Investing in any top rated fund may not be enough & returns can vary from under 5% to above 18%. Let’s narrow down to the best fund that can outperform in future.

The process I prefer to select the best ELSS tax saving fund to invest in 2017 is to select the best fund among the top performing mutual funds.

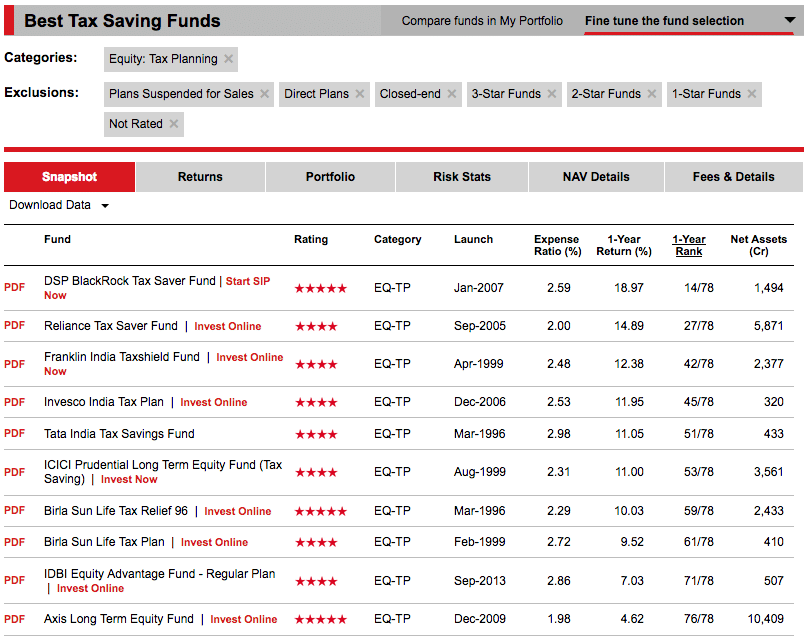

So first let us see the top-performing mutual funds for the past 1 year. We will use ValueResearchOnline’s 4 and 5 star rated ELSS funds.

What is 4 and 5 Star VRO’s Rating?

The funds at ValueResearchOnline are rated based on relative performance of the fund in the same category compared to its peer and adjusted for risk and return.

The Value Research Fund Rating is based on subtracting the fund’s Risk Score from its Return Score and then the top 10% funds get 5 star and next 22.5% gets 4 star. You can read about the complete fund rating process at VRO here but in short, the highest rated funds has least risk and best return.

The Top Funds for 2017

Using the above criteria we get the top funds to invest in 2017 as follows:

Investing in any of the top funds may not be enough because just 1-year return varies among the top fund from under 5% to above 18%. So we have to narrow down to find the best-performing fund among the top funds and look at which funds that can perform better in the future.

The Best Fund of 2017

The return we see in ValueResearchOnline is the performance of the past and we have to find a fund that can outperform in the future.

My view is midcap funds will outperform the large-cap funds in the future and so we have to identify which funds among the top funds invest more in mid-cap companies.

So let us see the benchmark for each of the top funds.

| Fund | Fund’s Benchmark |

| DSP BlackRock Tax Saver Fund | Nifty 500 |

| Reliance Tax Saver Fund | S&P BSE 100 |

| Franklin India Taxshield Fund | Nifty 500 |

| Invesco India Tax Plan | S&P BSE 100 |

| Tata India Tax Savings Fund | S&P BSE Sensex |

| ICICI Prudential Long Term Equity Fund (Tax Saving) | Nifty 500 |

| Birla Sun Life Tax Relief 96 | S&P BSE 200 |

| Birla Sun Life Tax Plan | S&P BSE Sensex |

| IDBI Equity Advantage Fund | S&P BSE 200 |

| Axis Long Term Equity Fund | S&P BSE 200 |

If we try to understand the benchmark in very simple terms.

- Nifty 500 – Fund can invest in 500 companies of Nifty 500 benchmark.

- S&P BSE 200 – Benchmark is formed by the top 200 BSE companies and fund can invest in any of those 200 companies from the benchmark.

- S&P BSE 100 – Benchmark is formed by the top 100 BSE companies and fund can invest in any of those 100 companies from the benchmark.

- S&P BSE Sensex – Sensex is the benchmark for the fund which means 30 companies listed in Sensex are the only option for the fund to invest in.

