Invest in the best dividend-paying equity fund in 2022 and earn a completely passive side income only from dividends.

Invest in the best dividend-paying equity fund in 2022 and earn passive income only from dividends.

I am a big fan of dividends for mutual funds because it is passive income.

However, dividend income is taxable as per your income slab now. So, if you have a higher taxable income, it may be better to invest in growth funds now and use the 1Lakh Rupees as tax relief on long-term capital gains.

Still, the idea of investing in funds that has a higher distribution of dividend is to build a passive source of income. So let us see the best Dividend Paying mutual fund to invest in 2022 and generate passive income.

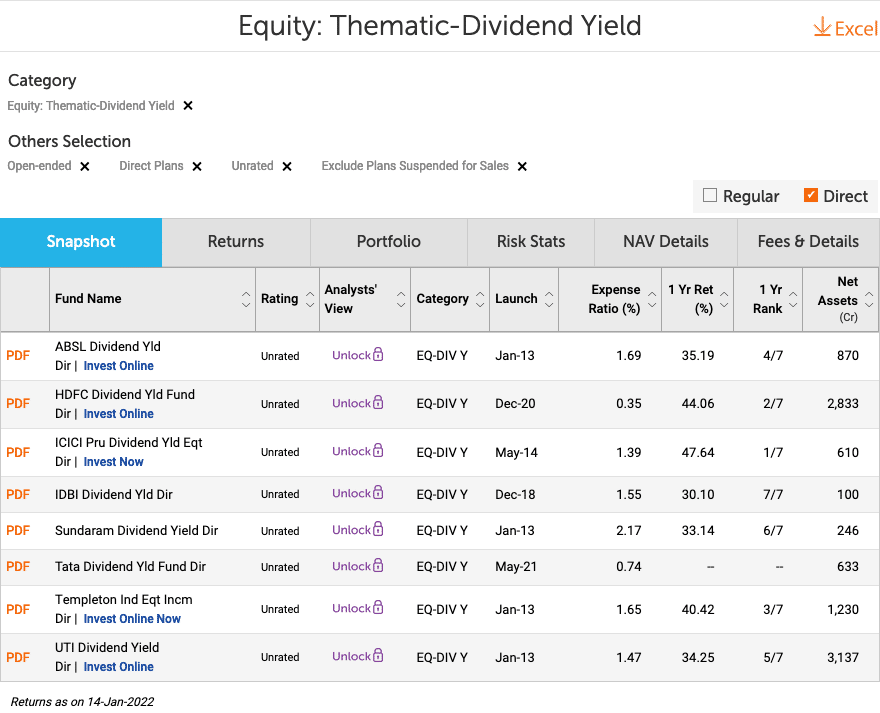

Top Dividend Yield Funds

From the dividend yield thematic category, we will find the best Dividend Yield Fund. The process will be choosing from the direct funds, the stable fund house, better returns and dividends, a sizeable asset under management, and the lower expense ratio.

They are all equity funds and invest in companies with a higher dividend yield.

The capital appreciation from such funds is often low, but the dividend is higher, the investment’s prime objective.

Best Dividend Yield Fund To Invest in 2022

From the top Dividend Yield Funds, we will find which fund has shared how much dividend in 2021.

| Fund | Div % in 2021 |

|---|---|

| ABSL Dividend Yield | 5.6% |

| HDFC Dividend Yield Fund | – |

| ICICI Pru Dividend Yield | 7% |

| IDBI Dividend Yield | – |

| Sundaram/Principal Dividend Yield | – |

| Tata Dividend Yield | – |

| Templeton India Equity Income | 7.5% |

| UTI Dividend Yield | 12% |

I’ve used BlueChipIndia.co, moneycontrol.com and AMFI India to get the fund’s dividend in 2021. Unfortunately, I couldn’t find data for all the funds on either of the three websites. For simplification, if the funds have declared multiple dividends, I have calculated the percentage for the whole year to simplify the comparison.

HDFC Dividend Yield Fund

The fund has the least expense ratio, and it is something that I like the most. Further, it is by the HDFC Fund house and a very stable fund house, unlike DSP and Franklin, who sell off the mutual fund business to others.

The only caveat is there is no dividend paid in 2021 despite stellar returns in the past year. Still, I will choose the HDFC fund as the best dividend yield fund to invest in 2022.

Tata Dividend Yield

The fund has the next least expense ratio, and as the fund was launched in May 2021, there is no dividend history. Still, I think it is a good fund house, and the asset under management is increasing, and so will be my choice of best dividend yield fund for 2022.

How is the Performance of the Best Dividend Paying Fund of 2021?

I share the series of best funds because we evaluate how we have done in the past. It means either we do well investing or learn from the selection process.

The Best Dividend Paying Fund to Invest in 2020 were:

- HDFC Dividend Yield Fund

- Templeton India Equity Income

And both the funds have delivered 40%+ returns for the past year, which by any metric is incredible returns. But, unfortunately, even my equity portfolio cannot give such stellar returns.

So, it gives me some confidence that the process we use to select the best dividend funds is working.

Final Thoughts

Investment is not about past returns but the future. Still, it is essential to go with a fund that has been doing it well in the past.

Suppose you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Then, don’t exit the investment in the old fund. Instead, stop the SIP and let the invested amount remain and grow over time in the past funds. Then, create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. Instead, the emphasis is on the process. The funds may be doing well now, but use the same process and find the best fund to invest in when you want to invest. Use ValueResearchOnline, MoneyControl, AMFI India and CRISIL as and when you want to invest in 2022.

Leave a Reply