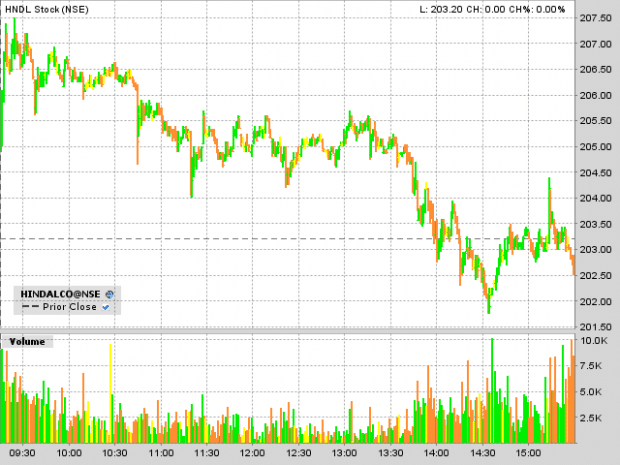

Before market opening Hindalco came up with very good set of results. On major news channels, brokerage houses gave price target of 208 but see the charts of Hindalco.

In last quarter we saw Nestle India come up with a very good set of results but the day when results were announced the stock saw a complete sell off.

Yesterday before market opening Hindalco came up with very good set of results and on many major news channel brokerage houses gave price target as 208 but see the charts of Hindalco for yesterday.

So are you still buying stocks that have reported very good numbers but when you buy them they start sliding down? If your answer is yes it’s time to learn and understand market.

Charts by Interactive Brokers Trader Workstation

Why do we care about these things? Isn’t it a better idea to check history? See monthly low s and highs… See the history and buy at previous months lows and if it breaks below short sell and again cover shorts at next support and so on….

It does not work that way.

Hi Shabbir,

I am interested in having your book. I have few queries about the contents in it.

1) Does it include ways/strategies for both day trading & short term trading

2) Does it cover investing for large period say 1-2 years.

Kindly advise.

Girish, my answer to your both the questions is yes. It has strategies for both day trading, short term trading as well as large period investments.

pl suggest about gvkpower buy rs45,yes bank rs234 spicejetrs44

VMK, I prefer not commenting on specific stocks because it really depends on your trading and investment ROI. Rather I prefer teaching how to find those suggestions like if it is a buy or not yourself.

Thanks for replying. What sectors are you bullish at this time. I read in your blogs sometime back to stay away from automobile and oil sectors.

How is the scene now.

I am heavy on stocks that have target audience with Indian markets like biscuits or utensils.

Hi Shabbir,

I was curious to know how does a day look like for a day trader.I have finished reading your ebook and I think I am all set to start.

1. How do you pick stocks to start your day with.There are so many and day trading is all about picking the right stock at the right time.Things can change in minutes.

2. What tools and resources should a day trader keep in handy through out the trading session.

3. Do you have a specific list of stocks that you track religiously.

As always,thanks again for your ebook and advises. I could not get ur reply on this earlier so I am repostimg it here.

Soumya, I have a set of stocks where I am comfortable trading. I select the stock based on sectors and currently I am looking at Indian based growth story related to food stocks.

When trading one should not have tools and resources because that can lead to adrenaline rush. Avoid looking at the screen all the time and enter the trade with conviction of both stop and target and you don’t need to be doing anything like looking at the screen.

Yes I have list which I think is suited for my theory and if you have the preferred sector the top stocks in that sector is what you should aim at.

Where did you post and probably I could have missed. I hope the reply is clear now.

Can you suggest some trading stocks from Sensex/Nifty.

For 2-3 days to 2-3 weeks period.

Currently I do with Bhushan, Jindal & JSW Steel..

I do this for 2-3 days time frame and if missed i could catch up in 2-3 weeks period..

Welcoming your views on this strategy… 🙂

Naveen, I don’t prefer sharing stock tips but I prefer helping people understand how to find such stocks for your trading.

What’s your take on Educomp & Lanco Infratech at CMP ?

Naveen, technically Educomp is below the strong resistance of 410 and so at the current market price I would not be buying into the stock.

Lanco is a new stock and don’t have any charts and so cannot say anything about the stock technically. Fundamentally I don’t track that company.

I hope this helps and also will recommend you to learn the technicals yourself using my book

Thanks Shabbir.. 🙂

The pleasure is all mine Naveen

Oh ok!

So I should get out when it strikes 2500 very strong resistance ? Or when it breaks 2170….ok 🙂

Win some lose some, I agree Shabbir 😉

Thanks Shabbir! That was informative 🙂

But getting out of the stock would mean a definite loss.

What if I continue to hold this for the long-term, say a year & above ? Will that help than taking a loss now ? At-least the dividend is saving grace 😉

Please advice….Thanks!

Chaitanya, if you are not ready to take a loss you should not be in the market. Understand that you win some and you loose some. The idea is to loose less and win more with a good risk reward ratio.

Hi!

I love following your blog, its a great help 🙂

But I could do with some more help from you….

I bought 1000 shares of SBI at 2,650 per share a few weeks back and took delivery. This was just before they declared a notional loss in their quarterly report due to bad debts provisioning.

I find the current price trails around 2,223 per share !

Of course I would continue to hold, but I wish to know what prospects do you see for SBI ? And when and at what price can I exit for short-term profits ?

I was not aware they would be doing bad debts provisioning all at once in the recent financial reports, and the prices dipped right after that…

but as long as I do not sell and exit until I get the right price, its just a notional loss that shows now right ? So no harm right ?

Thanks

Chaitanya, don’t feel bad but you have made few big blunders by taking position in SBI. Let me tell you what.

1. You took a long position in a banking sector and in high inflation we should be avoiding sectors like banking, financials, real estate, auto and even infrastructure.

2. You took position before the results and ideally I don’t like to get into a long position just before the results but what you should be doing is go for position that leads to a good result expectation and offload just before the results day. See how stock performs and re-enter.

3. From your comments I can sense that you are not ready to hit a loss though you think you have done a mistake.

4. You should have used the bounce till 2350 to get out of this position. If you have read my Technical Analysis book you know how to use the bounce to get out of wrong positions with less loss.

Now what you have done is history and what you can do.

I see you had dividend of 30 Rs and so that should be comforting to you. Now if the stock break 2170 I would not keep holding SBI. Again there are resistance 2350 and 2500. 2500 is very strong resistance and so make sure you come out of the stock nearing resistance.

I hope it helps.

Hi Shabbir,

Could you please let me know how we can use metastock to track Indian markets? I’ve downloaded the application and installed it in my PC but not able to download the market feed or Indian stocks and dont know where to get it from.

I am not an expert in the application you are using and so not sure if I can help

Yes, Absolutely you are correct. Nice guide.

Hi Shabbir,

Is it not a good buy for long term if stock has complete sell off when results are strong [which means fundamentals are strong].

Please comment.

Regards

Raju A.

It is a good buy but when to buy is what you should understand. Hindalco above 200 is always a good buy and see how it has bounced from 200 levels in the past but if you buy 3-4% higher than where you should be buying you can be in pain and that can lead to things which are beyond control of human nature.