How to Find Stocks with Hidden PE ratio of Under 1 – The Mohnish Pabrai Way of Investing using Screener and Annual reports

Today we will understand the Hidden PE Ratio and find companies trading at a hidden PE ratio under 1.

We will do some fundamental analysis of such businesses using annual reports to uncover their hidden PE.

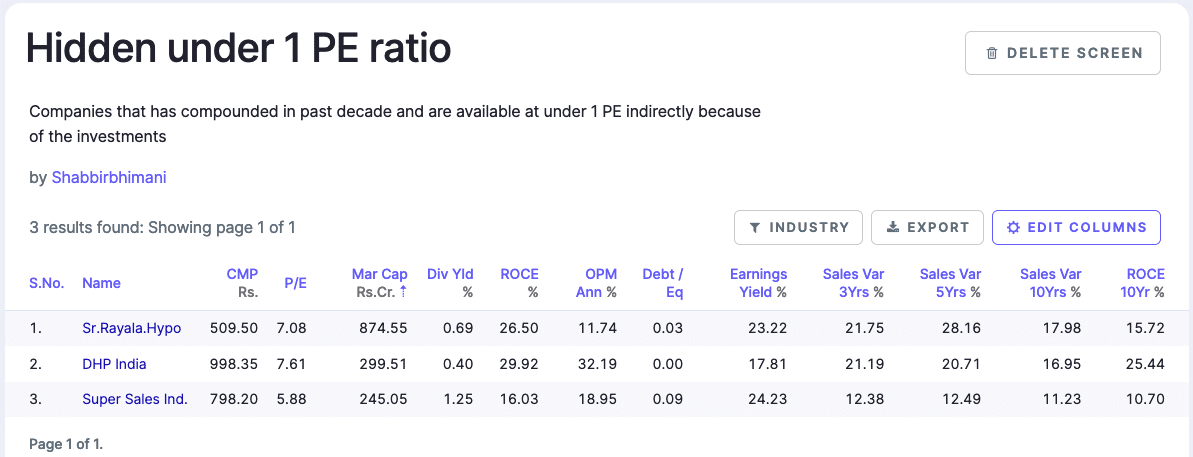

Screener Query

Let’s start with the screener.in query!

Let me explain the query in brief first.

- Sales growth 10Years > 10 AND

- Market Capitalization < 1000 AND

- Average return on capital employed 10Years > 10 AND

- Debt to equity < 0.25 AND

- Promoter holding > 25 AND

- OPM last year > 10 AND

- Earnings yield > 10 AND

- Investments > 100

Sales growth of the past ten years should be above 10 per cent CAGR. So we don’t want to consider companies that aren’t growing.

Then, we want to focus on companies with a market cap of under 1000 crores. We keep the market cap under 1000 crores because we wish investments to exceed 100 crores. Hence at least 10 to 15 per cent of the company’s market cap is in some investment. This will help us in finding the hidden PE.

The average return on capital employed for the past ten years should be above 10. In general, 15 is more favourable, but we are also considering the companies with scope for improvement in ROCE because we are looking at smaller companies.

Then we have some basic eliminators like the low debt-to-equity ratio, higher promoter holding, and sound operating profit margin.

Additionally, we have an essential factor called earnings yield.

Earning yield has to be more than 10. Hence we will remove companies with high PE ratios because if this increases, the earning yields decrease.

In brief, if the earning yields are higher, the company is available at a lower PE ratio than its growth.

And finally, the following parameter is investments to be above 100 crores.

Let’s analyse each of them individually to see their hidden PE ratio.

