Find the best large-cap fund for 2020 along with the selection process and review the performance of the best large-cap fund of 2019.

Let us find the best large-cap mutual fund to invest in 2020 and review the performance of our choice of best large-cap fund of 2019.

So let’s begin.

The year 2019 was good for large caps, and so large-cap funds had done better.

The Sensex and the Nifty did well in 2019.

Investing in the right large-cap funds in 2019 made sure it outperformed.

Still, I believe the amount invested in 2019 in a large-cap fund, SIP or otherwise, will reap the benefits over time as a passive investor.

The Top Large-Cap Funds for 2020

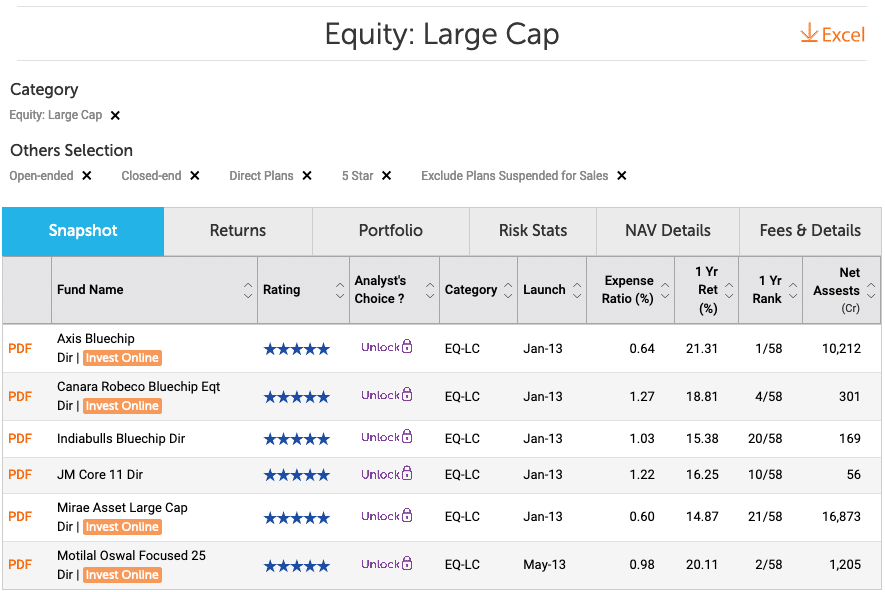

The process we will use to come to the best large-cap fund for 2020 is – from the 5-star rated large-cap fund by ValueResearchOnline, we will compare the performance for the past year along with expense ratio to get the best large-cap fund.

I do agree one year is very less time for fund performance comparison. But the idea is if the fund can perform well in 2019 and beat Sensex and Nifty – It has the right process to select better stocks. So the team, especially the fund manager, can continue doing it in 2020 to outperform.

Best Large-Cap Funds for 2020

The best performing funds in 2019 were

- Axis Bluechip

- Motilal Oswal Focused 25

- Canara Robeco Bluechip Equity

Based on the expense ratio, if we have to select only a couple of funds, then it will be:

1. Axis Bluechip

Axis Bluechip Fund has been a consistent performer. It has done well not only in the past year but has been doing well for quite some time now. Without a doubt, it has to be the best large-cap fund for 2020 as well.

It has been my best large-cap fund for 2019. Moreover, the Axis as a fund house has been doing a lot better. Its mid-cap fund is the best mid-cap fund for 2020 as well.

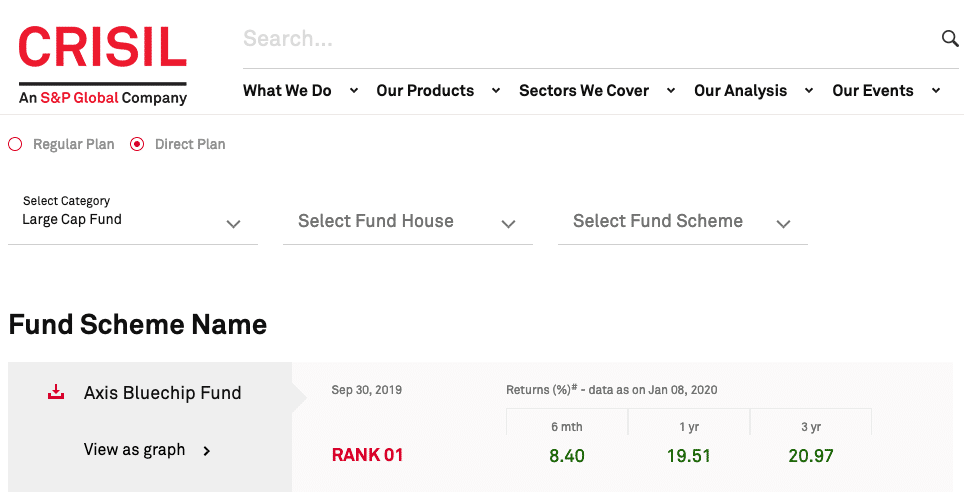

As expected, CRISIL also lists the Axis Bluechip fund as the top large-cap fund.

2. Mirae Asset Large Cap Fund

The next best large-cap fund for 2020 has to be Mirae Asset Large Cap Fund.

Though the fund hasn’t performed the best, it still has given a return of close to 15%. With a lower expense ratio and more assets under management, it can surely outperform in 2020.

How Well The Best Large-Cap Funds of 2020 Performed?

The main reason I share the series of best funds is, we evaluate how we have done in the past. It means either we do well investing or we learn to improve our fund selection process.

The best large-cap funds of 2019 made us better returns this time.

- Axis Bluechip Fund

However, the other fund as the best fund of 2019 was

- Reliance Large Cap Fund

It is renamed to Nippon India Large Cap Fund and has given a very meager return of ~8% only.

There is an important lesson one learns from this is, if the fund house isn’t stable, the return from the funds can take a hit. Axis fund house is doing well, and so are the funds in each category.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the past funds. Create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. The emphasis is on the process. The funds may be doing well now, but when you want to be investing, use the same process, and find the best fund at that time to invest. Use ValueResearchOnline and CRISIL as and when you want to invest in 2020.

Leave a Reply