Indian retail Investors are not able to differentiate between regular and direct plan for investing in a mutual fund and so let me explain what it means and when you should be using which one.

A very interesting question about mutual fund plans.

I wanted to purchase an ELSS fund and have read your article about dividend based tax saving but I also observed few funds offer a direct option which is different from growth and dividend option which your article discusses. What is it and how it is different from others?

Most Indian retail Investors are not able to differentiate between regular and direct plan for investing in a mutual fund and so let me explain what it means and when you should be using which one.

SEBI is constantly reforming norms for mutual fund investment and eradication of entry load in July 2010 was one of them which led many brokerage houses to loose on revenue. So in September 2012, SEBI came out with yet another reform in which mutual fund houses pay the brokerage houses a fees (known as distributor commission) which is added to the fund as an expense to the fund and is part of expense ratio.

Every existing fund plans become regular plans and every fund house is coming up with a new direct plan where the distributor commission is not being paid and investors can invest directly with the fund house.

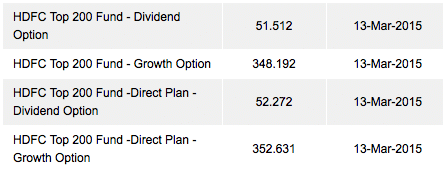

So ideally every fund will have 4 investment options.

- Direct Plan Dividend Option

- Direct Plan Growth Option

- Regular Plan Dividend Option

- Regular Plan Growth Option

You can get the NAV from AMFIIndia for each of the above choice.

And quite clearly Direct plan will always have better NAV than regular plans because of lesser expense.

Should you go for Direct Plan or Regular Plan?

It may sound quite obvious that direct plan is always the better choice but thats not what I think. If you want to be investing directly with the fund house, you may need to invest individually with each of those fund house and maintain lot of paper work or online accounts with each fund house. So you may end up managing too many unnecessary stuff which I prefer avoiding if I can.

So I follow a simple rule which is opt for direct plan only if:

- Investing above Rs 100,000 – With an investment of 100,000 the expense ratio of 0.5% only means 500 Rs per year and so anything below that should be all ok for me to avoid maintaining yet another account with yet another fund house.

- Investing for more than 5 years – Investing for longer time frame means, the variation in NAV widens and adds considerably over time and so I tend to avoid regular plans when my time horizon is above 5 years.

Conclusion

Investing in a mutual fund through a brokers like ICICIDirect / ShareKhan or any other brokerage house, you will not be able to opt for direct plans which is quite obvious but at times you may invest in a HDFC Mutual fund by visiting HDFC Bank but that may not be treated as direct investment with the fund house because HDFC Bank and HDFC Asset Management Company are not the one and the same entity.

Hi,

Good article. Investing through direct plan may work better for lump sump investments. If you invest through SIP, the direct plan NAV is always higher than regular plan, as a result one may get less unit than regular plan. So the difference is nullified over the long term. Please clarify.

Completely wrong Suresh. The price is higher or rather NAV is higher because direct plans have higher net asset value or it means they have less expense and so their price is higher than regular plans.

What it means is if you would have invested in regular plans, your returns would have been dampen by that amount.

If you fresh invest, you pay more but then your returns will be dampening as there is a fees being paid in the regular plans.

Dear Sir

My doubts regarding direct and regular plans really got cleared only after I read your article. Congratulations to you for providing a clear concept to all of us readers.

I plan to invest approx. Rs 50,000 in my spouse’s name and an additional Rs 50,000 in my name in mutual funds. My wife’s 80C segment is deficit by about Rs 35,000 while my 80C segment is complete.

1. Can you suggest how I should plan and diversify our portfolio?

2. Should I go for ELSS for her and non-tax saver mutual funds for myself?

3. Can you suggest some good funds in each category?

4. How should I go about this investment…i.e.through ICICI/HDFC?SBI CapSecurities etc.or through private brokerage houses like Motilal Oswal/Karvy/Sharekhan etc.?

As I am new to mutual funds, I shall be really thankful if you can give me a good start.

Regards

Dr.Syamal Modi

Glad my article helped you clear your doubts about regular and direct plans and I see you have series of questions and so let me try to answer them one by one.

Q1> You should understand the types of mutual funds available and then think about diversification. Read – http://shabbir.in/mutual-funds-types/ and also you can read about classification of mutual funds as well here – http://shabbir.in/types-of-mutual-funds/

Q2> Once you will not save tax, you should opt for open ended fund and not ELSS because ELSS has a locking period of 3 years and if you have done with your ELSS, I don’t see a reason to be locking your fund when you can have an option for open ended fund.

Q3> I will ask you to do the exercise and come up with some funds based on your criteria and I will definitely help you on each of those. Me recommending the funds would mean they are all biased based on my risk analysis.

Q4> Does not matter when it comes to mutual funds and all will charge the same money from you. Go for direct plan if you want to be saving else any one is as good as others.

Thanks

Shabbir

Dear Mr.Shabbir

I have gone through your post regarding types of mutual funds. I

have been doing this exercise of trying to prepare a portfolio for me and my spouse for the past one month but have not been able to arrive at a conclusion. One reason could be that in my profession, I hardly get an opportunity to be able to shift my frame of mind from medical aspect to financial side. Still the key results of my exercise are:

1. To invest Rs 20,000-25,000 each in 2 ELSS funds-Franklin India

Tax Shield and ICICI Prudential Tax Plan, for my wife, to cover her deficit in 80C.

2. To select open ended equity funds for me, direct/regular plan, and

growth option.

3. To go via ICICI direct or any other bank house for investment.

However, I am still not clear as to which category of funds to choose for myself-large cap or mid & small cap, or diversified or balanced etc.

My plan is to stay invested for 5-10 years so as to have substantial gains and I am prepared to invest in moderate to high risk funds.