Super Sales India Ltd

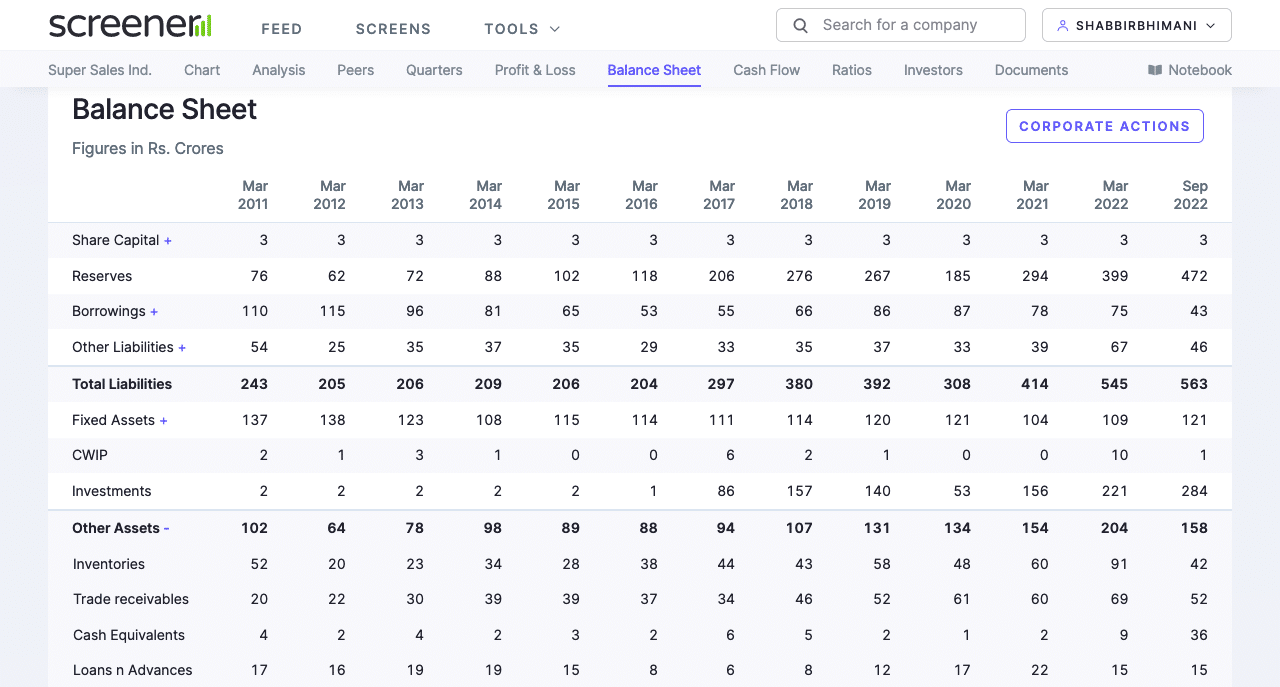

Super Sales India Ltd has a market cap of 247 crores, with the stock trading at just under 6 PE.

The balance sheet shows a startling figure of 284 crores of investment with a cash equivalent of 36 crores. This adds up to 320 Cr.

Don’t get over-excited here. First, we need to look at the details of the investments to see if it is equal to cash.

