Invest in the best dividend-paying equity fund in 2020 and earn a completely passive and yet side income only from dividends.

We will find the best Dividend Paying mutual fund to invest in 2020.

I am a big fan of dividends when it comes to mutual funds. I prefer investing in dividend funds for all my tax saving schemes. The main reason being, I get full tax savings without investing in the full tax saving amount.

From the next year onwards, even when the dividends will be taxable based on the income slabs one is in, I still think because of the abolition of the Dividend Distribution Tax or DDT, it will mean we are paid higher dividends and pay our taxes.

So higher dividend-paying mutual funds are the right choice.

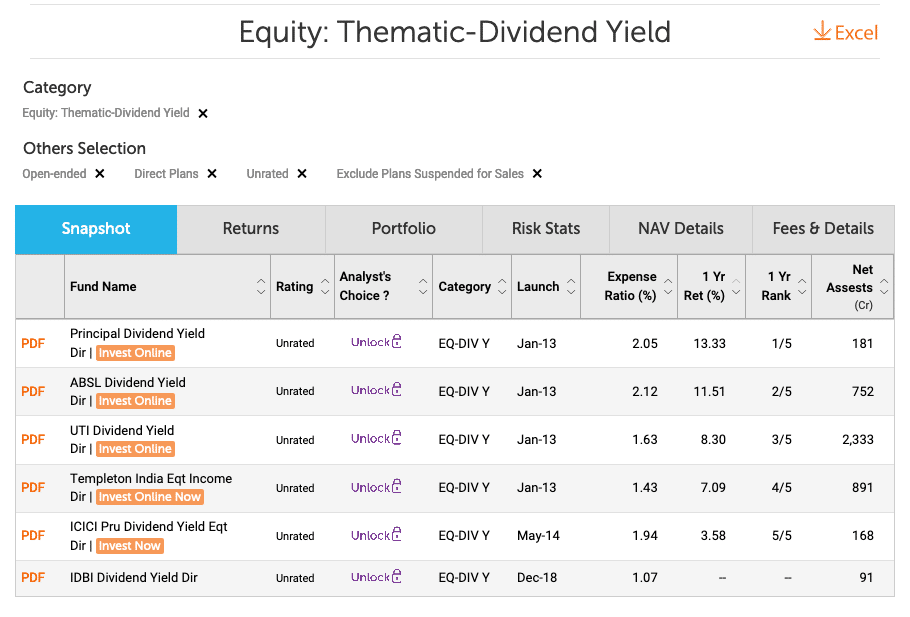

Top Dividend Yield Funds

To find the best Dividend Yield Funds, the process we will use is – from the direct funds, we will choose the funds that have a better dividend yield.

They are all equity funds and invest in companies that have a higher dividend yield.

Often the capital appreciation from such funds is low, but the dividend being paid is higher, which is the prime objective fo the investment.

Best Dividend Yield Fund To Invest in 2020

From the top Dividend Yield Funds, we will see how much dividend these funds have declared in the calendar year 2019.

| Div % in 2019 (Direct) | Div % in 2019 (Regular) | |

| ABSL Dividend Yield | 7.26* | 6.3* |

| ICICI Pru Dividend Yield Eqt | 8.32* | 9.74* |

| Principal Dividend Yield | 4.78* | 4.16* |

| Templeton India Eqt Income | 14.69* | 14.69* |

| UTI Dividend Yield | 11.51* | 11.51* |

* We used BlueChipIndia.co.in to get the dividend declared by the fund in the year 2019. Moreover, multiple dividends have been declared by the funds. To make the table simpler, the sum of all percentages of dividends is shown in the table above to be able to compare numbers.

UTI Dividend Yield

On three fronts, the fund has performed well. Dividend yield, asset under management, and expense ratio.

So clearly, it has to be the best dividend yield fund to invest in 2020.

Templeton India Eqt Income

The fund has the least expense ratio and dividend yield. The asset under management is slightly on the lower side, but I think the as more asset gets allocated to the dividend funds, it is bound to get higher.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the past funds. Create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. The emphasis is on the process. The funds may be doing well now, but when you want to be investing, use the same process, and find the best fund at that time to invest.

Hi Shabbir,

As per the current Budget 2020 would you recommend Dividend or Growth MFs

DDT is cancelled, dividends will only add one to a higher tax bracket

Kindly comment

I still recommend dividend because it will give money in your hand to invest back in the market at better price. Again, some may want to save tax and take benefits of LTCG lower tax rate but for those who are still not above 10L, I do recommend them dividend.

Thanks

The pleasure is all mine.

hi, shabbir, can you suggest best consistent dividend paying MF

how about “SBI Equity Hybrid Fund – Direct Plan – Dividend”

That is Hybrid fund but I prefer Equity funds. Still you can do the same analysis like I did for the above funds

OK. i will do it. but let me ask you. why don’t you see 5 years /3 years and 10 years divided history and take average to find approximate return. one year return not enough for better analysis i think

Correct but then the whole point is on the process than on the data itself.

Moreover, we have very few funds as well in this category and so choices are limited as well. If data from one year may not be conclusive, we may have gone for more data as well.

You may want to invest later in the year and you can take data based on what is available at that point of time.