I would request you to kindly analyze my results and give your expert opinion to help me finalize the list of fund(s) I would be investing into.

Thanks and regards

Dr.Syamal Modi

1> The funds looks good but then for me ELSS is more like making the least investment and getting the most of the benefits and so I prefer high paying dividend funds. http://shabbir.in/best-tax-saving-mutual-funds/

If you are able to invest in moderate to high risk funds, go for midcap funds. Market is not conclusive for one time investment and so opt for a SIP method of investing as of now.

You can get in touch with me on email ( http://shabbir.in/contact/ ) where I can ask you some more personal questions and suggest you accordingly.

Thanks

Shabbir

Dear Sir

I have finally prepared the following portfolio for me and my

spouse:

1. To invest Rs 25000 each in Franklin India Tax Shield and ICICI Prudential

Tax Plan for my wife.

2. To invest Rs 50000 divided equally in one of these combinations-HDFC Mid Cap

Opportunities fund+Franklin India Smaller Companies fund OR HDFC Mid Cap

Opps+UTI Mid Cap fund OR any one of these mid caps (HDFC/Franklin/UTI)+HDFC

balanced fund.

I have not included large cap funds. Is this a wise decision?

Does this portfolio seem all right to you for a start?

Should I opt for SIP mode or go for one time investment?

Awaiting your response.

Regards

Dr.Syamal Modi

1. I don’t see a reason to be investing in

2 tax saving fund unless you have a reason for that diversification.

Both are large cap ELSS funds from different fund house.

2. The same applies to your midcap funds as well. Both invest in

overlapping companies and so don’t see making your paperwork heavy.

3. Avoiding a large cap fund is not good choice but if you have done that, there should be a reason behind it and if you can let me know, will

help.

In current market scenario, SIP is the only option that you should go with and not with lumpsum investment.

Dear Sir

The reason for choosing 2 ELSS funds is just to split the capital of 50k into 25k each; otherwise there is no specific reason. Only to play safe, I thought of investing in 2 different ELSS funds, however, if you think differently, do suggest to me a better alternative.

Likewise, for mid cap funds, please do suggest how to split 50k in 2 or more funds, or maybe invest in a single fund ?

As regards large cap funds, I considered 5 year annualized returns which show slightly better returns for mid cap funds. However, I am not averse to investing in large cap segment.

To conclude, after so much exercise, I request you to provide me with a suggestive portfolio so as to fulfill my requirements. Please suggest specific fund names to guide me better.

Thanks and regards

Dr.Syamal Modi

Dear Sir,

I am an NRI .I got inspired from your article and thanks for the eye opening article.I am planing to change from my regular plan SIP to Direct plans which I recently started for 40000 Rs in different fund houses.i WANT TO KEPP ALL THIS FUNDS FOR 10-15 YEARS. As I opened all this through an agent ,kindly clarify some of my doubt and expecting your valuable advise.

What is this folio number really means and Can I use the folio number of regular plan fund for buying direct plans online…

what about the ECS(monthly automatic deduction from my Federal bank NRE account) for buying the SIP units every month.I am planing to Hold the stopped/balance units in regular plan for minimum one year and start immediately the direct plan

So let me know all the procedures can be done Online with out visiting any branch including ECS mandate,new Direct plan purchase.

Thanks,

Roy

Roy,

Glad to see that my article was helpful to you and so let me answer each of your question.

Folio number is the investment identification and so if you invest at different times, you can club them into one investment using your folio number. Ideally you should be investing using different folio number because investing in same folio number means you will invest through that agent only and not in direct plan but in regular plan.

If you plan to move from regular to direct plan, stop your current ECS and start afresh ECS after you are sure the existing ECS has stopped.

I am not aware of the all the process that all the fund houses deploy and so you have to be asking that yourself to your agent about how you can stop those SIPs

Thanks

Shabbir

Great Article Shabbir.. I agree with you that. Moreover we have common platforms like Fundsindia and Fundssupermart, who lets you invest in multiple funds and track the growth on same platform. It’s easier way of investing.

Yes its quite an easy choice but then if you have to be paying a lot for that easy option, you should see if you can manage more accounts with the AMCs directly.

But that is always there shabbir as hdfc AMC will not have to do anything with the hdfc bank in terms of association of its fund house but hdfc bank may be the distributor and so its the regular plan you are investing in and not the direct plan.

Krishnan, many a times we tend to think we are investing in direct plan because both being HDFC but being aware of what may be happening in the background is something every investor should be aware of. If he knows what he is doing and what is being done, its all ok.

Dear Shabbir,

Thanks for this brief write up on Direct Plans.

I personally feel that the Direct Online investment Plans of MF s have come to small and medium level investors , as a God-Send , as it offers lot of convenience of transacting everything online , ( buy, sell, switch, redeem ) day or night, at the convenience of our home and without depending on the availability and paper-work associated with the brokers. Registration is simple and most AMCs offer everything related to this, including PIN generation ( which is an esssential part of the process to access all transactions online ) to be performed by us on their website ( latest in this regard is the Motilal OSWAL AMC ) ! Of course, there are still some old-fashioned MACs like Sundaram and Religare which make it cumbersome with paper work and postal mails . Even then, once you are with it, you won’t feel like going to a broker !! Indeed, the broker also has his own positive side in taking our requests on paper and executing them on his own without any monetary load on us for such services , as they receive their part of the commission from the AMC s , regulalrly !

Devadoss E

Devadoss, yes registration is simple with most of the AMCs but then you have to be managing accounts with them individually which is something I don’t prefer for 1 or 2 Rs per day. If it gets anything significant, I am fine managing one more account.

The more I can make myself free from managing minor things, the better returns I can manage from my investments. At least that is what I think and do.