Find the best multi-cap fund for 2021 along with the selection process and review the performance of the best multi-cap fund of 2020.

We will find the best multi-cap mutual fund to invest in 2021 and review the performance of our choice of best multi-cap fund of 2020.

A multi-cap fund is a mutual fund that can invest irrespective of the market cap of the companies. The advantage a multi-cap fund over a large-cap or mid-cap fund is – it doesn’t have a limitation to the amount of exposure it can take in a mid or small-cap company in the rising market or a restriction like the small or mid-cap fund to move to large-cap stocks in a falling market for stability.

So it is a balancing act between the large-cap, mid-cap, and small-cap fund taking the best of both the world. One may see that the multi-cap fund has an undue advantage, but it also means that it can underperform badly if the fund manager is on the wrong side of the call.

Still, when the decision to choose more allocation to mid-cap or large-cap is with the fund manager, it can be more beneficial to the investor as highly qualified fund managers are more equipped to make better decisions in the market.

However, the primary aim of the fund manager is to outperform the benchmark and not absolute returns. So, if you think it is better to do it yourself, check out:

Best Large Cap Funds To Invest in 2021, Best Midcap Fund to Invest in 2021, along with the Best Small Cap Fund to Invest in 2021.

The Top Multi-Cap Funds for 2021

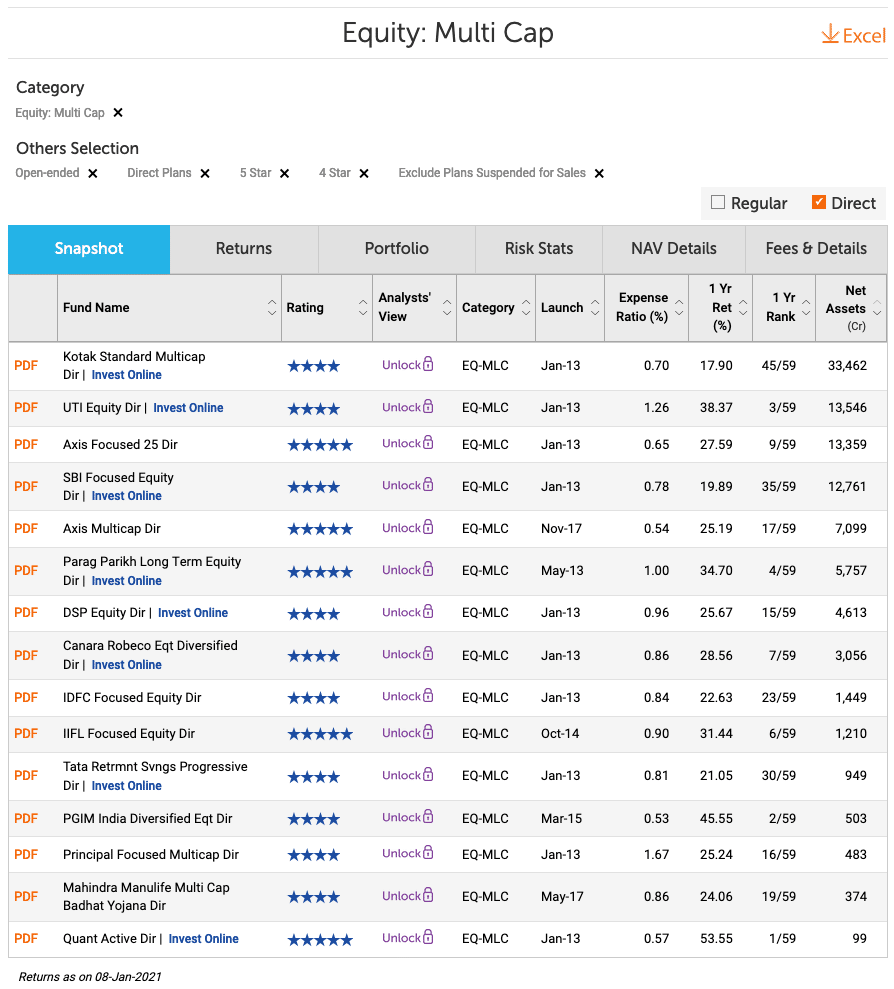

We will use the process from the 4 and 5 star rated direct multi-cap funds by ValueResearchOnline, and we will choose the funds that can outperform in 2021.

We selected only the funds with more than 4000Cr AUM or assets under management.

