What is the significance of the 52-week low list of stocks technically and fundamentally and what one should use the 52-week low list of stocks for.

Every stock market investors’ ultimate aim is to identify stocks that are available at a low price to buy them and sell higher.

In quest of finding such opportunities, investors look for stocks that are available at a lower price point in the market and this is when most investors look for the stocks trading at a 52-week low.

52-week is almost a year and so stocks trading at a 52 week low are those stock that is trading near its year low price.

No significance of 52 week low stocks – Technically

The basis of technical analysis is stock will continue to exhibit its trend. Stock hitting 52-week low is in down trend and so they will continue to hit fresh 52 week low.

Technical analysis focuses on the bottom being formed. There are many price action patterns to identify the formation of a bottom or even reversal of downtrend but as far as I know, none of them takes into account a 52 week low.

Technical analysts consider shorting these stocks that hit 52-week low because they are in a downtrend.

No Significance of 52 week low stocks – Fundametally

Fundamental analysis focuses on finding a value for the price and the stock trading at 52-week low doesn’t mean a value.

The only significance of the 52-week low list of stocks is, it can be a starting point to find valuation in some beaten down stocks but that doesn’t mean every stock in that 52-week low list offers value.

Fundamental analysts do look at stocks quoting at low prices, but buying in such 52 week low stocks are backed by analysis of the business fundamentals.

The significance of 52-week low stock lies in knowing the WHY?

The most important aspect is why the stock is making a low. There can be various reasons for such a move. Some reasons will offer value to investors but not all. Here are some of the common reasons why stock does badly in the market.

- Overall market sentiments are bad

- Overall view for the sector is negative

- Business is not able to deliver what market was expecting

- Business has issues remaining afloat

- Management has issues managing the business

And the list can continue.

Why one should avoid trading long in stocks where business has issues?

If business fundamentals are ruined, there is seldom a company can turn thing around. I can give you examples of few of the stocks that I hate the most and you can see these stocks have hit 52 weeks low year after year and this is despite the fact that market has touched all time high.

See the charts of some of the stocks since 2007 when they hit a new high and see each of them has been forming the similar pattern.

Aban Offshore – Despite Infrastructure Sector is booming

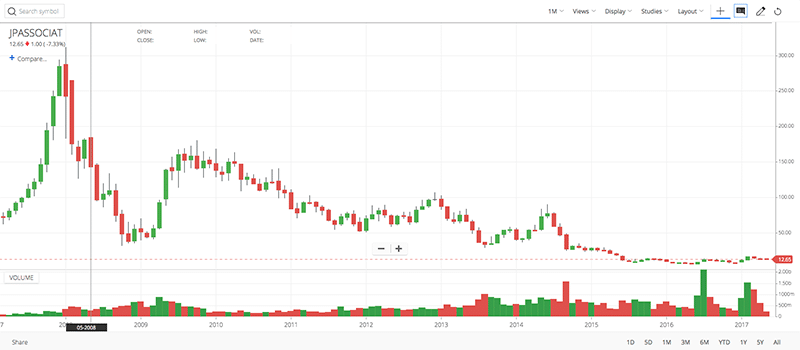

JPAssociate – Where management couldn’t control the debt

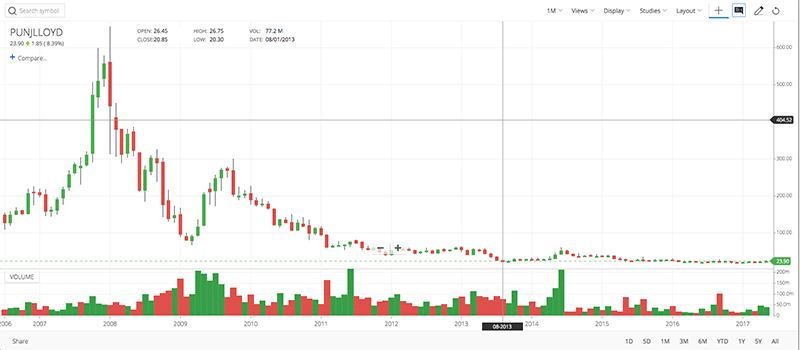

Punj Lloyd – Where they only grabbed orders over the years

I must confess, I was also an investor in Reliance Power IPO but luckily I was out of it with a small loss. See what kind of wealth destruction this company has done over the past decade.

Reliance Power – Company could never generated enough power

They were supposed to start operation and become profitable in 5 years. At least that was the talk of IPO time.

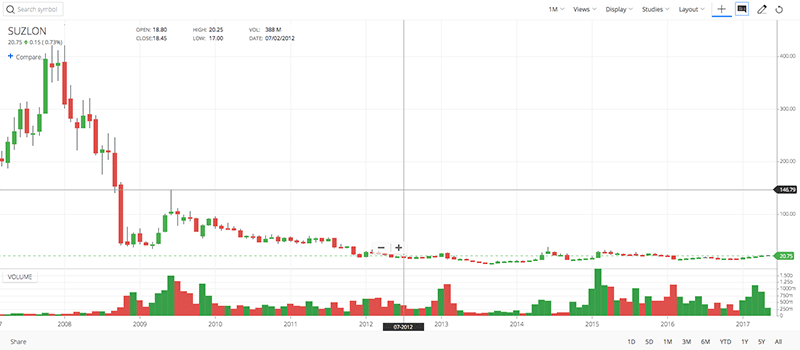

How can I forget Suzlon Energy? I almost get one query on Suzlon on a weekly basis and everyone is convinced about its turnaround story. My answer to each of those email is pretty simple and it is – Let the turnaround story reflect in numbers and then I will consider it. Not in an assumption that it will be a turnaround story.

Suzlon – The turnaround media hype

Final Thoughts

Neither technicals nor fundamentals has any significance of 52 week. It is the exchanges and media (52 week low list on BSE, NSE and MoneyControl) who have made significance of such lists. Retail investors fall into the trap of assuming 52 weeks low stocks are a value buy.

There is no significance of such 52-week low list and it doesn’t mean the downside in the stock is over. The stock price can tumble further the next day or the next week or the next month and it will appear in the 52-week low list again.

Hence never rely upon only 52 week low for investment.

All charts are from the Kite of Zerodha

Good thoughts. In short Change in market sentiments are welcomed but not business fundamentals . Here too how can sentiments push prices to 52 week low that’s impossible isn’t it. Only in Exceptional cases like Demonetisation, or some war type issues, or etc.