not just do it at any given price. Use technical analysis to invest at the right price.

What is ur opinion about Ashapura Intimates Fashion Ltd?

Worth considering but slightly higher debt but that can be worked around as the company is small and looking to grow but still a point to consider on.

Yes, It is easier said than done and that is hard part but one has to be doing it. This is what separates those who make money in the market and those who don’t.