Let us see technically and fundamentally why TTK Prestige is a Good Investment above 1400.

Technical Analysis suggests that TTK Prestige is a Good Investment above 1400. So let us see how.

First let us see hourly chart (Each candlestick represents an hour) of TTK Prestige for 1 month.

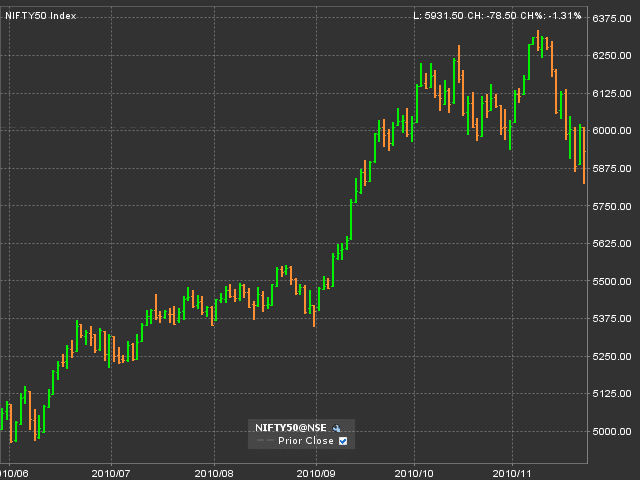

We see that there is lot of consolidation and sideways movement between 1st November and 10th November between the price range of 1375 and 1425.

When market corrected as expected this stock also corrected and on 19th November we see a strong bounce after touching low of 1400. Support held.

Today (23rd November) also we see a very strong bounce from low of 1438.20. Once again support held.

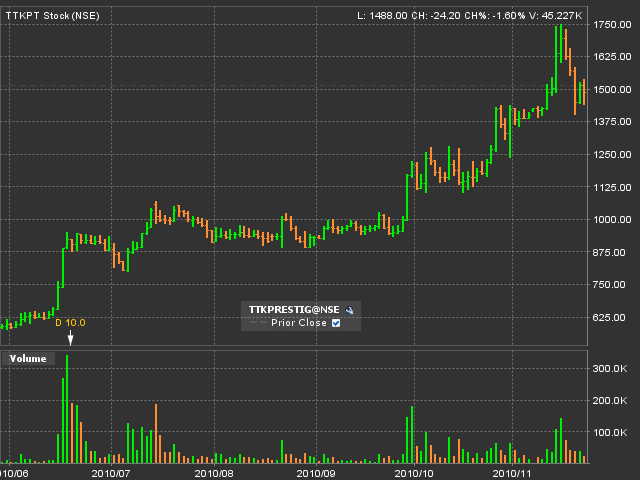

Now let us look at somewhat longer term view for this stock. Let us see the daily chart (Each candlestick represents a day) of TTK Prestige for 6 months.

We clearly see the step chart pattern where stock consolidates for few months and then moves higher. In the month of September I made a solid 20% in this stock (See the details here).

Remember there was no correction in the markets for last 6 months and so stock also showed no correction.

When the market corrected stock also did correct and held its first support and so I think this should be a very good long term buy.

Fundamentally I am sure many will agree that this stock is over priced. As per Moneycontrol.com TTK prestige EPS is 58.25 & Book Value of 107.77 and so PE of more than 25 but then if you compare it with other good rural demand stocks like Titan or Asian Paints, TTK prestige is trading at only 25 P/E.

I have scheduled this post to go live after trading hours so that you don’t buy this stock in a hurry but do your homework because remember I only share my personal views for education purpose only. I will still suggest don’t go with my recommendations but find such multibagger stocks for yourself.

Charts are from my Interactive Broker Application

Hey Shabbir,

Post is nice. However TTK Prestige is nice for speculation but is not good for investment at this point of time.

Regards

Sharetipsinfo

Finally you realized that there is no point in spamming here and yes if you can play TTK Prestige you can make good money.

Thanks for writing this excellent article. Very useful information

TTK is not only overpriced but fully operator manipulated stock. One should remain very careful when trading on this stock.

Can you explain operator manipulated stock? Do you mean hedge funds in action or something else?

I have been in touch with a no of operators who r of this opinion.I also recd a no of SMSes in this regard. I did trade on this stock on an intraday basis and reaped losses/benefits. I dont understand what do u mean by a hedge fund in the Indian Context,. If it were growth stocks, there are plenty. But for trading, particularly positional,BTST/SEBT or day, this is a good stock if handled with care. And also the price varies in BSE and NSE. so while trading one should not go for Market Price but mention ur price. It is important.

Hedge Funds actually breaks the support for the sake of arbitrage and buys back. Things like fake breakout or fake breakdown

I wish to invest in Educom company share. What is the right stage for it. Kindly advice.

Close to 500.

Thanks Shabbir. Though, I think this industry is doing pretty well and September quarter result for Jindal poly was excellent. Still it is not being considered as multibegger :(. I think I am missing something and need to learn more then.

My another doubt is on Mutual fund.

Currently SIP is about [FIX date] + [FIX amount to invest]. Is there any procedure in MF when I can have option [FIX date] + [Variable amount to invest] [ofcourse >5K]?

Regards,

Raju A.

Manually you can do that. Just have some reminder to invest in a particular fund on a given date and then decide the amount and invest it.

Hi Shabbir,

Thanks for your reply.

I am planning to start following SIPs:

a) For 3years SIP, total invest amount per month :Rs. 6500/-

MF-> 1) HDFC Prudence [Rs. 4500] 2) DSP MICROCAP [Rs. 2000]

Purpose: Foreign Travel

b) For 10years SIP, total invest amount per month :Rs. 4000/-

MF-> 1) Reliance Opportunity [Rs. 3000] 2) HDFC Prudence [Rs. 1000]

Purpose: BANK LOAN REPAYMENT

c) For 17years SIP, total invest amount per month :Rs. 5000/-

MF-> 1) HDFC TOP 200 [Rs. 2000] 2) Reliance Opportunity [Rs. 2000] 2) HDFC Prudence [Rs. 1000]

Purpose: Child Higher Education

d) For 24years SIP, total invest amount per month :Rs. 8500/-

MF-> 1) HDFC TOP 200 [Rs. 3000] 2) IDFC Premeir [Rs. 2500] c)DSP MICROCAP [Rs. 2000] 2) HDFC Prudence [Rs. 1000]

Purpose: Retirement.

All funds are growth funds only. My Age is 33 currently. Could you please advice if my MFs selection is ok.

Thanks,

Raju A.

Raju, I don’t track all of the funds and so I will suggest you to see the track record of the funds but one thing which is noticable is you have no debt funds and for small to life long investments you should opt for some debt funds as well. Not much but smaller amount.

Please read plastic industry.. not polister industry.. sorry.

Hi Shabbir,

I have noticed Jindal poly has EPS of 74.81 [as per MC] so as per your script [http://shabbir.in/dcf-to-calculate-fair-value-of-share-price/] if I enter:

a) EPS=74.81

b)Expected growth rate of the company =4 [assuming 4% growth atleast from here] and

c)No of years of growth to continue and then constant = 1 [assuming for one year only], it’s giving me value : 1169.

Assuming overall polister industry is doing well.

Shall I consider Jindal poly to be a multibegger?

Please advice and correct me if any mistake.

Thanks

Raju Agrawal

No Raju. Not at all. DCF is one mathematical algo and this algo does not take into account many things and one of them is sentiments and sectorial performance.

Today is 23rd and not 22nd

Corrected. Thanks for reporting

That was quick.

I think you were also very quick to notice as well as report it.