Find the best mid-cap fund for 2022 and the selection process and review the performance of the best mid-cap fund of 2021.

Let us find the best mid-cap mutual fund to invest in in 2022 and review the performance of our choice of best mid-cap fund of 2021.

So let’s begin.

The year 2021 was an excellent year for mid and small-cap.

The Sensex and the Nifty did well in 2021 overall, along with the mid-cap index.

Investing in the right stocks and funds in 2021 ensured a greater degree of outperformance in the mid-cap portfolio.

The Top Mid-Cap Funds for 2022

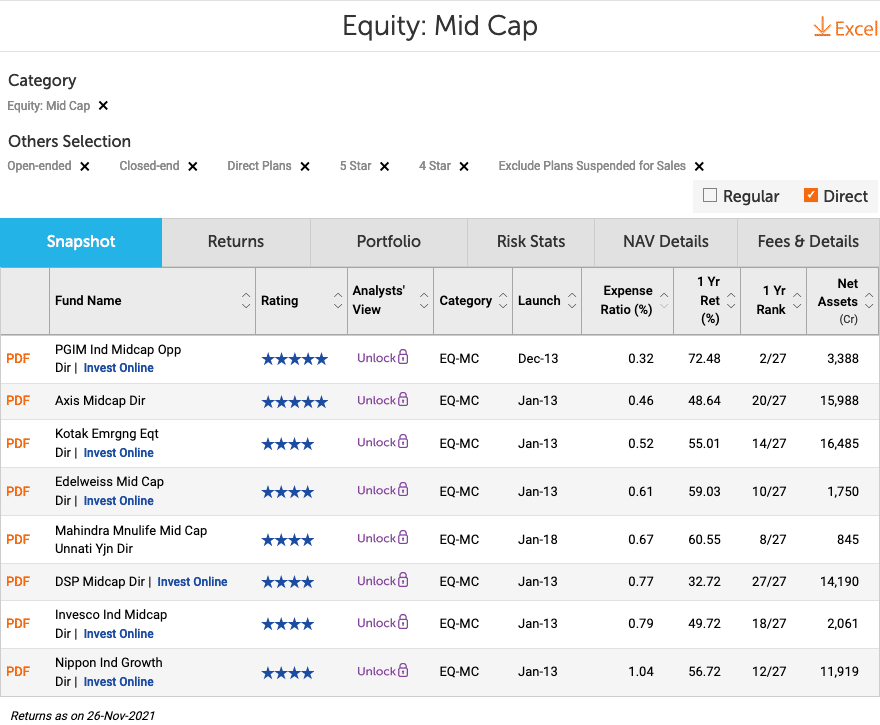

We will use the process to come to the best mid-cap funds for 2021 from the 4-Star and 5-star rated mid-cap fund by ValueResearchOnline. We will compare the past year’s performance and the expense ratio to get the best mid-cap fund.

We are moving from the top mid-cap funds to the best mid-cap funds based on the last year’s performance and expense ratio.

I am using last year’s performance though I think one should look at longer-term performance. Last year was an excellent year for mid-caps, and so funds have outperformed.

Best Mid-Cap Funds for 2022

The excellent performing mid-cap fund in 2021 with lower expense ratio and has increased asset under management considerably is

PGIM Ind Midcap Opp

PGIM India Midcap Opportunities Fund has increased its asset under management from under 500 Crores to over 3500 Crores in the past year.

Investors are investing in the fund because it has a lower expense ratio and can outperform the Mid-cap index.

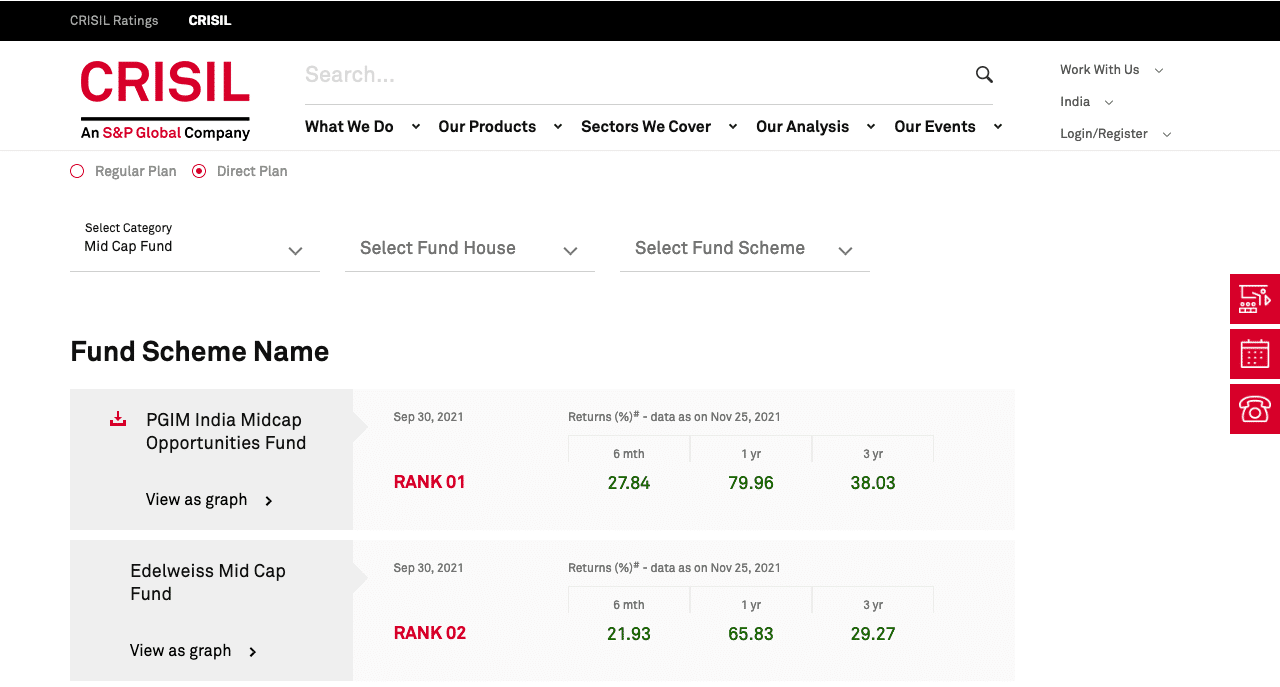

As expected, CRISIL also lists the PGIM India Midcap Opportunities Fund as the best mid-cap fund.

How Well The Best Mid-Cap Funds of 2021 Performed?

I share the series of best funds because we evaluate how we have done in the past. It means either we do well investing or we learn from the selection process.

The best Mid-cap funds of 2021 made us better returns, but they couldn’t outperform the indices.

The best mid-cap fund I selected in 2021 gave close to ~50% in 2021.

- Axis Midcap Fund

However, the Equity Midcap benchmark is up almost 55%. Still, I don’t think it is too much of a concern. I am confident that the process we are using to choose the best fund for investing is working.

However, PGIM India Midcap Opportunities Fund was also part of the selection process, but we didn’t choose it for low assets under management. In 2022, when it has increased the asset under management, it is the best mid-cap fund for 2020.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

Suppose you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Then, don’t’ exit the investment in the old fund. Instead, stop the SIP and let the invested amount remain and grow over time in the past funds. Then, create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. Instead, the emphasis is on the process. The funds may be doing well now, but use the same or similar method and find the best fund to invest in when you want to invest. Use ValueResearchOnline and CRISIL as and when you want to invest in 2022.

Leave a Reply