Anyone selling you insurance policies is actually not selling you an insurance policy but they are selling you the worst investment product ever.

Anyone selling you insurance policies is actually not selling you an insurance policy but they are selling you the worst investment product ever. If we take an example from LIC, more often than not agents sell either Jeevan Anand policy or Money Back policy. Even my father in law has taken money back insurance policy for my kids :D. Each time I ask him why or recommend canceling it and he replies kaam ata hain (It works) but cannot explain how, when or why. Cannot argue beyond this point with him.

The reality is every insurance agent is selling such insurance policies and unknowingly we all buy them. I also had couple of them but decided against it in 2008. Total premium paid by me was 200,000 and when I decided not to pay and get my money back I got back 110,000. Deepak Bhattacharya on March 13 asked a question about insurance here

I have used a very harsh words worst investment product ever. So let me justify why it is actually worst investment product ever and why I decided to make a loss of 90,000 investing in LIC policy would be better option for me.

Insurance and investment cannot go hand in hand and I explained why in my article – Is Insurance an Investment Option?. Let us actually see if we can be insured with Jeevan Anand or Money Back type of insurance policies.

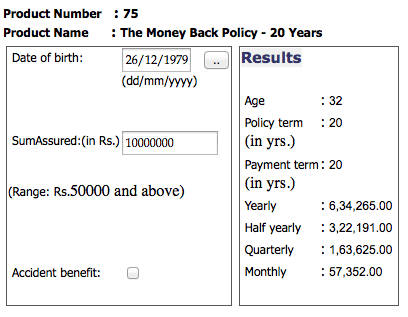

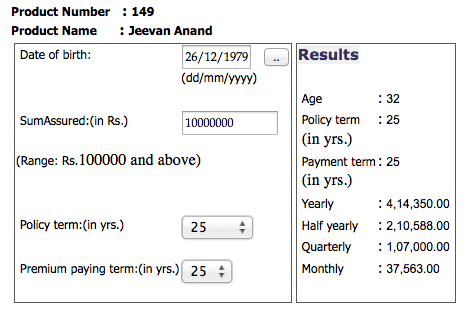

Based on my current earnings, expense and other liabilities I need an insured amount of 1 crore. I am 32 years old now and so adding those data into LIC’s insurance calculator this is what I see as the premium amount I need to pay for Money Back Policy and Jeevan Anand Policy.

Money Back Policy

Jeevan Anand Policy

I cannot afford 40,000 Rs as monthly premium and I am damn sure very few can actually afford such amount.

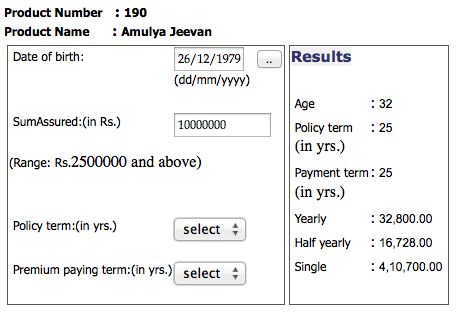

So what is the solution. Definitely not reducing the sum insured because the amount of 1 crore is not by choice but by compulsion based on my requirements. The solution is term insurance and LIC’s product name for term insurance is Amulya Jeevan.

Amulya Jeevan

The sum I need to pay is 32,800 Rs per year or 2733 Rs per month for being insured for Rs 1 crore which I think everybody can afford for an insurance cover of 1 crore.

This concludes that Jeevan Anand and Money Back type of insurance policies are not for your insurance but only for investments because you are anyway not insured. So if you are only investing in those policies then why you are giving away those insurance fees and administrative charges each year and reducing your return on your investment?

I know there is no answer to it and don’t worry I also had no answer to it when I took that LIC Policy. There is nothing to feel shy about and this happens to everybody.

Average return on non-equity linked insurance policies are in range of 7-12% and debt investment don’t work for the longer term because beating the inflation with debt only investment is very tough.

Let me give a small task to all my readers. List all your insurance policies you have and then ask to yourself – Are you really insured with those policies? Or can you actually afford to be insured with those insurance policies?

If your answer is NO make sure the next insurance agent calls you, ask him to give you Amulya Jeevan (or equivalent term insurance policy in his insurance company) and you will see how he will convince you that it is worst possible product that will not give you any return.

The reality is 3000 Rs as monthly premium would mean he would get hardly few hundred as commission and on top of that would need to get lot of documentation to get you insurance cover of 1 crore.

Remember insurance with returns is not affordable by any individual and so treat insurance as insurance and not as investment. Invest in investment products and not in insurance products.

Dear shabbir,

I do agree with your views on Insurance products. ’cause I am also sufferrer of the same.

