The process that I follow to Manage my Credit Cards and make thousands of Rupees out of it each year.

I have the following credit cards

- HDFC Bank – Platinum Plus Card

- Citibank – Platinum Card

- Standard Chartered Bank – Titanium Card

- Barclays Yatra card – Platinum

- SBI Card – Silver Card

And use them in such a manner that I get thousands of rupees worth gifts and cash back each year. I will show you how I do it but before I begin please understand that you may not need so many credit cards and you don’t need to manage so many credit cards to get the same benefits. The idea is to managing your credit cards efficiently so you can earn money each time you purchase something. I can manage more number of credit cards because I purchase lot of things online and have a complete business of websites, domains and hosting online and so I can spend lot of money on my credit cards and manage them efficiently. So don’t think that having more cards can help but the idea is to manage them in a manner such that you get most benefits out of your day-to-day purchasing activity.

Managing Your Credit Cards

1. Read TOS

The first step to managing your credit cards is to understand the terms of service or terms of usage. There are very few people who actually read them but I always read them. Remember these terms are not the ones that your sales person tells you but these terms are in the booklet that you get along with your new credit card. Ideally you should know them before applying for a credit card. You can read about the terms for your card you are applying online. It makes me aware of the minimum amount I need to spend on each of those credit cards each year to make them free for me and I don’t need to pay anything for using those cards.

So the first point of having a credit card is to use it because there are very few credit cards that offer you completely free card even if you don’t use it. SBI card is an exception and they don’t charge anything even if you just have the card and don’t use it for years but that is one of such cards. All other credit cards may charge you yearly fees for non-usage. My Citibank credit card offers me cash back but they also need that I use my card for at least 20,000 Rs per year to make fees waived off.

2. Automate Payments

Always make an ECS payment from your bank account for each of your credit card. I always do 100% payment to be debited from my bank account. I never want to be found guilty of not making a payment even if I am not around my computers for few days to make the payment but if you don’t prefer 100% payment, make sure you opt for minimum payment due to be debited from your bank account.

It does not make any sense to be using your credit card for minor loan or making a due rollover to next month because the interest rate on credit cards is very high. This is the only reason I recommend you to have 100% payment as ECS from your bank account to your credit card. Use other means of loan if you actually need it. Even a personal loan is better than loan on a credit card.

Apart from that never ever use your credit card for cash withdrawal because that has even higher interest rate. Just remember never purchase anything from your credit card that you think you cannot pay by the due date.

3. Don’t be Afraid

I have seen lots of Indians are afraid when it comes to using a credit card. I am not talking about people who are 50+ because they are not used to using cards anyway but even computer geek’s or even an MBA from reputable colleges are afraid of having a credit card. They are even terrified when using it online.

This does not mean you should be using your credit card online everywhere but if you see a reliable Internet payment processor or verified by Visa things on the site you should be fine using your credit card on that site.

Tip: If you see a transaction in your credit card statement that you are sure is not done by you, you can call your credit card company and get your card hot listed and launch a complain about the transaction. They would investigate and credit your money back for the transaction. Do this only if you are 100% sure or else you may be charged a fee for the unnecessary complain.

How I use my Credit Cards

You may wonder how I am able to manage so many cards, their payment dates and other such stuff. I have a complete plan the way I use my credit cards. Remember I don’t need to worry about the payments because they are always taken from my bank accounts and so this means I never have to worry about that part of my credit card management. This also means for all my credit cards, I have never missed a payment till date.

Where I use what

- Standard Chartered Bank Credit card is used for making payments for my hosting, domains and other online stuffs.

- HDFC Bank card is used in Google Adwords and at CESC (my electric bills).

- Barclays Card is used in Bing Adcenter and Facebook Advertising as well as in one of my smaller Adwords Account.

- Citibank card is used mainly for booking tickets online, making offline purchases as well as pay my telephone and internet bills for my home and office.

- SBI Card is used for recharge my prepaid mobiles and DTH accounts as I have very small credit limit in SBI Card.

The Benefits

Let me show you some of the benefits I get when using my credit cards.

1. HDFC Bank Credit Card

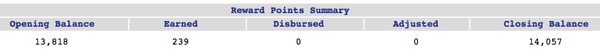

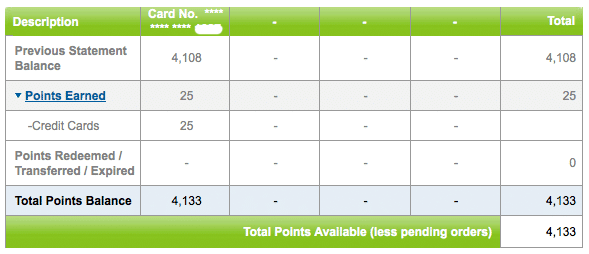

HDFC Bank’s credit card is the most heavily used card and so I accumulate lot of reward points with them. I have accumulated lot of points in the card without redeeming it because they have PlayStation as an option if you make 20,000+ rewards points which I think is not very far for me.

