Should opt for home loan or go for a rented house? Let me share what analysis should be used to make the right choice for yourself – Home Loan or House Rent.

I get this question quite often in my inbox asking if they should opt for a home loan or go for rented house. The question is mostly asked by salaried people where salary is in range of 30 to 50 thousand per month and most of the time my recommendation is to go with a rented house and I will share what analysis I use to come to that conclusion so my readers can calculate themselves what is the right choice for them – Home loan or a rented place.

Normally for salaried people it is very easy to get a loan of up to 85 to 90 % of the total value of the flat and so this is where people tend to opt for a home loan assuming they will only need to pay 10 to 15 % of the value of the flat upfront.

The Analysis of Loan Vs Rent

I live in Park Circus Area of Kolkata and so let me try to analyze some scenarios and cost of living in this area and analyze the Home Loan Vs House Rent scenario and then scale the same numbers.

The rent in Park Circus area is roughly in range of ₹ 15,000 to 18,000 in better complexes and price of per square feet is around ₹ 5500 to 6000 per Sq ft. So the cost of a 1000 Sq Ft flat becomes roughly 55 to 60 lakhs of Rupees and 3 to 4 lakhs for car parking. So assuming the cost of the flat becomes 60 Lakhs and cost of renting the same would be roughly 15 to 18 thousand Rupees each month.

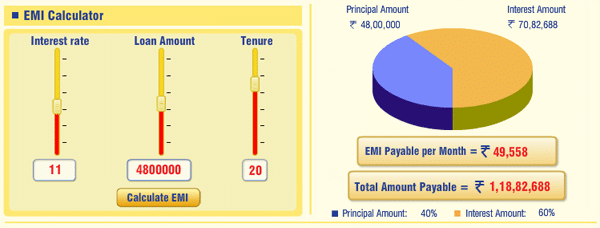

If you plan to take a home loan of 80% of the total value of 60 Lakhs then you are opting for a loan of 48 Lakh Rupees. Current interest rates are in range of 10.5% for SBI Bank to 11.9% for LIC Housing Finance and so for our calculations let us fix interest rate at 11%.

Using my favorite EMI Calculator by DHFL at an interest rate of roughly 11% – EMI for 48 Lakh is 49,558.

Which becomes too much for most of us and so many would prefer to go for more self-contribution part of 50% and still the EMI is 30,974.

This may be affordable by few but there is one more factor in our calculation which is Park Circus area of Kolkata which is slightly costly area and so you can opt for a house where the per square feet rate is slightly lower – something in range of 3500 to 4000.

Cost in New Town Rajarhat area is roughly ₹ 3500 to 4000 per square feet and so a 2 BHK pricing will be approximately 35 to 40 Lakhs. If you plan to take a loan of 30 Lakhs, you may only need to pay 25% as down payment and still may be able to afford a home loan but you should also consider the rent in Rajarhat New Town area which is 33% lesser than Park Circus area and is roughly in range of 12 to 15 thousand rupees per month. Comparing your EMI of 30k, you are roughly paying 2.5 times more as an EMI than to rent.

As a general rule that I prefer for a loan is if you can pay more than 50% of the value as your contribution, you should think about buying or else you can safely say no. Ideally I prefer 60 to 75% (depending on interest rates which I have explain below) of the value if I can pay then only you should opt for your home loan and not otherwise.

Why 60% to 75% is ideal Down Payment / Your Contribution?

The range of 60 to 75% is based on experience and data collected from various property prices in various areas in Kolkata.

The rent of houses is approximately 33 paise per ₹ 100 of price of the flats. So a flat for sale at 50 lakhs will have a rent around 15 to 18 thousand. Even in the new town city of Rajarhat where ready flats are priced at ₹ 3500 to 4000 per Sq ft, you get 1000 Sq ft flat for rent at around 10 to 12 thousand Rupees per month.

If your rent were 33 paise for ₹ 100 then if you make down payment of 66% of the total value of your house, your rent would be comparable to EMI in current interest rate scenarios. Add 7.1% as registration cost you need to pay to Government and 1% as other legal charges associated with purchase of flats and 66% would increase to approximately 75%.

If the interest rates come down to 8 odd percent then you can have 60% as your contribution and still your EMI would be comparable to rent.

How EMI Works?

Before jumping into a Loan, it is very important for every one of us to know and understand how EMI Works. EMI stands for Equated Monthly Installments where a fixed amount is paid by borrower to lender at a specified interval. EMI Consists off both interest and principal part being paid each month, so that over a specified period of time, the loan is completely paid off.