Clearly funds that have more option to invest in midcap can outperform in the future. So we select

- DSP BlackRock Tax Saver Fund

- Franklin India Taxshield Fund

- ICICI Prudential Long Term Equity Fund (Tax Saving)

Now the 1 year return of this fund vary from 11% to above 18% but we can look at 3 and 5 years return and see if we can determine the best fund to invest in 2017.

| Fund | 1Year | 3Years | 5Years |

| DSP BlackRock Tax Saver Fund | 18.97 | 22.34 | 21.31 |

| Franklin India Taxshield Fund | 12.38 | 20.96 | 18.36 |

| ICICI Prudential Long Term Equity Fund (Tax Saving) | 11.00 | 19.06 | 18.82 |

DSP BlackRock Tax Saver Fund is an outperformer for the last 5 years and is the best ELSS tax saving fund for me in 2017.

Final Thoughts

This is not an endorsement that you should invest only in DSP BlackRock Tax Saver Fund. I have shared the complete process I use to find the best performing fund but you can apply any other criteria (3 stars rated or best 5 years return or more than a certain amount of asset under management) to select any other fund of your choice. Just make sure you aren’t selecting the fund because you like the name of the fund or someone has recommended it to you.

Hi Shabbir,

I am considering to invest in MF for the first time with no knowledge in MF’s.

I met a wealth manager who works with one of the sub-borkers in mumbai and they manage AUM of 10CR (as per the info provided by him). I am actually planning to invest in ELSS for tax saving and also to enter the markets now. My aim is long term investing. He suggested me Birla Sunlife Tax Saver 96 and HDFC Tax Saver to start with with 2500/ INR for each in SIP. Do you think this is the right advise?

Regards,

Amit

Amit, your manager suggested you right funds for sure but then splitting them into 2 funds of the same category has no meaning which suggests he knows very little about diversification and about mutual funds. Ideally if you select anyone of the either funds, you should be as good as managing 2 funds.

Also if you invest via a broker, you can only invest in regular funds but ideally you should be investing in direct funds. Read https://shabbir.in/direct-vs-regular-plans/

Thanks for taking out to reply Shabbir.

In that case, can you suggest some direct funds for me to consider. Also my core motive is to save tax.

Regards,

Amit

Amit, I have already shared the same in the article above. Do you need more?

Hello sir,

I have SIP of 1500 in AXis ELSS since 3 years. now i want to add more 1000.

so you and Most of blogs suggest DSP Black Tax.

When i have started in Axis ELss, it is on 1st rank on Crisil and most of blog.

so i am confused start new SIP in DSP black Tax or should increase amount in Axis?

Please Help.

Vishal, let me reclarify things.

Axis Long Term Equity Fund which is an ELSS fund has given a 3 year returns of 18.34% and 5 years return of 24.67%

DSP BlackRock Tax Saver Fund has given a 3 year return of 17.61% and 22.80%

Now comparing them there is nothing wrong in going with any one of them because 1% difference in return for a period of 3 years is not a whole lot. So when I say one fund is best doesn’t mean it is the only fund you should be investing but more important is the process that I used to get to the best fund. Follow the process and don’t follow the name of the fund.

Again the idea to get the best fund was to know the process of making a choice among the best fund. My view is midcap fund will perform and someone can have different view and so his process may change based on his criteria.

Hello Shabbir,

I would like to ask that can I invest 5K in 4-5 different ELSS for my Retirement or any one ELSS FOR 30Yrs so that I can have maturity amount of 1.5Cr to 1.8Cr…..

Pls suggest me

vishalrj2107@gmail.com

Yes you can but if you aren’t saving tax by investing in them, why not try other large cap and midcap funds then? If you are saving tax, then its fine to invest in them and then instead of booking profit, you let the profit ride for a long period of time.

Thanks for your valuable suggestions….. 1 more help

Please suggest me

I have made 4 Bucket for investment

Ready to invest 5K in each Bucket which are

1. Retirement:

Investment period 30 Yrs

Maturity Amount Needed 2Cr

All 5K only in ELSS

2. Emergency:

Should be like whenever I need it I can redeem them

3. Children Education and Marriage:

Investment period 15-20 Yrs

Maturity Amount needed 70-80Lacs

5K Divided in large,small and mid caps

4. Future Goals /Short term Goals:

Investment period 3-4Yrs

Maturity Amount needed 3 – 3.5Lac

3k in Blue-chip, DSP BR,

2k in ELSS

What do u say is it ok or not according to my Target….

Pls suggest me….

The Reason behind 4 Bucket is to track my fund easily without any confusion… So

Pls suggest me some funds in which to invest……

TAX SAVINGS + WEALTH CREATION

vishalrj2107@gmail.com

Seems perfect.

Bucket 1 you can achieve your target with CAGR of 12%+

Bucket 2 I prefer to be my bank account.

Bucket 3 You will need returns close to 15%.

