Is it possible to invest in stocks and use the income from dividend as a means to plan the retirement? Can any investor in his 30s or 40s plan his retirement with dividend income?

Planning your retirement with income from dividend isn’t a wrong choice, but the goal to maximize dividend can be a catastrophe. Let me explain my personal experience on the aspect of income from dividend to help you plan your retirement from dividend income the right way.

But before we move towards retirement planning, let me share my views on retirement planning as a whole.

What is Financial Freedom?

If your monthly expense is less than or equal to the passive income generated from your investments, you have achieved financial freedom.

The passive income can be in the form of rent, dividend, or anything where you don’t work to earn a living.

So retirement is achieving financial freedom. Income from investing in stock and earning a Dividend can be a form of attaining financial freedom.

You can read all about financial freedom in my other article here, but today I will focus only on dividend as the source of income to achieve financial freedom or in other words, plan the retirement.

Why is Retirement Planning the Worst Option To Consider?

Yes I know it sounds quite contradictory to common knowledge one may hear from financial advisors. I have a different viewpoint which is different from common financial planners recommendations — the main reason why I don’t advise on financial planning.

The answer lies in fact – Why one considers retirement?

Because whatever he is working on, he doesn’t enjoy. The people who are working for weekends are the ones who want to consider retirement.

For me, retirement is like a nightmare.

What will I do if I have nothing to work on when I wake up in the morning?

Sundays are boring for me, and it is one of the reasons I write about investments on Sunday. The reason they are boring is that I love doing what I do from Monday to Saturday.

If 5 to 6 days of what you are doing isn’t something you enjoy, you will focus on retirement. I blog about doing what you love at IMTips.

So, I will like to write an article, code, and invest in a company on the day I am about to die. May not be for money but because I love it.

So instead of planning your retirement, I will suggest you start doing what you love and find a way to earn a living out of it.

Still, we are an investor community. So instead of planning a retirement, take the income from dividend to do something other than working for money.

So let’s begin …

Dividend is a Double-Edged Sword

If one is planning his retirement with dividend as the primary source of income, the aim is to maximize dividend. It is the wrong objective for investment and can lead to a disaster.

Let me share how.

As an investor, you will be tempted to invest in companies with the highest dividend yields.

Warren Buffett’s company has never paid a dividend. The reason is, instead of paying the dividend, they can invest the same amount to generate better returns for the shareholders.

In India, a company that doesn’t pay a dividend isn’t considered a right choice for investment.

So every good company pays a dividend even when they have a huge debt that can be paid off instead of paying out the dividend.

L&T is one such example I will like to share. As on September 15, 2019, at the current price of ₹1,363, it has a debt to equity ratio of 1.97 and dividend yield of 1.32%. Instead of paying off the debt, the company pays a good amount of dividend.

I don’t understand such acts. So I try to avoid investing in such companies.

Moreover, I found this in a WhatsApp group. Companies with the highest dividend with last year performance on a total return basis

| Scrip | Dividend Yield | Past Year Return |

|---|---|---|

| Coal Ind | 7% | -30% |

| Oil Ind | 7% | -27% |

| NMDC | 7% | -28% |

| Balmer | 6% | -15% |

| NHPC | 6% | -5% |

| HPCL | 6% | +4% |

| ONGC | 6% | -27% |

| BSE | 6% | -28% |

| Bajaj Cons | 6% | -39% |

| BPCL | 6% | +7% |

| National All | 14% | -39% |

| Vedanta | 13% | -38% |

| Polyplex | 12% | -29% |

| NLC | 8% | -25% |

| REC | 7% | +28% |

| IOCL | 7% | -17% |

So, the dividend is a double edge sword. It can provide you with money in your bank account but can also mean a lack of returns.

The Right Approach With Dividend

The best approach to dividend for me is – Maximise Returns, Dividend Will Follow

So invest in the right stock at the right price, and as the share price appreciates, the dividend amount will look handsome.

Let’s take an example from my portfolio of investment in Pidilite. At the Current Price: 1,378 the dividend yield is a meager 0.47%. But with my invested amount at close to ₹700, the dividend yield on my invested amount is 1%.

As the earnings or EPS of the company increases, they will share more dividend. The dividend yield may or may not increase based on the share price, but in absolute terms, the dividend will increase handsomely.

So I will re-iterate Maximise Returns, Dividend Will Follow

How Much Corpus I need to Retire With Dividend Income?

Finally, the most important question of all. What is the amount one needs to plan retirement with dividend or instead work without worrying for money?

The answer is 100x.

Let me explain what I mean by 100x.

Typically in India, the great multibagger companies have a dividend yield of 1%.

So if your yearly expense is ₹5Lakhs, typically the corpus should be 100x of ₹5L aka ₹5Crore. So with ₹5Crore as the amount invested in the stock market, it can generate an annual dividend of close to ₹5L.

If your annual expense is lower, the corpus amount will reduce. If your yearly spending is higher, the corpus amount will increase.

But wait …

What if one doesn’t have the amount and still want to retire on dividend income.

Let me share how …

How to Generate The Large Corpus Needed for Dividend

The solution is to start investing early.

At the age of 30, if you are thinking about retirement and want to generate ₹5L as income from the dividend.

