I will share with you my trades for today because I think there are some important lessons to be learnt. Remember there are very few things you can learn when you make tons of money but you can always learn from losses.

I will share with you my trades for today because I think there are some important lessons to be learnt. Remember there are very few things you can learn when you make tons of money but you can always learn from losses.

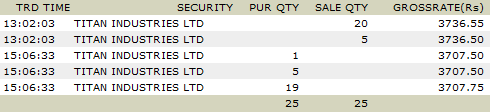

Let me first share with you first trades for today.

I made a loss of roughly 1375 and some brokerage.

Important information is not price but the time of my trades. Let me explain first why I took long call and why I was ready to move out of the call so early. It was no magic behind it.

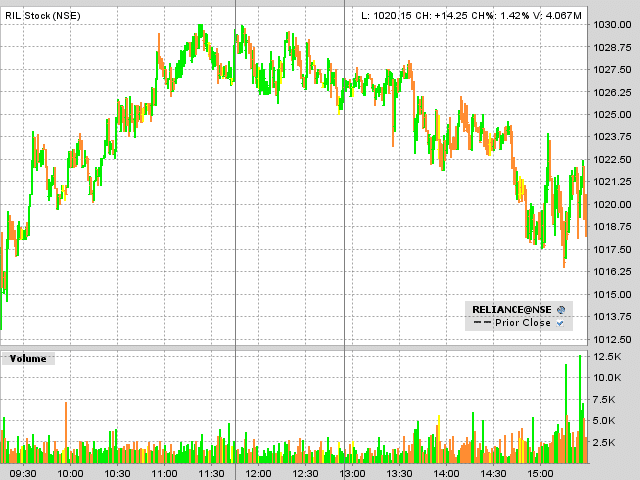

Let us first see today’s chart for Reliance. The vertical gray lines in the charts are when I executed my trades.

Reasons I took long call on Reliance

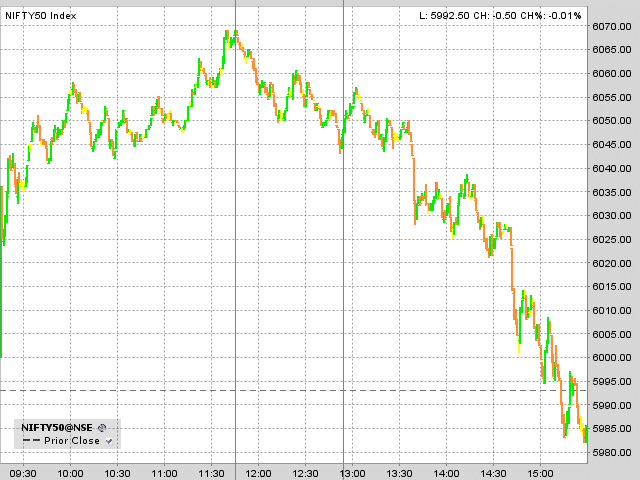

- In the morning I expected a correction but saw nifty was making higher tops and higher bottoms for couple of hours.

- Reliance is one of the heavy weights on Nifty and was showing good strength.

- I wanted to flip my money for roughly 10k profit. This point is very important because you should understand the objective.

Reason I opted for stop loss

- My objective was a trading profit and never an investment or a positional call. I was not ready to hold onto Reliance overnight.

- The top of Reliance was 1030 before my purchase and I wanted to see the next peak above 1030 which I did not see.

- The down tick in Reliance after my purchase was more than previous down ticks but more importantly I saw that Nifty also did not head higher but started to form a lower bottom.

Why short position was smaller and not in Reliance Industries?

I did opt for shorting but not in Reliance Industries but in Titan Industries because of two main reasons. First was Uncertainty at around 1 PM of whether the market can correct and go higher or break supports and go lower. I did not see a clear breakdown pattern yet but somewhere I knew it will go lower. Anticipation is bad and I should have waited for few more minutes for clearer picture. The second reason for not shorting Reliance was strength in the counter and if nifty would not have cracked Reliance could have led it up.

Why short on Titan?

