Let me share some of the horrible customer service incidence happened to me in this review. Being a classic customer I am really upset with HDFC bank services to its customers.

I would like to share some of the horrible service of HDFC Bank to classic customers. Yes you heard it right. I am one of the classic customers in HDFC Bank and yet experiencing horrible services.

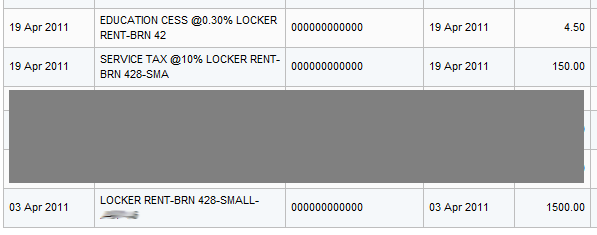

1. Locker Charge Issue

I have three accounts in HDFC Bank Moulali Branch. Personal savings account, joint account with my wife which is mainly used as my wife’s bank account and personal current account.

Apart from the bank accounts I also have a locker in the same branch. The charge for small locker is 1500 Rs per year for normal customers and 750 per year for classic customers i.e. 50% discount for classic customers. I am a classic customer for more than a year now but in April 2011 I was charged locker rent for normal customer.

As of now just make a note that I am charged 10% as service tax and 0.3% as education cess as well on 1500 Rs.

As expected I called up my personal banker (yes classic customers have a personal banker) and within 2 weeks 750 was refunded back.

You may be wondering what the issue is. The issue is the service tax and education cess that should have been refunded as well without saying i.e. Rs 75 and Rs 2.25. I asked my personal banker when this will be reversed and they always say it will be reversed soon. After following up for last 5 months with 3 of my personal banker in Moulali branch I could not get Rs 75 refunded.

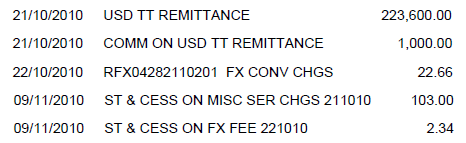

2. The Power to Branch Manager

In October 2010 I did a telegraphic transfer of 5000 USD or 2.23 lacs. The cost as convinced to me by branch manager was 1000 Rs but as I was a classic customer at that time I was told that I would get the same discount of 50% and so will only be charged 500 Rs but as expected I was charged Rs 1000 and after following up with the branch manager for 4-5 months the response that I finally got was. It cannot be done. If I would have been THE BRANCH MANAGER I would have deposited 500 bucks into my customers account before saying such words because you are not a sales guy but a branch manager.

I could not generate the statement online for the transactions older than 6 months and so here is the screenshot from the pdf statement that they send.

So each time my personal banker introduces me to the new HDFC Bank products I simply say a big NO with reference to the above incidence. I am still having my account and the locker with HDFC Bank and is planning to get locker closed as soon as I could but still being a bit lazy.

Share your experiences with HDFC Bank in comments below.

Dear All,

This was my First Account. And i felt proud of having account with HDFC Bank.

Past 9 years i have the salary account with HDFC bank. And additionally, i am using HDFC bank life insurance and credit cards too with no any defaults.

Critics:

During demonetization time ( DEC 18). The new rule is that we can invest below 5000 to bank account. If it is above 5000, then a reason is required which is acceptable.

Note: I have my salary account in HDFC Bank-other state

But, on Dec 18th when i was in the bank (HDFC Mint-Chennai branch ) to deposit amount of worth 15,000/- old notes.

I was not respected properly from the respective Bank employees including the Bank manager.

As i approached the Bank employees , I felt there was a ‘Domination’ by Malu representatives around the bank ( sorry to say) what ever query is raised I am routed to Bank representative here and there with getting no proper response including Bank manager of same category as mentioned above.which was totally furstating and annoyed for me ( as a Public).

Initially, the Bank representative did not accept pointing that i have a salary account.

Then later i met the branch manager, And explained the situation and provided the required justification to deposit my money which is hard earned one and i am regular “TAX PAYEE””.

The manager replied 2 points:

a. The amount you hold is not MONEY and it is a invaluable note. So, we did not accept it. And too the account is your salary account. So, we did not accept.

b. If you want, you can travel to out of station to the home branch to deposit balance money. We will not accept it.

