Invest in the best dividend-paying equity fund in 2021 and earn a completely passive side income only from dividends.

Invest in the best dividend-paying equity fund in 2021 and earn a passive side income only from dividends.

I am a big fan of dividends when it comes to mutual funds because it is a passive income. However, dividend income is taxable as per your income slab now.

Still, we will find the best Dividend Paying mutual fund to invest in 2021 and generate passive income.

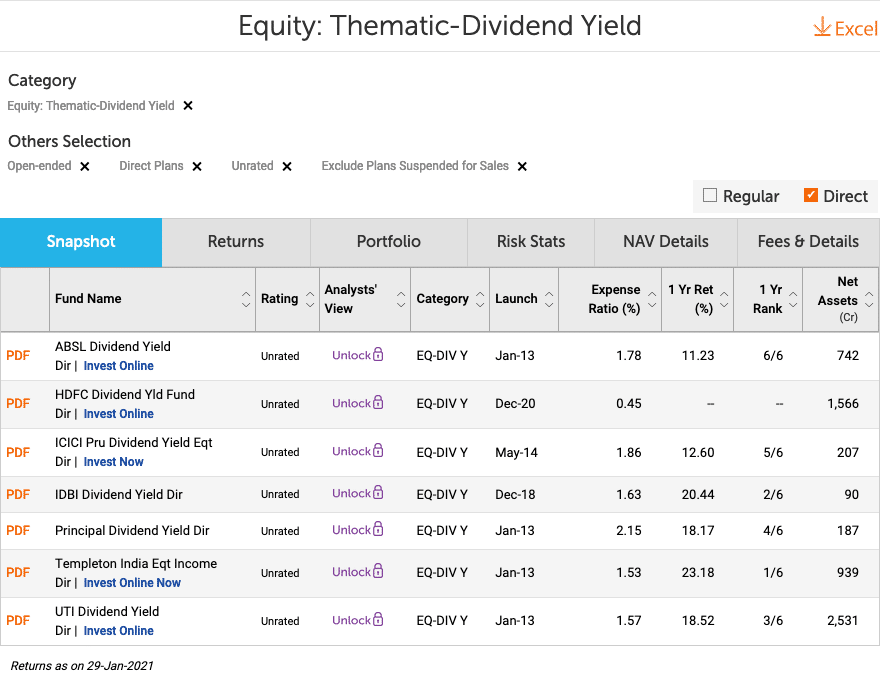

Top Dividend Yield Funds

To find the best Dividend Yield Funds, we will use the process from the direct funds. We will choose the funds that have a better dividend yield.

They are all equity funds and invest in companies that have a higher dividend yield.

The capital appreciation from such funds is often low, but the dividend being paid is higher, which is the investment’s prime objective.

Best Dividend Yield Fund To Invest in 2021

From the top Dividend Yield Funds, we will find which fund has shared how much dividend in the calendar year 2020.

| Fund | Div % in 2020 (Direct) |

|---|---|

| ABSL Dividend Yield | 5.7% |

| HDFC Dividend Yield Fund | – |

| ICICI Pru Dividend Yield | – |

| Principal Dividend Yield | 12.17% |

| Templeton India Equity Income | 13.5% |

| UTI Dividend Yield | 4.5% |

I’ve used BlueChipIndia.co. to get the fund’s dividend in the year 2020. If the funds have declared multiple dividends, I have added the percentages to make the comparison simpler.

HDFC Dividend Yield Fund

On three fronts, we have to judge the funds – Dividend yield, asset under management, and expense ratio.

The fund has least expense ratio, and the fund was launched in December of 2020, so there is no dividend history, but because it is from the HDFC fund house that has been going well, it is worth considering to invest in 2021.

Templeton India Equity Income

Templeton fund has a better dividend yield and a good asset under management, but I am not a fan of over 1% as the expense ratio. Still, if one has to select the second fund, it has to be Templeton India Equity Income.

How Well The Best Dividend Paying Fund of 2020 Performed?

I share the series of best funds because we evaluate how we have done in the past. It means either we do well investing or we learn from the selection process.

The Best Dividend Paying Fund to Invest in 2020 were:

- UTI Dividend Yield

- Templeton India Equity Income

UTI fund didn’t share good dividend income, but Templeton India Equity Income has performed well in the past year, with a return of more than 23% and a dividend payout of close to 13%.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the past funds. Create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. The emphasis is on the process. The funds may be doing well now, but when you want to be investing, use the same process, and find the best fund at that time to invest.

Leave a Reply