After the Jul-Sep 2022 results season, I am neither optimistic nor pessimistic view of the market. Find out why

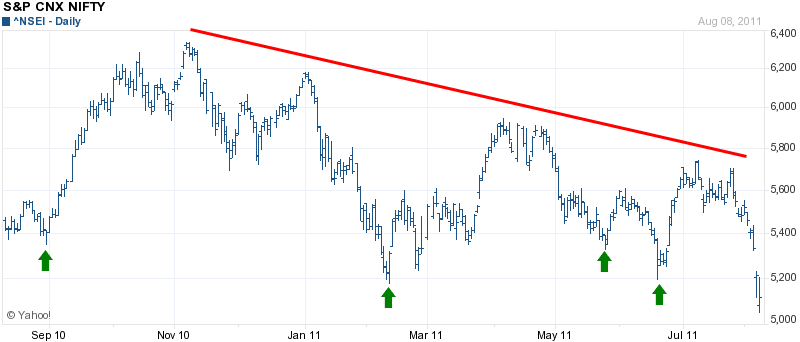

Why 4700 is Nifty Support and What to Expect From Market Ahead?

Why strong Nifty support is around 4700 along with what is an expected roadmap ahead in market with action items for each type of investment objective.

When to Buy In Market Crashes

Let me answering the questions that I am getting quite often these days which is when is the right time to buy in market crashes.

Understanding Signals of Market Crash & Sentiments of Retail Investors

Let us understands the signals that market crash is coming as well as understand the sentiments and reactions of retail investors. Are you being trapped?

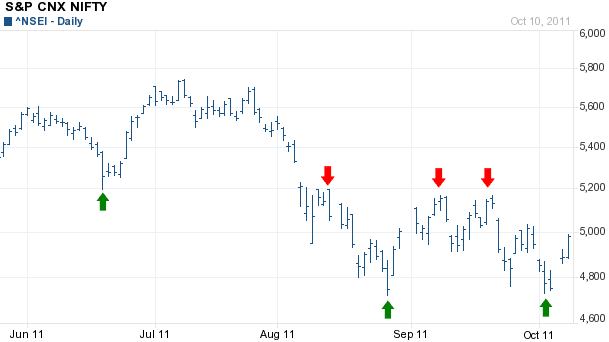

What Does Charts Tell You? Correction or Breakout

If we look at the Nifty chart for last one year we see one definite pattern. Nifty after the gap of 3 months corrects 7-8%. The dips were on …

What you think of 2010 market?

Instead of me saying all the things I would ask my readers what you think of 2010 market? Don’t be afraid to speak your heart out because no one can predict market perfectly and you may be wrong like I have been many times.

Is this the right time to invest in Indian Equity

We have seen a 40% rise in equity for over the past 5 weeks in Indian equity due to the strong Global Cues but now when the Global Equities Indices going down we at Indian Equity market is resilient to go down and so what could be the potential reasons.

Fundamental and Technical Analysis

Everyday when you watch TV for Financial news you specially hear couple of terms very frequently aka Fundamental and Technical analysis and today I would try to explain them in very newbie’s terminology for every one to refer to.

Expectations from the 2009 stock market

The year 2009, for the stock market investors will be a year different from 2008. This New Year 2009 is expected to be a year with two unique trends. The first trend deals with consolidation during the first half and the second trend is about building on that consolidation.

Are Indices true indicators of market condition?

The Stock Market Indices serve varied purposes starting from economic research to helping investors decide upon an appropriate portfolio for their investments. As said earlier, since the Index is an indicator of the overall mood of the investors in the secondary market, it also helps a company answer questions like is it the right time to take out an IPO, how to price the issue, etc.

How does one differentiate between a bull market correction and bear market Phase?

Typically bear markets are associated with economic contractions, recessions, high unemployment, low export and high inflation.