I got felt really shocked by his behavioral approach which came from a HDFC branch manager.

ON that second, I think the worth of the HDFC bank that till now i have the account. Customer relationship is zero.

Thinking that is a profitable bank for both you and Customers. But I need to remember one point that because of customer reliability and satisfaction HDFC Bank grows by earning profits.

I’m really so glad I’ve come across this section. I have been having no relationship status with just about anybody in the bank ( Pune . Bhandarkar Rd ) for the last 7 years. The service is absolutely lousy and the ppl just indifferent to what you have to say. Yet, I’m supposed to be Imperia Customer. I would really appriciate if anybody can give me the email ID of the Imperia Head so that I can forward some of the mails I have written to the bank.

Hello Shabir,

HDFC Bank has done it again! Am a customer for last 9 years or so. Over last 4 years they have absolutely non customer friendly attitude.

Two years ago all of a sudden we were not part of Imperia customer. There was no notification what so ever on mail, sms , call or letter.

Last year they charged me twice for my locker. and this year they increase locker rent from Rs.2,500 to Rs.18,000. There was no notification again .

HDFC bank seems to love to take customer for ride every time. Is there no way to complain against this autocracy?

Doesnt RBI have powers to defend us citizens?

Thank you.

I knew they increased the rent of small lockers from Rs 1500 to Rs 2000 and then reduced the discount for classic customers from 50% to 25% and so instead of paying Rs 750 I paid Rs 1500 for my small locker but not sure if they increased from 2.5k to 18k

Not sure if there is anything governs such increased rates either and I don’t think RBI takes into account citizens of India, they are more into economical growth and GDP. I could be wrong but that is what I get the feeling.

RBI does not intervene in this matter and this thing has been told to me by a senior authority of HDFC bank. He says bank can revise rent as much as they want upto ant limit and RBI will not question them. I have mailed the whole issue to RBI. Lets see what happens.

Rent is subject to reversal if you surrenders the locker before 30/04/2015

Shabir,

HDFC credit card bill show an additional 3.5% + Service ( Total 3.92%) towards Consolidated FCY Markup fee ( Foreign currency conversion charge) for the payment I made online.

I never faced such charge before. Is this something new? Is it applicable only with HDFC or other banks based in India? I do not know about HSBC or any other foreign bank. Do they also levy this charge? HSBC usually won’t charge when we swipe their credit card at merchant outlets abroad. So I think, they won’t charge us this conversion rate if we use it for online purchase as well. I am not sure. Any experience from any of them? Request you to share…

I wonder if this conversion rate is applicable if make payment via debit card or internet banking as well?

Every bank has the same fees and banks like Standard Chartered club the expense with the item and HDFC Bank shows it as different item in the bill statement.

If you read the terms and conditions of the card, you will see the 3.5% is pretty much constant with every credit card provider and this is possible from Visa / Mastercard only.

I have tested SBI, SCB as well as HDFC Bank and they all have the same expense.

Yes, you are right about banks based in India. How about the cards of foreign banks like CITIbank, HSBC, and other banks based out abroad? Do they also charge the same?

All Indian Bank Credit cards charge extra transaction fee when we use them at any merchant outlets abroad. But foreign banks like HSBC never charged that fee because these foreign banks have branches there. They did not charge anything extra and considered as the way the card was swiped in India.

About foreign banks, I can talk about Standard Chartered and CitiBank and they don’t show the forex charge as separate forex fees in statements but then the terms and conditions do state they charge 3.5% as fees.

Nothing to say more

Instead of focusing on reducing your interest rate, try making a prepayment as each rupee you prepay works more than those 1% decrease in EMI because you may be in such stage of your loan that you may be paying very little towards the principal amount.

You can read about it here ( http://www.thehindubusinessline.com/features/investment-world/beyond-stocks/dont-compare-home-loans-on-interest-alone/article6206698.ece )

Or you can see how EMI works on my blog here – http://shabbir.in/loan-vs-rent/

Just in case you decide to being debt free here is a good strategy – http://shabbir.in/debt-free/

I hope it helps.