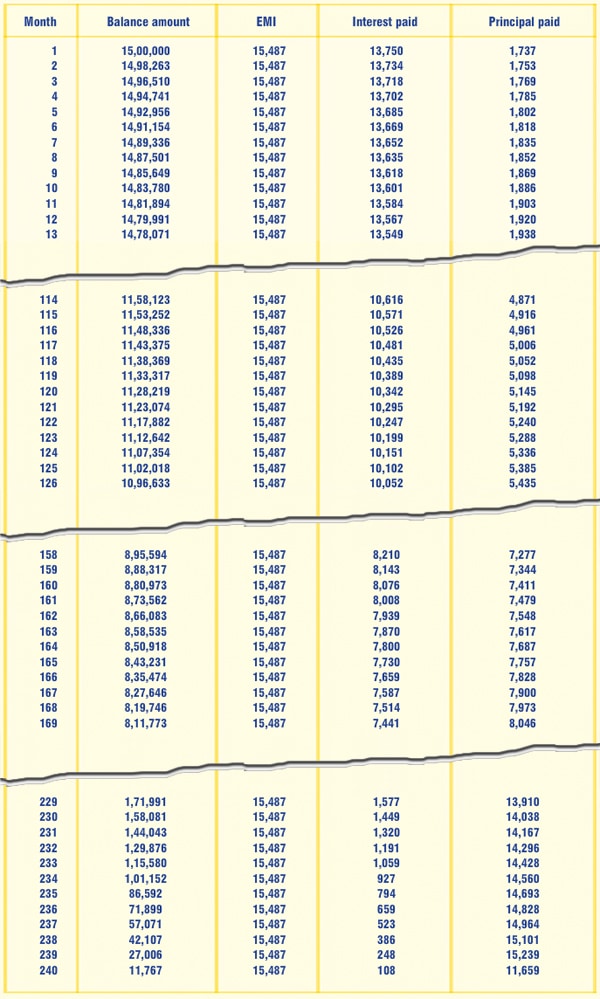

From the definition it is very clear that EMI consists of interest as well as Principal part but there is a catch, which every one of us need to understand. In EMI’s the principal part for the majority of period is kept smaller and interest part is kept higher and as you approach towards end of your tenure, principal part becomes a major contributor in EMI. See the Amortization Calculator in DHFL EMI Calculator.

On a Loan amount of 15 lakh at an interest rate of 11%, EMI is 15,487.

After paying the EMI for 10 long years and paying ₹ 18,58,440, your principal amount is not reduced to half and you still have a pending loan amount of 11+ lakh.

Even if you pay the EMI for 14 years, your loan is not reduced to half but this is the time where in your EMI portion, Principal becomes major part and interest becomes a minor contributor.

So for any loan it is important that you try reducing the principal part of your loan as soon as you can.

How Banks handle Pre-payment?

Indian banks don’t prefer anybody making a prepayment but as they are forced by RBI not to have any prepayment charges and borrower should be allowed to prepay. So now bank makes the prepayment process such that borrowers do not prepay. Prepayment ideally should mean reduced EMI so borrowers can save more and prepay more. On your loan of 15 lakh, prepayment of 1 lakh should mean that the EMI gets reduced in ratio of prepayment amount but banks prefer to change the tenure of loan so that you still pay the same EMI. This is when people turn themselves off from prepayment thinking, it is of no use and that is banks want.

Ideally you should ask banks for reducing EMI’s but even if they don’t, you should still prepay.

Mentally what I recommend is to consider EMI as payment of interest part only and as you pay EMI regularly and on time, bank may offer you discount on payment of Principal. Let me share with you an example.

We have a loan of 15 Lakh and so you should be mentally prepared to pay back the whole amount as prepayment. This is the first thing you should be prepared for when taking a loan. Let’s say you took the loan for 20 years but after a year, you have the needed funds to pay back your loan. Be prepared that you need to pay complete 15 Lakhs but as you were regular payee of EMI, you only need to pay 14,79,991, a discount of 20,009 for you being a regular payee of EMI.

Similarly if you are prepaying after 10 years, you still need to be mentally prepared to pay 15 Lakh but as you were regular payee of EMI for 10 long years, they offer you discount of 3,76,926 and you need to pay only 11,23,074.

My 3 Golden Rules to taking a Home Loan

- Go for loan only not based on what EMI you are comfortable paying but opt for 60 to 75% as down payment and rest of 40 to 25% as loan.

- Opt for EMI’s only when it is comparable to Rent and not otherwise.

- You should be prepared for prepayment within the first few years of your loan and make sure you don’t need any top-ups done to your loan for other expenses especially registration and legal expenses.

Common Misunderstanding for Home Loan

1. Tax Benefit Under 80C

Tax benefits under 80C are – For payment of Principal amount up to ₹ 1 Lakh and interest paid is tax free up to ₹ 1.5 Lakh per accounting year.

This is by no means a benefit because tax saving under 80C is an option for any individual without a home loan as well and he can avail the benefit by investing in Tax saving mutual funds also known as ELSS Funds, Insurance policies and the list continues. Apart from those investments your child’s tuition fees and your contribution to provident fund also falls under 80C tax saving scheme.