Apart from that they also offer cash back for my electricity bills which when paid offline would mean I have to waste time visiting the place to make the payment. It not only saves me time but also pays me back for using it.

2. Barclays Yatra card

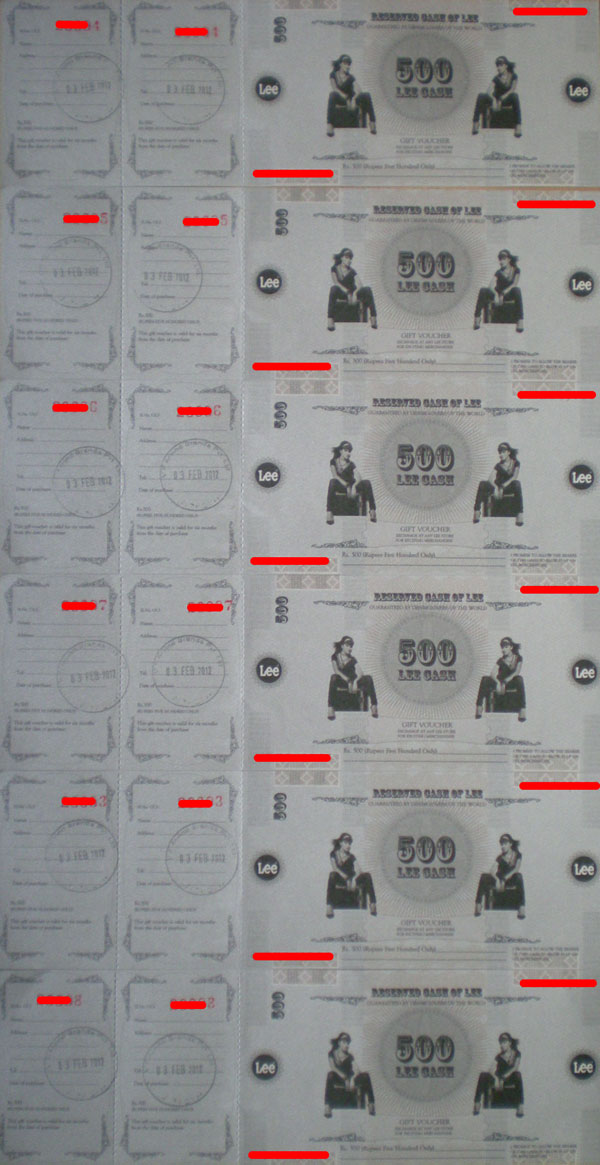

Barclay cards offer gifts vouchers of various brands and I personally prefer Lee vouchers from the pack. I get 1 or 2 Lee jeans each year just for using my Barclays Credit Card. Indirectly Bing, Google and Facebook sponsors my Lee Wardrobe.

3. Citibank Card

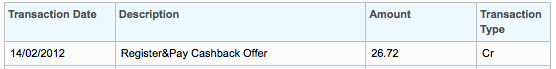

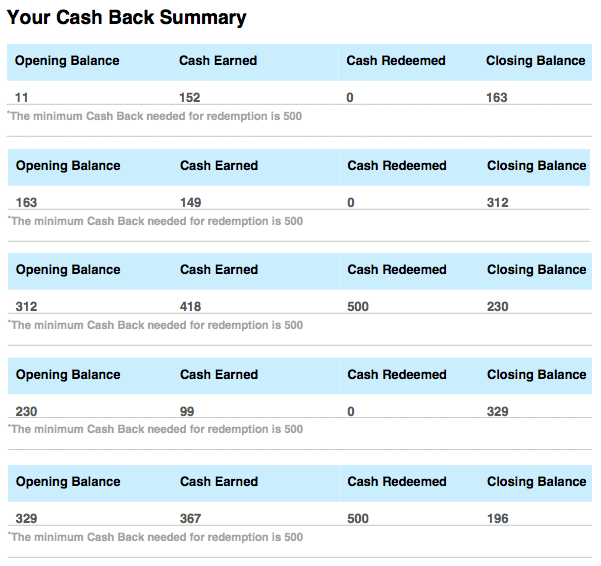

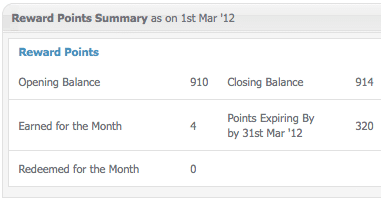

Citibank card is one of those cards where I get instant cash back and you can see how I managed 2 cash back’s in the last 5 months.

4. Standard Chartered Bank Card

I make all my USD payments through my Standard Chartered bank card because they have very good online interface for details about the transactions and so I can get details about any transactions before a statement is generated and it helps me if I need to verify my credit cards anywhere by entering the transaction ID or things like those. Apart from that like HDFC Bank card, Standard Chartered Bank card also offers lot of options and items as rewards and so it makes more sense to accumulate lot more points before redemption.

