Is it possible to invest in stocks and use the income from dividend as a means to plan the retirement? Can any investor in his 30s or 40s plan his retirement with dividend income?

How I Value a Stock For Investing Using Financial Ratios?

One has to identify at what valuation one is comfortable investing and then invest in the right stock at the right price and for the right time to make the most returns from the investment.

What is: DVR Shares Or Differential Voting Rights Shares

DVR stands for differential voting rights which means the investor holding DVR shares has different voting rights than the investor holding the normal shares of the company.

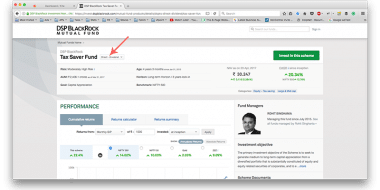

How to Invest in Direct Mutual Funds – A Step by Step Guide

A step by step guide to investing in direct mutual funds with an example of my investment of Rs. 50,000 along with why Zerodha’s COIN interface is an avoid

What is: Dividend – Everything You Need to Know About Dividends

Dividend is the money paid (typically once a year but some companies pay more than once as interim dividends as well) by a company to its shareholders out of its profits.

How to Save Tax on Profit or Return on Investments – Tax Free Investment Options

Tax is a very significant portion of our total expense. What if your profit or return on your investments can be tax free or significantly lower in tax?

How to Achieve Capital Protection And Still Remain Invested in Market?

The fear of loosing capital in market is one of the major reasons for Indian retail investors to keep themselves away from market. Let me share a step-by-step process to remain invested in market with 100% capital protection.

Fundamental Analysis – What we all know is completely wrong

What we all know about fundamental analysis from watching news channels is completely wrong. Understand the fundamentals of fundamental analysis

How to Save Tax On Short Term Investment With Profits

How profit from short term investment i.e. investment for under 1 year in equity market can still save lot of tax that may need to be paid otherwise.

Best Strategy To Save Tax Under Section 80C

The best strategy for saving tax is to invest with minimum locked in period and save maximum tax with minimum possible to zero investment.

Dividend or Return on Tax Saving Funds

After suggesting Best Tax Saver Funds on the basis of dividend the question of many readers of the blog is. What they should choose, Dividend or Return?

Best Tax Saving Funds

List of some of the best Tax Saving mutual funds. The list of funds selected are based on criteria of consistent dividend for a long period of time.