Definitely not for writing this article but I knew for sure Titan has strong supply at around 3830 (I have explained couple of weeks back when explaining support and resistance) and so I was not risking much by shorting Titan at around 3740.

What next?

Tomorrow many analysts will say market held the support of 5980 and so it is headed higher but beware this is not held-ing any support but cracking supports. Check out the TV tomorrow morning and share if you see anybody who says 5980 support was held. Share your views and opinion in comments below.

Charts taken from Interactive Broker’s Application

sir,i m holding infosys stocks from 30 mrch….nw will i get dividant if company declared dividend.whats d rule for this?

On the record date if you have the stock you will get the dividend. Record date is declared by company on some Annual results or meetings.

Record date is often good but the true formal SEC date is the ex dividend date. If you own the stock on the morning of the ex dividend date you are ok. If you buy it on that date your to late.

If you dig through enough filings you’ll notice there are many random dates associated with them, declared, record, ex-date etc…

They use ex-date for SEC purposes. Been burned before and learned the hard way after selling good stock for a profit and thinking I locked in divvy on record date. It was a Forward split divvy as well.

r/s sir,

i have bought 50 shares of vindhya telelinks ltd. at prize of 259rs…the day i bought this,it started declning n nw at 208rs….wats ur say on this….

Prashant, you are trapped and come out of it as soon as you can. It was just a pump without any news flow and I shorted where you have purchased it.

great call. and advice to prashant. Keep an eye on those pumps.

Thanks this post..

keep writing your blog will be more attractive. To Your Success!

Nice Blog. Keep posting more

Regards

Over time, I have learnt that I am not a good trader. I am better investor. But still I love short term gains (who will not love money:)

My questions is that what is the best/better pattern of these short term investment. I have bulk money like 5-6 lacs. Should i invest 5 lac in a single stock and wait for 20% in 1 or 2 month or should I invest 2 or 3 lac in 2 or 3 stocks and wait for 30-40% gain in 6-8 months time?

Manish, I will suggest you wait for couple of weeks and I am coming up with a book on how to trade and invest in market. It is being proof read and will be launching in Jan only.

Informative,keep post these type of information.

derivative market is bounce what stategies to draw in call and put how to book limited loss in market whn market have sudden fall of 200 points and by 2 regained it . how to protect our position is such

Aim small, Hit small and cut your losses quickly.

Really it’s so good thing written by you on this topic..It’s So valuable for us.There is so many guideline on penny stocks.Thanks for to say about this.I agree with you on this topic.

Hi,

First of all, like many of your followers would like to congratulate and thankyou for this tremendously beneficial website of yours. For small investors and naive ones like me, this is a great school.

I would like to ask you … how should an IT professional (yeah I m talking abt myself 😉 ) trade in the markets… It’s very tough to keep following the news throughout the day… also, as long as I am trading I have to keep flipping my work window and ICICI’s eMarketwatch and it makes difficult to make effective trading calls.

I would love to learn the art of balancing both the trades. Kindly suggest.

Vivek, it is not a very wise decision to be trading in markets when at work but yes you can do some good investments. Trading can help you learn investments.

Thanks for sharing your trades. It’s useful. Indeed, the most important thing in trading is to take loses and close position whenever it is necessary.

I totally agree with you on this.

This is quite helpful to see the insiders of how traders take those calls and come out. CNBC Awaaz Khatron ke khiladi tells you what trade they took but never reveals why but you are a lot different.

On lighter note did you actually lost 1500 in a day because I see some are covered.

Yes 50% is covered actually and also if I hold onto that position I could have lost 3 times what I have lost.

hello sir i am rizwan ….i am from delhi i m 19 years old i like to do trading….sir i want to ask you can i buy nifty call of 6000 of 27th jan.its current rate is 9.30.should i buy or sell

i want your suggestion what should i do and please recommend me how to trade i am totaly new in this line and i have lost my 9000 rs in 2 months please recommend i want to recover my losses

Rizwan, I will suggest you to keep yourself out of trading unless you are sure the buy and sell triggers from the market for yourself.