5. SBI Card

SBI Bank Credit cards is not very heavily used and so I don’t make anything significant as rewards from them but still I am accumulating points which I can redeem for big rewards when I think they are worth it.

Final Thoughts

According to me everyone should have a credit card and learn how to benefit from it. I am damn sure there will be no one who don’t pay electricity bills, telephone bills and make mobile and DTH recharges and just doing them with your credit card can not only save you lot of time but also help you get some rewards out of it.

Do you agree that credit cards can actually help you actually earn money? Share your views in comments below.

Thank You For Posting Credit Card Information.

best lifetime free credit card with no joining and annual fees.?

Want for

1. Earn savings interest

2. reward points

Do you need a loan to pay bill do contact us as we give out loan as low as 2% interest rate we also give long and short time loan for more information contact us via email andmoris38@gmail.com

I want to know the reviews of HDFC Diners Club Rewardz credit card.

Deepali, if your credit score is good, opt for the one that you can spend and earn rewards points. LIke if you are a frequent traveler in car, you can opt for petro cards, if you shop often, opt for more rewards on shopping card and so on and so forth.

Make sure you check out the joining fees / annual fees for the card and whats the criteria to waive if off. Normally it is certain amount of transaction in a year.

Thank you Shabbir

Nice article shabbir. Well I am planning to apply for a credit card and have checked my credit score too and its 820. I wanted to know which card is suitable for me and I found the correct information what I was looking out for. However, I also went through another blog site and would like to share here if anyone wants to compare the credit cards:

http://blog.creditsudhaar.com/2015/11/12/the-best-free-credit-cards-in-india/

Hey Shabbir.

Nice article, Very informative post about credit cards thanks for sharing this… I suggest citi bank credit card link for your reference. If you have any queries about citibank credit cards just gothrough this link.

https://www.online.citibank.co.in/credit-card/credit-card.htm

Nice article broh. I got a job recently, and I’m planning on getting a credit card. I also do pay for hosting, adwords, and lot of online stuffs. Plus I do shopping too. This blog post, gave me so much ideas on where to spend, and which cards to use. Thanks man.

Glad you liked it @iamanjithsasindran:disqus and pleasure is all mine.

Hi, I tried to apply for CitiBank rewards card online, and it seems like I’m not eligible since my age doesn’t fall under the eligibility criteria. They are saying I need to be 23 and above to apply. Same is the case with Standard Chartered. Do you know anything about this?

Not much I know.

hi bro,

i applied for HDFC money back credit card ..no annual and renewal fee they said if i applied via online am working in another pvt sector bank where EMI option is not available. i will do lot of online shopping in flipkart and snapdeal…my query is i have a plan to buy a household item of Rs.12000 via flipkart under EMI option..pls guide me when can i buy this product so as to get 50 days period time and i will do payment on exact date there wont be any due bcs am prompt on my payment…so guide me how far EMI option good if i pay in correct time also say about money back cc in HDFC features…thanks in advance..

Karthik, you should be buying the next day after your bill is generated and so it means you get the maximum time for paying the amount spent.

my suggestion for all to minimize your credit card swapping as low as possible. Prefer cash payment rather than card payment. You can balance your expenses. In extreme case use credit card like for buying articles on EMI. Credit card charges are too high and especially the cash withdrawal charges and interest rate. but dont worry, in case you are overdue then just shoot mail to customer care saying i can not pay and request to close the account.

Chiranjiv, cash payment is preferred if you overspend with a credit card but not otherwise.

Using EMI on credit card is the last thing you should be doing because it has a very high interest rates and so always avoid that.

Withdrawal is second thing you should avoid on credit card because it does not have a grace period for you to pay back the money and you will be charged interest from the same day.

And if you cannot pay your money back, you cannot close your account either and so you have to clear all dues to get your account closed.

That’s a really nice article Shabbir.

I think one should keep the credit limit low to draw the line of expenditure with credit card. I found many young people got very happy when they find their credit limit got hiked. This is not a salary hike, it is increasing your purchasing power but these are not at all your money. Most people got trapped like that only.

Hi. Thanks for the nice article. I have one credit card currently with HDFC. I had a huge amount to pay as fees for a course and used nearly 80% of the limit. I was not able to pay that immediately. I have been paying only the minimum balance due for each month for the past 6 months. How badly will it affect my credit score? How long will it take for my score to improve once I clear the outstanding amount? Pls help. TIA

It should not impact your credit score as you are making the minimum amount due as payment. The only issue you could have is paying lot more as interest and fees on your credit card (Around 3% per month). Opt for other loan option like a personal loan that can reduce your rate of interest.

If you cannot go for other loan, just call your credit card company and try to convert your purchase into an EMI.

I applied for a citibank credit card few days back and it got rejected. People told me it must be due to the outstanding in my existing CC. I heard CIBIL has a term named DPD and that will affect my score. That is why I was curious. I do not have any other loans/CC which could affect my score negatively.