With averagely good salary, your provident fund contribution makes most part of your tax savings under 80C. On top of that if you opt for rent, you may be eligible for tax-free HRA benefit as well.

Interest paid is your expense and if you don’t pay the interest, you only need to pay certain percentage as tax and if you are paying interest, you are paying 100% or the entire amount as interest.

As an example if your tax slab is 30% and if you are paying 1 lakh as interest yearly. You could save tax of approximately 30,000 but if you are not paying any interest, you save 1 lakh completely.

2. It is an investment

Property is an investment only if you invest most part of it’s pricing. If you prefer to contribute small part of the pricing of the property, banks would take up your investment benefits. Apart form that if you are investing few times your capacity to invest by taking a loan, you have no option left to diversify your investment.

Final Thoughts

Home loan has a snow ball effect and if you can prepay even 10,000 in the first year you save 23,762 in total EMI being paid over a period of rest of 19 years. Share your views and horror stories about loans in comments below for others to learn and not make the same mistake.

I?m Nelson Mac by name. I live in USA, i want to use this medium to alert all loan seekers to be very careful because there are scammers everywhere.Few months ago I was financially strained, and due to my desperation I was scammed by several online lenders. I had almost lost hope until a friend of mine referred me to a very reliable lender called Mr.Robert Gary who lend me an unsecured loan of $150,000 under 24hours without any stress. If you are in need of any kind of loan just contact him now via: gr.robertfinancials11@gmail.com I?m using this medium to alert all loan seekers because of the hell I passed through in the hands of those fraudulent lenders. And I don?t wish even my enemy to pass through such hell that I passed through in the hands of those fraudulent online lenders,i will also want you to help me pass this information to others who are also in need of a loan once you have also receive your loan from Mr.Robert Gary i pray that God should give him long life. God bless him forever. Nelson Mac

Hi Shabbir,

Good day.

Thanks for sharing your experience and your blogs is useful.

Nice article and very useful for salaried people to plan their financial goals and taxes.

My opinion is even if we can save more by renting an apmt/house it will be beneficial in the long term if we intend to purchase property for own use as it will give a mental satisfaction of staying in own house (of course after paying the home loan)

no need to shift house every year, renew lease every year

Once we have surplus funds it is always better to prepay/preclose the loan and use the additional surplus funds for investments.

Though this may vary from person to person based on their preferences.

Exactly Raviraj, it varies from person to person but what you have outlines is something that everyone should be going for.

Shabbir ji,

I dont kmow much about financial planning just reading your article. Iam 36 Yrs old married and a 1 yr old son. What would be my retirement corpus . ANd how i can start to build that.

And for my son future how i plan.

Regards,

Munish

Munish, for me to answer your question I need lot more information than just your and your son’s age like your assets, investments as well as your liabilities. You should not be sharing those information here in public and so you can get in touch with me and that would be ideal for our discussion.

I pay an income tax of around 2 Lakhs.

My dad says its better to buy a house since i get 2.5 lakhs tax free income which roughly evaluates to 80k per year in 30% slab. assuming I take a loan of 30 lakhs and 20 years tenure, and assuming i get a rent of around 8k permonth (1lakh per year), My total inflows would be 1.8 Lakh, and outflows would be 3Lakhs per year.

effectively I will be paying 1.2 Lakh per year for 20 years which is again 30 lakh.

*assumption: house rent of 8k is average houserent over 20 years

I dont see a flaw in his argument. Can you advice me on the same? whether i should buy a house for purely investment purpose? (I am not planning to stay in that house)

Hitesh, what your dad is saying is absolutely correct for you but then the way to look at it is not right and let me try to help you look at the same thing in a different but more efficient way.

You are paying an income tax of 2L and so it means that your monthly income is close to 1L. With that kind of salary (I assume it is salary), you should be having a good amount of PPF being deducted from your CTC. Contribution to your PF (which is under 80C) will be quite a significant and even if we assume 50k per year then you will not save 2.5L as tax free income but only 2L as tax free. If your PF is more the amount will become lesser.

Assuming 2L tax saving is what you do and if you don’t have a home loan then you pay 60k as tax but if you have a home loan, you pay 150k as interest.

Let us look at the calculations you have put in. With 30L as your loan amount, the EMI is 30k per month, so your outflow is not 3.6L

Inflow with 8k as rent means you have to pay a tax of 21k. (Assuming 30% of the rent income is tax free and on rest 70% you are taxed at 30% rate of interest). If you purchase the house in your wife’s or mother’s name, you can save this 21k as well but then they may not be eligible for loan and so we will look into this later.

