Let me answer what I think is the best possible investment opportunity in equity mutual fund for 2015.

I have been getting this question quite often on the the best possible mutual fund investment for 2015 in my Ask Me Anything. Let me answer it based on what I think could be the best mutual fund investment opportunities for 2015.

Thinking about investment, I always have a view of atleast 5 years or so. Anything less than 5 years is not an investment and you can know about the details of why I consider atleast 5 years timeline for investment in my fundamental analysis article where I have explained the time rule for investment.

So let us understand the investment criteria in 2015?

Does size matter?

Indices are at all time high and though correction is anticipated, I don’t see it coming anytime soon. So if you have to invest in mutual funds the best option should be in companies and sectors which are still to catch up to those that have already gone up which means it has to be more of mid cap and small cap companies that can do better than large caps.

So now we have 3 possibilities for market as a whole.

- Market goes higher from here.

- Market consolidates which means the small and midcap companies will have the time to catch up to the large cap companies.

- Market falls which can have a larger impact on the midcap and small cap companies.

So investment in midcap and small companies has higher risk for higher reward ratio and so I think the best strategy should be to invest in SIP in a small and midcap fund in 2015.

Other than size what else can matter?

Apart from size of the company I think sectors will matter more. Let us see how sectors have performed in the past and if we can make anything out of it.

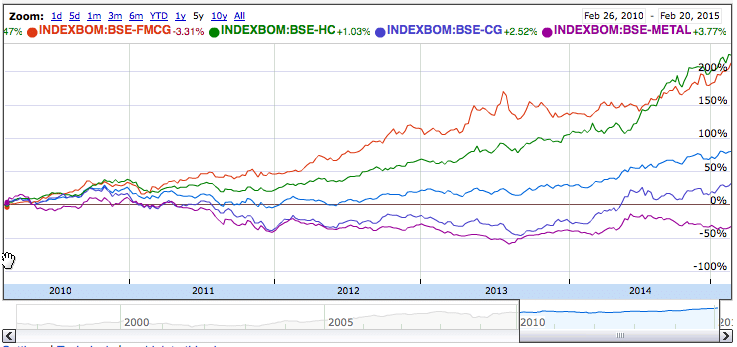

Above chart is from Google finance where I compared Sensex (Blue line) with 4 other sectors viz FMCG, Health Care (HC), Capital goods (CG) and Metal.

Clearly metal has performed the worst in last 5 years when compared to others and so if market remains stable with Sensex at around 28k, metal sector has to catchup.

Same thing could have been said about capital goods in 2014 which started to catch since second quarter of 2014.

Now you can use similar comparison on any sector using the following link in Google Finance and compare them with any other Indices.

I think metal index needs to catch up ASAP if market is to remain where it is now. So investing in mutual funds that have more exposure to metal index should be your best bet in 2015 for next 5 years or so.

What’s your view?

Do you think it is metal sector that will perform better or you think budget will have impact on other sectors? Share them in comments below.

Hi Shabbir,

I’ve been following your articles for quite some time which have acted as eyeopeners for me and I need your advice on some of the funds I’m currently invested in.

1. Axis Long Term Equity Fund – Growth

2. Franklin India Tax Shield – Dividend

The above two are for tax saving and are monthly SIPs.

Apart from these I’m also invested in

3. Franklin India Prima Plus Growth

4. Templeton India Short Term Income Retail Plan – Growth

5. UTI MNC Fund- Growth

All these are SIPs and I’ve invested in them for more than 5 years.

I’ve some goals assigned to them also.

Do you think these will be beneficial on a long run?

Any inputs on these would be really beneficial for me.

Thanks,

Prasanna

Glad you like my articles Prasanna Kumar Dash.

Yes the fund looks good but then 4 out of 5 of your investments are in large cap fund and only different is the name of the fund and fund house. It is too much paper work for very little benefits.

Also I see you have invested in growth plans but have you invested in regular plans or direct plan?

Hi Shabbir,

Thanks for the reply. Can you please suggest me some good mid and small cap funds which I can consider investing as of now?

Thanks,

Prasanna

Prasanna, why do you need some and one or two is enough. Go for the best performing funds from valueresearchonline.com and go for the one that you think has major investment in sector that will outperform next (Possibly metal).

My personal preferred fund is DSPBR’s small and midcap fund.

Shabbir,

Any reason you prefer DSPBR’s small and midcap fund. it has got only 2 star in valueresearch and it is not metal sector…Just curious! 🙂

Metal sector is preferred for large cap because once large cap run, then midcap and small cap will catch up and if large cap is down and out, no point in investing in small cap metal stocks.

VR ratings is not something I follow but prefer companies chart that are heavy in any stock.

Shabbir,

Do you still stay with the opinion about metal sector?.I am looking for starting an SIP. It seems metal is down by -16% as per google Finance charts. Your thoughts?

Sud, I don’t see metal sector as a whole has formed a bottom as yet but then there is not too much downside either and so I expect a better consolidation at the current level for sure. If it does not, there are very few chance of market remaining as it is now.

So yes my opinion is same as of now for the metal sector as a whole. Stock specific changes are clearly visible though.

Thank you Shabbir. Your view on ‘Franklin india hig growth companies fund’ Fund?

View should be yours and I should just be confirming if it is in the right direction or not because it does not matter what I think about the fund but it is what you think about it. This blog is about helping Indian retail investors understand the market and make money out of it.

I think as a beginner one should go with the popular fund houses in a SIP way. A portfolio with a large cap + mid + small cap fund will cover all types of stocks which can help to adjust the uncertainties.

Not a bad option Santanu but then you can always understand mutual fund types ( http://shabbir.in/mutual-funds-types/ ) as well as regular and direct pay option ( http://shabbir.in/direct-vs-regular-plans/ ) as a beginner as well.

But u dint mention the name of the funds which you would recommend….

Agreed but then I prefer to let users know how to find those funds that can go higher and not share exact funds because then people become complacent about it. What if the fund I suggest move out of the metal sector as major investment.

I follow “Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.”

Still if you ask me for one fund then it has to be DSP BlackRock Natural Resources and New Energy Fund which has considerable amount of exposure to metal sector.

Thank you Shabir… i second ur opinion… but manyatimes when u really track the market n see a gem… its alwys good to share it out… 🙂

I don’t disagree with you on it but then when you see a fund name in the article, people avoid the reason for the fund more often than not.

Consider me complete novice and my following statement would confirm that…

I just read this article of yours and its quite fascinating for me, why? Because around 5 yrs back I started a SIP in a pharma mutual fund and my basis of selecting it was its previous performance which was quite good. You can say it was my good luck that over the last 5 years pharma has done very well.

Now being said that, IF I were to go for another SIP, would pick the fund which is performing or course belonging to performing sector whereas you have placed a new approach wherein its wiser to invest in the sector which is a laggard. Something to explore for me.

Thanks so much

Amit, I always prefer the performing sector as well but then if the market as a whole has to perform, the under performers has to be perform or else it will be lot of imbalance in the market.

So I don’t think I recommend the under performance as yet but then I recommend the future performers and that can come from those who have not performed at all or those who can perform despite market remaining steady or range bound.

It is not about those who haven’t performed but those who can perform. Hope its clear now.

Thanks

Shabbir

Yes, I truly understand what you are trying to convey. Something interesting I discovered, I have a few mails from you dated way back, 2011. Not sure why we stopped interacting, hope it wont stop for now 🙂

About my emails stopping and it could be because you may have stopped interacting with the emails I sent and so it stops automatically due to inactivity. Don’t want to be sending emails just for the sake of it. If you keep reading them, it should not be stopping by any chance.