Understand the 4 key risks for a long-term investor when investing even in the bluest of the blue-chip companies.

We always think about investing for the long term to reduce the risks. But, the truth is, we don’t reduce the risk of investing in the equity market. We only lower the volatility.

So even when you are investing for the long-term in the best companies, you are still taking the risk. When I say the best company in the market, I mean companies that have been compounders for the past 2 or 3 decades like HDFC Bank, Asian Paints, Bajaj Finance, Pidilite, Page Industries etc.

Further, I am not talking about buying these companies at a high valuation or the risk of buying high. I am talking about business risk.

I am sure you are getting a bit confused now. Because till now, you thought investing in some of the best companies for the long-term reduces the risks.

I am not here to scare you from investing in the market. I am here to help you understand the market and its risks. Time and again, I have to remind my readers that only thinking about investing in the market for the long-term in bluechip stocks is not enough.

You are investing in the right stock and buying on dips. So the price may be correct but is it the right time to invest in the business.

So let me explain four key risks when investing in the long term.

Not Having an Investment Rationale

We invest in a particular stock for a reason. You should never forget the reason you invested in it.

Moreover, one should also check from time to time if the story is still playing out as you expect or not.

Not knowing the story or how it is playing out is the most considerable investment risk for the long term investor.

You may have heard the news about HDFC Ltd and the HDFC Bank merger. This article on Finshots explains the good and the bad part of it from both sides.

Is your investment thesis going to play out as expected after the news?

If the answer is YES, you should remain invested, but if you have doubts, it’s time to give your investment a second thought.

Similarly, many companies are in the process of mergers and acquisitions. So, again, each news should help you understand where the company is heading.

Always remember – why you invested in the company and if “your why” is still intact or not. If it is inline, you should be all fine.

Warren Buffett sold Airline and travel and tourism business in 2020, and you can understand why. COVID and lockdown may be a big reason for it.

However, what I think is his investment rationale may not play out as he may have expected because of lockdowns.

Ignoring the Competition

As a long-term investor, you are a business partner. So, it would help if you understood the business much better. Further, it would help if you also understood what upcoming threats to your business are.

If you don’t understand the competition, you are at a significantly higher risk of investing in the business for the long term. Ideally, one shouldn’t invest in the business.

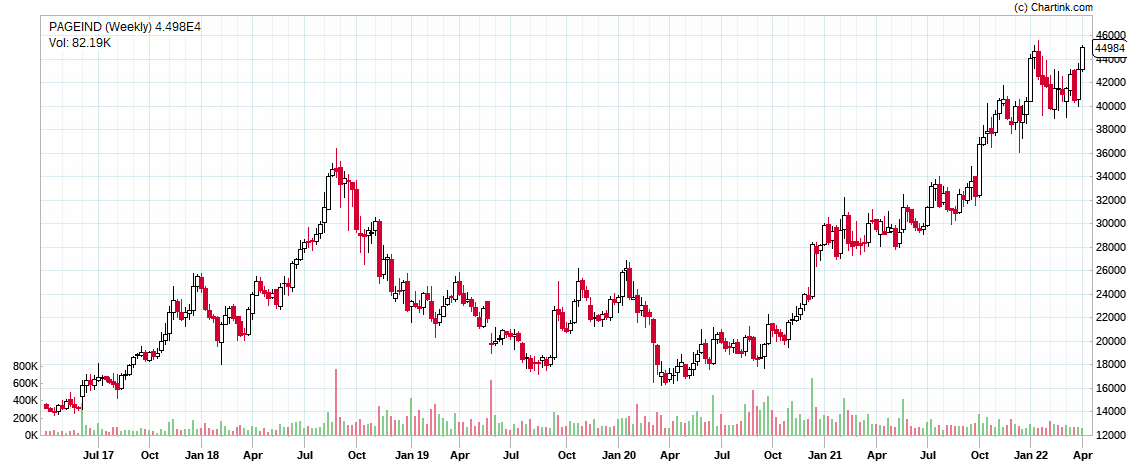

Let me explain this with an example of Page Industries. Again, I am helping you understand the competition from a business point of view. It is not a recommendation to invest in the stock.

Page Industries 2019 EPS was ₹350ish, and stock peaked at around ₹35k in late 2018. However, it corrected 50% since peaking in 2018. The reason people cited was that 100 PE multiple was too expensive for a stock.

