It is good to visit your portfolio time and again to see best performing funds / stocks and act accordingly to the non-performing funds. This time I have offloaded some non-performing mutual funds which gives me list of best performing mutual funds for me which I am excited to share.

It is not possible to invest in all the available mutual funds but with whatever subset of mutual fund you invest into it is good to visit your portfolio time and again to see best performing funds / stocks and act accordingly to the non-performing funds.

Recently I have offloaded some non-performing mutual funds which gives me a list of best performing mutual funds for me which I am excited to share here.

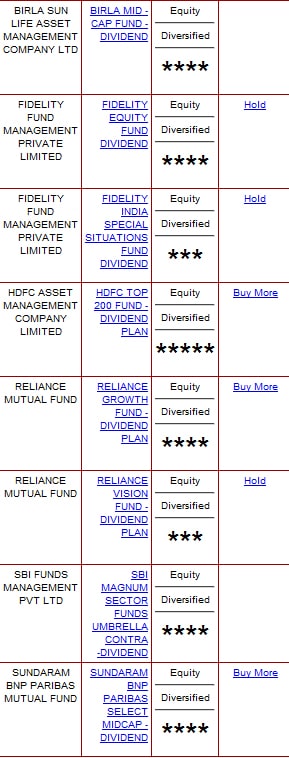

* Third column suggest category of fund & ValueResearchOnline ranking and fourth column is recommendation of ICICIDirect.com for the fund.

I am sure you have invested in quite a few mutual funds and not all of them perform the same this is quite a good time to re-look at your portfolio and offloading some.

Do share your performing mutual funds in comments so that we can grow more on our list of funds and invest wisely.

Dear Sir,

While doing searching for a suitable blog/site, fond this.

Now , the question:-

I have just prematurely retired.Have some funds to invest.Presently parked in bank FD for monthly/qtly interest for staedy income. But like to invest some for better income– advise whether shares,if so what and how, and MFs if so what and how much ?

Raju, I am not a financial planner and so cannot suggest you better ways to create wealth but what I do is play in equity markets for good gains. I am not sure if it is for you or not.

Also I don’t like to tell people which MFs and shares they should invest into but I prefer teaching people how to find such stocks.

thanks

Hi Shabbir,

Nice Blog!! its but obvious.

I have wasted 1 year without investing anything.Now i am like a raging Indian Bull dying to crash into the market and play safe at the same time.So want to follow the SIP route.

Can you please highlight some good funds(equity) to invest(4000 to invest monthly/multiple funds).

Also what should be my method of investing.

1.Going to fund houses one by one or

2.Using ICICI Direct, if yes do i need to go through a KYC process also.

Because i am currently deputed in some other place,away from my present address. So in short where can i start investing in mutual funds completely online without any haasle of proving myself through ID ards n address proofs.

Long queries!!! pardon Me….

Thanx in advance.

God Bless

Ashim see http://shabbir.in/invest-mutual-funds-online/

Hi Shabbir,

Thanks for your encouraging words! But what I would like to know is whether I should redeem any of my old investments which are not doing well like DSP TIGER ,SBI Contra,Reiance vision etc. or should I let them grow.I don’t have any need for funds in near future.So ,can you suggest some new investment funds for me.Also,should I go for lumpsum or SIP since market is touching low these days.Please reply as per your convenience.

Thanks again in advance for taking time out to reply !

Regards,

Snehal

You should not be redeeming your performing funds but yes switching the non performing funds is what you should always do.

Hi Shabbir,

Kudos for bringing up such an informatve site! Being a techie,providing financial aspects in such simple manner is really great! Luckily I stumbled upon your blog & it has really enlightened me in many ways ! Keep up the good work!

I had done some MF investments from idle funds in 2007 which I never bothered to check after big fall of stock market! Most of that have done OK so far & I have realized my mistake of not keeping track of it. I am correcting my mistakes now.Henceforth,I plan to invest regularly through SIP.I have some idle funds(2-3 lac)which I need to invest in equity MFs for long period.I plan for good retirement kitty around 15 years from now.My risk appetite is high.So can you suggest some good MF options for me to invest in?Also,since market is touching low now;do you feel I can invest lumpsum or as suggested by some experts invest in liquid debt funds & do SWP/STPs through them.What is the best approach ? I am listing my old investment as under.Currently I have only 1 SIP of HDFC Top 200 for 2k going on.Please suggest investment plan & please keep up the good work of making investment simpler!

My current investments:

HDFC EQUITY FUND -GROWTH

HDFC TOP 200 FUND-GROWTH

BIRLA SUN LIFE FRONTLINE Equity-Growth

SBIMF MAGNUM GLOBAL Fund-Growth

SBIMF MAGNUM CONTRA Fund-Growth —-

RELIANCE VISION FUND-Growth—-

RELIANCE GROWTH —

RELIANCE EQUITY ADVANTAGE FUND-Growth —

RELIANCE EQUITY ADVANTAGE FUND ——

BirlaSunlifeEquity(G) —-

DSP BLACKROCK LYNCH T.I.G.E.R(G)–

New investments in 2011

ICICI Pru discovery-G –lumpsum

DSPBR-MicroCap-G -lumpsum

HDFC Top 200(G)–SIP-Going on

Thanks & Regards,

Snehal

Snehal, thanks for the feedback and I am sure SIP will help you a lot but I must say you have some investment in some great funds and though you missed the investment down market you are better than many others who have lost from 2007

Hi,

I am looking for investment for my daughter who has just turned 1 year old.