HDFC is ridiculous. I am trapped with these blood suckers. Got loan on very attractive rate at 10.25%, but slowly and gradually they increased the rate of interest to 12% without intimation. After 3 year when I visited their branch and enquired about it. They said I have to pay Rs25,000 to reset my base rate. Which I paid and my based rate and my ROI came back to 10.50%. After 6 months they again started the same trick, gradually and slowly increased the rate of interest by incrementing it by 0.25% every quarter. Again currently I am paying ROI of 11.75%, whereas I am still able to see on various websites they are claiming to give loan on 10.15% to new customers.

Instead of focusing on reducing your interest rate, try making a prepayment as each rupee you prepay works more than those 1% decrease in EMI because you may be in such stage of your loan that you may be paying very little towards the principal amount.

You can read about it here ( http://www.thehindubusinessline.com/features/investment-world/beyond-stocks/dont-compare-home-loans-on-interest-alone/article6206698.ece )

Or you can see how EMI works on my blog here – http://shabbir.in/loan-vs-rent/

Just in case you decide to being debt free here is a good strategy – http://shabbir.in/debt-free/

I hope it helps.

Undoubtedly the tele services call are the most disturbing. I had worst experience of my life with the customer care executive of this bank. I would really suggest not to get credit cards and loans from this bank. Never

HDFC people r really fraud, I have saving acount in HDFC ranchi, in same city when I changed my residence n asked the HDFC people to change my adress, the cheat people of HDFC asked me that the system of hdfc is that I have to make fund transfer of whole amount n by cheating me n misguiding me they opened an another acount in same branch with my new adress.

Now close that new account with the real reason and that would actually be more pain for them for misguiding customer.

worst worst bank in india. Please guys if yu love ur family then dont go for HDFC loan or credit cards. My husband has taken personal loan without knowing me, If i would know i would have suggested him to go for any nationalised nabk like SBI, SBM, canara, syndicate. He couldnt keep suffiecient amount in his loan bank account as he changed his salary account. he went to pay the emi to near by branch n they said u have to go to old madras road branch. he couldnt go there and he missed to pay for that month. For that the executives came to my hse and talked very rudly when my husband was not there. i told i am no way realted to ur bank plz contact my husband and i spoke to manager vijaykumar as well and closed the door. that executive was keep banging my house door for 45 min;s that is really not good. again he came and he was talking like big goonda.. In hdfc bank, they recruit not qualified executives they are goonda’s. I logged the complaint to hdfc bank and no response for that. there is only onw branch where u can pay the loan amount which is really bad,there should be a facility where u can pay ur emi if u miss from any of hdfc branch. and u cant talk to any branch managers and branch people as the caall should go thru customer care executive and customer care people will talk very rudly and they will say u have to visit branch. they are not supportive at all. they will just say, we cant help u sorry. u better visit branch for any issues. this is really not good. Executives willharras ur family if u miss to pay the emi. so please dont ever go for hdfc bank loan or credit card.

i am sharing my experience which i faced with hdfc bank. Be careful with hdfc bank.

hi,

nodoubt IDBI is the best service provider bank,customer care is very good,bank’s environment is friendly,work is fast & easy,charges is best incomparison to other banks.

PNB is also very good bank.

HDFC in my view good ,negative thing is there undue pressure for credit cards,and other type of financial products.

SBI is worst at most place THE WORST BANKING SERVICE at MOTIHARI BAZAR Branch,heavy crowd is there,i dont know why they don’t increase staff number,simple work can take full day time ,if you dont have personal contact,staffs behave with cutomer as they are the valueless pathetic and sick people came to bank just to increase their headache.i dont know is there any behavior parameter for bank staffs or not.i had opened a account but due to all these it is allmost dormant (may be automatically closed) for last 5 years.

My experience with HDFC has been wobbly right from day one! As I figured out, it is not a bank, its just a commission based agent for selling various services. I had deposited 30k while starting the account and within one month of opening the account, they have deducted a total of 150 rupees under various false pretexts. So the thing is : why keep money in a bank that keeps thieving it? I’d rather prefer to keep my money on the shelf of an open window in my bedroom and let it be robbed by a poor man than let these supposedly educated thieves keep robbing me everyday.