Rejection of credit card can be based on many factors and not solely on CIBIL Score. If you are so concerned just get your CIBIL score evaluated and see what is effecting it if any. Here is a great article by Manish – http://www.jagoinvestor.com/2011/12/get-cibil-score-online.html

I got my credit score and I was happy and shocked at the same time. I had a score of 785 but still citi rejected my credit card application. If anyone here knows what all criteria citi has for a credit card, please share. It will be very helpful.

There may be many GEO or pin code related criteria as well which means if they don’t operate in particular city, they reject the application as well. Did you apply online for citi or manual.

I applied online. There were a few representatives too in my office campus but I thought online would be easier to apply.

Update: I spoke to a citibank representative and he told me “online applications get rejected 90% of the time”. SO I gave him the documents and applied thru him. It got approved for me. SO rejection might not be only because of credit score. May be petty reasons like ‘applying online’ etc.,

Excellent Article.. 1 should use credit card in a limit and yes of course they should take benefit of rewards points.. even on debit cards also there are so many rewards points going on.. HDFC Bank debit card provides you cash back also. u can check in your debit card column and what ever cash back u have got it., it will credit to your account instantly.. and even today u get lot of discounts on online shopping sites for using credit cards.So in all if u are able to use credit card well then credit card is a best tool to earn extra rather than paying extra. Thanks

Glad you liked my article Siddhath and yes I completely agree with your view on Debit cards especially HDFC Debit cards.

Hey amazing article

I had a doubt.

I currently use the citibank platinum card

Pay around 7-8k each month via my CC (sometimes bill reaches 20k) but I’ve barely accumulated a lot of reward points (points worth Rs 3k in around 3 years) whereas my friends get vouchers and rewards worth >10k while spending lesser, am I doing anything wrong?

Also what’s the procedure of receiving cash back instead of points in return?

Thanks in advance

Regards

Naveed, glad you like my article. Every card has different features and some card gives more card on certain kind of spends than others and so look for the details about where your card provides the maximum rewards and use accordingly.

About cashback, you need to opt for a cashback card and that way, you get cash back instead of points.

hi shabbir,

Vry useful article about credit cards.

I have a couple of questions.

1. Say my billing cycle is 1-30 of every month, and if i purchase on 27th using my cc. will i get the repayment grace period of 50days or i should repay it before the bill is generated.

cos i’m planning to buy a HDFC cc.

2. HDFC is offering a life time free cc, what does it mean. it means i dont have annual fee or its jus that i dont have to renew it.

Pls reply

If you just buy anything just after the bill is generated, you will get the maximum number of days which is closed to 50 days as grace period to make payment.

Lifetime free card means you will not need to pay yearly fees and most of the time the lifetime free card is when you make certain amount of transactions per year to make it free for the coming year.

Hi Shabbir,

Can you pls help me with below query?

I have a HDFC card with a limit of Rs 1,00,000/-. However I want to purchase a air ticket costing 1,20,000/-. I want to make payment through my cc only as I dont want to lose out on jpmiles. Will it be a problem if I make a payment of say 50,000/- in advance to my cc and then accordingly use my card for payment of Rs. 1,20,000/-

No there should not be a problem when you make an advance payment and I have done that in the past but there are other things to be considering when doing such transactions.

1. Check if there is any daily limit on your card. Normally it is not the case in credit cards but then it makes sense to be sure about it.

2. Also make sure your payment of 50k is credited into your credit card account before you make the purchase or you may be charged for over limit usage.

Hi shabbir! Thanks for your reply. But unfortunately my transaction was declined by bank today. I had paid 50k extra in my cc a/c and confirmed it with both netbanking as well as phonebanking. They confirmed the receipt of amount. But when I used the card for payment of ticket, it was declined… Truly stupid behaviour of the bank, i guess !!

Get the reason from the bank and that may help you to realize what could be the issue. May be per day limit or something.

Bank says they wont allow me to utilize the excess amount. They said this excess payment will be adjusted only against outstanding as on due date. Moreover when I made a transaction of Rs 1000/- today they reduced my available limit to 99000/-. They are simply ignoring the payment made. Maybe some serious policy issues with HDFC. And of course its useless to argue with these people as they will always have a upper hand.

So once the bill is generated, and if you have +ve balance, they may increase the limit for that month. At least for me when I get cash back credited, the limit on my citibank account increases by the amount deposited.

What you said is logic. But HDFC defies such logic. Anyway will check at the time of statement generation. As of now inspite of positive balance, I am not allowed to utilise it. Will update again after 8th Jan (Statement date)

There is no logic when it comes to Indian financial system as a whole. My company needed a loan few years back and eligibility for a loan of amount X was handed over to me which was not enough for my needs. Once one of my employee, having a salary slip and offer letter from the same company letterhead by the same bank was eligible for the same amount of loan X. So if I have 8 employees excluding directors, ideally my company should be eligible for a loan of atleast 10X? Isnt it?

And there are numerous such horror stories. Let me share one more.