Page Industries Weekly Chart of 5 Years by Chartink.com

I looked at it because Van Heusen, the biggest competitor for Jockey, commenced operations in 2017. Therefore, it was expected to give tough competition to the Jockey brand, which is almost 95%~ of the total revenue of Page.

Rupa, Lux, Dollar etc., currently compete with Jockey, but the segment is different. Jockey is in the mid-premium segment, whereas Rupa, Lux, and Dollar are in the economy segment.

The stock corrected 50% from the peak, but that shouldn’t be the reason to invest. Similarly, 100 PE shouldn’t be the reason to sell the stock.

For example, Avenue Supermarts, I thought Amazon was and is a direct competition to them. So for me, it always is an expensive stock. However, I am proved wrong repeatedly, but I still can’t think of DMart (aka Avenue Supermarts) and Amazon as non-competing.

I have done a lot of research to convince myself to invest in DMart. I have read about the co-existence of Walmart and Amazon in the US, but still, I don’t buy the theory.

When businesses do not have the pricing power, I tend to avoid them. So I am not an investor in DMart because it will not have the pricing power to sell the products at a premium.

Understanding the business is more important than anything else when investing.

No Focus on Concentration of Customers

A business thrives on its customers. However, some companies can have a very high revenue concentration from their top customers.

Typically it happens with B2B businesses where one or two significant customers can form substantial revenue for the company.

The example that comes to my mind is Mindtree, and I quote the Livemint report

Top client contribution saw a marginal decline to 28% from 28.5% in Q3FY21

28% of the total revenue is from a single client. What if the client goes away.

Similarly, the biggest customer is always the Government of India or GOI for the Infra sector.

However, don’t be fooled that only B2B companies can have a concentration of customers. Suppliers can also have a concentration, and it can pose a risk.

During COVID times, many companies realised that it is better to have fewer dependencies on supplies from china.

Similarly, in the case of Page Industries, we see that the Jockey brand has more than 95%~ of the total revenue of Page. What if something happens to the brand Jockey?

Not Understanding the Longevity of Products

In the changing landscape of technology, there are chances that the largest manufacturer of something can suddenly find itself having a completely obsolete product.

If you don’t understand the company’s product, you will expose yourself to a very high risk of investing for the long term.

There are many examples, and let me share a few with you.

Nokia and Blackberry were the leading manufacturers of mobile phones globally, but Apple and Android replaced them.

Similarly, Moserbear was a large manufacturer of CD Drives, and Pen drives replaced them.

Disruptors are everywhere, so you have to invest in companies where you think the company will remain relevant 5 to 10 years down the line.

If you invest in the EV ecosystem, understand the risk of being disrupted if the management doesn’t take a right on-time decisions.

Similarly, if you invest in new-age businesses like PayTM, you should focus on whether the company will remain in the next 5 or 10 years or if something else will replace them entirely. UPI has been a game-changer in the payments industry.

Final Thoughts

As a long-term investor, you have to understand the business, its customers, and the industry. You may be OK remaining invested in the company for the next decade, but will the company’s product remain relevant for so long.

Time and again, I keep reminding my readers that fundamental analysis is not about PE ratio and ROCE analysis. It is more about understanding the business, sector, and its customers.

Using a screener to sort companies based on a ratio doesn’t take even a minute these days. Investing is not that simple, buddy.

Are you investing in the market with a greater understanding of the business to minimise the risk and remain invested long-term?

Let me know your thoughts in the comments below.

In indian market there is no any value investing. those who are doing trading or speculating they don’t have to forget time of 2008 and 2002. In market people’s have short term memory. They always think this time market going to high and high but always in real life there does not exist any function which always increase.

When big fish will take money out then what happen I will explain one situation suppose xyz stock currently traded at 2000 from last year low 800, If people buy at 2000 level and suddenly big fish played role and price goes to 1200 then this xyz stock takes 7 to 8 year to reach again 2000. So be careful.

Also, big Risk in recently listed stock. When market goes down then first this newly coming company sharply going down. For example happiest mind book value just 37, pe 135, I can’t understand any good reason why this stock makes new high….

Last word: after 13 years of investing , there is no any technical and fundamental works in market. Always indian investor just doing satta. And normal public suffer a lot. They jave 5 to 6 lakh capital and invest in good stock 1 lakh each after one year just one stock gives 10% to 15% return and rest company going down. And normal people can’t buy any stock after 5 lakh . This way money stuck and they. Can’t made any profit . In market now a days lots of advisor gives falls advice And normal people suffers a lot.