Finally the telemarketing calls from these jerks just don’t stop! I decided that I had enough and walked in the bank just a month into opening the account and now they are asking for 560 rs extra as a ‘servce charge’ for closing the account.

I am in split thoughts whether I would pay the amount and get rid of the non-sense or just walk into consumer court and get my issue resolved for free. I might do the latter…

Shabbir, why don’t you escalate these issues? These days RBI has made strict rules for banks to tender services within a deadline.

Moreover, you can find a better bank & close all accounts with HDFC.

Pradeep, I have no plans to run after HDFC for 75 Rs and though I have opened my account in SBI, I probably cannot close everything from HDFC Bank because there are so many things like Mutual Funds and Demat account linked to my Savings account of HDFC.

I have my SBI account in CIT Road branch. I could not get the savings account because they told to have an SBI account I need to wait for a month and so got my current account. 😀

Well i agree with Ajit, my experience with HDFC has been really good. Infact i have education loan a/c with SBI & i must admit that every conversation with them is troublesome. The customer care executive could not respond to any of queries. Worst,she did not have the contact number for masjid bunder SBI mumbai branch, infact she was asking me to provide details about the branch!!!

No experience with HDFC. But I have account with ICICI FOR 15 YEARS & very happy with their service.

Overall, the private banks are fast, IT savvy, good systems & work with few staff, increasing their efficiency. Very less paper work & they don’t send you from counter to counter. They are a bit expensive, but it is value for money.

Shabbir i have never really like HDFC bank especially for two things, 1. there customer service

2. there working environment

While ICICI remains close by to HDFC with all the crap advt they pull up like bringing a laddu for the customer but both these banks do give laddu to you but probably will deduct that amount from your account as Birthday Charges**. This is reason why opened a account with SBI even though i have a account with ICICI which i use hardly and i think SBI is hassle free except that for new cards etc you need to go the branch. But at least you have a peace of mind in SBI.

I see your pain – HDFC is hopeless in customer service. There are times when they take a couple of hours to issue a DD at the bank. At SBI Personal Banking Branch, it took me under 15 min for entire transaction. SBI is good, but do open your account at a Personal Banking Branch. However, I have a home loan with them – all else being fine, I keep getting hit by a Rs 10,000 charge every year on Home Insurance. Never got a satisfactory response.

So, approach any bank with caution. Most banks are lousy at customer service. I live in London, my experience with HSBC was similar – at the branch, they can help with basic queries but you are ‘encouraged’ to go online or call contact centre for anything else.

SBI & other Public Sector Banks are the only banks that do not do such things!

HDFC Bank tries to pass on ALL its losses to its ‘Classic’, ‘Preferred’ and ‘Imperia’ customers…this is an accepted fact coz most do not bother to check their statements

Chaitanya, I would agree with you on this that people don’t prefer checking statements and I am also no different but because I have launched my book and I get NEFT’s I now need to verify them to send the book to people and so now I am used to verify lot of transactions.

I fall short of words in agreeing with you. You have just depicted my experience with HDFC bank. I’ve been a customer with 2 savings a/c,Fd & car loan. I feel starting from the marketing staffs,all of them have a single point agenda- to make fool of cuatomers & they take us for granted. I’m exploring other possibilities;what about IDBI bank? Please share your your experience if you’ve any.

Regards.

No Suman, I don’t have account with IDBI and so cannot comment on them.

IDBI bank is the bank I feel one can only dream but is a reality.

Everything is free there. No charge for anything and the service is far better than HDFC or other banks

The only issue is the limited number of ATMs. If you can bear with this, then go for

IDBI bank. It is even cheaper than SBI ( I have accounts with both banks)

I wonder, how come IDBI bank still make profits. HDFC bank should go learn from this people.

Lesser ATMs is not an issue because you can use any ATM for withdrawals.

Hi Shabbir,

I have accounts in Axis Bank which is excellent. I think, both HDFC and ICICI Bank are having same goal- To cheat the customers. In respect of overseas transaction, I can assure you as an NRI, State Bank is the best with least deduction as well as quick remittance.

Yes I have plans to open an SBI account very soon.