I am eligible for a personal loan of 15L by making few clicks from a credit card, same applies to my wife’s account (Not 15L but 5L) as well. Now I and my wife both are director of our company. So ideally we should be able to eligible for atleast 20L (+ some other for companies operation). My company is eligible for a business loan that is less than 10L. Fine so I told I will take loan in my account but then company rules are such that directors cannot infuse money in companies by taking loan and he has to have his own funds.

Can you beat those foolishness.

HI Shabbir,

I have two credit cards from axis and hdfc , i used axis bank credit card and need to pay for bank but i dont have money right now can i transfer the amount from my HDFC bank credit card ?

You cannot pay a credit card bill using other credit card but you can opt for balance transfer. Call HDFC customer and inquire about the same.

Hey. Nice article.

Actually i make a lot (over Rs. 1 Lakh per month) of online payments while booking air tickets and buying gadgets. Which card would you recommend for getting the best out of my expenditure in terms of rewards/cashbacks? I don’t care much about the interest as i always make the payments a day after my credit statement.

Thanks in advance.

The best rewards would be one where you can book some flights for free and so my suggestion would be some Airline privilege card like Jet Privilege or any other airlines where you book most of your tickets.

I am new to credit card scene. I am a government on regular intenational tours. I tend to do shopping utside india via cash. Is there any card which enables me to shop internationally without making a dent in my pocket.

All credit card charges atleast 3.5% as Forex charges (some even more) and the actual charges are written in tiny words at the back of the last statement you have received and so they will create good dent in your pocket but how much depends on your card details. HDFC has some foreign travel cards and not sure about that cards Forex rates or any similar cards by any other bank though.

nice article, i also use hdfc visa platinum card for my all purchase like dth bill, light , mobile bill, and departmental store,

Dear Sabbir,

I have just got HDFC Titanium edge card and my limit is 75000 INR. I want to know that if the billing cycle is for 50 days then will I have to pay credit card bills monthly or after every 50 days?

Another question is that what points should I remeber for effective use of this card.

Thanks

Monthly. Its just when the bill is generated and if you purchase anything just following the day the bill is generated, your payment date will be after 49 days.

Always make an ECS of the your credit card payment.

Shabbir , can you please tell , how to check the CIBIL mark or score , when you missed some payments to pay on time ?

Rajesh, check it out here.

Nice Rticle….

I had one doubt, can we pay one creditcard bill with another banks credit card?

Yes. Its termed as balance transfer.

Hi Shabbir,

I have a Citibank Platinum card. My Bill Date is 24/09/2013, and Due Date is: 11/10/2013.

When is the best time to Pay the bill? Should I pay before 24/09/13, or after? Does this matter?

Also, I paid 20,000 on 25/09/13, and then paid 5,000 on 07/10/13 towards credit card. However, online statement says that my minimum amount due is 12,000 by 11/10/2013. Does this mean that I missed the 12,000 minimum amount due for this month?

Really wanted to know when the Best Time to pay credit card bill is to avoid increasing interest? I know early is good. But do payments made before or after Bill Date matter to avoid steep interest rates.

Regards,

You should always pay before Due date and possibly after bill date. If you pay before bill date then it will not be considered towards minimum amount due but just a credit towards payment.

Hii Shabbir.

nice article.I do online shopping a lot. I would like to know if Citi gives cashback for online shopping(IRCTC,flipkart etc.,)

Yes it does Venkat.

My application was rejected. Credit Sudhaar was my choice. Initially they were slow. But their counsellors were able to handle all my queries. I will give Credit Sudhaar a positive review.

For what you gave them a positive review.

Very informative.

By the way; are there any limitations to online international shopping by getting a credit card through Fixed Deposit? And with a HDFC Card what is the minimum FD amount that I could start with ?

Pauline, not sure I prefer a Credit card with a FD and I am not sure about the minimum FD amount as well. You have to be asking to the customer support.

Hi Shabbir,

Interesting and informative blog for credit cards; however i have a query recently HDFC offered our company – credit card for all employees with salaries above Rs.20,000. They said the company logo would be on it and the Company would have absolutely no liability for any defaults made by the employees.

Just checking if this is true or are there any loopholes in the fine print which is not visible to the naked eye. 🙂

Thanks and Regards,

Pallavi

Pallavi, I don’t think so but it is always better to be going through the TOS carefully

Very good article. Can you please write an article about how to get credit cards easily. Which card is better etc. etc. I would prefer a card without any AMC.

Please don’t suggest for Fixed Deposit credit cards.

Credit cards are very easily available and all you have to have is a good credit score and an income of around 15k per month.

Hi Shabbir,

That was a great information you have provided, i had a look at it b’cos i am planing to get a CITI IOC Card.

My only question is, Are there Reward points for Paying online internet Bills and Life Insurance Corporation Bills and also for Booking Tickets In IRCTC? I am planing to use my Card for the above purposes mainly.

Apart from I will be also be Using Fuel and i do online shopping to some Extent..

