NO Public Provident Fund or PPF is not a smart choice of investment option for any investor whatsoever.

The answer is NO Public Provident Fund or PPF is not a smart choice of investment option for any investor whatsoever.

The reason being PPF has a lock-in period of at least 6 years (which has been proposed to increase to 8 years in Feb 2015) which means you have to keep your money invested for atleast 6 years before you can withdraw a dime. Apart from lock in periods, PPF investments are for 15 to 20 years which means you can partly withdraw after 6 years (or 8 years) but you can fully withdraw only after 15 years. Equity investments and ELSS funds has given better returns for such an elongated period of time.

Let us understand this with an example.

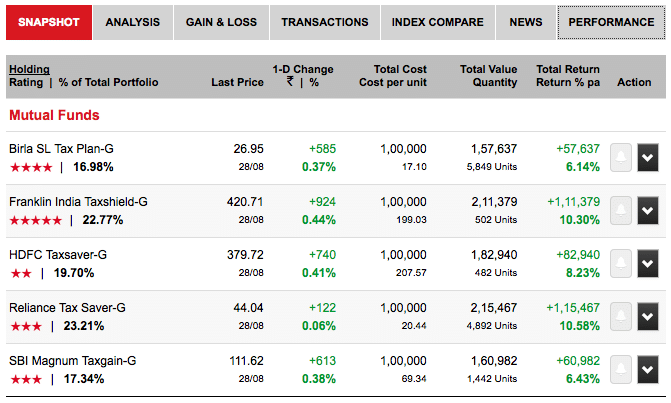

In the second half of month of January of 2008 is when market tumbled after making an all time new high. Let us assume that you were invested in an ELSS fund on 10th of January i.e. just before the market crash and at all time high. Perfectly wrong timing and still create a portfolio of investment of 100,000 (80C Tax saving limit at that time was 100,000 only) in any randomly selected 5 ELSS funds that existed at that time.

Still we are just into 7 years of performance of the funds and this is what it the performance of those investments looks like.

You can see that 2 funds has given a return of just above 6% and the other 2 has given a return of above 10% as well and one is around 8%.

Note: I have selected growth fund because we can understand the average returns from the funds and compare them to PPF. I prefer to invest the dividend payout option.

Even a randomly selected ELSS fund invested at the perfectly wrong time has 60% chance of performing better than PPF in just 7 years. Experiment in ValueResearchOnline portfolio section by adding randomly an ELSS fund when you actually invested in PPF and see what your returns be now.

Dear Bhimani,

PPF is a good choice since the matured amount is not taxable.

I have an existing PPF a/c maturing in April 2016.

You can invest at least once a year. The ROI/ROR is low when

compared with banks/stock markets. But is a must if you have children. There is no harm in having one account

in PPF .

I do not know your age but I recommend the following

investments subject to change according to individual requirements.

1. Stock markets : A trader is better than long term

investment. Trade in cyclic stocks.

2. PPF

3. LIC

4. Gold chit Rs 1000/= per month

5. Medical insurance Rs.5000/= pa. for a family of four. An

expenditure but an asset in times of need.

6. Running bank a/c with one months requirements always

there.

I thing this would help you. I am a retired person and I have

planned my savings but maintain a family of 8 members for 27 years. I use credit cards even now but in a planned way

. Deficit financing is good provided you know how to use it.

Diverisy your investments . Diversifying your stock

investments is sheer non-sense. Go with the market. Step in half

way amd get out before the destination even if your profits are

low. At times I make a profit of Rs 50/= per day. Thats it.

With warm regards

Venmathi

What if you average for the whole year and make almost 50*365 and at times equity can make few times more for that as well. You allow things to multiply and at times it can go wrong as well.

Dear shabbir,

I differ with you on this. You are comparing a bow with an arrow.(equity with debt)

Debt is an essential part of any investment portfolio. PPF provides a better tax free return than many other debt options. Equity allocation on the other hand doesn’t necessarily need to come from ELSS.

I prefer PPF for my debt investments and also for tax savings.

Micks, I am not comparing two different things but what I am trying to compare is returns from two different instruments.

Yes I agree that debt should be part of any portfolio but if debt has a lock in period of such an elongated time, you are far better avoiding it and use other debt options where your money is not locked.

Having PPF is not a bad choice and if you know what you are doing, it is all good.

Yes ppf is most reliable tax saving scheme u/s 80 c earning tax free

interest @8.7%.in Other tax saving schemes only mutulfund elss schemes

income is tax free but I’d contains market risk but 3 years lock in

period. Ppf is s long term 15 years. In my opinion PPF is. The best

scheme among others. Uti ulip is also good.but ppf the bes

tIyh

I don’t think most reliable and best option but would agree PPF is best among the debt options

Please note that one person (so called expert) firmly told that we should invest in PPF for a good safe return.

Now, you are telling correctly about the lock-in period etc.

Once again, thank you for your information.

Regards.

S. Sridharan

Yes you should invest in PPF if you are planning to invest in debt instruments but aim should be security and diversification and not return on your investment for sure. As long as you know what you are doing, it should be all ok.

If we compare PPF with equity mutual fund , you may be right but still we can not ignore PPF because it is most secure instrument for investing backed by Govt of India. Now it depends on allocation how much one can invest in ELSS and how much in PPF. I think, in my personal opinion, PPF is also a MUST HAVE for any portfolio.

What is safety or risky? Loss of capital or less returns? If you consider both the aspects too…..ELSS beats PPF with huge margins in the long-term. Its only a myth that PPF is safe and ELSS is risky. Come out of that perception and don’t let that myth pass on to others

it is not a myth Sir…….I know ELSS is better and i also invest a large sum in ELSS but i Only Said that PPF can not be ignored……..All Eggs should not be put in one basket

One should diversify if one doesn’t clearly know what he is doing. If one is clear about the product, then there is no point in diversifying just for the heck of it. Mr. Warren Buffet said “Nothing is risky as long as you know what you are doing. There is no point in unnecessary diversification”. In terms of rate of return, lock-in period, getting inflation beating returns, liquidity (only 3 yrs lock-in) etc., ELSS is the best and PPF is no match to ELSS. ELSS returns are almost double that of PPF in the long-term. So, lets not bring diversification as the reason to choose PPF….when all the factors are in favour of ELSS. This reply is not hurt anyone but to change the mind-sets

Really nice analysis @shabbirbhimani:disqus Shabbir and the same also holds true for a FD that people do for 3 to 5 year time frame.

Yes quite true but then on FD, your returns are taxable again but equity investments of more than a year is not taxable and so that makes return from equity mutual fund even more lucrative.

Hi Shabbir, Nice analysis. Can i share it with my friends and colleagues?

Yes vinay, you can and we have Share buttons in the left hand panel for easy sharing options for my readers.