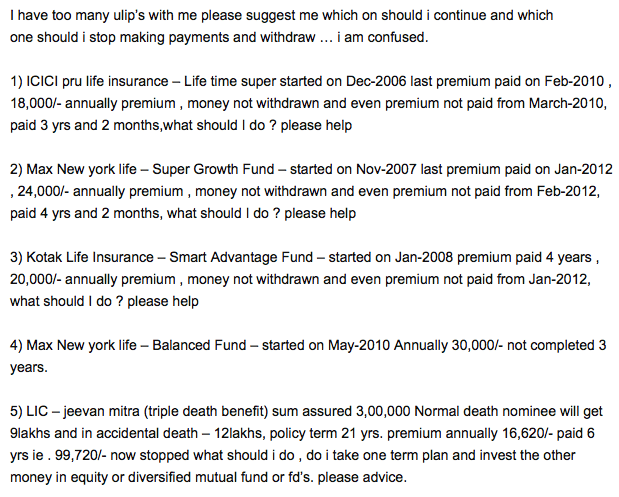

As regards to Deepak’s ULIP policies, my views are as under :-

In the ULIP linked policies issued prior to November, 2010 , the payment of sum assured (SA) to the nominee after death of insured is higher of SA(Less patial withdrawal,if any) and Fund Value. After payment of first three years premium if further premium is not paid the policy status becomes “in force but on premium holiday”.There after mortality and other charges are recovered from the fund value till the fund value is not less than one annualised premium.The policy holder can withraw from the fund value by keeping amount at least one annualised premium.(There are service charges for it and zero service charges are from 6th policy anniversary).

So Deepak can withdraw amount from the fund value of the policy keeping balance amount upto 1.5 times of the annual premium(On the safer side) . So the policy will remain in force and only the mortality and administrative charges charges will be deducted from the balance amount.

I have taken a term insurance policy in aviva life insurance company. My age is 24 years….Is it fine for an individual to go for a relative new insurance company or should stick to LIC for the policies..(My decision was based on the premium charged by the LIC which was higher than Aviva since aviva provided me online term policy and charged me lower premium).

I think you are fine with those companies if your policies are covering the risks that you want to cover.

Nice article.

Glad you liked it Stephen

What are your views on Kotak instant advantage ulip. 50% into classic opportunties & 50% into dynamic bond fund.

I am not a fan of ULIP’s and so my views are to avoid ULIPs in general.

jeevan anand 149 table. How many rupees premium 5 lac, and 10 lac. half yealy and yearly. birth date 11-07-1990.

Your arguement is fully correct.

Ignorance of the people is the great asset of the Insurance companies.

Financial illiteracy rules everywhere.

Keep it up your postings

Sure I will and make sure you also don’t forget to share the article with your friends.

Excellent post. I think it is one of the biggest responsibility which we as financial advisors need to take to ensure that people don’t fall into these kind of traps. I don’t know where i read it.. ULIPs are not bought, but they are sold..

Regards

BFA

I really like that

True. Ulips are bought by false notions but are not sold on merits.

Thanks for a great article.. You’ve written it in a simple & lucid manner which makes it easier to understand.. Looking forward to more such articles as always..

Thanks Nikhil for your feedback.

Awesome that you are on this and getting the news out in understandable terms. Thank you.

The pleasure is all mine. 😀

shabbir, thanks for your informative post.the great thing about your article is that it always forces us to think.this is your great achievement.but it is very tough to convince others to buy term insurance,because they argue that if the insured survives then he will get nothing out of his investment.

Safdar, I don’t want to convince anybody but just to make them aware that if you are buying insurance, buy insurance and when investing, invest but great to see that it made you think.

Shabbirji,

Grt article… I belong to the view that insurance & investment are totally 2 different aspects & neither of them can supplement each other. Your post only seconds my decision to go for LIC’s Jeevan Amulya. Thnx again.

The pleasure is all mine Bikram.

Superb explanation! I agree with you…Absolutely correct what u said

Thanks Ashok for agreeing.

Hi Shabbir,

Liked this post.. totally agree with you.. I always thought the same and tried explaining the same to my friends who come for advice on personal finance.. It has become a taboo among ppl of our Indian society that Insurance Policy is a must have. 🙂

It’d be great if you could compare and review the term policies and give your opinions on them.

Coz there are companies offering Rs. 1cr Term policy for Rs 9,000 P.A. also. But I’m sure there would be a reason why you’ve opted for LIC’s Jeevan Amulya, which apparently is more expensive.

Thanks.

Vamsi, I am not comparing term insurance policies because I am not a financial expert but what I have tried to explain is investment and insurance cannot go hand in hand.

I agree that there are other term insurance product that are cheaper but when it comes to LIC itself we can see how the premium can be reduced by 10+ times.

So I don’t recommend LIC’s term insurance but if you are fascinated by the LIC ad tag line (Kahin aur kyun Jayen) then also you have a choice for being insured.