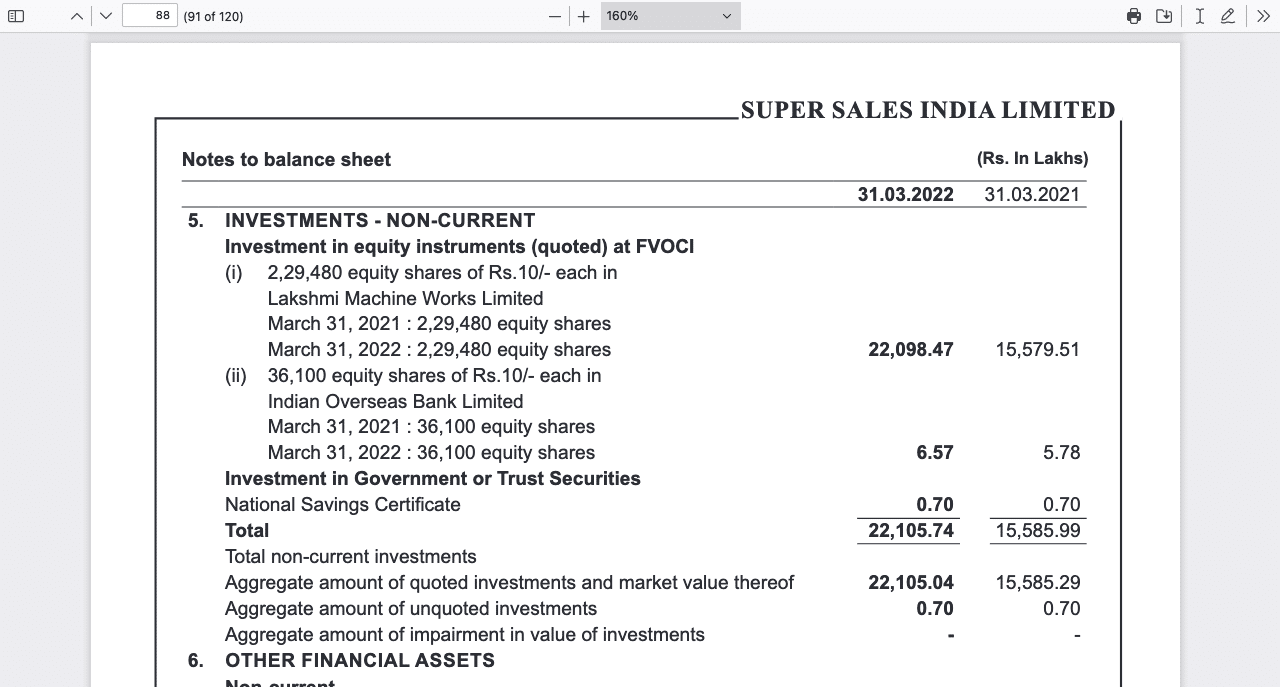

On the balance sheet page inside the annual reports of March 2022, the investment is 221 crores. Therefore, the annual report shows approximately 221 crores in Lakshmi Machine Works Ltd.

