We will find the best small-cap mutual fund to invest in 2019 and review the performance of our choice of best small-cap fund of 2018.

We will find the best small-cap mutual fund to invest in 2019 and review the performance of our choice of best small-cap fund of 2018.

The year 2018 was a great learning year for the small-cap investor. Some of the small-cap stocks saw a massive correction in 2018.

Investing in small cap is great for return, but it also means they are a riskier asset to own as well. I prefer small-cap stocks to add the multiplicative factor to my overall portfolio.

The same also applies to the mutual fund as well. The small-cap fund can add the boost to the overall portfolio. Having exposure to the small-cap fund can help boost the performance.

So let’s begin finding the best small-cap fund to invest in 2019.

The most important factors we will consider for selecting the best small-cap fund will be the consistency of its performance in the small-cap segment.

The Top Small-Cap Funds for 2019

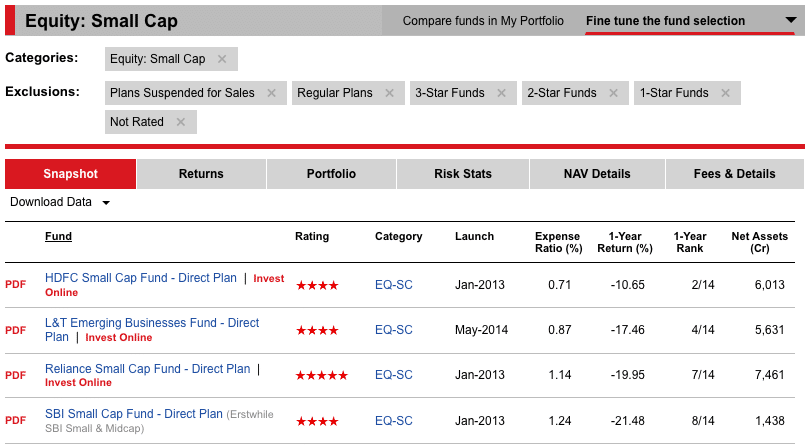

The process we will use is- from the 4 and 5-star rated small-cap fund by ValueResearchOnline, we will compare the performance in the past year, compare expense ratio to get the best small-cap fund for 2019.

Best Small-Cap Funds To Invest in 2019

We nail down to a fund that has a lower expense ratio and has fallen the least in the past one year despite a very significant correction in the small-cap index.

HDFC Small Cap Fund

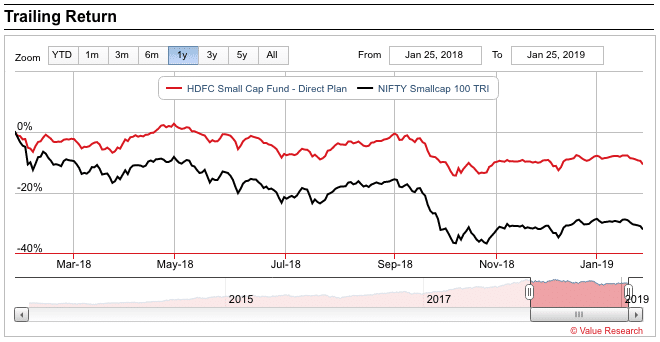

HDFC Small Cap Fund has scored well on both the fronts – one-year performance in the falling small-cap segment as well as the expense ratio.

The fund outperforming the index is because of its resilience to fall in the falling market between September and November.

Without a doubt, it is the best small-cap fund to invest in 2019.

How The Best Small-Cap Funds of 2018 Performed?

As per the ValueResearchOnline, Small-Cap Fund Category has given a negative return of more than 20% in the past year. The funds we selected as the best small-cap fund of 2018, though has also provided a negative performance in the past year, has outperformed the underlying benchmark by a significant margin.

- SBI Small & Midcap Fund – Has been renamed as SBI Small Cap fund due to stricter SEBI guidelines on fund classifications. It has given a negative return in the past year and has slightly underperformed the small-cap fund category.

- HDFC Small Cap Fund – It has given a negative return in the past year but has majorly outperformed the small-cap fund category. So it is the best small-cap fund of 2019 as well.

- L&T Emerging Businesses Fund – It has given a negative return in the past year but has outperformed the small-cap fund category.

Out of the three funds, only one fund has slightly underperformed, but the other funds have outperformed.

Final Thoughts

Small-Cap fund should be a small part of the portfolio unless you can handle the high volatility without being too concerned about it. Don’t always consider the returns as the point to invest. Assess the risk associated when investing in the small-cap fund or stocks.

And Remember, do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the past funds. Create a new SIP in the new funds.

As always this isn’t an endorsement of the above fund. The emphasis is on the process to select the best mutual funds using tools like ValueResearchOnline as and when you want to invest in 2019.

Hi Shabbir,

Thank you for such a great compilation of best funds for 2019.

I want to invest 3000/month in a SIP with 10+ year term. Could you please suggest which fund category would give best returns from mid-cap or small-cap? If small-cap then what about Axis small cap fund? Should I consider this or not? I can see from the comparison that it has fallen least in last 1 year in the fund category, Means it has some good components which made it resist to fall even in the downside market. And if not this fund than which is best fund for best return as I have already invested in HDFC small cap, mirae emerging, canara emerging and axis mid cap all direct options

Nitin, I am not a financial advisor and your financial advisor can suggest you the right allocation based on your assets, liabilities and need for funds in the coming years. As a general rule, I have given an asset allocation model here

https://shabbir.in/market-cap-allocation/

Hello Shabbir ..

I want you to review my portfolio which is running over past 14 months

I m 32 years old , working in a PSU Bank

Following are the sip , all investment is in direct and growth option

1. SBI Bluechip fund – 2000

2. ABSL Frontline Equity -2000

3. HDFC Hybrid Equity Fund – 2000

4. L & T emerging Business fund – 5000

5. Canara Robeco Emerging equity – 3000

Kindly give your observations , I m having long term horizon

Anant,

First of all I am not a financial advisor and you need a financial advisor to suggest you better investment options based on the risk profile, liabilities and requirements of funds in the near and long term. I am more of an equity investor.

Still coming back to your portfolio, I can say, the choice of equity funds are quite good if you have a horizon of 10+ years. I will suggest you to add more of a large cap funds as well.

Thanks

Shabbir Bhimani

As per my understanding, HDFC samll cap has fallen a little less as compare to L&T emerging business fund and Franklin small company fund. So HDFC seems a little better choice. Thanks Sir again.

As per my understanding, HDFC samll cap has fallen a little less as compare to L&T emerging business fund and Franklin small company fund. So HDFC seems a little better choice. Thanks Sir again.

As per my understanding, HDFC samll cap has fallen a little less as compare to L&T emerging business fund and Franklin small company fund. So HDFC seems a little better choice. Thanks Sir again!!

Thanks Shabbir, i also found Reliance small cap is good fund. What’s your thoughts?

Good fund for sure but there are other better funds with lower expense ratio.

Thank you Shabbir! This is just about what I was thinking recently ..

And I was confused what to do with non performing fund. I had stopped the sip and started a new sip with a different funds house. Now I will not withdraw but just keep the amount in the earlier fund. Thank you!

The pleasure is all mine.