So you net income becomes 80k from rent and savings of 60k from tax and you are paying 3.6L per year and so your net outflow is 2.2L which according to your calculation is 1.2L

Again if you don’t own a house means that you can pay rent to your dad or mom (if you live with them and house is in their name) and can save on tax as well (Details here) but lets not get into those details as of now because I think with the kind of salary and income you have it makes much more sense to be owning a house even for the sake of investment purpose only.

So now you have two choices to make. Do you want to be buying a property wholly and solly for the sake of rent or you want a house where in future you can think about shifting to as well.

If rent is your primary focus, look for commercial property and not residential property (as you get more rent in commercial property) but if rent is not your primary focus and you may also want to keep the option open for moving to the residential property in few years time opt for a residential property.

So once you have decided on residential or commercial property, opt for the one which is under construction and can be completed in next 2 to 3 years time and try to make a maximum contribution by brutally saving your money for couple of years. Once it is fully complete and you don’t have any other choice but to make the payment to the builder, opt for loan but try to avoid it as long as you can.

I hope this answer helps you make the right investment choice with right perspective.

Sir, I took loan of 1629000 rs from union bank before tow years my EMI IS 17000pm, yet i repay total 100000 rs as a prinicipal, now i want to prepay 50000 P.A. is it gooD FOR ME.

And also know which is best in current market position, RD IN BANK OF 3000PM @ 8.75% ANNUAL or MF OF 3000PM, because from last few years mutualfunds returns are not good.

Sapan, you have taken a loan of 1629000 and I assume the tenure is 20yrs and based no your EMI amount your Interest rate is close to 11.25%. Unless you are able to generate more than 11.25% ROI, it is always better to keep yourself away from RD or Investment and pay off your loan ASAP.

So I will not consider investing unless I am able to beat interest rate of the loan. I hope I have answered your question.

thank you sir,

The pleasure is all mine.

Hi Shabbir,

Would like to add on your point. Your logic would work only in cities where the property prices do not escalate drstically . In Mumbai , where property prices have doubled in last 4 yrs, it would be profitable to streach and buy a good one even when EMI is more than the rent amount.

Swapna

Swapna, In Mumbai the prices of property have actually gone down in last 12 months or so as well.

Very Good article

Glad you liked it Sam

Hi Shabbir,

A good school of thought. I have a different view. 1) The investment made in real estate by taking a HL from a Bank is not a gamble. Even for Rs.48.00 Lakh, the EMi is 49000, the appreciation rate is so attractive i.e more than 13% on an average whereas our outgoing interest loss is 11%. We dont get anything more than 12/% in any safe investments other than SIPs in a long run.

I completely agree with your view point Bala but only when you are taking this as an investment and not when you put your bread and butter into it and stretch yourself to the extent that it becomes a burden.

I have invested in my flat as well as is in process of investing in commercial property as well. I will share the same on my blog about the deal. I am in process of finalizing paper work.

Hi Shabbir, An article explained in very detail.

I always thought that, the tax saving that we get on housing loan is just making us poor and not save much,

but i did not have much of data to actually prove it, but from above article it is very Clear. Thank you.

But i always wonder why there is no mention of this topic in any financial websites or forums.

Always people suggest go for EMIs/home loans.

Not only that if some one says he has prepaid the loan and finished all the EMIs, usually people suggest go for

a second house(bigger) and take higher loan(higher EMIs). Can you put some light on this commonly suggested myth.

People always prefer to be rich rather than happy. If I have a house that is good for me, I don’t need to take burden of yet another loan unless there is something more in the new house than just social status.

I always prefer to be happy than to be rich. For those who would argue on the fact that bigger house means more facilities as well as getting better standard of living, I have one more point to argue with them. i.e. Why not live in the same house and start looking for better business opportunities instead of going for yet another home loan. Business would always yield better returns than property provided you are ready to try out things.

Now anybody could say that it is always better said than done but I am actually doing it.

I live in a 2 BHK (Snaps here – http://imtips.co/snaps-of-my-new-flat.html ) where as I could easily get a 3BHK or even a 4BHK but I am investing in my business. You could see that I have not blogged for last 3 months and this break is because I have been doing a big investment in a company which I am funding. I will soon share the updates. Preferably in December or may be in early Jan.

Hi Shabbir,

Your house is beautifully decorated. All the best for your business.

You made a great point –“I always prefer to be happy than to be rich”.

Regards

~Phani

Thanks for the compliment Phani

Respected Sir,

Good Morning.

Sir, I have 2 LIC policies each of 5 lacs purchased in 2005 for 20 years,I want to utilise this in taking home loans,plz guide me what is the best way to utilise this policies.kindly reply to me at drghazalairfan@gmail.com.

Thanking you in advance.

