Two individuals, one of them invested ₹3000 for 10 years and yet he made ₹1.43 Crore more than the person who invested the same amount for 30 years in the same asset class with same average return on investment.

Many of us don’t realize how important it is to start saving and investing early in life until we consult a personal finance adviser but very few Indians (read no Indians) prefer to hire a personal finance expert in the early stages of their job and career. Ideally you need to understand and start managing your finances early in life but humans are not idealistic creature by nature and so we don’t do anything unless we are compelled to and managing finance is no difference. So I thought I will put some eye opening numbers in front of you to see how starting with your savings early can make a difference.

We will take scenarios of two individuals where one of them invested ₹3000 for 10 years and yet he made ₹1.43 Crore (1 Crore is 10 millions) more than the person who invested the same ₹3000 per month for 30 years i.e. three times more money. If you think that the smarter guy invested in riskier asset class, you are wrong. They both invested in the same asset class with same average return on investment.

If your reaction is either shocking or surprising this should be interesting article for you to read.

The Scenario

To understand the scenarios we take example of two engineers (yes being an engineer I will be biased to take them into my example :D). Engineering is completed with 16 years of education; it means an individual can get Bachelors Degree in Engineering or equivalent at the age of 22. We take a cushion of few years for higher education or MBA or may be some years lost in getting through the engineering entrance. We start the investing cycle from the age of 25.

Investing ₹3000 per month or rather ₹100 per day should not be a problem for majority us. At the age of 25 I think the amount can be really more because you are having very little burden of expenses and this is the time when you can cut on your expense more than any other time in your life. I am sure many would not agree on this and if you don’t agree with me on this, I am sure you are younger than 25 but those who have crossed 30 would agree more with me. There are very little options to cutting down on the expense as you grow up because you cannot cut on the family expenses or kids schooling or EMIs and the list continues.

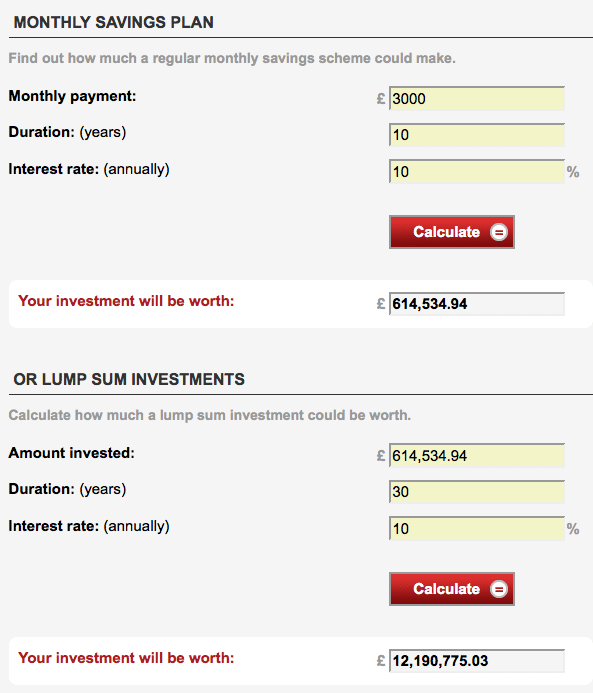

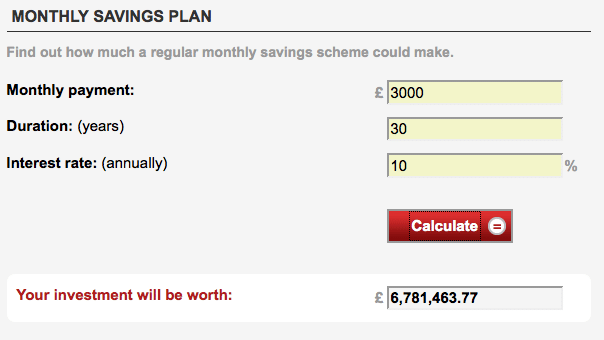

We will use Financial Calculators by thisismoney.co.uk because I could not find any such calculators in Indian site. The unit in the screenshot represents £ but then it does not matter what unit you put in front of the numbers and we can safely assume it to be ₹

The Smart Investor Suresh

So lets say Suresh (Yes the famous Ramesh and Suresh of Five Star Ads :D. Suresh is the smarter guy) starts investing at the age of 25 with only ₹3000 per month. He does that till he is 35 and then because of other expenses he added along, he could not invest anything for the rest of his life.