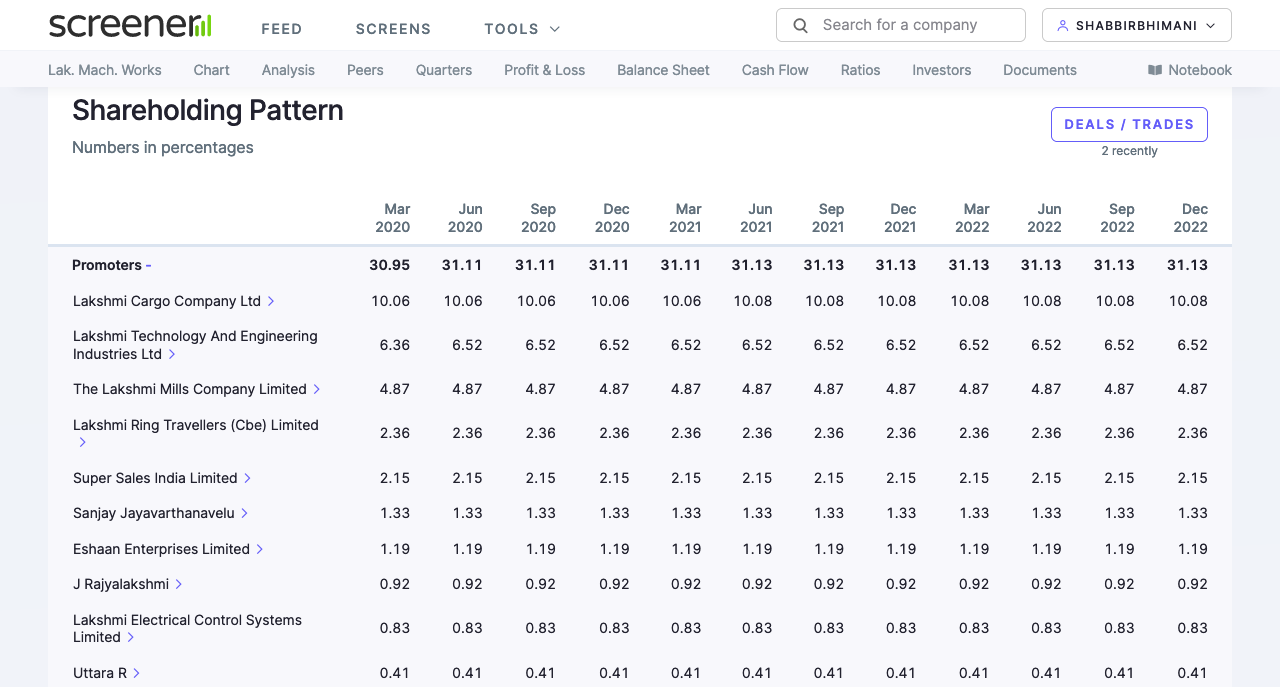

As per Screener, Lakshmi Machine Works Ltd has 12,204 crores of market cap with 2.15 per cent investment. This means the company has an investment of 262 crores at the current price.

But can Super sales India liquidate them?

I don’t think so because they are not investors but promoters of the company. So you have to consider this investment with a margin of safety.

In conclusion, the company has a good amount of cash and investment and is available at under 1, 2, or 3 PE, depending on how much value you put into the investment.

And we have to analyse the business further and understand why the company’s net profit jumps from 9 crores in march 2021 to 48 crores in march 2022.

Further, how one business will change when there is an adverse condition for the other business must be considered.

DHP India Ltd

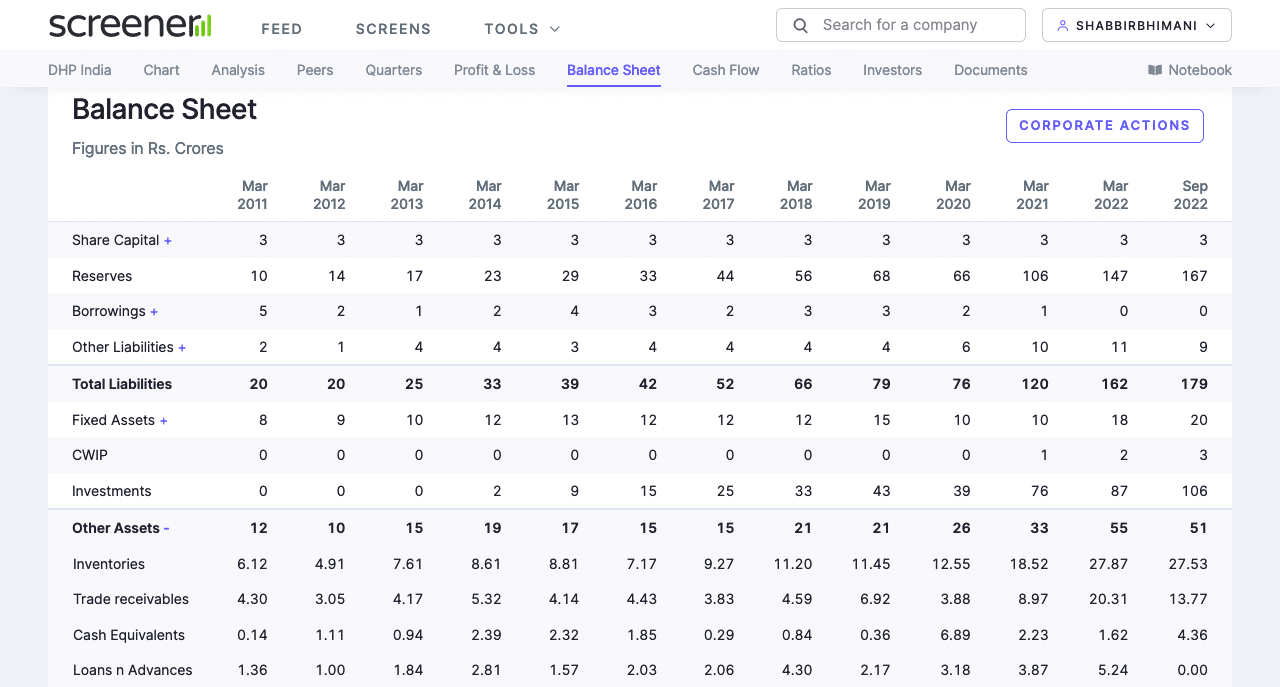

Next, we’ll look at DHP India. This company has a market cap of 310 crores, with the stock trading at a PE multiple of just under 8.

