Find the best Value-Oriented fund for 2021 and review the selection process and the performance of the best Value-Oriented fund of 2020

We will find the best Value-Oriented fund to invest in 2021 and the selection process and review the performance of the best Value-Oriented fund of 2020.

What is a Value-Oriented Fund?

A mutual fund that can invest irrespective of companies’ market cap restrictions based on the fund manager’s discretion where companies offer great value is known as a value-oriented fund.

The difference between a Multi-cap fund to a value-oriented fund is a fixed ratio of large, mid, and small-cap companies in a multi-cap fund. In contrast, a value fund invests in companies that are available for a price that offers value.

As an individual retail investor, the process of finding value stocks can be a double edge sword. So one can leave it to the professional fund manager to find value for us.

Top Value-Oriented Funds

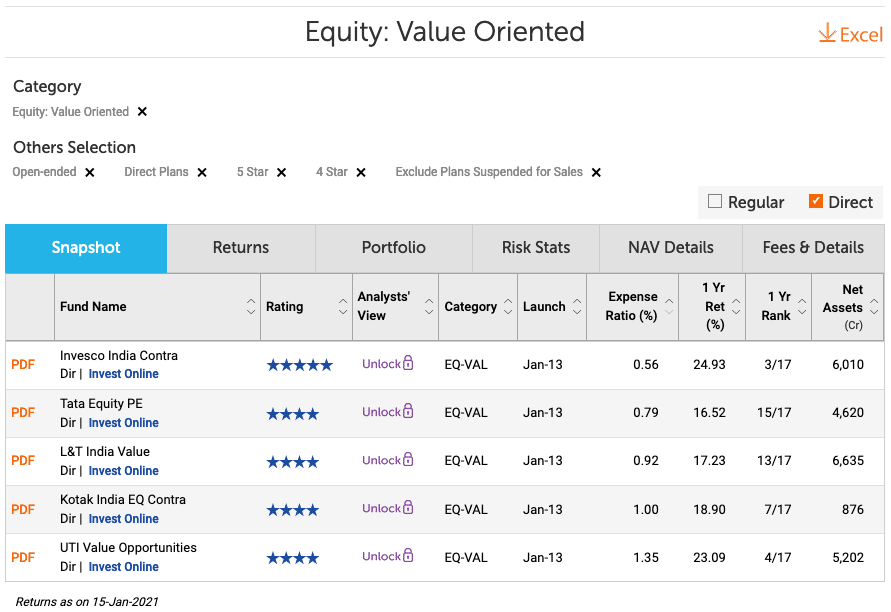

To find the best Value-Oriented Funds, we will use the process – from the 4 and 5 rated direct funds by VRO, and we will choose the funds that can outperform.

Best Value-Oriented Fund To Invest in 2021

We will see the allocation in the top 3 sectors for each fund from the top Value-Oriented Funds.

| Fund | Top 3 Sectorial Allocation |

|---|---|

| Invesco India Contra | Fin, tech, Energy |

| Tata Equity PE | Fin, tech, Energy |

| L&T India Value | Fin, tech, Construction |

| Kotak India EQ Contra | Fin, tech, Construction |

| UTI Value Opportunities | Fin, tech, Healthcare |

Every value fund is heavy on the financial and technology sector in 2021.

So depending on whether you are bullish on Energy (predominantly Reliance Industries), construction (predominantly L&T), or healthcare, your choice of best Value-Oriented fund to invest in the year 2021 will vary.

UTI Value Opportunities

No points for guessing. I think in 2021, there is a minimal downside to the healthcare sector. So my choice of the best value-oriented fund for 2021 has to be UTI Value Opportunities Fund.

How Well The Best Value-Oriented Fund of 2020 Performed?

The best Value-Oriented fund of 2020 was Tata Equity PE Fund. It has given an averagely good return of 16.52% for the past year.

Though it is not very good returns, I think it is OK returns considering the volatility in 2020.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in those funds. Create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. The emphasis is on the process. The funds may be doing well now, but when you want to be investing, use a similar approach, and find the best fund at that time to invest. Use ValueResearchOnline and or CRISIL as and when you want to invest in 2021.

Leave a Reply