Not sure how you can use your LIC Policies for home loan because you are anyway keeping your house deed document with the bank.

hi,

i just want to know is banks calculate fixed home loan interest rates or for example if i take 15 lakhs loan for 6 years tenure and after 1 year if i pay 2 lakhs lumpsum amount so on the remaining amount bank is going to charge interest or i have to pay fixed interest as usual as i was paying. please let me know as iam very confused.

Steven, it is always on the remaining amount.

Nice article.The money u spend to pre pay the home loan can be diverted into investing into equity or mutual fund,where u can earn more returns. The money u spend is the post tax interest u pay to service the loan.But u can earn more in mutual fund. so u end up earning more in investing the money in market , rather than pre paying the loan.Kindly comment.

The more you will earn depends on your ROI but normally it is not more than couple of percentage and so if you make the calculations, it will be really low amount.

I liked it very much. Thanks for sharing….

I have a question…

I have a taken a personal loan of 3L 17% interest. I have paid 28 EMIs another 20 EMIs I need to pay.

out standing is: 149976

Principal paid till date : 150024

Interest paid till date : 92372.

Now I am planning to Pre- Close my loan, as I have saved some money is it a better Idea to Pre-Close with extra charges of 3%? Please advice me. If I am not closing what is the better investment of that 1.5L.

Waiting for your reply. 🙂

Hi Vissu,

Putting your numbers into the loan calculators, I see that as of now you are paying roughly 2500+ as interest and rest is towards the Principal. If you pay back your loan they are asking for a payment of 4500 as prepayment charges at 3%. Ideally what I would do is not pay full 1.5L but pay 1L+ back and pay them 3000 as prepayment charges because this would mean your tenure is reduced by considerable amount. Preferably by 12 EMIs and so you will lot more than 3k as interest for sure.

I will always suggest you to pay back loan because at 17% because it is not advisable to be investing that money. One suggestion for sure what I will give is visit them to pay back 1L and be ready to pay 3K as well. Then politely negotiate the 3K with anything that you can like 2k or even 1K because they want you to be with them for more loan. Ask them for home loan and other loan products to make sure they know that you want more loans after personal loan is out of the way. What ever you save on prepayment charges is the amount you should be partying with today. 😀

I hope it helps.

Great article with vivid explaination. !!

Neel, thanks for your feedback about the article and I visited your website as well and it really is inspiring. Great job.

Hi Shabbir,

Wonderful article. Thanks a lot also for giving the reference to the wonderful EMI calculator of DHFL. It’s pretty good and playing with numbers on it will reveal lot of information.

I took a loan of 20 lac for 10 years. By pre-paying almost 45% of loan (i.e 9 lac) in 16 months after start of EMI, i already saved 4.5 lac on interest outgo. This is considering i will clear the pending 11 lac in 9 years which obviously i don’t need.

Home loans are good only if you can close them in around 7 years max. Otherwise it is stupidity to slog and pay EMI’s for 20 years with the constant fear of what to do if there’s no next month pay-check! Thus with EMI’s for 20 years, people cannot take even an iota of risk, holidays/sabbaticals.. always on the verge!

Phani, paying 45% of your loan in 16 months in awesome achievement and I am damn sure you have worked really hard towards getting that done.

I have found some numbers where business people pay back loans in under 4 years and salaried people under 7 years and this was by a sales person so though I don’t believe it much, it really feels good.

Great article and explained with a lot of patience and detail.

Kaushal, glad to see you liked the article.

Hi Shabbir,

It’s a impressive article, even though I am thinking otherwise.

I could see the cost of Sq.ft on metropolitan area, and the affordability could never meet, but we may be missing the bus as land value is sky-rocketing.

I could debate this with a real life example. One of my friend have an aspiration to buy 1000 Sq. ft house in prime area in chennai and the cost comes around 40-45 Lakhs (Rs.5000 per Sq.ft). He was not even able to afford 25% of the cost of the house.

So he bought a small flat on nearby area for 25 lakhs and was able to afford 5 Lakhs down payment. And the monthly EMI comes around Rs.18000 (20 Lakhs loan). This has happened 3 years back.

Now the value of his house is around 36 Lakhs and He sold it.

he sold his house and repaid the loan and now has 16 Lakhs in hand.

He again bought another house in prime area for 45 Lakhs and paid this 16 lakhs as down payment. (Loan amount : 29 Lakhs, EMI : 27000).

yes, he has to pay Rs.9000 more for EMI, but his salary was increased in last 3 years, so he can afford that.

And yes, he has paid most interest part of first loan in last 3 year, but the profit he got through the house is way higher.

Previous house was just a 2 bedroom flat, and now the new house is 4 bedroom flat.

Initially, Rs.18000 EMI was a little bit of burden to him (his salary was Rs.35000), but once his salry increased, he come to the comfort zone and able to pay for other lavish expenses, and now again after he recently got a promotion, and he did the above. May be, he would again go to a discomfort zone because of higher EMI, but he would be able to pass through this in next 2 years.