Bucket 4 Aim for 18% so you will be able to make that amount.

Thanks for your suggestions….

Hi Shabbir,

Thanks for your valuable inputs !!!

I also have same goals and investment period as Vishal. Please suggest name of some good funds to invest along with investment amount for each goals.

For retirement suggest funds other than ELSS also.

Hi !

My father has started investing in ELSS for tax saving since FY 2016-17. Invested in –

1. DSP BlackRock Tax Saver Fund

2. Franklin India Taxshield Fund

3. ICICI Prudential Long Term Equity Fund (Tax Saving)

4. Birla Sun Life Tax Relief 96

Should he continue with the same funds or change some?

Please guide.

Regards

Alok

Alok, these are too many funds without any advantages. It just adds the hassle of managing more funds and more paper work. You can select one or at the most two funds and still achieve the same results.

H Shabbir,

I am looking to invest in ELSS funds for the FY2017-18. I already have invested in DSP BlackRock Tax Saver Fund & Franklin India Taxshield Fund (this was for FY2016-17). Should i continue investing in these wo funds only or would you suggest to invest on any other ELSS (so that the risk are diversified). Please advise?

Saurabh, Yes you should continue investing in those funds as they are good funds. Just investing in new fund name will not diversify and diversification comes when you invest in different companies that these funds invest in and different fund name is just not enough.

I will recommend you to read couple of my articles to clarify your thoughts about diversification

https://shabbir.in/diversification/

https://shabbir.in/mutual-funds-types/

Shabbir, thank you for the reply and for sharing the links.

Can you also help me with your view on “Motilal Oswal MOSt Focused Long Term Fund – Regular Plan”.

I will be going through your posts on best Equity MF (Large cap, Mid cap, Small Cap, Multi Cap) and will trouble you for suggestions 🙂

Saurabh, MOST focused is a very good fund but then you should always consider direct plan over regular. Yet another link for you to read – https://shabbir.in/mutual-funds-direct-plan/

Any time on any article, feel free to ask anything and will be more than happy to answer them and help you out.

Hi Shabbir, I am planning to invest approx. 20,000/Month in various MF –

Large Cap – 3,000/Month (2000 in DSP BlackRock Focus 25 Fund &1000 in Franklin India Bluechip Fund)

Mid Cap – 4,000/Month (2500 in Mirae Asset Emerging Bluechip Fund (G) & 1500 in HDFC Mid Cap Opp Fund (G)

Multi Cap – 7000/Month (5000 in Mirae Asset India Opportunity Fund & 2000 in Franklin India Prima Plus Fund (G)

Small Cap – 2000/Month (Franklin India Smaller Co Fund)

Euqity Balanced Funds – 4000/Month (2000 in HDFC Balanced Fund & 2000 in ICICI Pru balanced Funds)

Please let me know if the above would be right allocation of money (in type of Caps) and also your view on the choice of MF in each class.

Regard

Saurabh

Saurabh, the right allocation of caps will depend on your risk appetite and your target corpus after certain time.

I have appetite for more risk and so I can take up more allocation towards small cap but if you have appetite for less risk, you can go for more allocation in large cap or balanced fund.

You can read https://shabbir.in/how-many-sips/

Hi Shabbir,

This is my first ever tax saving investment, and I have decided to diversify my ELSS investment into DSPBL and BSL TR 96

My doubts:

1). Are these two good, or u will suggest some other funds ?

2). How many different funds should one opt for ? I mean, is 2 fine, or we should invest in more than two different funds ?

3). Looking at the PF policies at companies, I decided to open a PPF account as well.

So, out of 1.5 lacs, how much should be invested in ELSS and how much in PPF, according to you. (I have thought of 1.3 in ELSS and .2 in PPF)

Hi Aditya,

Welcome to the world of investing in equity. Let me clarify your 3 doubts.

1. Yes your choice of funds are good.

2. 1 fund is fine as well but the your choice of 2 funds are also good because both are differently benchmarked fund and so will provide you good diversification as well as returns. I prefer investing in one fund for a given year to save tax.

3. I invest complete 1.5 into ELSS fund and you can see that openly with contract notes here – https://shabbir.in/portfolio/ but it is because I am an aggressive investor but if you aren’t you can allocate anyways between 50% to 75% in ELSS fund.

Also note if you are doing a job, your contribution to PF is also under the same tax saving scheme and so you may not need to invest full 1.5L.

Hope it helps.

Thanks Shabbir.