Now for all the funds, let’s make the table for allocation to Giant cap, large-cap, midcap, and small-cap.

| Fund / Allocation | Giant | Large | Mid | Small |

|---|---|---|---|---|

| Kotak Standard Multicap | 54.47 | 16.49 | 28.75 | 0.29 |

| UTI Equity | 39.66 | 25.92 | 29.50 | 4.93 |

| Axis Focused 25 | 71.04 | 23.31 | 5.66 | – |

| SBI Focused Equity | 46.49 | 13.49 | 36.68 | 3.34 |

| Axis Multicap | 76.35 | 17.85 | 4.12 | 1.67 |

| Parag Parikh Long Term Equity | 46.95 | 11.40 | 29.99 | 11.66 |

| DSP Equity | 45.91 | 15.18 | 28.27 | 10.64 |

*All data as per ValueResearchOnline as on 10Jan2021

Best Multi-cap Fund to Invest in 2021

From the above table, depending on your view for 2021, one should select the best multi-cap fund to invest in 2021.

There are two choices as far as I can think of as of now:

- Big will continue to get bigger at a much faster rate despite the bull run they saw in 2020.

- As the Indian GDP recovers, the mid-cap segment of the market will do well in 2021, and the big will consolidate, much like Reliance, which started the bull runway ahead of the market and is now consolidating.

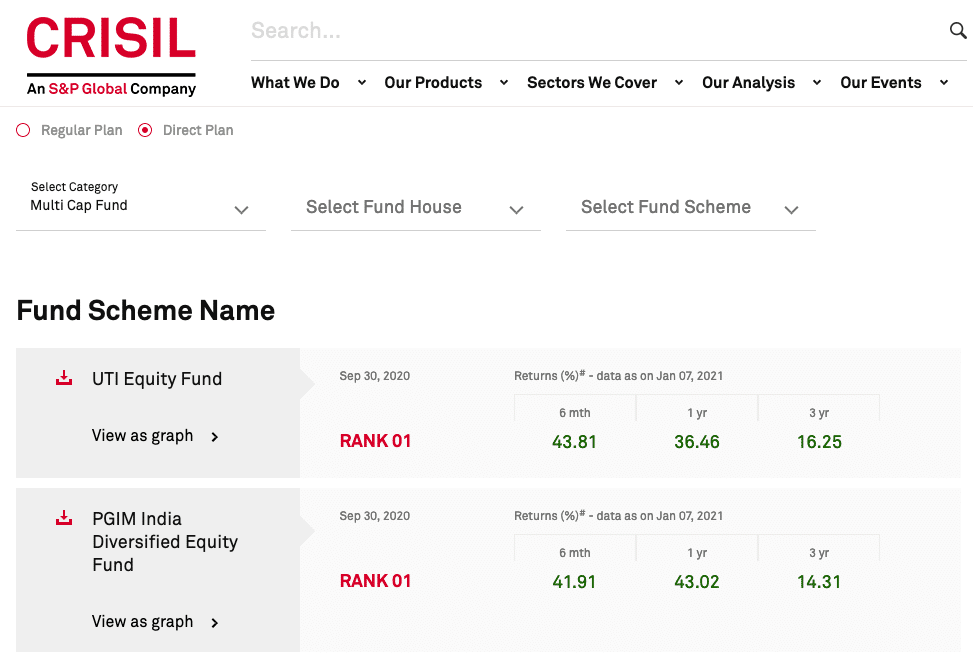

Depending on your view, you should select the best multi-cap fund. However, if you don’t want to view it, you can also use CRISIL and use their choice of better performing funds.

I am of the view; the mid-cap segment will do well. So my best multi-cap fund is the one that has maximum exposure to mid-cap and small-cap segments.

Parag Parikh Long Term Equity

With more than 40% of its asset allocation in the mid and small-cap segment, I think Parag Parikh Long Term Equity fund is more likely to outperform in 2021.

DSP Equity

The next best fund with 39% of its asset allocation in the mid and small-cap segment, I think the DSP Equity fund is more likely to outperform in 2021.

SBI Focused Equity

If I have to select the third one, it has to be SBI Focused Equity because it also has close to 40% in the small and mid-cap segment though it has only ~3% in the small-cap segment.

How Well The Best Multi-Cap Fund of 2020 Performed?

The best multi-cap fund of 2020 was Kotak Standard Multicap along with Axis Focused 25.

- Kotak Standard Multicap Fund has returned 17.90% for the full year, which isn’t bad considering the volatility we saw in 2020. However, it has underperformed the BSE 500 Index.

- Axis Focused 25 fund has returns of 27.60% for the full year, which is excellent returns and has outperformed the BSE 500 Index.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in those funds. Create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. The emphasis is on the process. The funds may be doing well now, but when you want to be investing, use a similar approach, and find the best fund at that time to invest. Use ValueResearchOnline and CRISIL as and when you want to invest in 2021.

Leave a Reply