As a long-term investor, here are 10 things I look at in the quarterly results to help me invest in a stock or remain invested in the existing ones

I am a long term investor. So, quarterly results are crucial for me. So here are 11 critical aspects I look for in quarterly results when I want to either consider a new stock for investment or remain invested in the stocks in my portfolio.

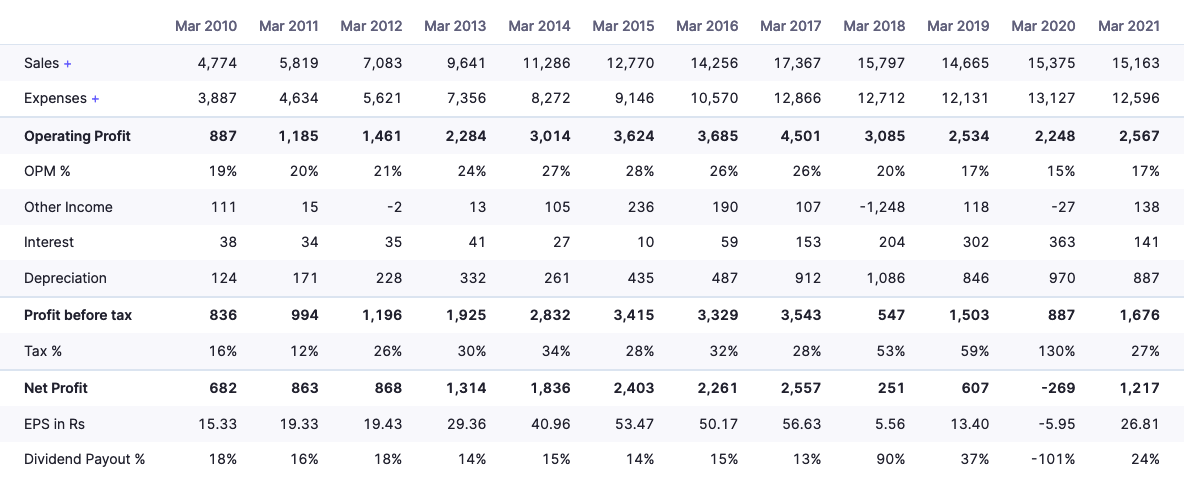

1. Revenue Should Always Grow

The most crucial aspect to consider for investing in is a consistent quarter on quarter and year on year revenue growth.

I seldom consider a stock for investment if there is no top-line growth.

Every other investment parameter can be compromised, but there shouldn’t be any compromise on the top-line growth aspect of the company in the future.

However, in Covid times, I am okay with no growth, but still, I like companies who can improve their bottom line despite flat top-line growth.

2. Profit Growth

The next crucial factor to consider for investment is the compounding profit growth.

Once the company can grow revenue, it should increase its profit in line with the revenue. In other words, the company should opt for profitable growth.

The business shouldn’t look to burn cash for top-line growth and hope to make profits in the future.

3. Improvement in OPM

There is always a scope for improvement. The best way to improve a business is to opt for cost-saving measures.

Once you have a growing top-line with growing profits, the bottom line will see a vast improvement once the operating profit margins or OPM improves.

So in quarterly results, I like to see how is the trend for operating profit margins. Furthermore, what is the management’s target for OPM and how they are improving the OPM to achieve those targets?

4. The Updated ROCE

Return on capital employed or ROCE is a way to judge the efficiency of the promoters. For example, what returns a business (read promoters) can generate from the cash or capital deployed in the business.

Higher ROCE means more efficient operations by management, and it can mean more profitability for the business in the long run.

The ROCE changes every quarter, but even a yearly update on it is okay. Yet, I keep an eye on the updated ROCE for each quarter to understand how well the management is doing.

Generally, I’m not particularly eager to invest in a company that has ROCE consistently under 15%.

5. Cash Flow

Revenue and profit growth are essential, but ultimately the revenue and profit should trickle into real cash coming into the company’s books.

Once a company set up a new distributor, the distributor’s stock can be taken up as revenue for the company. So such a phase can mean there is revenue growth but little to no cash flow. However, it will end up generating cash flow in the future.

So the cash flow from operations should be close (as high as 80 to 90%) to the total sales generated by the company in a given quarter. At times, the actual sale of a product happens a few days after the product is dispatched from the company.

So in an ideal scenario, the cash flow can vary compared to revenue, but it shouldn’t be too less when compared to the revenue.

6. Debt

If there is one aspect I generally avoid when investing is high debt in a company.

Though I don’t actively consider debt in the quarterly results, I keep an eye on it. The reason I don’t consider debt every quarter is because I like to invest in a unique business that has very low debt in the first place.

So there is seldom the case of debt being high in the future.