I am looking at a horizon of 15-20 years.

From what I understand ( & I am a doctor, so no financial background) it makes sense to invest in a good mutual fund SIP and not worry about the same.

I believe that 1-2 MF should be more than sufficient.

Which ones out of the above mentioned list would you recommend?

Do you agree with my line of thinking?

Dr Gupta

PS: Just stumbled upon your website .. I am lovin’ it 🙂

Yes I agree with you and SIP is best way for your daughter. I have similar things done for my kids in DSP Blackrock Small and midcap fund. I prefer to use my wife’s account for their investment because my account sees lot of churning and I don’t want to be touching investment for them.

PS: Great to see you stumbled upon my blog 😀

Thanks Shabbir. How do I understand the tredns and the dips. Can you please help.

Regards

Piyush

Invest small amount and observe how fund drops in NAV when market corrects. That will help you understand when you should add to your investments.

Thanks Shabbir,

If liquidating is not a requirement for next 3 years, what will be your take.

Regards

Piyush

Piyush, I would watch them for the trends from now on and start investing in dips.

Hi Shabbir,

Very nice site. Looked at the ebook. Would it be good to invest in all the 9 funds (adding the various a and b options make it to around 13-14 funds) by putting smaller sums in each one of them. Or will be it be putting eggs in too many baskets.

Best Regards

Piyush

Piyush, It all depends on your requirement to liquidate your investment. I would suggest if not all some would be good.

Shabbir, what is your idea on the just concluded NFO DSP BR FOCUS 25 Fund? What risk appetite could look at taking a bet in this Fund?

Mirza, I prefer not to invest in NFO’s and there is no reason to do that as well.

Hi Shabir,

Just a quick question, as I am new to this MF piece need your help in understanding if I have made the right investments. I have recently invested in the following —

Birla Sun Life Mid Cap A Fund (G)

ICICI Prudential Discovery (G)

Franklin Pharma (G)

DSPBR Small and Mid Cap Reg (G)

Would it be worthwhile to keep it for a period of 5 years….?

Looking forward to your reply… Thnx!

Ankan, I would say not bad but cannot predict such a long predictions but yes looks good now.

The main objective of my listed funds is i like to invest around 1 lac which is sitting idle in my bank, so i have decided to invest amount into these funds.

Nice but the funds you should do investment into should not be the ones we find useful but it should the funds which you think will help you.

Mirza,

I guess ur potfolio of MF’s is too lengthy.. Guess u stick on to 5-6 diversified funds which shld be the best.

Rgds

Melwyn

Shabbir can you please go through below list of MF i like to buy. Do you think my below selection is worth keeping for 5-7 years period. Suggest me in the present market scenario.

Sundaram BNP Paribas Taxsaver OE- App ELSS

SBI MAGNUM TAXGAIN SCHEME 1993 – GROWTH ELSS

Birla Sun Life Special Situations Fund – Growth OPEN

Birla Sun Life MIP II – Saving 5 Plan-Plan B (Growth) OPEN

HDFC Top 200 Fund – Growth Option OPEN

HDFC Cash Management Fund – Savings Plan-Growth Option OPEN

HDFC Liquid Fund-GROWTH OPEN

ICICI Prudential Infrastructure Fund-Growth OPEN

Sundaram BNP Paribas S.M.I.L.E.Fund-Growth OPEN

Principal Tax Saving Fund ELSS

Principal Personal Tax Saver Fund ELSS

Reliance Diversified Power Sector Fund-Growth-Growth OPEN

Reliance Vision Fund-GROWTH PLAN-Growth Option OPEN

Reliance Natural Resources Fund-Growth Plan-Growth Option OPEN

Franklin India Taxshield-Growth ELSS

UTI – Infrastructure Advantage Fund – Growth Option OPEN

LICMF Liquid Fund-Growth OPEN

HSBC Dynamic Fund – Growth OPEN

Franklin India High Growth Companies Fund – Growth Plan OPEN

ICICI Prudential Indo Asia Equity Fund – Retail Growth OPEN

DSP BlackRock India T.I.G.E.R. Fund – Regular Plan – Growth OPEN

I would cut down on the list of funds in the same category and go for 1 that is the best in that category. See ( http://shabbir.in/select-best-mutual-funds/ ) to select the best mutual funds.

Shabbir,

What are views on the below funds I hold SIP’s in all the 4.

Reliance Reg Savings Growth – Equity

UTI Opportunities – Growth

SBI Magna Conta – Growth

UTI Dividend Yeild – Dividend.

I also wish to take 2 SIP’s in RIL Infra & ICICI Pru Infra. How good are there.

Thanks

Melwyn

UTI funds I do not track and check for yourself how they have performed over the past but rest looks good.