How to Identify Trend Reversal Point and how it is different from identifying the end of bull market and bear markets.

I am damn sure you want to know when the current bull run will end, and you should be able to identify the trend reversal point.

However, there are certain things that I will like to share with you, so you not only be able to identify the trend reversal point in the market but also execute the trade and book the profits at the right time.

First, we have to understand what is a trend in the first place.

What is a Trend?

We assume when the market is going up, it is an uptrend and vice versa.

However, the trend is a little different.

When the market moves as per the trend lines, it is known as a trend.

So let me explain the trend lines in brief. I have covered them in detail in my book Right Stock at Right Price for Right Time.

The trendline is a line that we get by connecting the support or resistance levels.

So when connecting the support levels with a line, it is known as Uptrend lines. Similarly, when we connect the resistance level, it is called the down trend line.

When the up or downtrend line is horizontal, it is known as the consolidation period.

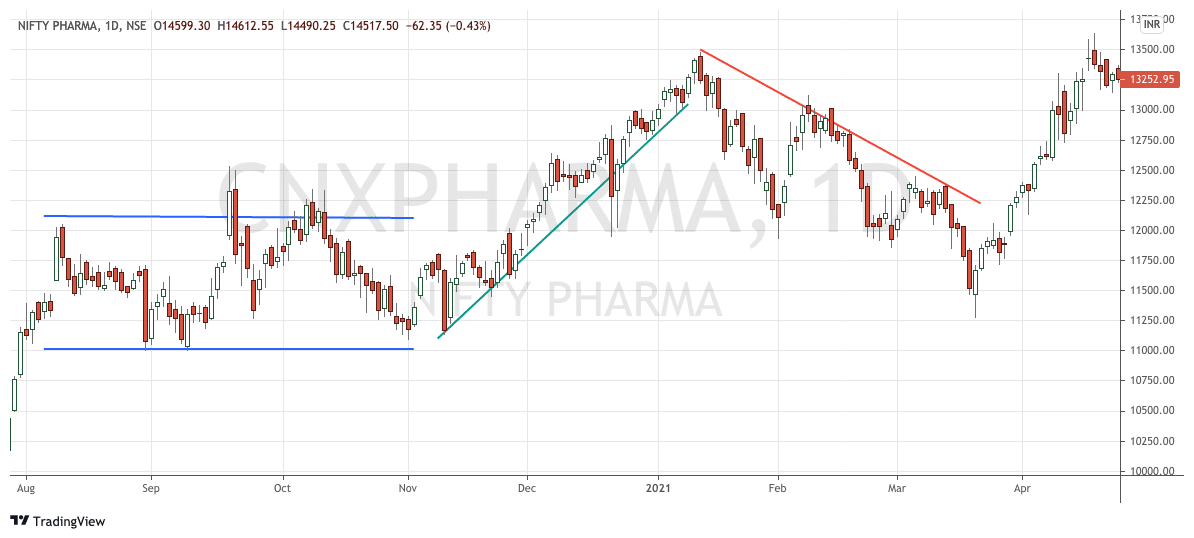

In the above chart, we see an upward trend line in green and a downtrend line in red. Blue is the consolidation period.

Identify Trend Reversal

Now we know what a trend is. So, now it is much easier to identify when there is a trend reversal.

The point when the trendline is broken is a point of a trend reversal.

So we have a red coloured downtrend line formed by connecting the resistance level in the above charts.

If we extend that line further down, at one point, it will touch the chart again. At the point where it will touch is the next resistance level.

Once the stock crosses the trend line decisively, the point of a trend reversal is imminent – this is the point of a trend reversal.

Similarly, if we extend the green line upward, we see a point where it will touch the chart again, which is the next support level.

Support, when broken decisively, means a trend reversal and a start of a downtrend.

How do we misunderstand Trend with a Phase?

If you can draw the trend lines, it is straightforward to find the trend reversal point and believe me; it is easy to draw trendlines.

However, depending on what time frame for the chart, the trend reversal point will vary.

I am sure you will agree that a daily chart trend reversal may be at a different point in time than a weekly or hourly chart.

However, what we want to know is when the current bull run in the market will end.

A bull market or a bear market are phases in the market. They are not the trend that is identified with a trendline.

So in a bull market, there can be a 10% or even 20% correction and still, it may be a bull phase in the market. So when there is a 10 or 20% correction, the trend within the bull market may be down for a short period.

The bull and bear markets are based on fundamental factors like the one we discussed last week – Nifty PE and PB Ratio.

However, if you want to use technicals, you may have to get to a longer time frame like weekly or monthly charts. The downside of it is, you may get the trend reversal point at a much later time (after few weeks or few months). At times, it can be too late.

Final Thoughts

Many experts believe that the market has started rallying since March of 2020. So we are into a bull market that is only 1+ years old. Bull markets typically last in between 2 to 3 years. So there is some time before the bull market ends.

The other school of thought is that the indices double multiple times or triples from the low in bull markets. From the low, Nifty has doubled, but there is still room for upside.

Then we have a third kind of experts who expect that market hasn’t seen any major correction (in the range of 10 to 20%). So this time bull market is different. So, it may not be wise to compare it to the past. The current bull market may not stretch too much from the current levels.

The views are from the market experts with decades of experience. Yet, there is very little conviction about what is going to happen next.

The reality is, no one knows.

So my suggestion will be don’t identify the phase reversal in the market with the help of trend reversal techniques.

Remain invested with the money that you know you are unlikely to need in the next five years. In the meantime, keep booking profits in non-performing stocks.

I think we are in the market phase where one should move from average companies to good companies and from good companies to great companies. So I am trying to churn my portfolio in that direction. Doing anything else may be a waste of time.

Leave a Reply