For first loan he was not able to afford even 50% of loan amount (20 Lakhs loan, but he has only 5 Lakhs for down payment). Even for second loan, 16 Lakhs down payment of 45 Lakhs house is just 35% down payment. But his affordability on down payment is increased. now after two year, he could even see the profit of 30 Lakhs with his current property, and he may to even bigger house.

If he dint start with the 25 Lakhs house, he would have never been able to come this far, Am I correct?

If he postponed buying a house, because he can’t afford the down payment of atleast 20% for 45 Lakhs house, he would have never been able to buy a house.

Your article is comparing the down payment, but if we postpone buying a house due to this, we may not be able to buy it, as house price keeps on increasing and our affordabilty may never be able to meet it.

So my thought (or advise to any one reads it), is even if you are not able to afford your dream house, you need to buy a smaller one. That way you can chase the house price increase, as your property value will also increase in the same phase.

Expecting a reply 🙂

Hi Raj,

Glad you liked the article and also a very good example of your friend with numbers for me to breakdown on things. I do appreciate what he did but then he could have done few things better as well.

He had 5L for down payment and his salary was 35k at that time. So making a saving of 5L Rs could have come from him in range of 3 to 5 years of his job. I assume for the time being it is 5 years i.e. 1L each year. More towards the end and not as much as when he was not making 35k each month.

Now assume the scenario for next 3 years. He paid EMI of 6.5L in 3 years time. Now if you add this to the 5L, he would have made to 11.5L in his hands theoretically but that does not happen practically because if you are not paying the EMIs, you don’t tend to save 50% of your salary and this is how it is. Now Let us add interest on the investment. 5L in a FD would become 5.9L in 3 years and 18k per month in Recurring deposit would become 7.57L for 3 years. This totals to 13.5L. The other expense of 25L flats for registration and other expense and it would not be very different from what he have i.e. 16L but we have not considered the rent expense and so that may be sucking some money as well.

The scenario of what I have explained in the above paragraph is complete theoretical and not practical because investing 50% of your salary is just too much for anybody but then EMi as 50% of salary becomes a possibility for most of us because we think that we may miss the bus.

So investing for big purchase and starting early is what you should be doing. ALWAYS

Second scenario is 18k was too much for him but as he got salary hike, it was more of a relieve but what if he could continue his same life style with issues for few more months and then invested the hike into the loan. Again that becomes an issue. Salary hikes is always followed by change in lifestyle as you have mentioned for your friend. What if he could use 50% of the extra amount paying towards the EMI and that would be ideal.

Now coming back to scenario instead of numbers, what he did was to push himself investing 50% of his salary into a flat which he could just manage and also he invested in a flat where price appreciation is very good 25% per year.

What I recommend, if you plan to buy a house, start saving and investing for it as early as you could and you will not feel the “missing the bus” scenario. If you cannot afford a house, either opt for a smaller one or best would be to make a booking in initial phases of projects where you have to be paying money over a period of time and so you can delay the loan to a great extent.

Rise in price of house is always a situation in India but then it does not mean you cannot get house for less price. You have to move to slightly far off places.

In Kolkata also there are areas, where price of house is still around 15L and what if your friend would have invested with 15L house scenario. He may have made lot more than may be now but then he may not have anyway paid extra to the EMI and that is where the real issue comes.

15L becoming 25L is pretty much a scenario in cities like kolkata and this would mean he could pay lot more towards his EMI and who knows, he may have made more than what he has today.

I hope I have explained it to your satisfaction level and if you have more questions, shoot them in comments.

Hi Shabbir,

Good article, I just have one question do you and info of prepaying the housing loan using our deposited EPF amount.Is that a wise way to do ?

Yes Vikram, that is wise option currently because you are getting 8% in EPF but you are paying 11% in loan as interest. On top of that equity investment for an elongated period out performs debt by a big margin and so you can opt for paying loan using that and start a SIP may be in equity for making up for that prepayment to corpus.

Dear Mr. Shabbir,

Thanks for nice thought provoking article.

You need make clear distinction between buying a home for self occupation/ first home and second home/ investment purpose.

What ever said is necessary for the second house/ investment house….but the rules and criterion would and should be different for self occupied house. All investments should looked the lens of ROI. Few items have emotional value and has to be factored.

Also another factor to be brought into discussion is the increase in earning capability increase over a period of time. Long term returns, Income tax exemption/ Loss from house property to be factored for the investment property.

Regards

N

Nataraj, Glad to see that you liked my article. Apart from the emotional value all the other factors you mentioned have been taken into account. Returns are accounted only if you have more investment in your house than bank.

>As an example if your tax slab is 30% and if you are paying 1 lakh as interest yearly. You could save tax of approximately 30,000 but if you are not paying any interest, you save 1 lakh completely.

