The best tax saving ELSS fund to invest in 2020 and chacking the performance and the process for selecting the best fund for 2019 as well.

It is that time of the year when I share the process to find the best tax saving ELSS fund one should invest in 2020 as well as look back on the past best tax saving funds to learn something new.

Let me kick off the 2020 series with the best ELSS tax saving fund.

The Top ELSS Funds for 2020

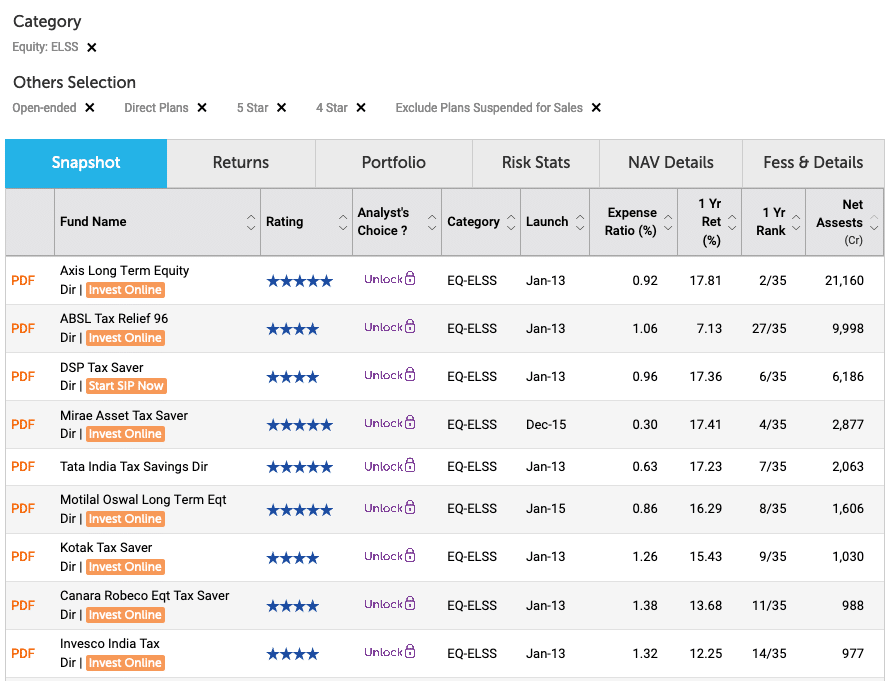

We start with ValueResearchOnline’s 4 and 5 star rated direct ELSS funds. Arrange them in decreasing order of the asset under management by each fund. Now we have the top ELSS tax saving funds:

Moving from the top funds to best funds based on expense ratio alone.

Best Tax Saving ELSS funds for 2020

For me, the best fund is the one that has the least expense ratio.

Mirae Asset Tax Saver

Mirae Asset Tax Saver has the lowest expense ratio as compared to its peers by a considerable margin.

So it is was my choice of a fund in 2019 and remains the choice of fund for 2020 as well.

The expense ratio was and will be a crucial factor in the fund’s performance going forward.

Tata India Tax Savings

The next best fund is Tata India Tax Savings because it also has a better expense ratio.

If one has to diversify in an ELSS fund and want to consider a different fund than 2019, then Tata India Tax Savings is an ideal choice.

How has The Best ELSS Tax Saving Funds for 2019 Performed?

In 2019, my choices of funds were:

- Mirae Asset Tax Saver Fund – It is one of the best performing funds in the ELSS tax saving category and remains as the best fund for the year in 2020 as well. Over 17% return in 2019 is remarkable.

- Aditya Birla Sun Life Tax Relief 96 – The fund didn’t perform as well as one would have expected. Subpar return of only ~7% in the past year. I expected IT, Pharma and FMCG will outperform in 2019, but I was wrong. I think we have to wait a little longer for Pharma and FMCG sector to outperform.

The best 2019 ELSS funds have performed well, and I expect the fund to be doing good as well.

Final Thoughts

This review is neither a sponsored one nor an endorsement that you should invest only in the above mention funds.

I have shared the complete process I am using to find the best performing ELSS tax saving fund for 2020. Feel free to apply your choice of criteria that gives you comfort while investing.

Make sure to invest in direct funds. Moreover, never invest in a fund because someone has recommended it to you. Always apply your investment logic to each of your investments.

Can you share the site from where you got the ScreenShot of the different funds. Thanks in Advance

That is ValueResearchOnline. The link is above the screenshot and it will take you to that list itself.

Oops, I missed It. I have been doing my own research for Mutual Funds, and i always thought Expense ratio as One Of the Important criteria for taking an informed judgement. However most sites, while they provide other comparative infos,, expense ratio is generally not stated there.

True,

Happy New Year To You And Your Family!!!

You made one Whatsapp group if it still exist Plzz Share the Link.

It is full but you can be part of the broadcast. Contact me https://shabbir.in/contact/ for the number and I will share it with you.

u havent added me yet

Dear Shabbir

I completely agree that and expense ratio should not be high but i would like differ with that being the only criteria. After all, the returns of the fund for the investor is given after catering to the expense ratio. In such a case, Axis LT equity is giving the highest return and has been a top performing fund for years together. I have been an investor in that fund from inception practically and have now stopped only because of its large corpus. But somehow it still continues to perform splendidly

However, I am surprised by the large expense ratio of Axis fund because i thought the ratio should come down as the corpus increases

ABSL has been disappointing not only in Tax saving but ractically all funds. Not sure what has happened to that powerhouse

Just for the record – i too chose Mirae for 2019 and most likely will continue in 2020 but my reasons will be different

Pradeep, I am not telling you what you should be doing but I prefer to tell you how you should be doing. Whatever fund you select, have a process for it and it should be all good. For me in tax saving fund when the guidelines are all too tight, I use expense ratio. You can use your parameter. As long as it is working for you, keep building the wealth.

Coming back to Axis, it is an awesome fund but with such a high AUM and such a high expense ratio makes me uncomfortable as well.