I would request your suggestion on when should I invest in these two ELSS funds, looking at the following points :

1. Many people are advising to stay away from Equity currently, as Recession chances are increasing.

2. The election results on 11th March may also turn the Stock Market upside-down.

3. I have only 22 days left for investing in current financial year, and save my taxes.

Also, kindly explain me how the NAV of funds should be considered, before actually investing in these ELSS funds.

Thanks a lot.

Aditya,

1. There are others who says that the best in Indian equity market is yet to come and these people are the best fund managers of India including Ramdev Agarwal, Madhu Kela etc.

Again it is not about what others are saying but what you think about investing in equity.

2. Yes it can but it can also mean you buy everything 5% higher than where it is currently. Trading ahead of the news is never expected but then for investment, it should be over a period of time. As we have short time, we can only split the investment in 2 to 3 parts in the next 20 days.

3. Split your investment in 2 to 3 parts but make sure you don’t invest on last day because you may end up buying MF in April. So provide few days of time for complete transaction to complete in March.

NAV is nothing to consider before investing as it does not matter much.

Thanks Shabbir.

As I am very new to investment, kindly suggest me some good sources that can help in increasing my knowledge on the same.

Do you mean increase your knowledge of investing in mutual funds?

Books are always good source of information and here are list of books that I have read and recommend reading – https://shabbir.in/category/books/

Thanks.

I meant my overall knowledge of Financial Markets.

Those books can give you a good start and if you want to consider my eBook you can find the link in the top menu.

Hi Shabbir,

Thanks a bunch for sharing the analysis.

How about Axis Long Term Equity Fund? – As you rightly said for 2017, the future is bright for midcaps as compared to large caps. And As per my understanding the Axis Long Term Equity fund consists more of midcaps. Isn’t it?

Does not that mean Axis Long Term Equity fund will even shine in 2017?

Please share your outlook on ALTE fund so that I can decide if I should continue my SIP with it or switch to DSPBR.

I don’t mean Axis long term equity fund can’t shine. In fact I am no one who can judge the future of any fund but I would prefer to invest in the fund that I think will be better choice based on my understanding of funds.

I could be wrong but more important is the process I followed and your process can be different and you may end up with Axis fund and it is all good.

We are selecting the best among top funds and so should not be too much of an issue either.

Hi Shabbir, Thank you for sharing your knowledge with all of us here, I have one question for you, recently I have started my ELSS in AXIS Tax saver, what you recommend should I continue with it or should I change it to Blackrock or Franklin in that case ?

You should continue for this fiscal and complete your ELSS quota till March 2017 and then possibly from next year switch.

Dear Shabbir,Can we wait for correction before 11th march,if there is any,to invest in DSP tax saver?Or it doesn’t matter..

I don’t see a more than 5% correction in the market and so I did not wait for the election results but if you think, you want to then there is nothing wrong in it.

Best could be to split your investment in 2 halves. In either case you have time till 31st March only.

Hi Shabbir Sir, I am planning to invest in DSP ELSS due to my tax bracket. Just wanted to ask one question, given at the current NAV of 39.55 is it advisable to invest now or should I wait for the NAV to lower little and then invest. Also, I need to invest before 31st March, 2017 or else I will have to pay tax 🙁 Please help sir.

Since you have only 50+ days left, I will suggest you divide you investment in 3 steps and invest them every alternate week. Dips will come in NAV only if market and midcap indices gives dips and not otherwise. I also have 45k still pending to be invested in ELSS in my portfolio ( https://shabbir.in/portfolio/ ) and so have plans to invest in 2 steps now instead of 1 as I had planned earlier.

Thank you Sir for the reply. I really liked the investing in 3 parts idea. One thing is still haunting my mind, the NAV of DSPBR is still highest in 52 weeks. Do you think we can invest when it goes low or lower circuit is not something we can expect at least till 31st March, 2017?

Funds nav do not hit circuits (lower or upper) and it’s nav should see corrections only if market corrects. If it doesn’t till 31st March then you will invest things at much higher valuations. So it is better to invest over time to nullify the ups and downs.

Simple and straight method adopted.

Sir Can you please do it for Large Mid and Small Cap also?

Sure I will try getting those as well.

I really love the simplistic process that you have laid and I think we can use the same process for midcap funds as well.

Yes you can apply the same process to select the right fund for your investment.

Great analysis and I was an investing in AXIS Tax saver and I think it is high time to stop SIP in Axis and move to DSPBR.

Glad you liked it Amit and don’t forget to share this article with your friends on social media.

Dear Shabbir,I request you to write on best flexicap funds.

Sure I will

As per returns DSPBR taxshield outshines other funds.Axis LT EQ fund,most favoured fund has underperformed.

Yes it has given the best returns in last 1 year, 3 year and 5 year time period.