In this case, I would be saving Rs. 60,000 because I will have to pay 30,000 towards income tax, isn’t it?

Apart from that a good read and thought provoking.

I personally feel that, Emotional Value (http://www.tmius.com/eval3.htm) from owning a house is not considered in any of the Home Loan Vs. Rent calculations. Human being is irrational in thoughts, emotions and behavior. Though I could not find any references/articles to the value associated with status, pride, satisfaction from owning a property. There are even further things associated with quality of life when one has a own house vs. rented. E.g. Someone with own house will spend on interiors, furniture, maintenance etc. to ensure that the property stays in a shape that gives ’emotional value’, whereas there is more probability that a person renting in a house will not think of all (or some) of these aspects. This in turn means that the person will be away from experiencing the quality of life in the context of property.

I understand that this is subjective and also debatable. And because this deals with human, there can always be exceptions. I am just trying to be on a higher probability side based on what i see around me.

Being in IT sector, I can see that the young couples buying home and renting home live in a very different way.

One more thing. The people who buy property (most of the times) feel that it was a very good decision to buy because the prices are increased and they don’t have to worry about the rent hike, shifting etc. The EMI most of the times give initial hiccups but after few months, things settle down with the financial planning (adjustment). The EMI normally do not increase over the time. But typically the salary increases. This is not the case with rent. Even if salary increases, the rent also increases.

So I personally think that owning a house is better than going for Rent.

NitinB,

You would be saving 70,000 and not 60,000 but that is not really that important as your point of Emotional Value, As you have raised the point, I will put one more factor which is social pressure for many to take a loan and own a house instead of renting.

If all your friends and colleagues own a house, you may have pressure socially to own it though cannot afford it may be right now because your cost of living is higher than your friends or your salary is not as good as them.

Now when it comes to owning a house for emotional and status value, you can always be an emotional fool but you should not be fooled to the extent that you are owning something which becomes a headache for your financial management. If you can afford 60% of your house, you should always be emotional or else you should be ready to control your emotional or look for some other property to get yourself emotionally attached to. Spending on furniture again should be based on your financials and not based on emotional Should be done from what money is left from your EMI. I purchased flat without any loans and as I could crack really cheap deal of my flat, I could spend slightly more on interiors. I have shared it here.

What you see around is not emotional attachment but more of a social pressure. I have seen lot of my friends and former colleagues (I am also in IT sector) have a burden of loan and though they were boosting about the offer from builders in 2006 are now having issues paying the EMIs because of change in interest rates.

Now coming back to your point of NO increase in EMI but increase in salary. Actually our salary is not increasing by the amount we are given hike in companies if you consider the inflation but then when it comes to calculations, we tend not to add that. Apart from that you possible know the scenario where between 2008 to 2011, there was no salary hikes and EMI increased due to booming interest rates from 8% to 12% For Rent, you can always shift to some areas where rent is lower but that cannot be done for EMIs

You should buy only when you can afford and not otherwise. Emotional attachment can be with houses you may have grown up with and not with house you plan to purchase. At least that is how it is for me.

Looking for your views as well NitinB

i completely disagree that on pepayment one should go for emi reduction.

Do any financial analysis and it will all lead to point that one should go for term reduction and not EMI reduction.

Sumit, yes reduction in tenure always saves paying extra EMIs at the end but then it is better to be doing reducing the EMI and then prepaying. The idea was always to reduce the EMI but with money in your hand, you can be controlling more things.

Yes, when you talk you say that is is one thousand rupees but when you write you always write rupees one thousand.

Thanks for letting me know that Amit and I have made corrections. Also Changed Rs to ₹

Shabbir,

Very well written article Shabbir. Many people have made mistakes buying a house without doing the homework.

Just one point in your blog. Whenever you write an amount the rupees should be written ahead of the amount, but when you say you say it the other way reound. For e.g. if you want to write one thousand as an amount you would write it as Rs. 1000 not 1000 Rs ( though while saying it you would say it as ‘one thousand rupees’)

It feels great for those wonderful words and thanks for pointing out the issues with 1000 Rs but does it make wrong when I say as it reads. If yes I will get that corrected in the article. Never knew about that.

Nice and useful article shabbir , I definitely share this to my friends. keep writing and sharing…:)

Pleasure is all mine and Yes I will try and write more on this topics Anand

Dear Shabbir Bhai,

I have question on home loan. I have purchased a 1bhk flat on Axis bank home loan 3 years back. Now I wish to purchase 2bhk flat in same CIDCO area in Navi Mumbai. My question is – I am staying in my 1bhk flat and want to purchase new 2 bhk without selling 1bhk before shifted in 2bhk how can I deal ahead. I want to stay in same 1 bhk till getting possession in 2bhk. please guide me.