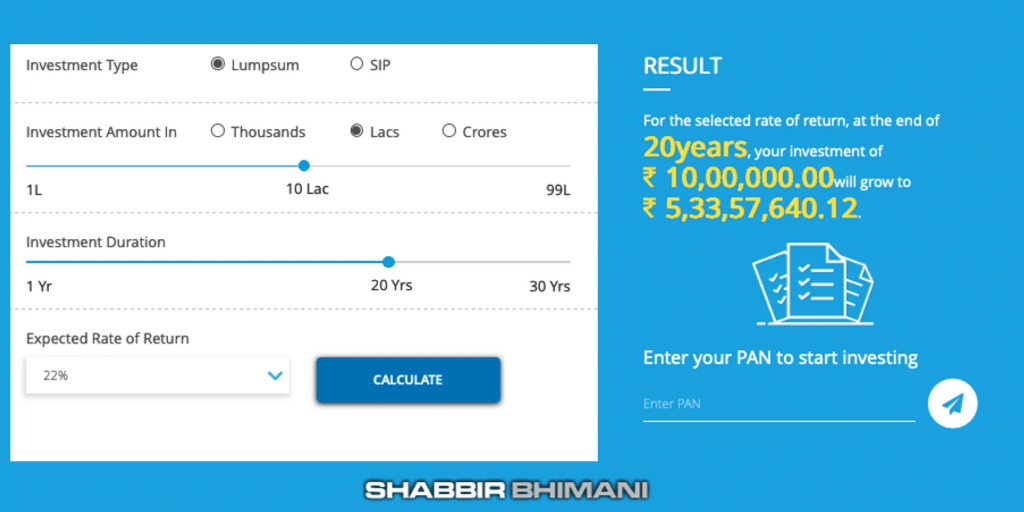

So if you invest ₹10L as the one-time investment and if it can generate a return of 22% for the next 20 years, your corpus will be above 5Cr.

So at the age of 50, it can generate a dividend income of ₹5L.

Yes, I agree, 22% returns for the next 20 years is tough.

However, one should consider that we invested only once a lumpsum amount of ₹10L. One can top-up the invested with an additional amount in the coming years or can even consider an additional SIP investment along with the one time invested amount.

The other option is to increase the tenure from 20 years to 25 or 30 years.

Final Thoughts

The options are endless if one is willing to take that first step.

What are your views on dividend as a source of full-time? Share your opinions in the comments below.

Hi Shabbir, thanks for the good article, i do have couple of question though

1. With FD of 5 cr even at 5% you can generate 25L/year which is a lot more amount than divident yield of 1%. How is it the better retirement option then?

2. Dividends are taxable, for this reason SWP is suggested, what are your thoughts on this?

In an FD it is the total appreciation of your corpus. With Dividend and equity investing, you get only some part of it and rest keeps compounding as well. So I think it is better but again, it all depends from person to person.

Yes SWP are better if you can keep them below 1L per financial year otherwise it is also taxed at LTCG rate which is currrently 15%.

Thanks for sharing your thoughts..make sense.

Hi Shabbir , Nice article however few points needs to be added. Mostly everyone follows a stock portfolio and how many stocks will give 22-25% consistent returns is the big question. If it happens , our 10 lacs will be 100 crore in 30 years , by doubling the amount in every 3 years. Identifying some 5-6 very good long term quality bluechip stocks is the key . And we need to grow our small portfolio in the initial years to a level of 10 lacs in each stock . May then we can dream about this goal.

Nope. We don’t need 10 Lacs in each stock. The overall portfolio of 10L only.

Right sir, but now a days in India not any company are reliable to invest and making profit. Most of the small and mid cap company are handled buy some big fish. Instead of this, do sip and forget , also in sip when market going up then book profit and using this money at the time of retirement make FD in post office. Or

other way start PPF account now and invest every year 1.5lakh this gives batter return..

Now market situation is change in current time. Buy and hold stretagy is not possible….

FD. Huh. If it is working for you, great but otherwise you need to rethink your strategy.

Sir this is india,we can take risk in our young age. But at the time of retirement we need safety and security. In this country market is not safe. In future there are chance of fraud happen in mutual fund….Like IL&Fs and dhfl..

I have also sip of 15000pm but not trust in indian corporate.

Thats your view and it is completely correct. It all depends on the risk taking ability.

Thanks Shabbir for the article! I fully agree with you. Maximize returns, Dividend will follow. Also in your sample example, it’s 5L dividend/annum you get at the end of 20 years with starting capital of 10L with 22% returns. Here the only catch is value of 5L will be much lesser after 20 years considering the inflation. Although I understood it’s just an example but we should consider inflation into consideration as well. Keep writing, keep guiding.

Agree on the Inflation part but this is just a number. We can make it higher as well. The point I think is well conveyed.

Yes!! It’s very well conveyed. Also I was wondering if you can shed some light on instruments like embassy REITs, Indigrid InvIT etc.for sake of purely high dividend . Thanks

Don’t invest in them purely because my aim is maximize returns.

@Shabbir, good article. I concurwith you and I have done these dividend paying stovks analysis multiple times in the last years. Most of the names in these companies are public sector that are forced to pay dividend which goes to Govt, whereas the returns are abysmal. I would not want tobe invested in such companies.

Some companies may be an exception. Hero honda has has good run in returns and so with paying dividend.

Nice article.

Regards

Lavesh

Yes Hero Honda in the current correction is in my radar but I am not buying at the current levels. Want to see it going below 2k for me to enter.

We must buy stock at lower price in order to get high dividend

yield. invest lump some money when market / stock in lower level not in peak

True.

Shabbir good article and good thinking.. I think we can

expect 2 to 3% dividend. Last 5 years I calculated on my stock it was around 3%

as average

Yes it is true. Depends on the stocks but quite close to the rough estimate