You read my article on how to get a lot more amount of tax saving benefits under section 80C. Today I share how you don’t invest a single penny and yet get the full tax benefit

Yes, you have read the title correctly. We can save tax under section 80C (Up to ₹1.5L) without any new capital investment.

Withdraw an old investment from an ELSS tax saving mutual funds done three years prior. The period is three years because in ELSS Tax Saving Mutual funds have a lock-in period of three years. Once the lock-in period is over one can withdraw the amount.

Invest the same in a new or same Tax Saving ELSS mutual fund. It is a way to record a transaction of tax saving investment in the current financial year without a need for fresh capital. Assuming we are eligible for tax saving under 80C in the current fiscal.

I did the same in this month itself for my tax saving investment for the financial year 2019-2020.

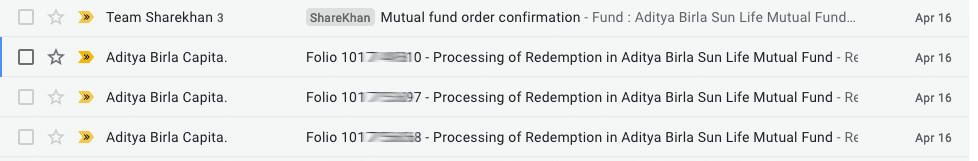

I placed a withdrawal request for my investment in early 2016 on April 16, 2019.

The amount got credited into my HDFC bank account on 22nd April 2019.

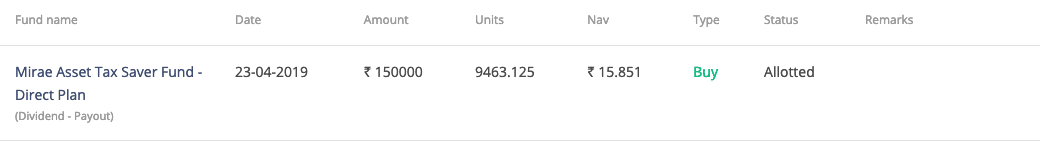

On 23rd April 2019, I placed a purchase request in the Mirae Asset Tax Saver Fund Direct Dividend which is my choice of Best ELSS Tax Saving fund for 2019.

The order got executed on 24th April 2019, and I got the confirmation in a couple of days.

Note: I Always prefer Direct Funds Dividend Option. Read Why here.

Remember, the withdrawal from the old fund may have an LTCG or long term capital gains tax depending on an individual’s total gains under LTCG in a fiscal.

Is this Completely Legal?

As far as I have asked my CA, Yes it is entirely legal. You are allowed to withdraw the investment in the ELSS fund as and when the lock-in period is over. So once the withdrawal is permissible, and after it hits your bank account, you can make a new investment either in the same or a new ELSS fund.

Still, if you have any doubt, please consult a CA on the matter. I am not a legal advisor, and exact details can vary from individual to individual.

If you don’t find it convincing, there is one more way to make a full tax saving without total investment. Invest in the dividend option. As and when funds declare dividends, receive back the tax-free amount. Read the full details here.

What if I Invested in SIP 3 Years Back?

If your investment is in parts, your withdrawals have to be either in parts where each units lock-in period is over. If you wish to redeem all, one has to do after the lock-in period of the last transaction is over.

So my investment was made in Feb and March of 2016. So I was eligible for units purchased in Feb 2016 to withdraw in Feb 2019. Units purchased in March of 2016 were available for withdrawal in March of 2019.

I could have withdrawn all my investment in March of 2019 but I wanted to wait till April, so I can withdraw the money and use the same for completing my tax saving investment for this fiscal.

Again, after three years, i.e., in April of 2022, I can use the same money to invest back in an ELSS tax saving fund and save tax.

What if I didn’t Invest Full 1.5L 3 Years Back?

No worries. There is no correlation between past investment and current investment.

I invested ₹1,05,000 in 2016. My withdrawal amount was ₹1,30,000+ which includes 25k+ as LTCG gain. It is below the level of 31st Jan 2018 which is grandfathered date for the investment value for LTCG. The reason it is lower than the amount on 31st Jan 2018 is because of dividend paid out by the fund.

So I don’t have to pay any LTCG on the gains either. Even if it weren’t pre Jan 2018, as the amount is lower than the 1L allowed limit per year for LTCG, I wouldn’t be paying LTCG either. If I make a lot more LTCG gains in this fiscal, I will have to pay the tax.

Coming back to the original question. The thing I am trying to explain is, what you withdraw and what you invest has no correlation. The only thing to consider is LTCG.

So if you withdraw the money and invest back and if you didn’t invest the full amount in the past, you can still add new investment and save the complete ELSS tax saving under 80c.

Even if you have not withdrawn any past investment in ELSS, one can withdraw them and invest in the current year if you don’t want to commit fresh capital for saving tax.

It is quite normal for someone not to have a full 1.5L as an invested amount because 80C also offers other tax saving option which includes LIC policies, PF, PPF or even be paying school tuition fees. So if your mutual fund investment is less, one can withdraw whatever amount he has invested in the past. Add, Subtract or use the same amount to re-invest. There is no relation between the two.

One is free to withdraw a partial amount from the past investment as well.

Why I withdraw ELSS Investment instead of building a Portfolio?

I get this question quite often. My prime objective with an ELSS investment is to save tax.

For investment, I don’t prefer mutual funds because I am better off investing in the stocks directly. When I can beat the returns of mutual funds by a significant margin, it doesn’t make sense for me to be doing it the mutual fund, but I don’t recommend it to others.

I have a simple approach to investing in stocks.

If you can’t beat the best ELSS fund’s returns by a margin, you should be building wealth via the ELSS mutual funds. If not go with the mutual funds. I don’t advocate you to be dealing in stocks just for the sake of it, but if you are confident, you can beat funds return, invest in stocks but not otherwise.

Thanks for the List .. Its a good one, I always look forward to see your post. I really appreciate the work you have done, you explained everything in such an amazing and simple way.

Nice article Sir. Very informative. Thanks for sharing

Glad you like it.