Go for as much as you can for your 2BHK as down payment and that will be ideal Sameer. Once you are all paid from pocket to the extent you can, loan is the next option.

Don’t over burden with loan and when you shift to the new flat, you can selloff the other and repay back the loan.

The pre-payment part is a tricky call, I think. For a person whose excess cash is in fixed deposits, sure pre-payment makes sense. However, if one invests the money in stocks or even decently-performing mutual funds, one is likely to make 15% and above on the money compared to the 10.5-11% one would be saving by pre-paying the loan.

Aditya, you would be falling a trap with it and I have explained that time and again but let me do that once again.

Say you have taken a loan and have one lakh that you can either repay or can invest in market. You are paying 10% as interest for loan and can make 15% in stocks and other riskier investments. After a year you would only make 5000 Rs more doing this i.e. 416 Rs per month.

Do you think it is worth it and assuming we didn’t consider the risk part on your investment and assume you would make 15% no matter what.

Now if you prepay the loan and can make your EMI reduced, you will feel the profit in your bank account. Once the EMI is reduced, start a SIP in better mutual funds instead of doing a one time investing. I have shared the same here as well – http://shabbir.in/stay-invested-or-pay-back-home-loan/

Yes, I am assuming AT LEAST 15% per annum on average, no matter what. And yes, that is possible even when markets are choppy. As I said, it depends upon how a person deals with his excess cash– risk appetite and way his investments work. So, I’d think if one is confident of making at least a few percentage points higher than the rate of interest he is paying, it might be judicious to stay with the EMIs (of course, provided that it isn’t pinching).

And I forgot to mention in my earlier comment, apart from this particular point of disagreement, the rest of the piece is very well-written and useful.

Aditya, thanks for liking the article and yes few percentage better than market is really good and I most of the time make make 30 to 40% from market and I have no debt whatsoever till now but still I don’t take up loan to make my portfolio bigger (though it is quite big now) because it does not make sense (mentally) to be getting in debt and pay EMI.

Apart from mental satisfaction, I don’t think extra few percentage of 800 Rs per month would make a hell of difference. 800 Because if I take personal loan at 18% and make 28% from market with the calculation from below comment.

Its all right, thanks.

If you are considering your property as an investment, you should opt for as much part as you can pay because the bank is going to take the fix cut of its interest and so if you are paying the most part of your investment, it lessens the fix cut you need to give to bank and so you can make your property investment work for you or else it would not.

Your conclusion of at least 60% would mean, I am investing more in my property than the bank by a margin of at least 20%

Yes Ankita, that is also nice way of looking at it.

Ankita,

I think if we are talking about residential properties bought for investment purpose, the lesser you pay, the better would it be considering the leverage effect of Loan on your overall value of the property. For example, if you buy a property of 1 cr with just 10 lacs downpayment. If in 5 years, the property prices doubles to Rs. 2 cr, your payment would be around 10 lacs plus any principal component only. Ignoring the principal repaid via emis, Your 10 lacs have earned Rs. (2 cr – 1 cr – interest paid to bank e.g. 20 lacs). Net net, 10 lacs would have gained around 80 lacs or around 8 times in 2 years.

On the contrary, if you would have invested 40 lacs initially, the same calculation would have resulted in reduced payment of interest to the bank (approx 12 lacs). However, your overall return situation would look like (2cr – 1cr – 12) = 88 lacs over 40 lacs or just over 2 times.

What would be your take on this ?

Hi Shabbir,

Very well written and self explanatory article. Congratulations. I have shared it in my time-line. Would you like to write some guest post for my website BTB.

Thanks

khalid

Khalid, thanks for the feedback but I am not a firm believer of guest posts and so I don’t prefer doing guest posts on other blogs.

Hi Shabbir,

Excellent post and well researched. Another aspect associated with Housing decisions is whether to buy them in the first place. I have come across so many people who classify their house in which they live as their asset. However, practically speaking this asset is a dead asset which shall never be used by the person during his whole life time. Your readers may enjoy this article which shall give them a completely different perspective on housing decisions http://insight.banyanfa.com/your-house-drain-on-finances/

Regards

BanyanFA

Yes very true BanyanFA, An asset that is always on paper to make you feel good if it does not put you in debt.

Even more Shabbir. I am seeing so many young professionals being trapped by the greed of accumulating more and more properties – either owing to peer pressure or lured by the big returns it has offered in the past. And as a result they entrap themselves into big ticket debts which would take years to clear. This is completely screwing up their portfolio diversification and the requirement for emergency funds. A small job shock / family emergency is enough to start the process of liquidation of their properties and their future financial viability. Not sure, but they really need good advisors rather than brokers who are luring them into the property markets..

Every India is looking for anything but financial advisers and that is bad part. They don’t wish to pay fees of as low as 10k to get things sorted for say next 10 years because they think that they would not gain anything.