The balance sheet shows an investment of 106 crores as of September 2022 with cash and cash equivalent of 4 crores, making it a total of 110 crores in investment and cash equivalent.

So, at an 8 PE, this company becomes a PE multiple of 5 as we only pay 200 crores for the business, and the rest is the cash with the company.

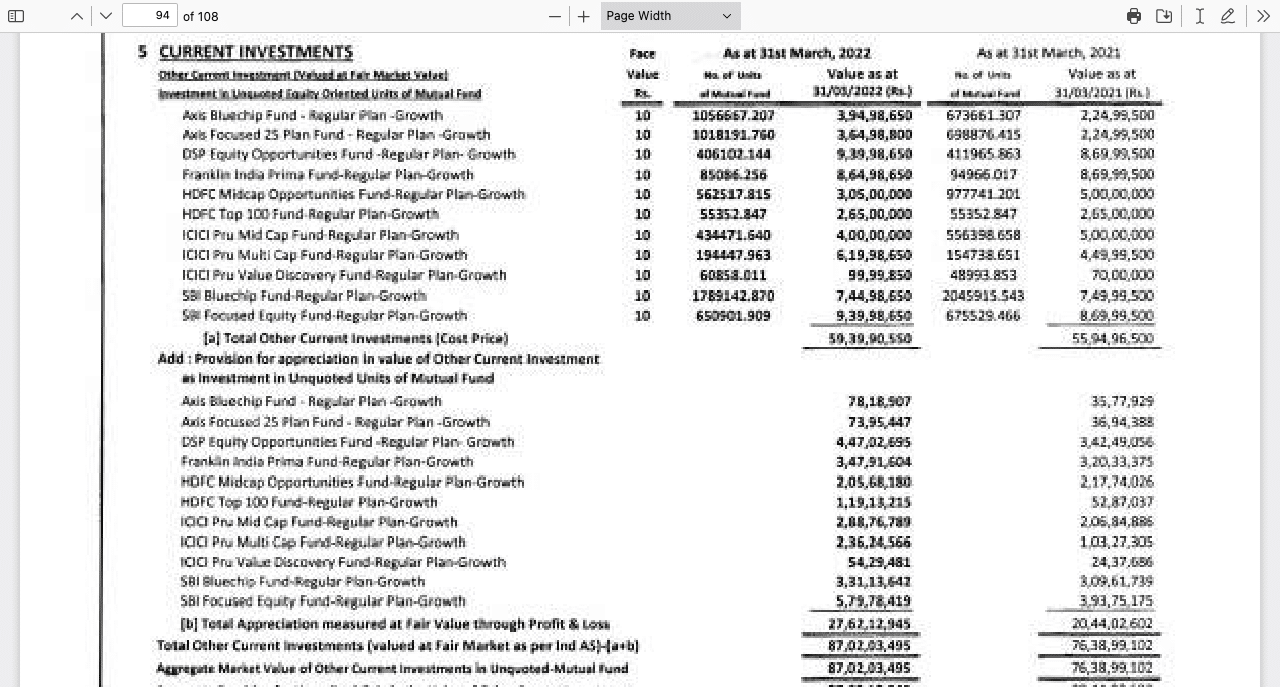

Still, let’s look at its investments of 106 crores in September 2022 but 87 crores in March 2022.

Looking at the balance sheet inside the annual reports, we see that this company has investments in mutual funds, most of which are equity-oriented mutual funds.

So, DHP India’s investment is very liquid compared to Super Sales India.