And is there any annual fee charges applicable if get the card in the month of March 2013, Since this is going to be an year ending and i haven’t spent any thing on the card? As April comes it is going to be a new financial year..

Muthu,

Glad you liked the information shared and the answer to your questions lies with the card type and not general. So Internet bills and LIC Bills are almost free on all cards but then some pay back even as cash back and some card reward with extra bonus points. IRCTC charges you extra for paying through credit card apart from SBI Rail card (if I remember correctly the name).

Fuel again depends on your card reward type and there are many card that charges a surcharge for fuels but many have surcharge things waived off as well.

I hope it helps.

Hi Shabbir,

Thanks for the info. Now i have got a problem here, When i applied for the credit card In citibank they rejected my application saying that “we regret our inability to process your credit card application as it does not fulfill our internal policy criteria”.

After this i called them and asked the reason and they told that i dont have sufficient CIBIL score. I want to know how dose CIBIL track our records? which mode they use to track us or our accounts? How do they work behind?

A write up on CIBIL score is coming soon from me. Give me some time and I will soon share a very detailed post on this.

Actually, CIBIL score is the only thing, depnds on which loan and credit card will be approved. If you are having a credit card or loan, and if you pay that in right time in each month, your score will be increasing. But if you miss even a single payment within the due date, that will surely reduce your CIBIL score. So, credit card or loan may be a factor to increase or reduce your CIBIL score. And also cheque bounce, credit card payment(not even minimum payment due) will reduce your CIBIL score.Every time bank, in which you are transacting will update these to Credit bureau. Credit bureau is the one, who will maintain the CIBIL score of all, with respect to PAN number.You can check your own CIBIL score by paying Rs.450 via CIBIL site.you will get the score in next 20 minutes.

For your info, CIBIL score will be calculated out of 900.It is good if u have 700.

Actually, CIBIL score is the only thing, depnds on which loan and credit card will be approved. If you are having a credit card or loan, and if you pay that in right time in each month, your score will be increasing. But if you miss even a single payment within the due date, that will surely reduce your CIBIL score. So, credit card or loan may be a factor to increase or reduce your CIBIL score. And also cheque bounce, credit card payment(not even minimum payment due) will reduce your CIBIL score.Every time bank, in which you are transacting will update these to Credit bureau. Credit bureau is the one, who will maintain the CIBIL score of all, with respect to PAN number.You can check your own CIBIL score by paying Rs.450 via CIBIL site.you will get the score in next 20 minutes.

For your info, CIBIL score will be calculated out of 900.It is good if u have 700.

can we pay citibank credit card bill by using another citibank credit card

I doubt but if both of your cards are issues to same person and are different card with different billing cycle and you have option to balance transfer from your second card, then you can.

No, you cannot balance transfer for the same bank account card.And moreover, your credit limit will be common for both the cards(as both are same bank cards).Hence, you cannot balance transfer between the same bank cards.

No, you cannot balance transfer for the same bank account card.And moreover, your credit limit will be common for both the cards(as both are same bank cards).Hence, you cannot balance transfer between the same bank cards.

Hi Shabbir,

Your post on ‘How to use credit card efficiently’ is quite informative and wanted to know few details regarding my credit card.I have bought HDFC Platinum credit card and it says as life time free credit card for corporate employees like Infosys. I wanted to know what they meant by life time free credit card and i also want to know whether they charge me if I have the card unused for a long time. Please provide me these details.

Thanks in advance,

Sanjana

Hi Sanjana, Glad you liked the article. The lifetime free credit card comes with a asterisks and normally that asterisks terms is such that you have to be spending few thousands per year to make it complete free. Read the TOS of your card that is in the statement sent to you to know the specific about how much exactly you need to spend yearly to make it lifetime free.

Can I also know whether they charge me if the card is unused for a long time.

Yes that is what I am saying if you don’t use it in one year’s time, it no more remains a lifetime free card.

Like in my CitiBank card, I need to spend 20k every year to make it a free for that year.

No, HDFC won’t charge you anything even if the card is unused. But in case of other bank cards, you need to spend at least the minimum amount(depends on the bank and the type of card). But in case of HDFC, they won’t charge you a single paise, because am using the same HDFC bank card also for the last 5 years.

Thats not true for all the credit cards by HDFC banks and there can be some cards which are not free for life.

No, HDFC won’t charge you anything even if the card is unused. But in case of other bank cards, you need to spend at least the minimum amount(depends on the bank and the type of card). But in case of HDFC, they won’t charge you a single paise, because am using the same HDFC bank card also for the last 5 years.

Thats not true for all the credit cards by HDFC banks and there can be some cards which are not free for life.

Hi Shabir , i have got SBI Platinum Credit Card , Can you please tell me what are possible ways i can use it effectively , I dont want to spend much money by using creadit card , just wanted to use it effectively , can you please advice me ?

Use only where you want to be use it.

