I often get queries from reader’s about Punj Lloyd and each time I tell them why I hate this stock so much.

![punj_logo[1]](https://d1ip8y7yws0fph.cloudfront.net/wp-content/uploads/punj_logo1.jpg)

Technicals

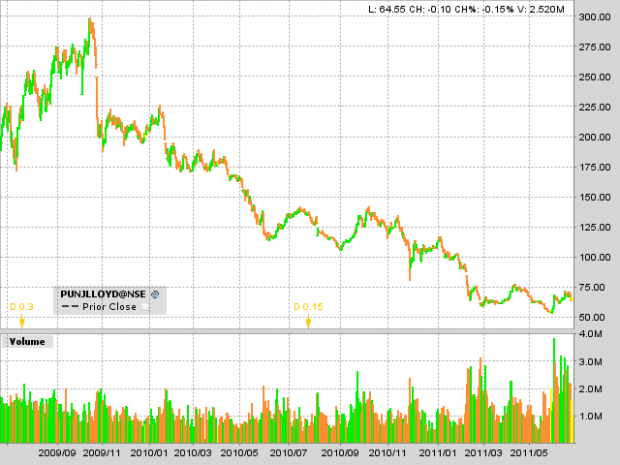

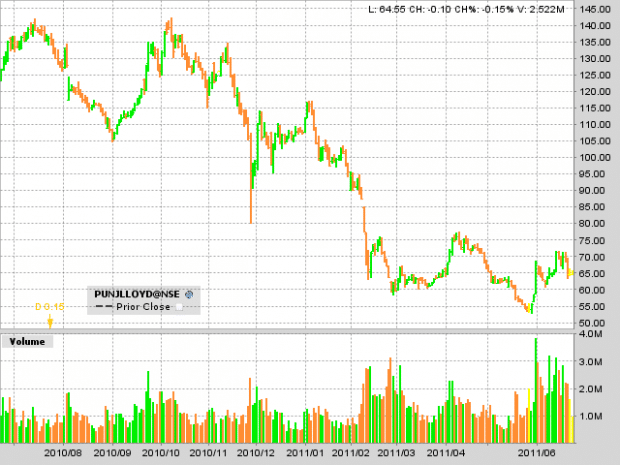

Technically we see charts of Punj Lloyd for last 2 years and see how this stock has performed.

There is no point in having any technical analysis applied to this charts when you see an such long down trend.

Fundamentals

Many readers try judging a stock with good fundamentals of the company but as per IndiaEarnings Punj Lloyd has an EPS of 0.37 and PE of 174.46 but is trading at half its book value of 107.94.

For me fundamentals of the company has more to do with the company management than with mathematical numbers. As far as I remember Punj Lloyd IPO was somewhere in 2006 (don’t quote me on this because this is not based on facts but based on my memory) and price range was around 500 if I remember correctly. It had one stock split of 5:1 and so if you had invested in Punj Lloyd at the time of IPO cost of your holding would have been roughly 100 Rs per share. They have given roughly dividend of 30 Paise each year which is pretty negligible.

So your 100 Rs invested in this company 5 years back would fetch you 65 Rs as of today. I am sure this tells the fundamentals of the company. Punj Lloyd is not able to turn their fortune in 5 years time frame.

Final Thoughts

Punj Lloyd is one of those worst stocks that are in Nifty and is even recommend on News channel many a times by analysts especially on Zee Business. Short covering and trading bounce in this kind of stock can always be seen but make sure you are not trapped into such stock for value investing.

Charts by Interactive Brokers Trader Workstation

And this price target strategy is applicable to what type of stocks?

In can of ORCHID can I follow the same? ( Can I expect target price of 2, 3, 4 for this scrip?)

Ok. so Stop loss for the stock Rs.210 which is 100 rupees less than purchase price. So should I set target price as 410 (100X2)+ 210 as minimum? (ie 410, 510, and 610)

But what is the possbility that this target would be achieved? This target price is just an assumption, right? Or any logic behind it?

What is the name of the book you suggested ( Technical analysis) Shabir?

Ummer, you should have done that calculation when you purchased the stock at 310 and had a stop loss then because now when doing the calculation you may have already been 2-3 stop losses down the price.

I am talking about my book here

Price action strategy works on all stock if you know how to apply them.

Shabir,

THanks for your response. Actually i do not want to exit from this stock now because I will make a big loss now. I don’t mind waiting until it reaches above 350 level.

My query is: Is there any possibility for this stock to touch above 350-360 level under the present management? if so, how many months you suggest me to hold on to this?

Ummer, I don’t know if this stock will go above 350 or not because I don’t know and if anybody claims he is also making it a guess. Now depending on who is guessing it based on what assumptions is what matters the most.

As far as I can stretch my brain I remember Rakesh Jhunjhunwala taking some stake in this stock and that was reason for the runup and as I did not invest fundamentally in this stock I don’t track this and so cannot say for sure what will happen and how good is companies business and things like those. Taking a 2 year call cannot be based on technical but should be based on management and fundamentals.

Thanks for your response.

Do you suggest me to hold on this? If I opt for stoploss now the loss will be big.

If you cannot bear losses equity is not for you. Now how much losses you can incur depends on your ROI value. I normally have a target of 2,3,4 times my stop loss.

Shabir,

You mentioned: Target of 2,3,4 times stoploss

What is this 2,3,4 times stop loss means? You mean 2 times

of current stop loss value that is 2X 220?

No. I have explained in details those things in my Technical Analysis ebook but I will try to explain more here for you as well.

You purchase some stock at 300 with a loss of 250. Depending on the volatility of stock you can have the target for the stock as 400, 450 or even 500 because your stop loss is 50 Rs down and so your target should be 100, 150 or even 200 Rs more i.e. 2,3,4 times of your stop loss difference.

Is it worth holding for that much period?

At what price you purchased and when?

Hello Shabir,

I bought it at around 307. I knwo it came down drastically. But I am ready to wait provided if I can see this scrip go above 350 level.

Any possibility for this stock to move to this level in two years time?

Ummer, 2 years is a very long time frame and I am not sure if it will at what levels but as of now 220 is a very good support for orchid chemicals and you can have 220 or even 210 as your stop loss.

Hi Shabir,

Your stock price analysis is convincing.

I would like to seek your opinion about Orchid Chemicals and Pharma.

What is its future prospects? I can wait for two years or even more.

I don’t prefer commenting on stock specific and so if you read my book on technical analysis you can get that done yourself as well but do let me know more details and I will be more than happy to have a look at it.

Very nice analysis, you are right that price of a stock is depend on management and not the numbers and this is exactly what reflects here in Punj Lloyd. This stock is mainly in the hands of short term traders and they don’t consider fundamentals.

Thanks for such a nice post.

I don’t agree that stock is in hands of traders which is the reason why it is falling. I think the sharp falls does mean that big investors have offloaded their position for non-performance.