5 of the most common reasons I see why companies like MRF Ltd, Eicher Motors or Page Industries don’t announce bonus shares or stock split.

Some companies share price keeps rising and the management neither do a stock split or issue bonus shares to reduce the per share price.

Companies every few years issue bonus shares or do a stock split to reduce the share price. This is common among most of the companies but some tend to avoid it as a whole. Only 9 out of the thousands of companies being traded on NSE and BSE has share price in 5 figure as on 3rd June 2018.

- MRF – 74,848.90

- Rasoi Ltd – 34,502.00*

- Eicher Motors Ltd – 29,868.75

- Page Industries Ltd – 24,934.25

- 3M India Ltd – 19,353.55

- Honeywell Automation India Ltd – 18,553.10

- Bosch Ltd – 18,292.40

- Shree Cement Ltd – 16,656.40

- Polson Ltd – 13,840.80*

In fact, you can enter the following query on Screener.in (I use Screener for stock watchlist) “Current price > 10000” and get all the stocks that are trading higher than 10k. Maruti Suzuki Nestle India and P & G Hygiene are other stocks that may join the 10k price group soon.

* In the above list, stocks like Polson and Rasoi Ltd have a face value of even more than 10. I am not sure how but it is what it is.

But coming back to the original questions like why some of these companies don’t issue a bonus or split their share so the price of the stock reduces which can mean with less price per share means more retail investors can invest in them.

Don’t Want To

The short answer is, these companies don’t want to be doing it.

Don’t Need To

The second most important aspect is, there is no rule or guideline for face value to make sure some of these companies have to split their stock.

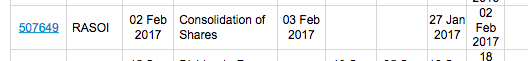

In fact, doing research for this article, I found that Rasoi Ltd has done a Consolidation of Shares on 2nd Feb 2017.

So from a face value of 10, they now have a face value of 200. I am sure there will be a reason for this but as of now the daily trading volume for shares is in single digit.

If at any point in time, if Indian regulators want face value of every listed company as equal, those companies will be forced to split.

No Financial Benefits

There is no change in business or financial aspect of the company if the share price of the stock is at 10k or 1k.

If a company does a bonus or split, the number of shares increases and the price of the share reduces by the same amount. As there is no change in the business or it’s financials why make a change?

A penny saved is a penny earned. Such company may have been saving the legal and financial costs of doing the bonus or stock split.

Symbol of Status

Some investors consider companies as more valuable based on the share price it is trading at. Many investors consider MRF as the most valuable stock in the Indian market.

Berkshire Hathway the company of Warren Buffet has its share price in Crores. Some Management may want to be following the same path as Warren Buffet and don’t bother to consider bonus or split. Being the highest price per share of the company as a status symbol.

Keeps Traders & Speculators Away

Once companies issues bonus or do a stock split, the number of shares increases making it more liquid and available to trade and speculate (day trading). This may invite more traders and speculators. If the share price is high, there aren’t too many traders or speculators part of these companies and the management want it to be that way.

Without traders and only serious investors are the shareholders which can mean there is much more stability of the share price movement.

Some newbie investors even consider these companies as too pricey and avoid it as well.

Yes, I agree that some retail investors aren’t able to invest in such companies but they can go the mutual fund route and invest in these companies indirectly. I have also seen some investor even end up selling the shares of these companies because they don’t see room for upside in the price.

Leave a Reply