Hi Shabbir,

I came looking for a credit card review but after reading the article got more excited on your internet business side. I’m not hoping that you will divulge your business secrets here but I’m tired seeing those ads of making money online as none of them works but knowing that you have a whole business running on internet ad business comes as a pleasant surprise to me.

If you can tell me offline how it works and all it will be great, I will also be interested to help you if you are looking for an extra help in your business 🙂

Hi Aman, I get this question quite often and so I have a blog for sharing those (what you term is as secret) – http://imtips.co/

There is no secret and there are thousands of bloggers and online entrepreneurs doing the same from around the world and it is also catching up in India.

Hi shabbir,

Could you please advice me on Axis bank My wings credit card as i am looking to apply for that. And also Please let me know any of the good credit card from HDFC bank.

Thanks

Naresh

I

Naresh, what kind of advice are you looking for the axis bank cards and for good cards by HDFC Bank, visit their site and see the one that suits your needs and gives you best return on your spending.

hi, i hav a citi bank credit card with a limit of Rs.:30000, so can i use it for buyin an iphone that is worth Rs.:44500 on emi….

No. You can spend maximum of 30k and not 44.5k

Would like to know how you get maximum cashback from Citibank cashback card… Could manage 250-260 only per month but seen that you got more than 400 in a month… Please share more knowledge…

Hi Amit, the more you spend, the more you get per month as cashback. Nothing rocket science and I purchase everything I could using my Citibank credit card

But Shabbir, there is a limit of Rs. 100 for utility bills and bills through merchant’s website… Otherwise you could earn only 0.5% for all other purchases… Instead, use HDFC debit card to get 1% on all the purchases other than utility payments etc. I do have same set of cards with me and availing the similar set of cashbacks…

I do have 1) Citibank Cashback, 2) HDFC VISA Signature, 3) Manhattan, 4) Yatra, 5) HDFC Titanium debit card and few others… Had planned the expenditure in the same way, you suggested in your blog… If you could some better combination, let me know pls…

According to me it is always the cashback that wins my preference but yes if I have something better will update.

Hi Shabbir,

Very nice and informative article. I’m glad that I had been following this and I do agree with Amit here as I’ve been getting 1% cash back from my HDFC Platinum debit card/netbanking payments which is lesser for credit cards. I have also used virtual credit card created using debit card when I buy something outside India purely for security reasons. I would like to know is it cheaper to pay online in $$ from virtual credit card via net banking or through credit card cause many other charges are added.

I don’t think there is difference in charges but as far as I know credit cards charges Fx charges and not dure if Virtual credit cards also does the same or not but I think they would.

That was very informative, I was very hesitant on having a credit card & has always tried to avoid having one..

Now have ordered one.. wanna try my money managing skills with it…

Good .. thanks for the tips !!

The pleasure is all mine Vidya.

Hi Shabbir im Naveed, i wanted to know if this is a good idea:

Ive linked all my phone bills (Vodafone, MTNL), about 4-5 of them to my HDFC credit Card,and i want my HDFC credit card bills to be cleared by ECS.

is that good? What’s the procedure for ECS??, im always charged extra since mom forgets to pay before due date.

also what happens to my mobile bills accounts once my credit card expires???

Thanks.

regards.

Hi Naveed, that is perfect and you will not only earn rewards on your HDFC Bank card but also not paying any interest or late CC fees for your card due to ECS.

Regarding card expiry it does not matter and HDFC will be sending you new card and those linked payment from old card will be either transferred to new card or those phone company will notify you about the card getting expired.

HI Shabbir,

Thanks for the great article. I am a regular followers of your article. Keep up the good job man.

I am also using multiple credit cards since last 5 years and always been loyal paying back to respective bank through Net Banking. But how do I plan for ECS in HDFC Bank? As most of the time I had to login to HDFC bank net Banking site and do a third party transaction to to pay my credit card balance within due date. If I could plan for ECS facility in HDFC bank then as you mention above life will be much easier.

The ECS option is provided by your credit card company. HDFC Credit cards can be linked using the Netbanking itself but for other cards you can opt for ECS or you can pay manually but ECS is always the best option.

shabbir,it is always great to read your articles on financial market.it give us important lessons to save from marketing fraud & be an informed citizen.kudos for your efforts.

The pleasure is all mine Safdar.

Credit cards are a financial tool that can turn into a double edged sword if they are not used carefully. If you get a credit card and use it wisely, you can gain a better credit rating, maintain a responsible level of debt and save money on interest rates.

Mr Shabbir.Bhimani thanks for clarifying your reason for quoting people above 50+ as being unaccustomed to the usage of Credit cards.According to me , innovation and change is permenant in every vocation including finance applications, hence banking methods of the 1980’s are almost redundant in 2012!To survive every person, irrespective of age has to adapt to change, including the proper responsible usage of credit cards.

Yes I completely agree that age is no bar to innovations and am pleased that my view point is now conveyed and clarified.

