One Up on Wall Street is a must-follow book for every investor. My portfolio aligns with the stock-picking ideas from the book to keep it in the green in such a brutal fall of 2019

One Up on Wall Street is one of those books that every investor should read in every correction. The current downturn was the perfect time for me to get some excellent insights once again from the book.

I always follow Peter Lynch’s method of stock picking but never shared my view of the book. So today I will share my opinion or rather appraisals for the all the time classic book on investing.

Peter Lynch is one of the top money managers in the US. His view is, any average investor can pick up high winning stocks as effectively as a professional by keeping his eyes and ears open for business around him.

By simply observing business developments and taking notice of your business around you – malls, workplaces, etc. one can discover potentially successful companies even before analysts and brokerage houses.

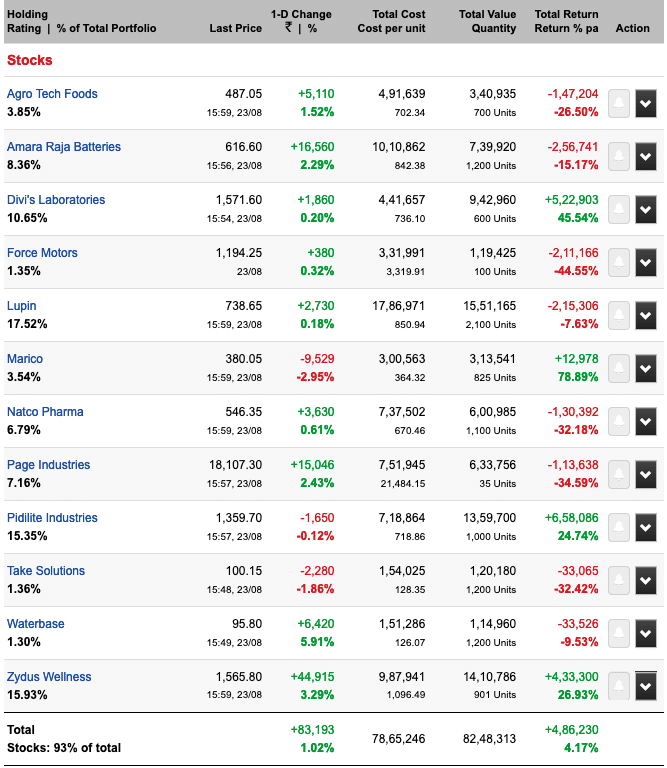

The process I also follow and have share it here. My complete portfolio is built around the same philosophy.

And in such a brutal correction in small and madcap in 2019, my overall portfolio is still in the green.

One Up on Wall Street

The book has three sections.

Section 1 (Chapter 1 to Chapter 5) – How to pick stocks with cues from Main Street and not Wall Street or Dalaal street in India.

Section 2: Chapter 6 to Chapter 15 – What to look for in a company. Every company is different, and author classifies investing opportunity in 6 categories.

- Slow growers

- Stalwarts

- Fast Growers

- Cyclicals

- Asset Plays

- Turn Arounds

So an investment in slow growers has a different aspect to consider into than a cyclical or a fast-growing company.

Section 3: Chapter 16 to Chapter 20 – How to craft your portfolio.

Words of Wisdom from One Up on Wall Street

Let me share words of wisdom from the book:

On Being Long-Term Investor

The typical big winner in the Lynch portfolio generally takes three to ten years or more to play out.

This word of wisdom from the book is very much needed for us for sure.

We find ourself as long-term investors investing for a year, but all the great investors consider three years as a short time to invest.

Your losses are limited to the amount you invest while your gains have absolutely no limit.

This is so true. Investing 1L in stocks can mean I can loose only 1L if it becomes zero. Now consider the potential of return from the same investment when it becomes 5L or 10L and even beyond over several years.

Following the Big Investors

There are at least 3 good reasons to ignore what Peter Lynch is buying (or for that matter any big investor in India)

- He might be wrong (He has a long list of losers)

- Even if he’s right, you will not know when he has changed his mind.

- You have better sources around you.

So true, and still, we try to follow investors like Rakesh Jhunjhunwala or Porinju Veliyath for investment idea.

They have their own looser.

The current investment of Rakesh Jhunjhunwala in DHFL is the most recent example. But it is terrifying is the number of people who follow him and has invested.

The next HDFC Bank or Page Industries…

The next of Something is Never On.

I have followed the same to try an avoid looking for the next Page Industries in the same sector.

I have explained in great detail why there can’t be next page industry in innerwear segment when explaining OPM.

Number of Stocks in a Portfolio

I get this question often because I prefer focus approach than diversifying. Finally, here is the perfect answer to this question.

Own as many stocks are there are situations in which you have an edge or has uncovered an exciting prospect that passes all the research.

As a fund manager, the author has categorized stocks for investments in six categories. But I never like to invest in turnarounds and avoid to an extent cyclical unless I can understand and predict the cycles.

So whatever category suits you, play on it. When you find those and they pass all your teats, you should be fine adding them. There shouldn’t be a rule of only N number of stocks.

I have an investment checklist. Once it passes, I go for fundamental analysis and a business checklist.

Selling Your High Returners

In 2019, whenever I doubt about booking profits in Pidilite or Divis from my portfolio, I remember.

Selling an outstanding fast grower because its stocks seems slightly overpriced is a losing technique.

And

You won’t improve results by pulling out the flowers and watering the weeds.

They are my top performers, and they can be overpriced as well. But that shouldn’t be the reason to sell either. The growth story is still on.

Finally

I will conclude with a couple of quotes from the book:

Keep an open mind to new ideas.

And

Just because a company is doing poorly doesn’t mean it can’t so worse.

I am ordering the book right away. So good to see your portfolio is doing great. Mine is down by 25% overall even in mutual funds.

I am sure the book will not disappoint you.