What is LTCG? What is Grandfathering of taxable LTCG up to 31 January 2018? Does LTCG apply to Mutual Funds? What is the tax percentage and How to calculate the tax?

How to Save Tax Under 80C Without Any Fresh Capital Investment?

You read my article on how to get a lot more amount of tax saving benefits under section 80C. Today I share how you don’t invest a single penny and yet get the full tax benefit

7 Investments Gains That Can be Adjusted Against Loss From Stocks To Cut Tax

Profits of debt funds, gold & gold ETFs, real estate and other such investment can be adjusted against short term capital losses for saving tax.

What Happens If I Miss Couple of Monthly SIPs to My ELSS Fund?

Will the invested amount be considered for tax deductions if I miss a couple of monthly SIPs?

Is PPF or Public Provident Fund A Smart Choice of Investment?

NO Public Provident Fund or PPF is not a smart choice of investment option for any investor whatsoever.

Is Home Loan Right Choice for Saving Tax?

Answer to Question: My gross salary is approximate 12L and my net take home is roughly ~78,000 Rs per month. I think I am paying lot of tax and want to know ways to save tax. Can I save tax with a home loan?

Unknowingly I have been Forcing My Readers to The Biggest Mistake to Managing Personal Finance

The worst investment tend to happen in the month of February and March for saving tax and I realized I have been preaching the same on my blog.

How to Save Tax On Short Term Investment With Profits

How profit from short term investment i.e. investment for under 1 year in equity market can still save lot of tax that may need to be paid otherwise.

Best Strategy To Save Tax Under Section 80C

The best strategy for saving tax is to invest with minimum locked in period and save maximum tax with minimum possible to zero investment.

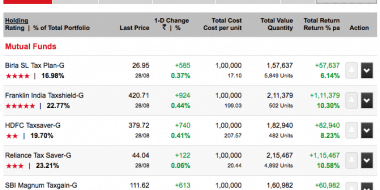

Best Tax Saving Mutual Fund ELSS Options for 2013

In 2009 I shared Best Tax Saving Funds and though the idea of finding the best tax saving ELSS fund is still valid, it makes sense to be sharing some new insights as well as the look into better option to save tax in 2013.

Do I need to file my IT returns when I have loss or no Profit?

In the last quarter of fiscal when we approach the month of March, questions related to taxation hit my inbox quite often and one of the very common question is – Do I need to file my IT returns when I am in loss for my portfolio?

Where to Start Investing and by How Much?

Let me answer the question. I am N years old and earn few thousands a month and have no investments so far. How much should I invest and where?

Impact of DTC on ELSS Funds

ELSS will not be an option once DTC is enforced. Till we have the option I am definitely going to use it to get Full tax saving without investing one lac into the Best dividend paying Tax Saving Funds.

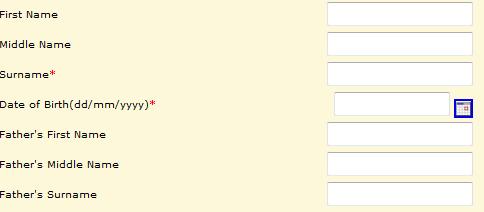

How Unsafe Is Income Tax India e-filling

December 15 is the last date for quarter’s Advance Tax Filling and this time I thought of registering myself at Income Tax India e-filling to view my fillings online. When you click on the register link it asks for a PAN Number. Once you provide a valid PAN number you can proceed further. The shock […]

New Direct Tax Code

New taxation rule is in talk once again and so I would like to point you to one of my article where I shared How New tax Code can Impact us?