Sree Rayalaseema Hi-Strength Hypo Ltd

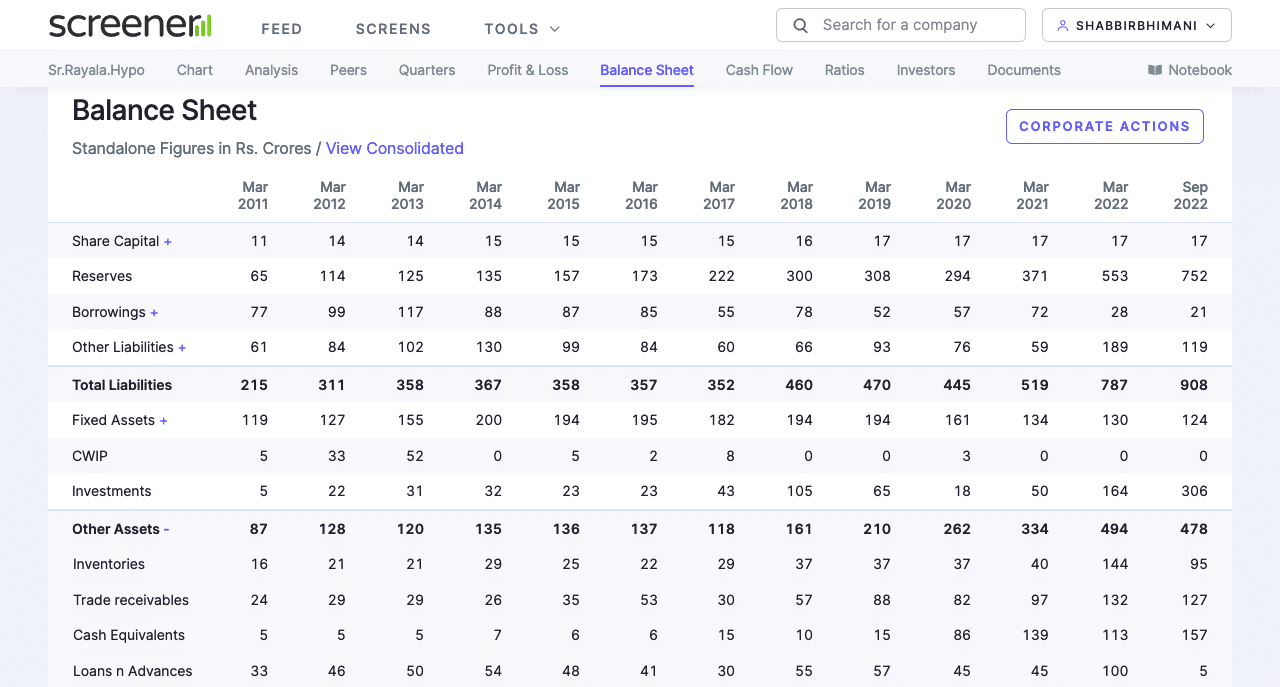

Next, we have Sree Rayalaseema Hi-Strength Hypo Ltd is available at a market cap of 900 crores.

Looking at its balance sheet, it has an investment of 306 crores and 157 cash equivalents as of September 2022. So it already has 450-460 crores in cash/ cash equivalent.

The company trades at a PE multiple of 7+ but with investments and a cash equivalent of 450 crores. So if we remove it from the market cap, the company is available at 3.5, 3.6 PE, which is still under 4 PE but not 1 PE.

Now, I will leave it to you to go through the annual reports and balance sheet and share the details of its investments in the comments section.

Final Thoughts

The stocks discussed are not a recommendation for you to invest. On the contrary, I strongly recommend against it. The reason being these are small companies and have meagre trading volume.

So, if you act, you may inflate the price of these stocks.

I have shared the complete process to find the stocks at a meager and cheap PE ratio which Mohnish Pabrai prefers.

Feel free to apply your choice of criteria that gives you comfort while investing.

Make sure you learn to invest and not look for silver bullets to find readymade investments.

Only a few people on this planet want you to make money. One is, of course, you and the others are your immediate family (father, mother, wife, brother etc.) members. Everyone else is trying to make money for themselves, even at the cost of using you in any which way possible. So if you find someone who will do it for you, you are on the wrong planet or in the wrong era.

So don’t invest because someone has recommended it to you, including me. Instead, build your investment logic and iterate over time to improve each time. I prefer doing it that way and want you to follow the same.

“Then, we want to focus on companies with a market cap of under 1000 crores. We keep the market cap under 1000 crores because we wish investments to exceed 100 crores.” i think 1000 Croes not 100 crores – may be typing error ?