Let us analyze the past two decades of bull and bear phases in the market to identify what can lead the next bull run in the market and invest accordingly.

Different sectors lead every bull run. Can we use the past two decades of the bull and bear phase to help us identify what can drive the rally next?

Let us first analyze some of the bull runs of the past and see what led the bull run.

- 1985-1986: It was for the IT and Telecom Revolution.

- 1990-1992: was led by Harshad Mehta, where everything rose.

- 1998-2000: was led by IT Sector.

- 2003-2007: was led by capital goods and PSU companies.

- 2008-2012: was led by Pharma companies

- 2014-2018: was led by Banking and NBFC

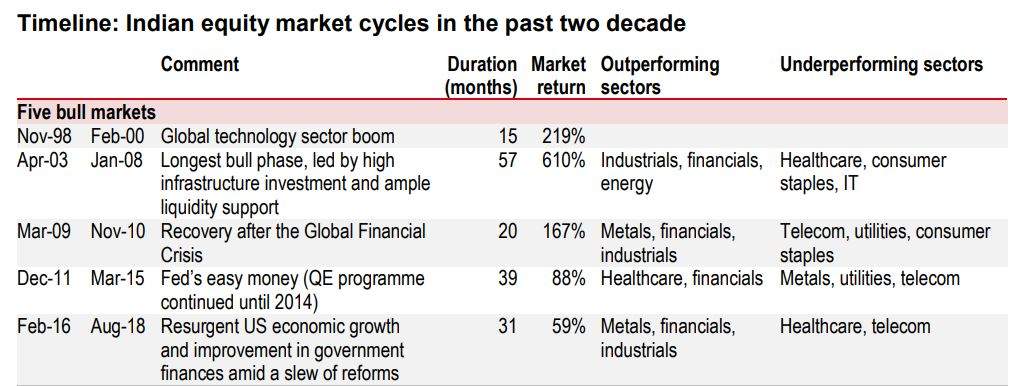

Here is a critical analysis done by Economic Times earlier in March 2019

Here is a crucial statement in the above article:

Data compiled from corporate database AceEquity shows Nifty Bank jumped 101 per cent in the last bull run. Nifty Realty soared 111 per cent and BSE capital goods index 69 per cent, but Nifty Pharma fell 7 per cent.

So from the above image, we have some very important derivations to help us identify a potential leader in the upcoming bull market whenever it starts.

Can we use the above data to spot the leader of the next bull run?

Financials

Financial is part of every outperformance period in the past two decades. It indicates it has to be part of the next bull run as well.

However, the second school of thought is, it has to take a break.

Industrials

Unlike Financials, though it didn’t perform in one of the bull runs, it has a significant role to play in the last two decades of outperformance in the market.

Energy

The energy sector has not been part of the last three bull runs on either side. It makes me think it can be a surprising sector for the next bull run.

Metals

It has always alternated between underperforming over performing. As it has over-performed in 2016 to 2018, it is more likely to underperform now.

Healthcare

Very interestingly placed. It has underperformed in the past five years. A Virus leads the current fall, and health becomes the prime concern for the world, it is more likely to outperform.

Consumer Staples

Consumer staples are not part of the outperformance category in the above chart, but the stocks in this sector have done well in the 2014 to 2018 period for sure.

Maybe the outperformance wasn’t as much as others, but it is more likely to remain an outperformer. May not be able to lead the outperformance in the future but is not expected to underperform either.

IT

The sector is very interestingly placed. The outperformance in y2K led it to underperform. However, the sector is out of favor since, but the companies in the sector are cash-generating.

Telecom

The sector has underperformed in the last three bull runs, which is making a lot of people invest in it. However, for me, it is still an avoid.

Not even a single country in the world has ever produced a telecom or aviation sector leader to the billionaire’s list and remained there for a very long time.

So for me, it is an avoid sector all the time.

Utilities

The underperformance has made the sector to be worth considering. Some of the utility companies are trading at a PE multiple of 3 and 4.

Conclusions from Past Bull Runs

Here is what we conclude essential points from the past bull runs:

- Financial has been part of the last four bull run.

- Industrials are often part of the bull run. If it isn’t leading the rally, it is not underperforming either.

- Consumer staples have never lead the rally.

- Telecom has been underperforming for the last three bull runs.

- Metals outperform alternatively.

- Healthcare alternates between outperformance and underperformance like metals.

Wait for the Leader to Emerge

My view is, the next bull run will be lead by a new sector, and it has to be either Bio-Technology or Insurance.

Technology mixed with Pharma is what may lead the next rally.

Analyzing the trends, technology, and the Pharma sector are well poised for it. Maybe a combination of both can be worth considering.

Moreover, it seems quite likely that every Government will focus on developing the technology to fight Viruses like Corona Virus. Companies able to do so can be the leader of the new bull run.

In the current environment, what is your prime objective?

Safety.

Insurance is one more sector where everyone in this fear of health environment will flock to.

Some companies make air purifiers and masks, which can lead the rally as well.

Some experts believe in the PSUs as well, but my view is to avoid them as they are not efficiently run companies.

Everyone is predicting, and no one knows for sure who will lead the rally. It is easy to analyze the past but impossible to predict the future.

So the best option is to wait and let the rally begin. Keep cash handy. Don’t put in the last penny you have in the fall. Have at least 3 to 5% of your portfolio in cash to be able to identify the next leader in the market and invest in it.

The next-best option is to invest in the Nifty Index ETF.

Final Thoughts

Remember this quote from Mark Twain

“During the gold rush its a good time to be in the pick and shovel business”

So don’t look for companies trying to find a solution for the Virus (dig gold). They may not be ideal for investing. Look for companies that can help with the tools for digging gold. The Utility sector is one such opportunity for sure.

Update: For those who are not sure about the Utility sector here is a BSE List of Utility companies

Please tell us quality and good dividend paying stocks.

Reason

Want dividend income around 6-8%pa on investment

+

Growth 10-12%

Here is a screener where I searched for dividend yield of more than 8% and sales growth in the past 5 years more than 10% and found quite a few stocks

https://www.screener.in/screen/raw/?sort=&order=&source=&query=Dividend+yield+%3E+8+ANDSales+growth+5Years+%3E+10

Now you can apply your own investment logic to weed out companies that don’t fit the criteria.

For me the criteria has to pass investment checklist and business checklist

https://shabbir.in/investment-checklist/

https://shabbir.in/business-checklist/

Which companies are the Utilities one?

I did update the article and here is the BSE list of utility sector and companies.

https://www.bseindia.com/markets/Equity/EQReports/IndustryView.aspx?page=100101001+&scripname=Electric+Utilities

Found it on Google as well. Here is a nice one by India Infoline

https://www.indiainfoline.com/markets/bse/sp-bse-utilities/indices/65970