The screener query to the Joel Greenblatt’s magical formula from the book “The Little Book That Still Beats the Market” along with my view on the magical formula.

In the DIY member’s area, we had a discussion about the Greenblatt’s magic formula to pick the right stock which led me to online content about Joel Greenblatt and his magical formula.

We all like to have a Magical formula when investing in the market so we can skip the heavy lifting and yet find good stocks that can outperform the market and become multi-baggers for us. So I ordered the book.

The Magic Formula

The magic formula is simple and yet effective. As the author puts it, it helps to buy good companies at bargain prices or above average companies at below average prices.

The magic formula is:

- Assign a rank of 1 to N to companies with highest ROCE or return on capital employed. 1 as the rank to a company that has highest ROCE.

- Assign a rank of 1 to N to the companies on earnings yield. 1 as the rank of the company that has the highest earnings yield.

- Add both the ranks for each company.

The company with the lowest summed rank is the one that has better earnings and use of capital and yet available at much better valuations.

Applying the Magic Formula

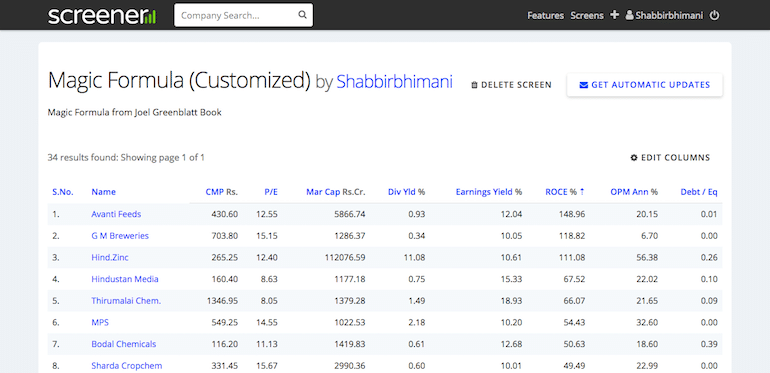

The formula is simple and so logical that I decided to do some calculations on a small set of data. One can easily use Screener.in (my choice of site to track stock news easily) to get this done in a matter of few minutes.

Use the following screener query.

https://www.screener.in/screens/128499/Magic-Formula-Customized/

Note: Your set of columns may not be same as above. Edit columns to add ROCE and earnings yield if needed.

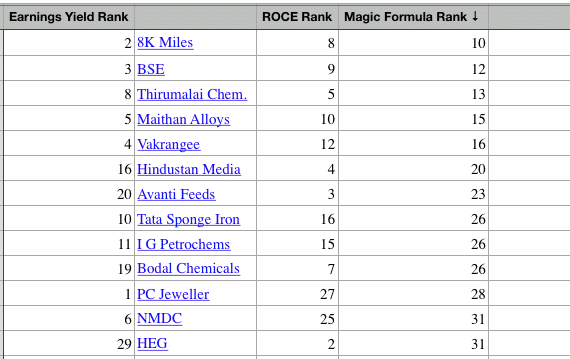

First sort based on ROCE and copy the data set in an Excel file. Use the serial number from screener as a rank.

Now sort based on Earnings yield and update the Excel file for its rank earnings yield rank.

In the third column sum both the ranks. Now sort the whole data based on the third column.

Though book only says to use earnings yield and ROCE and invest in top market cap companies, I added couple more of my own check for debt and OPM to weed out companies that have a debt burden or business that aren’t generating good profit margins.

So my query for the above resultset is

- Earnings yield > 10 AND

- Return on capital employed > 15 AND

- Debt to equity < 0.5 AND

- OPM > 10 AND

- Market Capitalization > 1000

Feel free to change the above formula as per what you feel.

My View of the Magic Formula

The magic formula seems so logical but when I found Vakrangee and PC Jewellers in that list, I was sure, one has to pick and choose the stock from this list and one can’t go directly investing in this list.

The author mentions the same on page 111 and I quote.

Rather than just blindly choosing stocks that catch your fancy or blindly accepting the output of the magic formula, how combining both the strategies? Start with the magic formula and put together a list of top-ranked stocks. Then choose a few of your favorites by whatever method you want. You must, however, choose solely from 50 or 100 stocks as ranked by the magic formula.

It makes complete sense at least to me. So if you use the magic formula and then invest in companies based on your way of investing, that will be awesome. My Investment Checklist, Fundamental Analysis and business checklist work for me and I can always extra check for earnings yield to invest at bargain prices.

Final Thoughts

The book is actually a little book, that doesn’t have any extra fluff or too lengthy. It is organized in 13 chapters and each chapter is a continuation of the previous one and avoids the chapter title as that doesn’t seem too logical.

The book explains the rationale behind the magic formula in chapter 1 to 5, reveals the magic formula in Chapter 6 and continues with the rest of the book with a lot of data and stats to show how magic formula always work in the long-term.

It is a must read for every Indian retail investor who tends to buy random stocks. Application of the formula is simple and one can keep his own minimum level of ROCE (15% is suggested by Saurabh Mukherjea in The Unusual Billionaires) or an earnings yield (6% which is the bare minimum return one can expect from any investment) can help avoid many bad investments.

Are you able to check % return for your portfolio that was arrived with this Magic formula for over 15 years origin?

Yes you can using ValueResearchOnline portfolio.

If you think that the “Magic Formula” is good then you should read the “Acquirer’s multiple” – it generates even better returns!

Thanks for sharing all the useful resources on your blog. My question how did you decide to settle on ROCE and earnings yields provided by Screener? I started doing my own calculations as explained in the book and found that the figures doesn’t match.

Apart from this, do you have any “Magic Formula” Portfolio?

Thanks

Yes you will find difference in numbers even when you compare different sites data. Often the difference is based on the numbers as well as consideration of only standalone or consolidated numbers.

No I don’t have a portfolio only based on magic formula. I have used this as an added number to check based on my ways of finding the right stock for investment.

Thanks for the response. I emailed screener.in support team and they explained how to identify the formulae used for their ratio and also how to perform custom calculations.

If I get satisfactory results, I am planning to start a test portfolio using magic formula and see how it goes.

Great and if you do setup a test portfolio, make sure you test it for the long term because that is the whole point of the formula.

Yes. Agreed.

another book to read is – THE DHANDHO INVESTOR – it is authored by MOHNISH PABRAI.

Completely agree with you.

We are always focusing on PE ratio and EPS but I just discovered that earnings yield is far better things to be focusing on than PE ratio itself.

True.