After my investment in Lupin around 2017ish time, the debt to equity ratio of Lupin went to as high as 0.6. So it was then I had to keep a keen eye on how the debt is being reduced.

The debt was comparatively higher than I would have liked it to be, but they aggressively paid off the debt. So I remain invested.

7. Interest cost

When the debt increases, the interest cost will inch higher.

I like to invest and remain invested in companies where the interest cost is much lower than PBT or PAT (Profit before tax or Profit After Tax).

Of course, there is an interest coverage ratio to understand how likely the company will pay off the debt on time. However, I like to see how much a company is paying as interest compared to what they make for the shareholders as net profit.

When the net profit figure is lower than what the company is paying as interest, I need a high conviction the interest cost will come down ASAP for me to remain invested.

I don’t mean the company was making a loss when I said the net profit figure is lower than what the company is paying as interest. What I mean is if the interest cost is 200 Crores, but the company, after paying the interest, has a net profit of only 150 Crores, then I consider the company is working for the bank more than for the shareholders.

8. Shareholding patterns and Pledge

The shareholding patterns for each quarter is released before quarterly results.

It may not directly impact the company’s performance, but it is essential to know how much promoters have their skin in the game.

Is management selling stakes in the company? If yes, the critical question is why and how they want to use the money.

Also, if promoters have pledged shares in large quantum, it means promoters may have taken up too much debt. The company doesn’t have the debt, but the promoters do.

So promoters may be investing elsewhere, and that may not always be a good choice. As an example, Emami Ltd is a great company to invest in. Still, I didn’t invest in it because the management pledged the shares of Emami Ltd to invest in other verticals like Paper Mills, Reality etc.

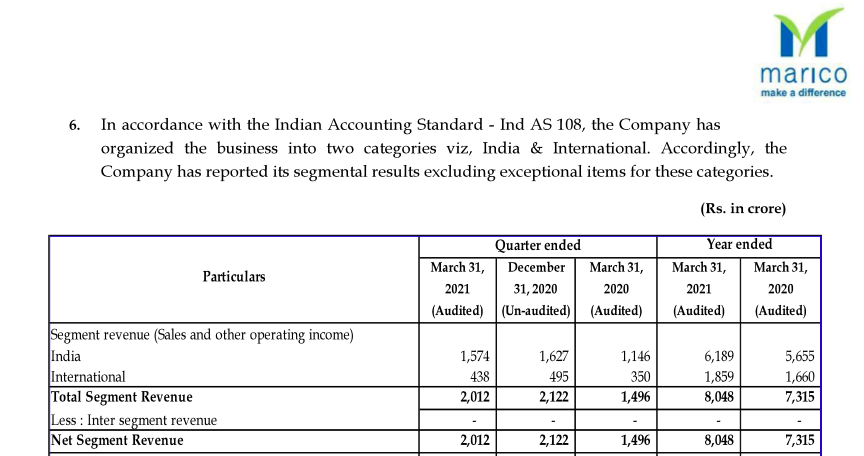

9. Segmentwise Revenue

Quarterly reports contain the company’s financial performance (Revenue, expenses, net profits, etc.) in different segments they operate in.

Here are the segmental results of Marico in its March 2021 quarterly results.

Marico has organized its business into two segments, India and International. So we can now understand how India’s growth is compared to the change in the export segment for Marico.

10. Investor Conference Commentary

After declaring the quarterly results, each company announces an investor meeting. Generally, it is a telephonic meeting where investors can ask questions to the management.

I generally do not participate in the investor conference, but I like to read the commentary of the meeting to understand how the management is willing to grow the business.

Like in my investment in Agro-Tech Foods Ltd, I was not willing to remain invested in the company because I didn’t see margin expansion or high top-line growth.

However, after hearing the investor meet audio clip, I am now willing to wait for another year before taking a call to exit.

So I am always looking for future growth triggers and management guidance. If I am convinced, I remain invested in the business.

However, one point to note is that I am looking for management commentary only in stocks where I cannot see sales and profit growth. In other words, if anything isn’t growing as I wanted it to be initially, I may take hints from commentary to remain invested.

11. EPS Growth

EPS growth is one of the last points I am considering. If there is a growth in revenue and profits, ultimately, it will trickle down to EPS.

I am even considering EPS growth because the share prices appreciate more based on the earnings growth in India.

So there must be an EPS growth for the company as well.

The question is, if Revenue and profit are growing, why on earth EPS won’t.

However, profits may grow, but if the company is re-investing heavily, the other expenses or depreciation will dampen the EPS. Furthermore, lofty acquisitions can also dampen the EPS.

Final Thoughts

Did I miss anything that you want to add to the list of things to look out for in quarterly results? Then, please share them in the comments below.

Leave a Reply