At the age of 35 his investment will be worth ₹6.14 Lakh and this is when he stops his regular investments but he lets the amount remain invested for his retirement at again the same 10% per annum. As you can see in the screenshot, at the age of 65 he would have ₹1.219 Crore

The Other Investor Ramesh

Ramesh thinks about investments at the age of 35 and he thinks that now he needs to do something for his future, retirement blah blah blah. Sounds familiar. He even consults a financial adviser and he only manages to invest ₹3000 per month and he also plans to do the same for next 30 years.

He only makes ₹67.81 Lakh at the age of 65. A difference of ₹54 lakhs just with investments of ₹3000 per month

If you make the return on investment to 8% instead of 10% for both Ramesh and Suresh and apply the same calculation we see the difference between the corpuses at the age of 65 is ₹15.30 Lakh and if you increase the return on your investment to be 12% the difference changes to ₹1.43 Crores.

Yes you read it right. ₹1.43 Crore difference in corpus when the average return is just 12% and with an investment of only ₹3000 per month or rather ₹100 per day.

Long term investments, equity always provides better returns and Manish Chauhan in his book JagoInvestor (My Review here) has shared lot of numbers and statistics in Chapter 4 on how equity investment provides better return in the long run and average return on investments for a time period of 15+ years is in range of 7 to 26%. If you can achieve 15% return on your investments the difference becomes corpus becomes more than ₹5 Crores with meager investment of ₹3000 per month

The FAQ’s

What if I couldn’t invest ₹3000 per month because my income is low for any savings or I have a student loan to pay?

Start with whatever you can and then try to scale up. You should be fine investing even ₹500 per month because it’s not the amount that makes a difference of hell or heaven and it’s the habit of starting early. Do it now and that is more important rather than at what amount you start with.

Isn’t planning for retirement too early at 25?

Yes, it is too early to plan for retirement on practical grounds at the age of 25 but what if I tell you that you can use the same plan to buy a property. Indians are very keen on getting a property and so instead of making the calculation for the age of 65 make it till 40 or may be any age where you think you should be buying a property and you will see that you are in a lot more better position with lot more options to buy your property with more down payment option. On top of that if you are doing down payments, you have more option to negotiate 10 to 12 percent in the total price you pay as property value.

If you were to start investing ₹3000 for your house at the age of 25, it means you will have more than ₹12 lakh in your corpus for your house at the age of 40 and this can actually save you from lot of EMI payment. I am sure ₹3000 is too low for investment as big as a house for Indians and people prefer to pay even 50% of salary as EMIs because that is the maximum that bank allows. If you plan 15% of your salary as investment towards buying a home at 25, I am damn sure you can get away with home loan EMI’s or at least can manage EMI’s very easily. Just make the calculation for yourself.

If you think that buying a property is not something that you can plan right now, think about expense on your marriage. I have seen many of my colleagues are under personal loan after marriage expenses or after honeymoon, which they always wanted to go for but never planned for. If you plan saving from now, you not only save yourself from personal loan very easily but can also plan lavishing honeymoon for yourself as well.

Final Thoughts

The point is not about planning for future but more important point is starting investments early.

Share your views and questions and I will be more than happy to answer them all.

hi shabbir…excellent post….plz suggest me which is the best route to invest..i.e 3000 per month….buy recurrent deposits in bank or buy mutual funds…??

My inclination would be towards mutual funds but then it depends on your risk appetite as well as your investment horizon.

Ur article is veey informative and Motivating. Could u please share some idea about any ideal minumal risk investment option so that this 3000 would compond to Approz 1 crore in 30 years..

Shyla, 3000 Rs for 30 years with ROI of 12% could fetch you 1 Crore Rs and so you have to invest in instruments that can fetch you 12%+ ROI

I read similar article in other blogs too.This explanation easy to understand.

keep writing and sharing .

Happy investing 🙂

Thanks,

Anand

Sure I will Anand.

Hats-off to ur idea of inspiring youngsters to invest early. The means of explaining by taking simple examples was really impressive.

I do suggest mutual fund investments/financial planning to my friends & colleagues.

I have written a doc on Why Mutual Funds. I would like to share it wid u if u r interested.

Yes I have your doc in my email and will let you know my feedback soon and if you want, can share them here as well.

Helpfull sales tools/skills for bankers who are dealing with investment banking.

COMPOUNDING IS THE EIGHTH WONDER OF THE WORLD said Eiensten

Very true 😀

Very informative and helpful to plan for retirement.

Glad you liked it Masih Patel.

You have explained it very well shabbir , i am new to this blog i saw ur ads in google.

Thanks for your feedback and yes being an Internet marketer, you can expect PPC campaigns for all my sites. BTW your blog is also quite interesting and related. Thanks for sharing the link.