There is no advantage to being the first mover. On the contrary, it is a curse. Let me share how and why first-mover advantage is a myth.

I am getting a lot of queries about electric vehicles and Zomato, where people want to invest in the first mover and take advantage of it. However, I think investors are missing critical information that makes me believe First Mover Advantage is a total myth.

Investors want to invest in an excellent EV startup or an excellent tech startup in India as early as possible.

However, today I am going to shatter all your expectations. I will share with you facts that first-mover never had any advantage. I will share examples from Silicon Valley as well as Indian listed players to help you understand.

So without much ado, let’s begin.

The Misconception of First Mover Advantage

We all tend to believe that one is well ahead in the race if he is the first to start something.

However, I am yet to see any company that has made a significant impact just because they started early.

- Google is not the first search engine.

- Facebook is not the first social media platform.

- Apple is not the first phone/computer company.

You may say, but Shabbir, you seem to be giving the same three examples all the time.

So, now let me share a few more.

- Netscape was the first Internet Browser. Chrome dominates now.

- Yahoo was the first Internet company. Google dominates now.

- IBM was the first to make an operating system. After that, Microsoft dominated the personal computer operating systems.

We are equity investors in the Indian market. So I know you want to see examples in the Indian listed market.

- Asian Paints is not the first paint company.

- Page Industries is not the first apparels company.

- Bajaj Finance is not the first NBFC.

- HDFC Bank is not the first Indian bank or even the first Indian private bank.

- Avenue Supermart or DMart is not the first supermarket.

- JIO is not the first telecom player.

And I can keep on citing examples. However, the question is, why the first mover has no advantage?

Why First Mover Has no Advantage?

The answer is simple. The first mover builds the market. Still, as a customer, you want more. So the next mover tries to rectify all the pain points and come up with a better solution. The iteration continues until the last player comes with a ten times better solution than the current players and becomes a dominant player.

Let’s take the example of JIO.

The telecom operators pre JIO used to offer a limited voice and data. For example, some players offered 5GB of data per month, and a new player would offer 10GB of data in a month.

JIO offered unlimited data and disrupted the whole sector.

The exact process was followed by Google when it offered Gmail.

Hotmail offered 2MB of inbox size. Yahoo was at 3MB as far as I remember. Rediffmail was super fast and was slightly bigger.

Everyone had mail offering with inbox sizes under 10MB. Then, Gmail launched its mail services with 1GB of space.

The last mover is so dominant that we tend to think they are the first mover after a while.

Zomato listing was a bumper success, but as an investor, I am not investing in it. I have reasons to avoid Zomato, but that doesn’t mean I will not invest in any tech startups. I need to see a startup innovating consistently than just being the first in the race.

Investing in the EVs

Electric vehicles as a sector is a classic case where every investor wants to be early.

I am sure now you are convinced that first-mover has no advantage but, on the contrary, it has many disadvantages, so the first-mover advantage is a myth.

As an investor, you don’t need to be the first to invest in the EV ecosystem. Instead, the right approach is to invest in the right company that can grow consistently in the space.

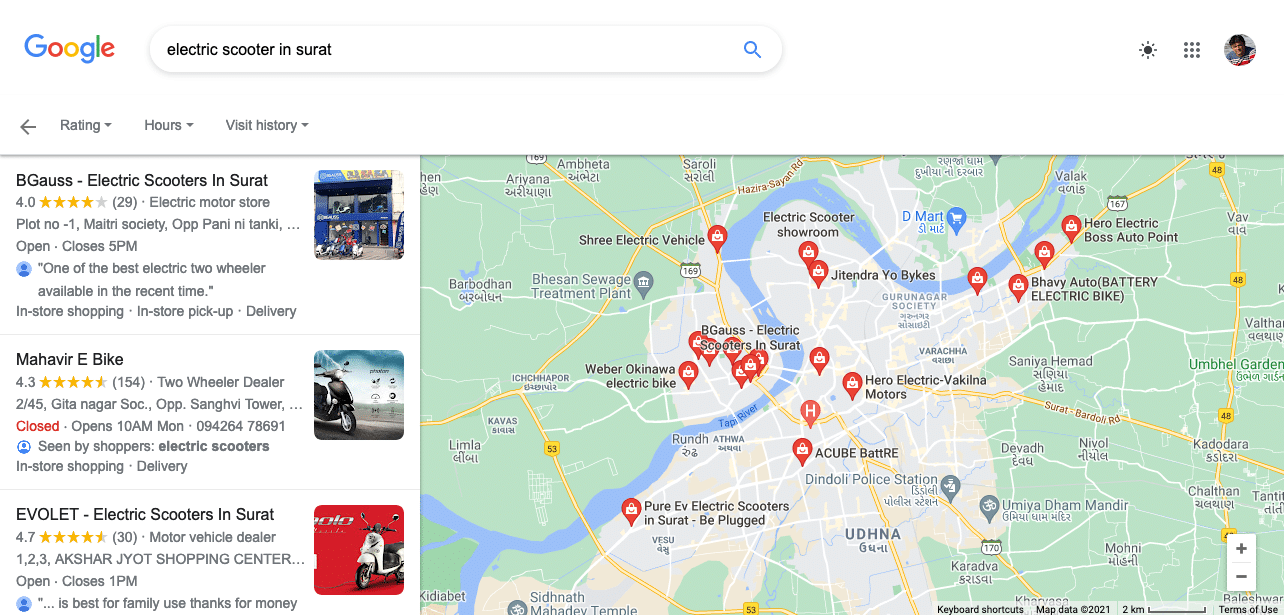

In Surat, I see that every tom dick and harry is selling Chinese imported electric scooters.

In 2021, you can be a customer to test a few of them, but you can’t be an investor in any of them. You are not sure which company will ultimately dominate the sector. It can be a Chinese player or even TVS, Bajaj, Hero, Honda, or a completely new player, including Apple or Google, that completely disrupts the incumbent player.

The best investment will be if you invest in the disruptor. Remember, you will have ample time to finally invest in the disruptor, provided you don’t consider that you are too late to invest in it then.

REALLY I OPENING ARTICLE , IN THE NOISE OF TOMORROWS MULTIBAGGER . TATA NANO , IS ALSO AN EXAMPLE OF ABOVE THEORY .

Yes it can be. Everyone thought it will disrupt the car industry.

This is eye opner for all of us. Good description. But one can’t find out who will be disrupter in the sector and when.

No it is very clear who will be the disruptor but the problem is people think it is now too late to invest in it.

A different and right though.

Glad you find it interesting.

Good article…keep writing and sharing.

Thanks and sure will do.