Mr Shabbir.Bhimani you mentioned that 50+ age-group are not accustomed to using credit cards since that generation didn’t grow up in the credit card and computer age.Its a big mistake on your part to totally discard a group of people based on their “AGE”, akin to certain job selection priorities.One of my greatest hero’s late dev.anand produced movies till he dropped dead in his late eighties ahile one of English bands “Rolling stones” , all over 60’s make young teenager musicians embarrassed by their music and acrobatic zest on live performances.Similarly in the world of finance and investments, manny 50+ retirees haved a carved a niche in money generation by becoming self-entrepreneurs and creating employment for people much younger then them.So please don’t make the mistake of using “AGE-GROUP” as a cut-off line for judging mental or physical skills of humans.Adaptation to innovative technologies is the key to survival in the finance and economic world, hence people above 50+ who do not adapt to change usually persish financially, need not be in credit cards alone.

Rudolph, the idea was not to have age groups divisions but let me mention few instances.

My Dad has never used a credit card and he still does not know how to use a debit card and I use it for him. My mom can never believe that you can actually purchase anything even if you have no cash to pay and we live in a metro city of India, Kolkata.

See the ads of Flipkart where we get the feeling that small kids recommend dad for using credit card online.

Things like many of my friends Dad has similar stories and this does not mean to say everybody who is above certain age group has not done anything with a credit card or finance but generally people who have not used credit cards in their 30s and 40s find it difficult to manage.

I have seen lot of my Dad’s friend even know very little when it comes to operating in mobile phones.

The meaning of my statement

We can understand those people who have never used a card for few decades can have issues getting used to it but for tech savvy people it is much easier to be getting used to using credit cards.

I never meant that you cannot achieve after certain age and there are lot of my blog readers whom I have met personally and realized they are father figure to me.

Good one Shabbir!

I’ll plan for a credit card 🙂

Good to see that and do let us know your feedback about the same as well.

Hi

good one!! I am 21 only. I am follower of ur blog, jago and some other finance blogs.I will buy whatever thing i need(essential) it thru debit card . I have learned a lot from all of you ppl. I totally agree to your point . Paying all the utility bills is an essential thing which everybody does.This we can do thru credit card. The negative part comes here.On getting credit card one will not stop with paying the essential bills. The spending will obviously increase. The product which we have planned to buy three months (EMI deal)after will become an achievable one. Like this people start spending!!!! So we need to carefully evaluate the deal and then use that wisely. I have seen very less people managing the credit card efficiently(like you) . well done. A new lesson learnt.

Vignesh, using debit card is the next best thing and I also use that because my HDFC Bank Gold Debit card comes with 1% cash back on all Point of Sale transactions and as that is debit card I have not covered it here. I pay lot more as yearly fees to having Gold debit card that has that facility and make money out of it as cashback as well. Few times what I pay as fees. The disadvantage is I can make in multiple of 250 and I have to call bank and get the credit deposited into my account which is kind of headache but then I do it as well.

Now you can place the cash back redemption request of HDFC Bank Debit Card through net banking. Gone are the days when you need to call the customer care for the same.

Can you tell me where can I find that option in Netbanking?

The option is available inside Debit Cards Menu after login into HDFC Bank Net Banking. From here, one can track the total cash back points accrued and can also place the request for redemption. 🙂

Great. Thanks for sharing that info and I just never noticed the Debit cards menu in that list of menu’s

Hi Shabbir,

Excellent post ! Gives a good understanding of the benefits of using credit card. However, I have often seen that people end up overspending their credit card for the sake of earning points.

Further, more important aspect is Credit Cards and its relationship with the credit history of the individual. If a person fails / misses to make the payment towards the card, it would result in severely impacting their credit history. The topic is a bit complex and I have a seperate article written on it (http://insight.banyanfa.com/?p=421) I think it would benefit the readers to know the pros & cons of using a credit card.

Regards

BFA

I have not missed a payment for my credit card for last 5 years and the process that I follow can never allow me to miss it.

Now over spending for points is something that is the most stupid thing that you can do because there are very few cards where points expire and so I don’t see a reason behind such habits.

The article you have written is nice one and If you want you can link to my articles for further reading on your blog about managing credit cards. Let me know your thoughts.

Hi Shabbir,

Excellent idea. I have one draft article pending review and shall be finished later this week. I would definitely like to link the reward points benefits to your blog.

Regards

BFA

That would be awesome and do let me know when the article become live.

Hi Shabbir,

I have now published my article. Have a read at http://insight.banyanfa.com/?p=528.

I have referred the reward points section on my article to your blog. Hopefully you would okay with it.

Regards

BFA

Perfectly fine.

I am reader of many international personal finance blogger like Ramit Sethi and others and each of them recommends using credit cards for huge $$$ gains but havent seen any Indian in India (Ramit Sethi has an Indian origin) do the same with credit cards before this. Very nice Shabbir and keep up the good work.

Dev thanks for those kind words and I really touched. 😀

Yes I also follow Ramit’s Blog

very good article.

Thanks Milind. 😀